When investing, listening to common wisdom can be very productive. But not all “wisdom” is worth listening to.

Here are three philosophies that can help you improve your investment results.

1. You Don’t Have to Own Stocks Forever

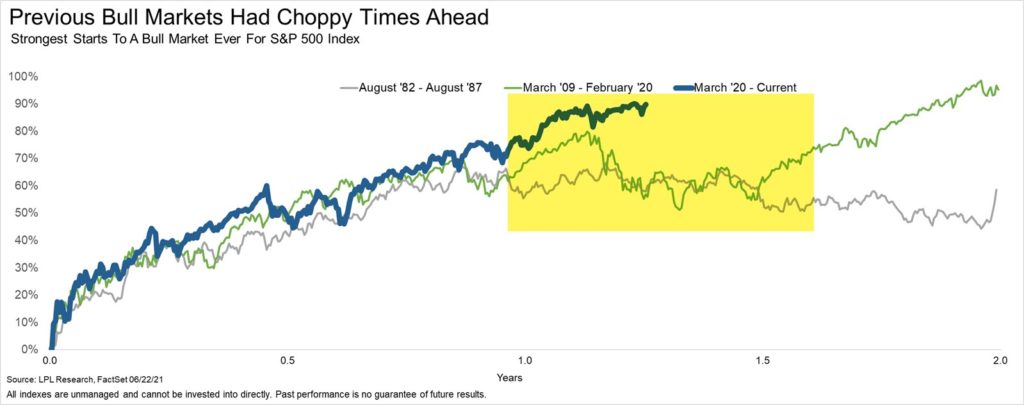

There is a lot of potential risk in markets right now.

But guess what? There always is.

We’ve been trained to think that if you buy stocks, you must own them forever or else you’re doing it wrong.

Don’t buy into that kind of thinking.

It’s okay to get out. It’s okay to have stop losses. It’s okay to allocate capital to stocks right now, as long as you have the proper risk management strategies in place. In our opinion, that means having rules to move out of stocks and back into cash.

In fact, we think that you should intentionally be thinking shorter-term when it comes to stocks right now. There are signs that the stove could get hot. But avoiding it means you may be passing up on solid investment returns in the meantime.

2. Separate your Emotions from your Actions

We believe in having rules. This allows you to not have a vested emotional interest in the outcome of the stock market.

When humans predict something will happen, they create both a confirmation bias to that prediction as well as an anchoring bias to the predicted outcome.

A confirmation bias is when we look for things that support our way of thinking. Politics and social media are the ultimate examples of confirmation bias today. People like to watch and read things that support their view.

Anchoring bias refers to how we view an array of information based on an initial assumption or data point. If we view the market as one that should be rising, we tend to subconsciously view that as the primary outcome we should expect. And we don’t only actively seek out confirmation of our theory, we interpret data points and events to be supportive of that belief, whether that is the accurate way to interpret it or not.

Both of these biases result in viewing markets without the objectivity and discipline needed to be successful investors.

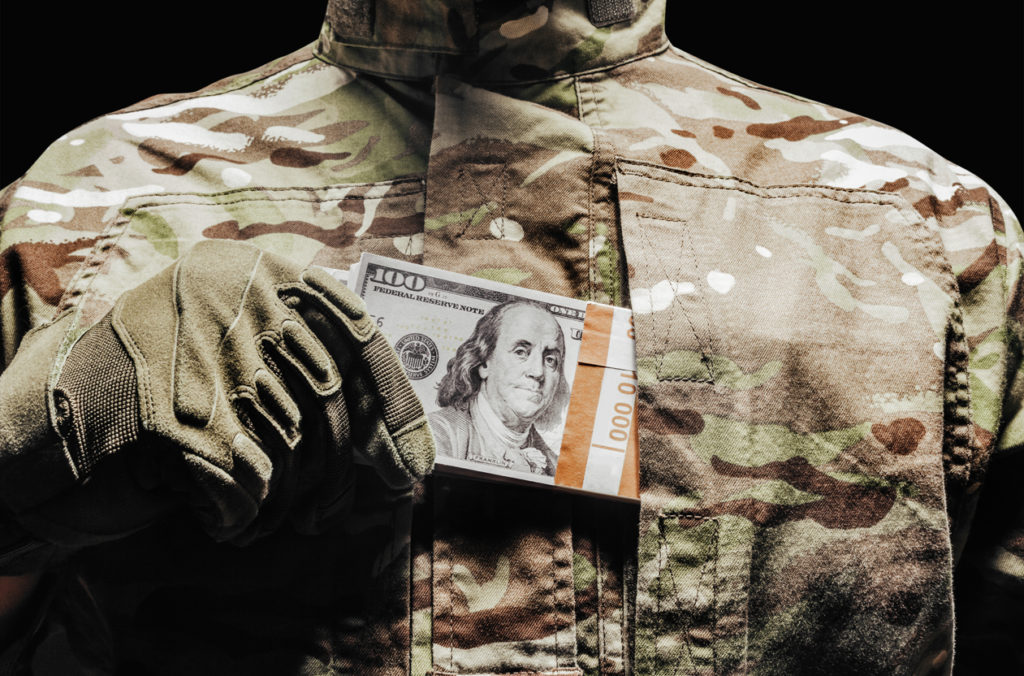

3. Be a Mercenary

This means you want to fight for the side that both pays you the most money and avoids the most harm.

Tech is doing well? Great. Invest there.

Inflation is coming? Great. Invest in areas that are showing benefits to that inflation.

Markets are crashing? Great. Have more cash.

Bottom line: Don’t be dogmatic. Don’t be a permabull or permabear. Try to fight for the winning side. You won’t always be right, but you’ll be on the right side of the big trends when they happen.

Having a process will help tremendously when markets get confusing. Remembering these three