The idea which some people seem to entertain, that an active policy involves taking more risks than an inactive policy, is exactly the opposite of the truth. The inactive investor who takes up an obstinate attitude about his holdings and refuses to change his opinion merely because facts and circumstances have changed is the one who in the long run comes to grievous loss.

– John Maynard Keynes

The US stock market just had one of the strongest four months in history.

Can this market strength continue?

Spoiler alert…probably.

This time last year the data was NOT good, and risks to markets were incredibly high.

But as the year went on, the data improved. Our signals added risk back to target levels in client portfolios, and we were able to capture nice gains.

Fast-forward one year, and we have almost the exact opposite situation: good data, good markets and a generally positive environment.

However, the quote above from Keynes is as applicable today as when it was originally said in the 1930’s…as investors we MUST be able to look at data objectively and change strategy when it is required.

We were required to do that in 2023.

Will we be required to change from a bullish stance to a more negative one in 2024?

Let’s do a quick market scan to determine the likelihood of this.

Stock Strength to Continue?

As we mentioned earlier, stocks just had one of the strongest four-month spans in history.

In the 20 weeks that ended on March 15th, the S&P 500 index gained over 24%.

One might logically think that since stocks went up so much, they are overdue for a major pullback.

But the data tells a different story.

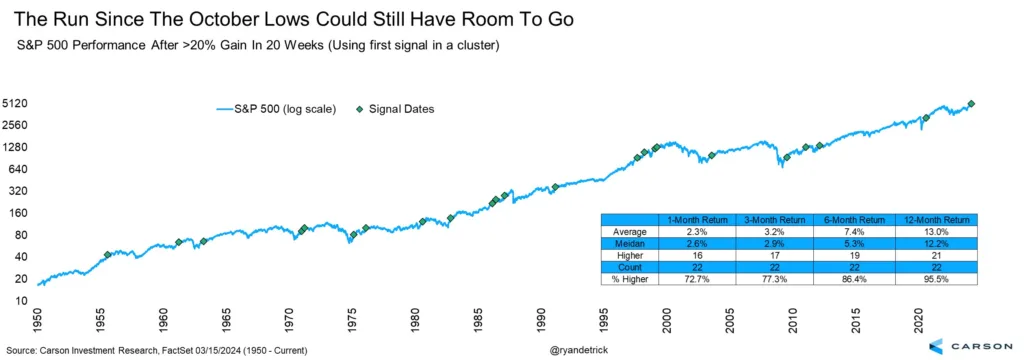

Our first chart is courtesy of Ryan Detrick of Carson Investment Research.

This chart shows the previous times the S&P 500 was up over 20% after 20 weeks. (You may need to click on the image to enlarge it.)

Since 1950, there have been 22 times the S&P 500 has been up over 20% in 20 weeks, as shown by the green diamonds in the chart above.

In 21 of those 22 times, the market was higher 12 months later by an average of 13%.

This is on top of the 20% that already occurred.

Even over the shorter timeframes, markets tended to do well.

Markets are higher one-month later roughly 72% of the time with an average performance of 2.3%. This beats the average monthly gain of 0.7% by nearly 3x.

Bottom line is that recent strength is positive, and despite any near-term correction that may occur, higher prices appear likely over the course of the year.

Opportunity Still in Small Caps

If we do see the historical trends mentioned above continue, then there still remains an opportunity in small cap US stocks.

We discussed small caps in detail in our 2024 Outlook report, which can be viewed here:

The summary of our analysis was that if markets continue higher, we should expect smaller companies to perform well, possibly outperforming large cap stocks.

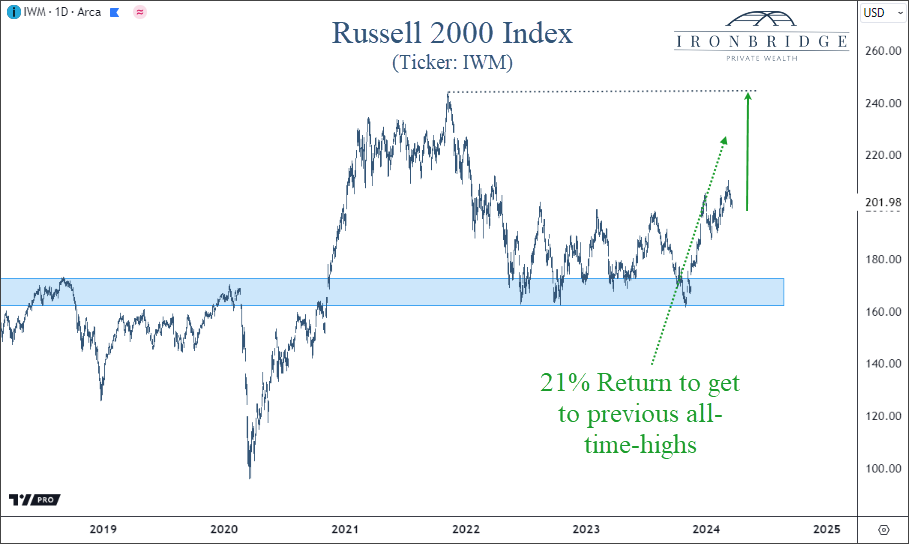

The next chart below shows this opportunity.

While the S&P 500 surpassed its previous all-time-highs last year, small caps still have a ways to go to achieve the same result.

In fact, the ticker IWM needs to go up 21% to get back to it’s previous highs.

Small caps are trying to break out of their range from the past two years, and if they are successful, then we should see the next leg higher for markets in general.

That is, as long as problems in the commercial real estate sector stay contained.

Commercial Real Estate is Stable (for now)

The wild card in small cap stocks remain the challenges from commercial real estate (CRE) debt.

So far, CRE debt has not been an issue in 2024.

Delinquency rates continue to be elevated, but there has been no further deterioration, which is a good sign.

Optimism that interest rates would fall this year has helped contribute to a stabilization in commercial real estate prices.

This stabilization has been needed for that sector of the economy.

CRE debt remains the single biggest risk to stock prices, in our opinion, given the potential to cause failures in smaller banks.

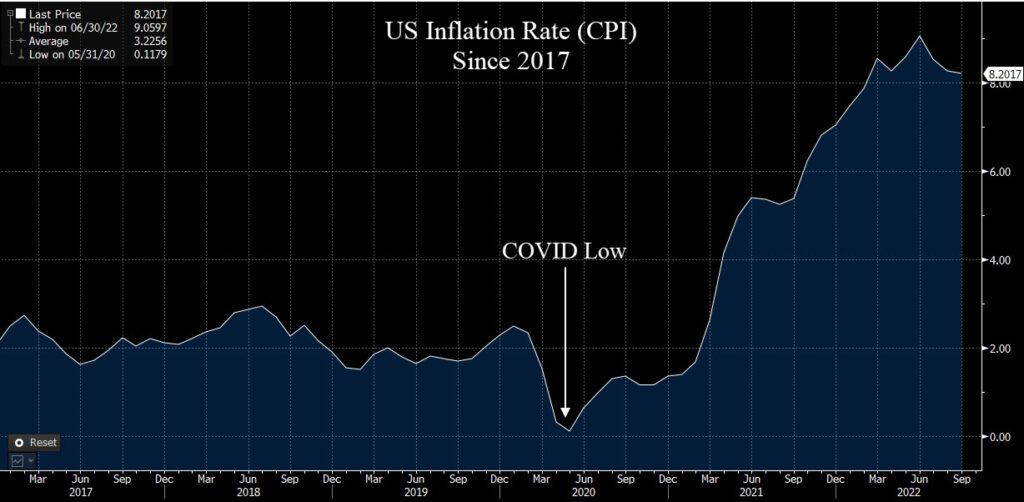

Inflation Pressures may keep Rates High

What about interest rates?

After all, the Fed did meet yesterday and kept rates unchanged.

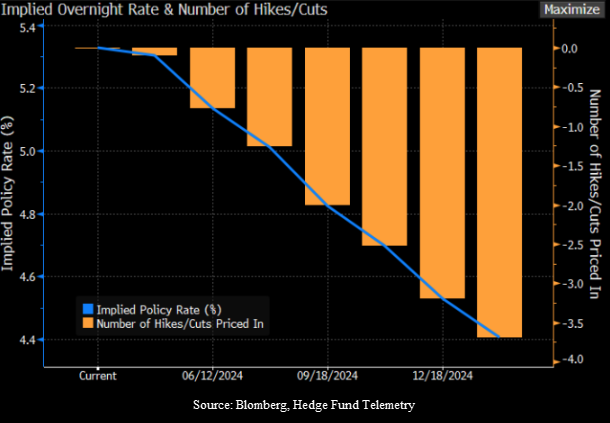

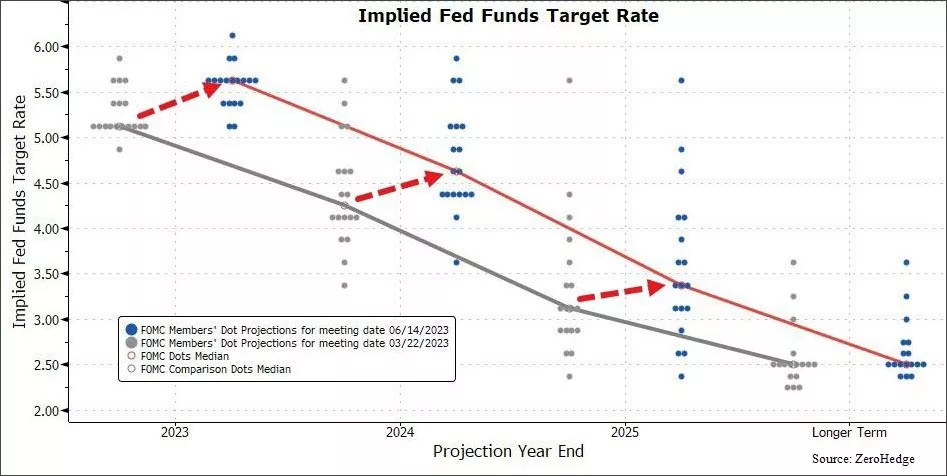

Two months ago, markets expected the Fed to have 6 rate cuts this year. Now, we’re down to an expected 3 rate cuts this year, with another expected next January, as shown in the chart below.

The blue line above shows the implied policy rate, or the rate which the Fed charges banks to hold funds overnight. This rate is currently in a range of 5.25 – 5.50%.

Learn more about the Fed Funds rate HERE.

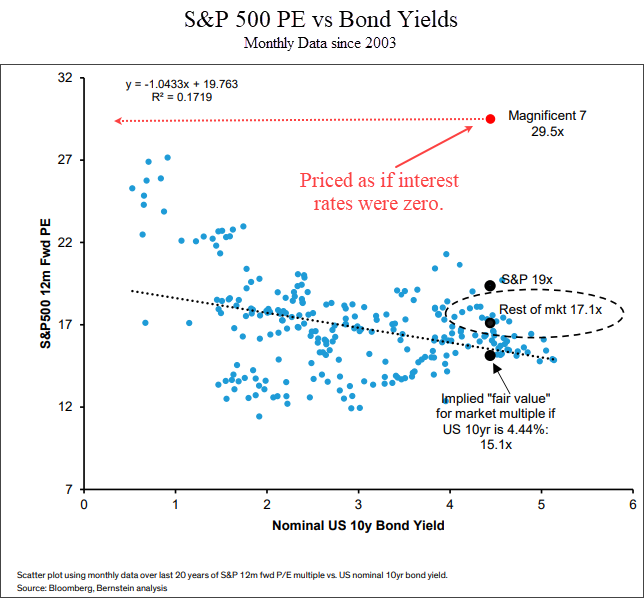

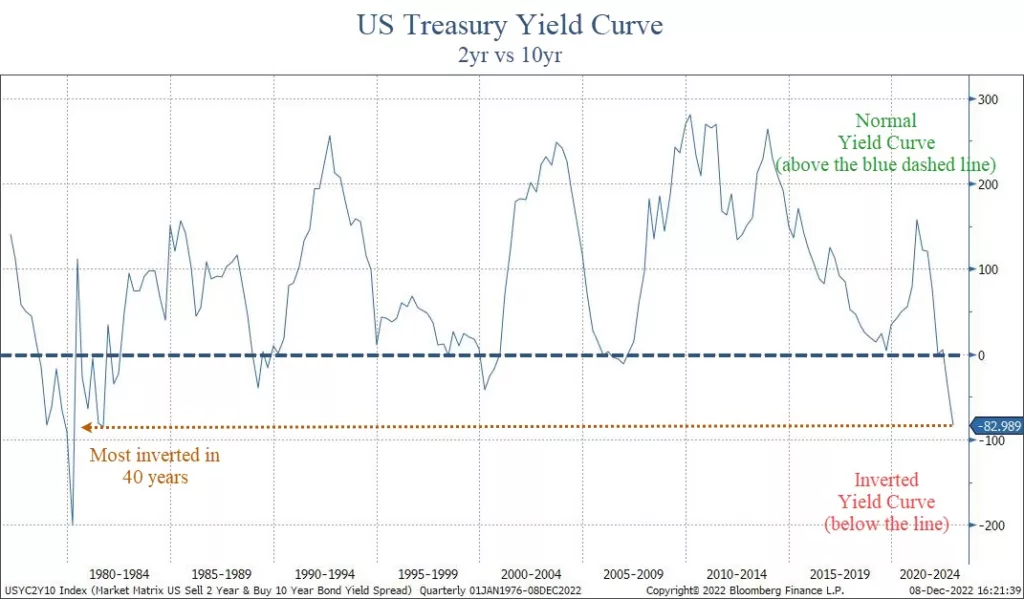

With this many rate cuts projected, the market still appears to be anticipating a recession, despite the lack of recessionary data.

Why do we say that?

First, financial conditions are as loose as they’ve been since at anytime since the ’08 financial crisis.

Loose financial conditions imply that stress is low in the markets and the economy, providing support for economic growth.

Second, credit spreads are narrow.

This simply means that the riskier parts of the bond market are not showing signs of stress when compared to US Treasuries. Credit spreads are one of the earliest signs of stress in financial markets.

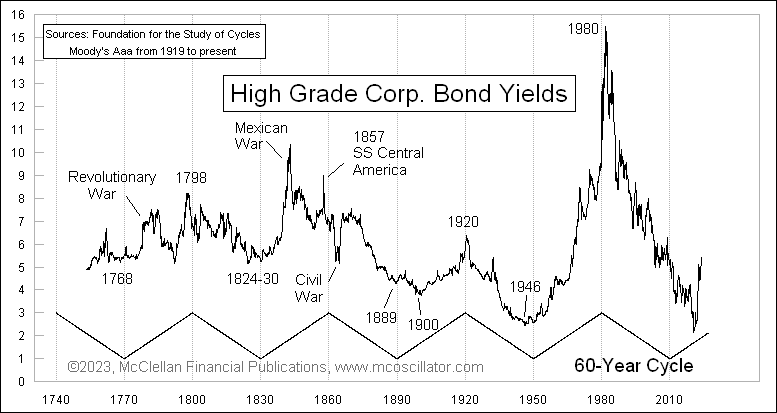

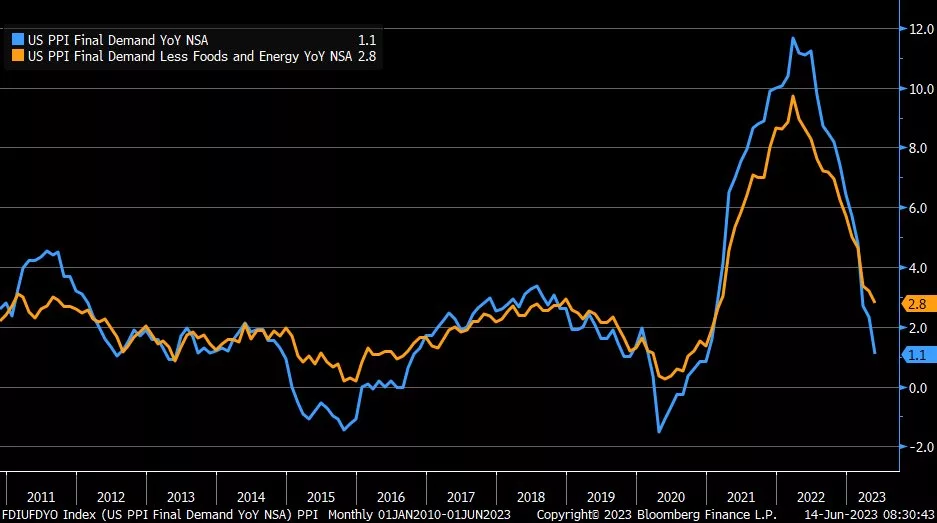

Third, inflation could be headed higher.

With a tight labor market, loose financial conditions, a supportive Fed, and an economy moving in the right direction, the conditions exist for another wave higher in inflation.

Higher inflation will NOT warrant rate cuts by the Fed.

In order for the Fed to cut rates, we believe that there needs to be a recession. And we simply don’t see that in the data in the near term.

But what if they do cut? What should we expect from markets?

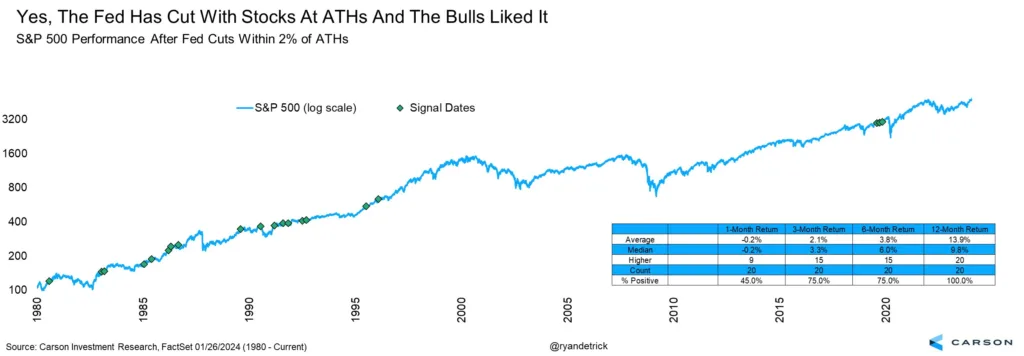

Rate Cuts when Markets are near All-Time-Highs

Let’s imagine that the Fed does decide to cut rates in the next few months, and stocks remain around these levels or higher.

What would that mean for stocks?

Our friend Ryan Detrick once again has excellent data.

He looked at every time we saw a Fed rate cut with the S&P 500 within 2% of all-time-highs.

What he found was also bullish.

There were 20 times previously that the Fed cut rates with markets near all-time-highs.

Of those, markets were higher 20 out of 20 times, with an average gain of 13.9%.

Put another one in the bullish camp for 2024.

Bottom Line

The weight of the evidence suggests higher prices over the next year.

The combination of a strong market, loose financial conditions and stability in the commercial real estate market point to a generally calm market environment over the near term.

Things can always can change, so we must remember the quote above from Keynes and be vigilant in assessing risks and opportunities.

But for now, we should expect near term volatility to occur at any time, but expect that it should be short-lived and followed by higher prices.

Invest wisely!