Something we at IronBridge have been discussing over the past month has been an expectation that COVID cases would rise following Memorial Day and the opening up of the economy and society. This is now happening. In financial markets, increased risks around COVID are battling the liquidity tsunami from the Fed. Who will win?

Once again, COVID numbers are spiking.

Once again, COVID numbers are spiking.

And it shouldn’t come as any surprise.

At our core, humans are social beings. We crave personal interactions, and have a deeply rooted need to be a part of an accepting and protective group. There are various ways people fill this need, through religion, political affiliations, or something far more important like football (we are in Texas after all).

Being isolated for extended periods of time can wreak havoc on a person’s psyche. So it is no surprise that after 3 months of isolation, people want to get out and experience the personal interactions we so crave.

But instead of being cautious, wearing masks and practicing social distancing, many people simply said “forget it”, and went back to life as normal. This combined with massive protests have led to a surge in cases, particularly in people ages 20-40.

So here we are, once again, seeing parts of the economy either slow or be shut down. Today, the state of Texas required bars to close following the recent surge, and it is prudent to anticipate that in the near future other businesses will be shut down as well.

Due to these potential shutdowns, today’s economic environment is as uncertain as any we have experienced in our careers. And likely as uncertain as anyone alive has ever experienced.

But as we have witnessed over the past few months, markets can be strong in the face of great economic uncertainty. There continues to be a huge disconnect between the markets and the real economy.

When there are disconnects like we have today, it is very difficult to predict the direction which will prevail. Will the economy catch-up to the markets? Will markets fall to be more in-line with economic realities? Or will the disconnect continue?

To understand the potential scenarios at play, we must first attempt to gain clarity on the driving forces in markets today. This exercise is a very easy one.

It is COVID versus the Fed.

In one corner, we have the potential damage that an unchecked or extended COVID outbreak could cause to society, the economy and the markets.

In the other corner, we have the Federal Reserve pumping trillions of dollars into financial markets globally.

For now, we simply must ignore the economic data. Why? Mainly because there has been no correlation between market movements and economic data. Why should there be? Markets are forward-looking and built on expectations. Economic data is backward-looking and reflect activity that has already happened. Economists are reliably incompetent, so in an environment where economic data is incredibly uncertain, it does not make sense to apply this to market analysis. Economic data will obviously matter again in the future, but it is a distraction right now.

Before getting into the correlations between the stock market and both COVID and Fed data, let’s first look at the price of the S&P 500 Index this year.

We are now in Round 3 of the heavyweight bout.

Round 1 was easily won by COVID. The uncertainties around the impact of the virus led to a market crash of 37% in just 6 weeks. Other areas fared much worse. Small caps were down 44% and some international markets were down over 50%.

But in Round 2, the Fed woke up. Following the March crash, we saw an eye-popping 47% rise between March and early June. That is a massive move, that more or less happened without much of a pause.

We are now in Round 3. COVID numbers have been rising, and markets have fallen 9% from recent highs.

But who is ultimately going to win…COVID or the Fed?

COVID versus the S&P 500

Let’s start with COVID.

The current bearish argument suggests that the rise in confirmed cases is causing market volatility. This may very well be the case, but let’s take a closer look.

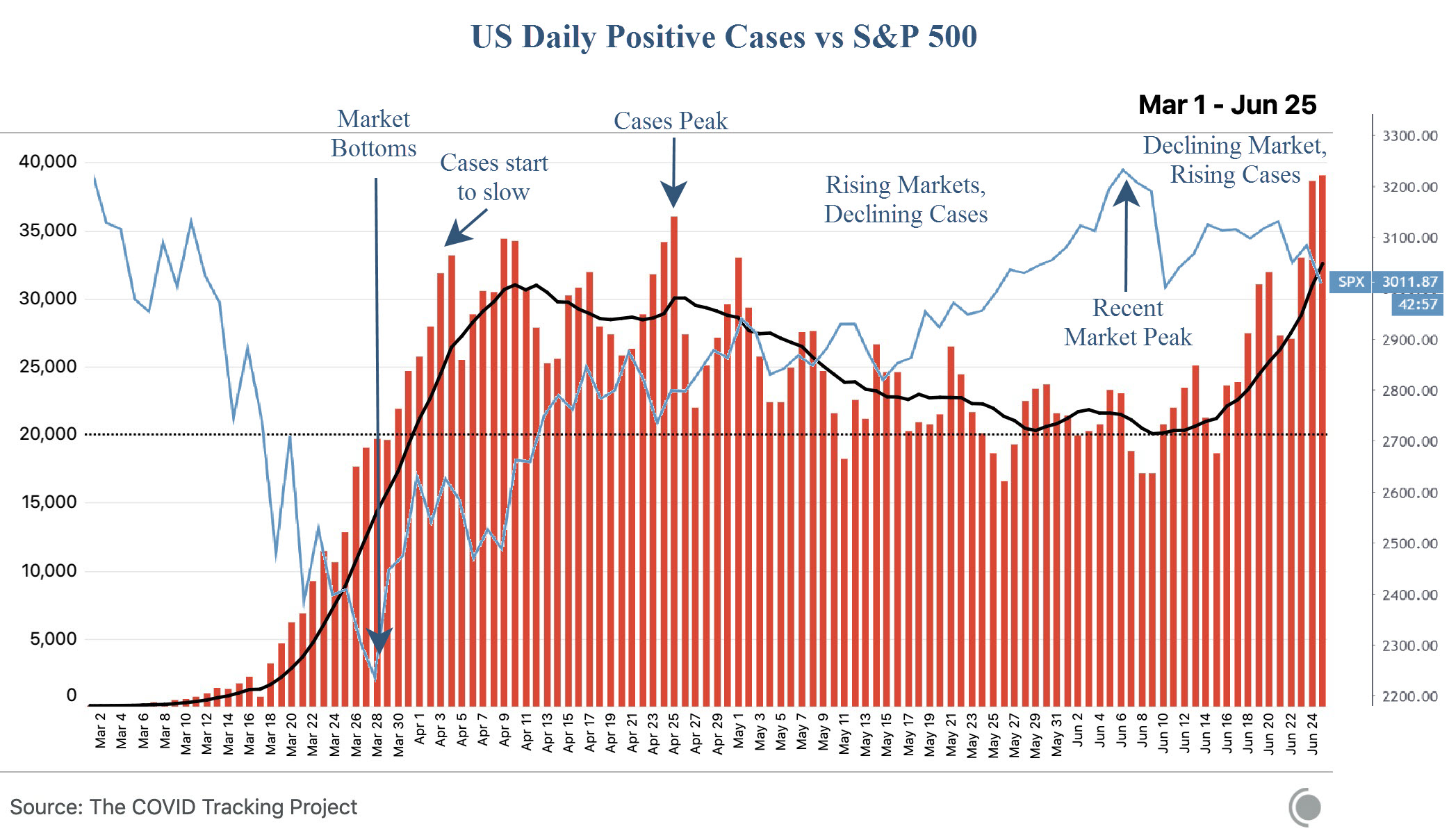

The chart below from the COVID Tracking Project shows confirmed positive cases daily in the US, with a 7-day moving average in black. We have overlaid the S&P 500 index on top of this chart to give it some context. (We apologize that some of the S&P chart may be difficult to see. Click on the image to enlarge it.)

This shows a few interesting trends:

This shows a few interesting trends:

- Daily confirmed cases didn’t begin to slow until two weeks after the market low.

- Daily confirmed cases didn’t peak until almost a month after the low.

- The steady decline in daily cases does appear to correlate with the push higher in markets in late May and early June.

- The market began to fall before cases began to rise again.

Cases were steadily rising well after the market bottomed, and didn’t peak for nearly a month after the lows. Initially there was zero correlation between confirmed cases and stock prices.

However, things changed, and there was a decent correlation in May and early June when cases were falling and markets were rising. We could make that same argument over the past 3 weeks as well, as markets have moved lower as cases have once again risen.

If we looked at cumulative cases, instead of daily cases, there were roughly 200,000 total confirmed cases in the US at the market low in March. Today, we have nearly 2.5 million.

So an increase of 200,000 cases caused a 37% crash, but an increase of 2.3 million corresponded to a 47% increase in prices?

Bottom line, there must be a correlation. But the correlation is one of expectations around COVID cases, rather than actual reported cases.

This would make sense. If COVID statistics were unquestionable in their accuracy, we would have a much better sense of how markets actually correlated to the outbreak. But these statistics are suspect at best. Do we really believe the data from February and March? Testing was jokingly low at first, and is still under-reported in our opinion, although strides are being made in the right direction.

As is the case with many data points that are external to the markets, one can argue it both ways. On one hand, it’s difficult to conclude that an increase in cases won’t have any effect on prices. On the other hand, one cannot make a conclusion that a second wave will inevitably result in another market crash.

We must consider the Fed.

The Fed versus the S&P 500

As we referenced in our previous Insights publication, “Dispersion”, the Fed can and should take the credit for the huge rally off the lows. You can read this report HERE.

They have flooded the market with over $3 Trillion of liquidity. From the market lows, the Fed consistently added money to the financial system, directly resulting in a rising stock market.

But an interesting thing happened in early June…the Fed stopped printing.

Despite having announced that they would add over $6 Trillion into the markets, they paused at $3 Trillion. Maybe it was because they felt a 47% rise in markets was enough. Maybe they saw financial conditions easing and felt the prudent thing to do was to stop the madness. Maybe they needed to keep some dry powder in anticipation of a second wave outbreak.

The next chart shows the Fed balance sheet versus the S&P this year.

This shows an extremely clear correlation between the Fed and the stock market. Once the Fed started printing, stocks halted their decline and proceeded to explode higher. And when the Fed stopped printing, the market paused as well.

Regardless of the reasons behind the Fed’s actions, the result is crystal clear. The Fed has a direct impact on stocks. More than COVID, more than the economy, and more than corporate earnings.

So What Happens Next?

In our direct discussions with clients, and in our published reports, we consistently expected a large rebound when markets eventually bottomed. We have definitely seen that occur.

Client portfolios have been fully allocated for the most part of the past 3 months. And clients have benefited from a bullish environment that our signals identified.

In the near-term, however, things are less clear. As uncertainty rises, it is natural for markets to become anxious. It is also very normal to see 8-12% pullbacks when things are normal, much less in the long, strange trip of 2020.

You never know when a small pullback will turn into something larger. March was a great example of that.

But to become too bearish following the recent rise in COVID cases does not appear to be the most prudent action.

Patience is the key. If you have cash, it can be prudently put to work, but let the market come to you. Don’t force exposure. Don’t chase stocks higher, but don’t wait too long either. Establish a process, and follow a predetermined plan.

On the flip side of it, patience is also key if your portfolio is invested. Don’t force your portfolio into cash with the expectation that things are going to fall apart. Establish risk management rules, and follow your plan.

We have been consistently raising stop losses in client portfolios in the event markets deteriorate once again. The market has rebounded tremendously, and we don’t want to give too much back.

However, a nearly 40% decline in markets is a major move lower. And major moves like that don’t tend to repeat very quickly. This is an unprecedented year, so we cannot ignore that possibility, but we should not expect it either.

In the short-run, what we should expect is slightly more volatility than we have seen in the past two months. However, we should not expect volatility to return to levels seen in March during the crash.

When the COVID outbreak began, uncertainty and panic were tangible. It was an ugly surprise, and no one knew quite how to handle it.

A second wave does not carry with it the same uncertainties. Yes, it may cause more death, and may cause continued economic hardship. These are awful things, and we’re living in difficult times. But the unknowns are fewer today than they were in March, and any market shocks should be much less painful than during the first wave outbreak.

So despite the COVID uncertainties, the elephant in the room remains the Fed. If chairman Powell unleashes the remaining $3 Trillion of liquidity, it will likely overwhelm markets once again.

In this heavyweight battle between the Fed and COVID, at least with regards to financial markets, we must give the edge to the Fed until proven otherwise.

Invest wisely!

Our clients have unique and meaningful goals.

We help clients achieve those goals through forward-thinking portfolios, principled advice, a deep understanding of financial markets, and an innovative fee structure.

Contact us for a Consultation.

Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness. Disclaimer This presentation is for informational purposes only. All opinions and estimates constitute our judgment as of the date of this communication and are subject to change without notice. > Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness.