“When we have hope, we discover powers within ourselves we may have never known- the power to make sacrifices, to endure, to heal, and to love. Once we choose hope, everything is possible.”

-Christopher Reeve

We continue to closely monitor the unprecedented environment surrounding the Coronavirus (COVID-19). While our primary concern is for the safety and well-being of our families, our team, our clients and our community, our primary focus is to help ensure the financial well-being of our clients.

We continue to closely monitor the unprecedented environment surrounding the Coronavirus (COVID-19). While our primary concern is for the safety and well-being of our families, our team, our clients and our community, our primary focus is to help ensure the financial well-being of our clients.

Over the past few days, it seems like the anxiety has radically increased. We can feel it, and our guess is that you can too.

It can be unsettling. Shelves at grocery stores are bare. Normal plans are being cancelled. It now seems like a violation of social protocol to go out to dinner.

It’s not that it CAN be unsettling…it IS unsettling.

Today, instead of focusing on market data, let’s take a step back. What are the overall objectives that we are trying to achieve during this time?

In today’s chaotic environment, we are focused on four primary goals:

- Portfolio Values: Keep portfolio declines at levels so that the time it takes to recover any losses can be counted in weeks or months, not years.

- Financial Plans: Get through this period of time without needing to modify your personal financial plans in the wake of this panic.

- Distributions: If you rely on your portfolio for current income, make sure you have sufficient cash to support your distribution needs.

- Communication: We strive to keep clients up-to-date through individual phone and email communication, as well as sending bulk emails like this one to reach a large number of people quickly. We have implemented a policy of no in-person meetings over the coming weeks, and have invested in technology that will allow for webinar and video conferencing with our clients as warranted.

We discuss each of these goals below.

Portfolio Values

It was another bloodbath in the markets today. Stocks were down 12%, which was the second worst day in history for the Dow Jones and the third worst for the S&P 500. The only days worse were in 1987 for the Dow, when prices fell a staggering 22% in one day. For the S&P, October 1987 and one day in 1929 were worse.

The current market environment is obviously extremely tricky and incredibly complex. We have been adjusting clients’ net exposure to risk based on a combination of our quantitative processes and deep experience in financial markets.

Over the past few days, two existential threats have emerged:

- The likelihood of a recession now appears imminent.

- Financial markets could be closed for a period of time.

While social distancing on an individual and family level is indeed occurring as we speak, it is beginning to look like mass quarantines may very well take effect. San Francisco has implemented a “shelter-in-place” order, requiring all residents to remain at home with only a few exceptions. We fully expect other cities to follow suit.

The success of the economy is based on the movement of goods and capital, as well as the performance of various services across the country.

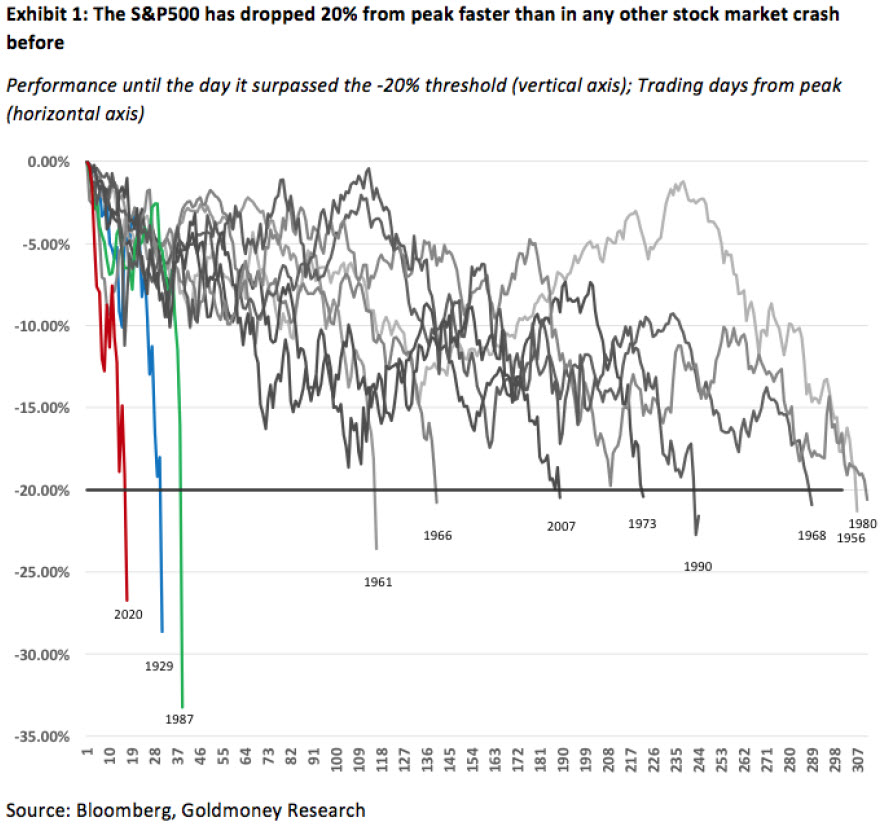

With such large parts of the population staying home, it appears improbable that we will avoid the existential risk of a recession at this point. Market prices have already begun to price in a deep recession, with the market having the fastest decline from all-time-highs in the history of the modern stock market, as shown in the chart below.

This is truly an unprecedented environment. The chart above does not include today’s 12% decline.

We still continue to believe that the current panic environment is not one that you should bulk sell into. With the VIX now over 80, we should expect daily moves to continue to be very volatile, both up and down.

While we don’t want to panic sell, we also believe that we should take steps to manage the risks of these relatively new existential threats.

On one hand, we must strive to keep portfolios so that there is a short recovery time. To that end, we have moderately increased cash and reduced equity exposure and are continuing to “thin the herd” by removing the weakest equities from portfolios. We also added hedge positions over the past two weeks that go up when markets go down to help offset short-term volatility in portfolios.

On the other hand, as we have said many times during the past couple of weeks, current conditions are so extreme that we must maintain an appropriate equity exposure so that we do not miss the inevitable (very strong) bounce that will occur. Even if that means additional near-term declines. We need to be cautiously opportunistic, and continue to adjust exposure into areas showing strength. And we need to be prepared to be very opportunistic, as this selloff ultimately will provide an excellent investment opportunity.

While we never like portfolio declines, client portfolios are currently at levels where recovery times are still acceptable. We want to make sure we keep it that way. Hence, the additional steps we have taken to manage risk.

The other existential risk is the possibility that financial markets shut down completely. This potential should not be ignored. We hope that doesn’t happen, and are uncertain whether that would be good or bad for markets over the near term. This appears to be a lower likelihood scenario, but we cannot ignore the potential for this to occur.

We discuss this in the “Distributions” section below, but from a portfolio standpoint we simply want to own a smart combination of cash, equity and hedges, so that if markets do close we are not concerned about positions if it happens. If it were to close, the logical time that it would be closed would be for a week or two, and would not likely extend weeks or months into the future. And again, we think this is a lower probability scenario.

Our best guess is that if markets were to shut down, it would likely happen this week.

While market closures are rare, they are not unprecedented. According to thestreet.com, the markets have been closed the following times:

- 1865: Following the assassination of President Lincoln, the New York Stock Exchange was closed for a week.

- September 20, 1873: The market closed for 10 days after the banking firm Jay Cooke & Company went under as a result of failed demand for railroad bonds.

- July 31, 1914: The NYSE is halted for 4 months at the start of World War I. Foreign nations had large investments in US stocks, and the market was halted to prevent these nations from using funds for war build-up efforts.

- 9/11 Attacks: Following the events of September 11, 2001, the all major US markets were closed for 10 days.

- October 2012: Markets were closed for 2 days due to Hurricane Sandy.

There were other times where markets shut down to honor US Presidents who had passed away and various other reasons, but these were the major ones. Once the markets re-opened, they were generally positive over the coming months.

The Fed has also taken unprecedented steps by cutting interest rates to zero over the weekend and announcing $1.5 Trillion of funds that will flood the market. This should eventually have a very positive effect on markets, but it is uncertain when that positive influence will start.

For now, we will continue to adjust exposures both up and down, look for opportunities to both manage risk and be opportunistic, and will work to keep portfolios in positions to weather this storm and emerge stronger as the crisis subsides.

Financial Plans

Fortunately, portfolio fluctuations like what we have seen this year are already factored into financial plans. We do not make straight-line assumptions for returns. Rather, our financial planning software assumes that market volatility will happen over time, and incorporates both good and bad market conditions.

In addition, one of our key financial planning philosophies is to be conservative in our assumptions. We do not use aggressive return assumptions. We plan for longevity. We assume spending may be slightly higher that what may actually happen.

By combining all of these factors, we can have our confidence that our clients will achieve their goals. Even in the midst of the current chaos, we can rest knowing that we are not outside of any tolerances that our financial plans have projected.

Distributions

As we mentioned above, some clients rely on their portfolio for income. In preparation of potential market closures, we further raised cash today that clients can use if needed, without having to sell any positions.

Again, we do not think this is the likely outcome, but we need to prepare for it nonetheless.

For clients taking regular distributions, we have raised cash equal to at least 3 months of these distributions. Portfolios have more overall cash than that, but these funds are held in bank deposits within accounts so that they can be transferred to other banks as needed without the need to sell anything.

Communication

We find reports like these to be very useful, as we can communicate with large numbers of clients, friends and colleagues all at once.

That does not replace the importance of one-on-one communication. If we have not spoken with you, we will soon. If we have spoken with you via phone or email, expect to hear from us again soon.

If you have questions, please do not ever hesitate to reach out to us directly.

IronBridge Policies

Everyone must do their part during this chaotic time to help slow the spread of this virus. As our little part, we are eliminating in-person meetings for the time being. As mentioned above we are now using web-conferencing technology to help keep our client meetings as personal as possible.

From day one, IronBridge was set up to work remotely. So today’s environment will not affect our ability to serve clients. We use a third-party technology firm that leverages military-grade encryption technology so that our clients’ information is protected, regardless of where we perform our duties. Our laptops allow us to be fully functional from anywhere with an internet connection, so we will be able to handle portfolios and financial requests.

Conclusion

This is a scary time. The level of uncertainty is higher than any other time in recent history, including 2008 and the events of 9/11. I think we all would agree that you can feel the anxiety, and it is real.

But we will get through it. And we will emerge from these times stronger than we entered.

We must remember that we are in this together. If we do, we can rediscover the sense of community that only tragedy seems to bring out. Maybe, just maybe, this sense of community can be more permanent than has been the case in our recent past.

Stay safe friends.

Our clients have unique and meaningful goals.

We help clients achieve those goals through forward-thinking portfolios, principled advice, a deep understanding of financial markets, and an innovative fee structure.

Contact us for a Consultation.

Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness. Disclaimer This presentation is for informational purposes only. All opinions and estimates constitute our judgment as of the date of this communication and are subject to change without notice. > Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness.