Employees of publicly traded companies are often granted company stock as part of the compensation package. From a portfolio management perspective, holding outsize amounts of stock in the same company that provides income can increase risk. If the business were to become wobbly, not only would the stock decrease in value, but the employee could also potentially find themselves out of a job. Employees who are granted stocks often mitigate this risk by selling some of the company stock and reinvesting it in other assets, to diversify growing wealth away from the source of income.

But what about when you own your business?

The situation becomes more complex. One strategy that’s often followed is to put everything except living expenses back into the business while you are growing it, and then sell part of the business or take on a strategic investor to help you begin to diversify elsewhere. Retirement planning is put on the back burner until the business has grown to a point where the business can be monetized.

We think there is a more thoughtful approach that may work for business owners.

The Key: Diversification

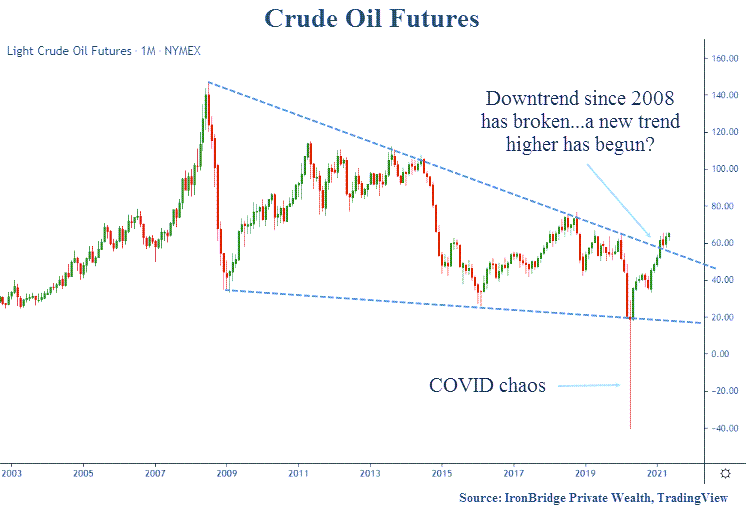

While it may seem like a good idea, relying solely on your business as your source of wealth can expose you to a lot more volatility than you think. Whether it’s saving for a rainy day, or longer-term goals like retirement, if all of your wealth is tied up in your business, your business dictates your moves. Creating and regularly adding to a separate investment portfolio may help diversify your assets. And if you invest away from areas you are already exposed to in your business, it can be a powerful tool to help you smooth volatility across both your business and life. For instance, if your business is vulnerable to cyclical sectors, you’ll want to create an investment portfolio that is defensive against those sectors.

Retirement Savings Tax Advantages

There can be significant tax advantages to setting up the right kind of retirement plan for your business and ensuring that you set aside money to invest as close to the maximum as possible every year. While there are of course upfront fees and ongoing costs associated with formal retirement plans, they also allow you to save in a very tax-advantageous manner. Depending on your situation, a 401(k) plan and a cash balance plan are tools you can use to save and look towards a future income stream you can access without having to sell your business. They can also be a great way to attract and retain talented employees.

How About Timing?

When you’re putting everything back into your business with the idea that you’ll eventually fund your retirement by selling all or part of it, you’re essentially making two bets: That you’ll be able to sell when you are ready and not before, and that when you are ready the market for your business will be at a good point for an exit. Having to liquidate early because you are no longer able to run the business, or having to sell when either the business is struggling or the market isn’t right, can limit the amount you realize. You only get to sell it once, and your retirement life will be dependent on what you realize. If you’ve planned for a source of retirement income away from your business, you’ll have more flexibility when it comes time to sell.

The Bottom Line

Even as you’re building your business, it makes sense to think about your personal wealth as a completely different stream of future income. Thinking about diversification across your total asset profile can get you started on a journey to financial independence.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation. This work is powered by Seven Group under the Terms of Service and may be a derivative of the original. More information can be found here.