As we continue the discussion of economic reality versus market reality from our previous Insights issue, we also look at the various illusions that are present in the investing world. This includes the illusion of one of the most over-used and misunderstood concepts in wealth management…the idea of diversification.

“Reality is but an illusion, albeit a very persistent one.”

-Albert Einstein

Weak Economic Data vs Strong Markets, Part 2: The Illusion Continues

In the last ‘IronBridge Insights’ we discussed the massive schism that was occurring between the stock market and the economic fundamentals around the world. (Read it HERE.) That continues through today. We believe this is just more proof as to why having a strategy that is adaptive to the changing market conditions will be key to future investment success. A strategy that actually pays attention to the market will be ever more necessary as we can’t rely on the economics and fundamentals to be near as predictable as the academia and portfolio pie charts suggest or would like them to be.

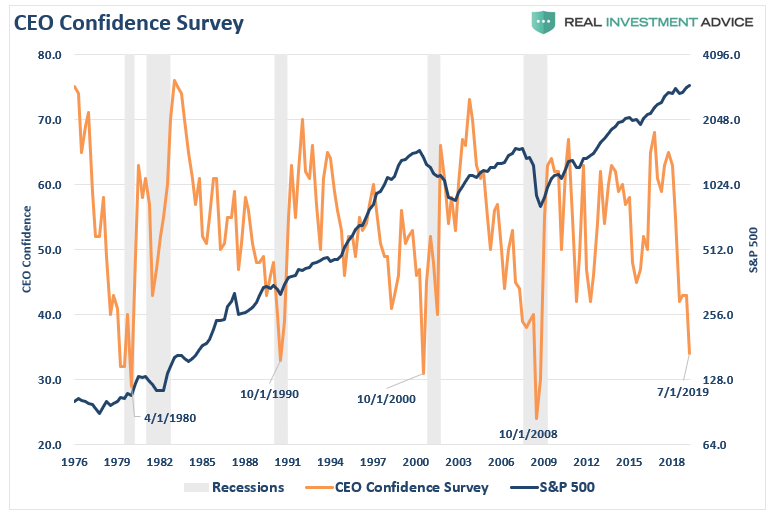

Why do we have deteriorating fundamentals but a stock market at all time highs? Have you seen the latest CEO confidence numbers? They are miserable. The chart below shows CEO confidence has cratered back to financial crisis levels. In addition, all kinds of companies are reporting dismal earnings. Just this week Home Depot was the next victim, now with 3 consecutive negative quarters while trimming full year forecasts. The economics and fundamentals continue to weaken yet the market remains near all time highs. Why is this?

The problem lies with the question. We should not be asking all of these “whys”. The “whys” will never be figured out, not with any certainty anyways. Instead of continually wondering “why’, instead we should turn our focus to what actually matters, focusing on the “what is”. The “what is” is the fact the markets have all recently made new all time highs. This has occurred in spite of of an inverted yield curve, a supposed trade war that may never end, and a backdrop of significant fundamental and economic deterioration.

Another way to think of this is illusion versus reality.

The illusion is a deteriorating and weak environment that infers significant price contraction, but the reality is a strong stock market that keeps providing price gains. If the market is strong then why are we bothering with all of these other distractions?

The market is what matters to your portfolio. The fact of the matter is the markets are near all time highs and are not supporting the narrative of a weaker and deteriorating economic backdrop (at least not yet).

The Illusion of Diversification

The Illusion of Diversification

The illusions in today’s markets are not only found when comparing economic data to market strength. The illusion goes across asset classes. Again, we are less concerned with the “why”, and more concerned with “what is”. (However, we have a strong suspicion that the global central banks are a big reason “why” many of the strange things we see today exist.)

Let’s look at the illusion in bonds. The 10 Year Treasury yield is below 2% right now (1.8% to be exact). How do you think bonds will perform over the next 2, 5, 10, or 30 years? The illusion is a bond market that has historically done pretty well. The reality is the starting point of the measuring stick matters greatly.

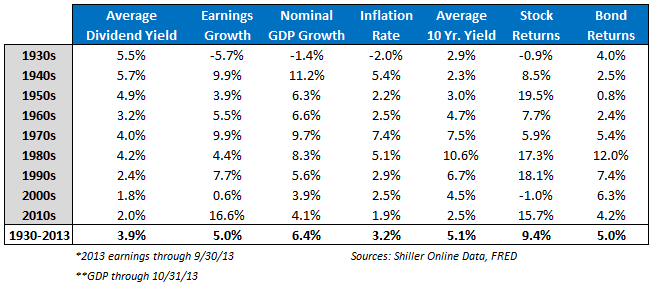

The table below, from economist Robert Shiller, reveals that bonds have returned on average 5.0% per year…not bad. But the starting point matters a lot when it comes to returns as the price one pays is the single most important factor affecting one’s returns, and right now with bonds near all time low yields, bond prices are near all time high prices.

Notice how bonds performed historically when the 10 Year Yield (3rd to last column) averaged 3.0% or below. The only times in history we saw this were the 30s, 40s, and 50s (and thus far in this decade), long before diversified portfolios were being pushed upon the public. The average return for bonds during those 3 decades were under 2.5% per year. With the 10 year at just 1.8% today, do we really think bonds are going to give us much bang for our buck? The answer is no, so why should you dedicate a static 20%,30%, or even 40% or more of your portfolio to that asset class?

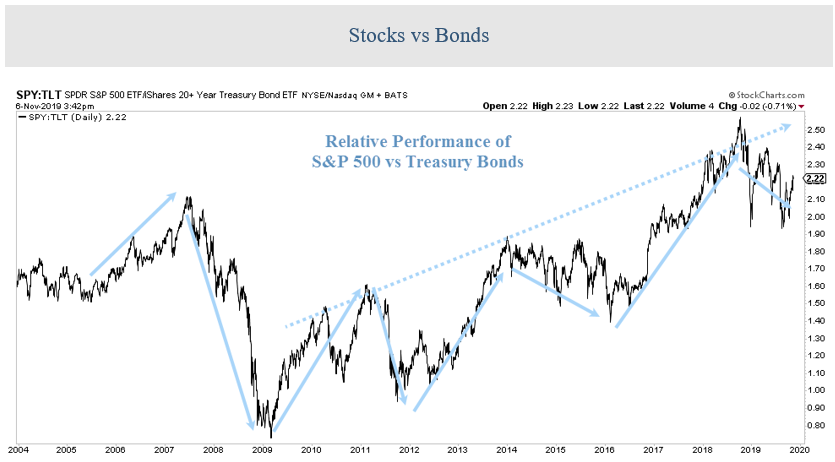

There will still be times when bonds will be a good asset class to own, even with rates this low. The chart below shows that even in a low rate environment, bonds are still very cyclical. The chart below compares equities as represented by the S&P 500’s ETF SPY, compared to the long term Treasury bond, revealing the cyclicality of the most boring of asset classes.

Although stocks largely have been more attractive since 2009, there certainly were times it was more attractive to own bonds rather than stocks, like 2014-2016 and more recently since 4Q 2018.

With cyclicality like this, it is tough to justify owning a set % of bonds at all times like most portfolio managers advise. Instead it makes sense to have a strategy that can move your assets to what is working. Overweighting stocks since 2009 (and underweighting bonds) and during intermittent periods in between has been much more appropriate than setting an allocation to bonds (or any asset class) and forgetting it. At a minimum you greatly improve your risk management, and likely also your returns.

Source: IronBridge Private Wealth

Below are some more excerpts from a client presentation we did that focus on the traditional static portfolio illusion versus the cyclical markets reality. The illusion is you need all assets all the time to have a diversified portfolio. The reality is you need only certain assets during certain times to achieve much better risk adjusted returns. Over time you also will achieve the same diversification (or better) as you actually get non-correlated and inversely correlated holdings when you need them most (like more bonds and cash in 2008 than stocks) rather than positively correlated holdings when you need them least (like bonds and stocks today when they are both going up in price).

In fact, the benefits of diversification itself are largely a fallacy.

Its illusion is safety but the reality is a diversified portfolio is often very risky. It’s extra risky when you need less risk, and less risky when you need more risk.

The place to be in the investment markets over the past decade has been U.S. stocks, so in addition to the heavy weighting of bonds, why has your advisor had you 5%,10%, even 20% allocated to international stocks instead of U.S. equities during the entirety of that period? They will claim it’s all part of some diversification need, but doing so likely had you significantly underperforming with more risk (volatility), the opposite of what diversification is supposed to do for you.

Can you afford another 10 years of underperforming with more risk? The easiest example is 2008 when a very diversified portfolio still fell over 30% in value as advisors mimicked deer in headlights, offering the oh so helpful advice of “staying the course”. How did they actually manage your portfolio during that time period and since? We question what it is exactly these advisors are “managing” except their own pocketbooks.

Do you really need to have international stocks and bonds and small caps and value and growth and financial stocks and REITs in your portfolio at all times? To us this is a cop out and a surefire way to tell an advisor doesn’t really “manage” your portfolio. After all there are plenty of computers that can (and do) do this at much cheaper prices.

At best it doesn’t work, at worst it is disingenuous. At a minimum your portfolio is at the mercy of the market at all times and almost certainly no less risky.

The chart below shows a similar chart as the one above, just comparing the S&P 500 now versus emerging market equities.

Source: IronBridge Private Wealth

U.S. stocks have tripled the returns of emerging markets since 2010, and done so with much less volatility.

Again, why does your advisor have you still exposed to emerging markets at roughly the same percentage you have always been exposed to them? Are they actually building correlation tables and calculating co-variances and doing the analysis to prove they are providing risk protection (of course they are not), or is it more likely they are doing so because it is the industry’s standard cop out?

Don’t get us wrong we are not saying emerging markets are done and should be forgotten, we just want to make sure there is a dynamic plan that will help identify when that time has come.

Indeed, there may be a time when U.S. stocks are doing horribly and emerging markets are doing wonderfully. The tables could certainly turn and you deserve something better than a static exposure that underperforms on the way up and also leaves you over exposed on the way down.

You don’t have to be allocated to all assets at all times. Having any emerging market exposure during the last decade has significantly hurt one’s portfolio.

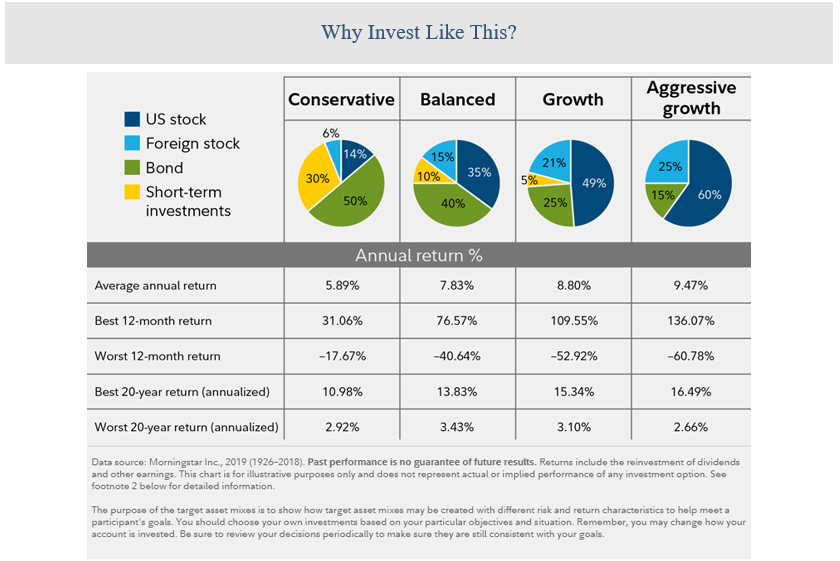

The final chart below provides examples of the portfolios we are advising against. These are the standard “pie chart” portfolios that 99% of advisors suggest to their clients. Notice the upper left reveals a constant allocation to the various asset classes?

There is 6%-25% of suggested full time exposure to international equities right now, and if you ask why, the answer will be to diversify for diversification’s sake, or something along the lines of “foreign equities add value for diversification reasons”.

The chart above showing just how much better U.S. stocks have done compared to international equities reveals this not to be true. In fact it is untrue from the returns perspective as well as from the risk perspective since international and emerging market equities tend to also be more volatile than U.S. equities. Diversification for diversification’s sake is one of finance’s biggest fallacies.

Since our last ‘Insights’ we have followed our own advice and are now fully allocated. We even have a little international and small cap exposure. Why? Not because we always do, but because we have a system in place to take advantage of the things that are working and stay away from the things that are not. We don’t have to be victims of the market’s whims. To do so we need to stay away from the portfolios that set it and forget it, rebalance it to a set % of asset allocation quarterly, and are only reviewed when preparing for a client meeting.

We haven’t owned international equities in client portfolios in a long time, and as mentioned we have a small exposure right now. That could change and we will be happy to either shift it back to domestic equities or increase the allocation internationally, within each of our client’s pre-determined risk thresholds. We are not beholden to a pie chart and thus we are not at the market’s mercy.

Invest Wisely!

Our clients have unique and meaningful goals.

We help clients achieve those goals through forward-thinking portfolios, principled advice, a deep understanding of financial markets, and an innovative fee structure.

Contact us for a Consultation.

Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness. Disclaimer This presentation is for informational purposes only. All opinions and estimates constitute our judgment as of the date of this communication and are subject to change without notice. > Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness.