With rapid advancements in technology computing power, we now have access to information that was once unfathomable. But having information and properly using information are two very different things. A successful investment strategy must combine the benefits of both humans and machines.

Numerous economic indicators are flashing warning signs. Most recently, December retail sales came in horribly below predictions. Additionally, the consumer has taken on a massive amount of non-housing debt since the financial crisis. It seems the prevailing theme of a strong consumer may be misleading, just as the strong corporate balance sheet was proven to be in our last ‘Insights’.

Portfolio Insights

Cyborg Portfolios

“Computers are incredibly fast, accurate and stupid. Human beings are incredibly slow, inaccurate and brilliant. Together they are powerful beyond imagination.”

-Quote attributed to both Albert Einstein and Leo Cherne

The stock market continues to suck investors back in, us included. Following such a dramatic fall in Q4, the market completely reversed course and has been amazingly strong since Christmas Eve.

So was that it? The bear market lasted three months, and we’re now on the way to new highs? We definitely are not ruling that out. Or was that the market decline just an omen of things to come? We can’t rule that out either.

We find ourselves today in an absolutely textbook Late Cycle environment. What makes investing so difficult late in a cycle is the wide dispersion in potential outcomes. Return potential is still good, as the bull market could last another 3-5 years. But downside risk is incredibly elevated as well. So we end up with a year when the market could easily be up 20-30%. It could also be down 20-30%.

You may ask, “So what’s an investor to do…just buy the index and forget about volatility?” We don’t think so. “Should you bury cash in the backyard and avoid this mess altogether?” We don’t think that either.

“So I’m supposed to just sit here and read your vague answers to my serious questions?” Sorry, we’ll get on with it.

In this kind of environment it all comes down to two things: Discipline and Mindset.

Discipline

The investment world is not lacking in technology, and it is not lacking in information. Quite the opposite, as we are awash in information about the markets provided by a plethora of different technologies.

But having too much information can become a burden if there is not a repeatable way to process that information. This is where Discipline comes in.

Microprocessor counts have doubled every year since 1971, as shown in the first chart. This gives us access to data that was once unimaginable.

Microprocessor Growth over Time

Access to technology and data can be a great asset in portfolio management when used properly. It can help identify and adjust to opportunities before our brains piece the puzzle together. Computers can process millions upon millions of data points in a fraction of a second. The human brain, on the other hand, can only process between five and nine “chunks” of information at any given time.

Here is where things can go wrong. What if you’re using technology to find great data, but it’s the wrong data? Or what if you’re focused on a few seemingly important investment themes, but they are the wrong themes? Or, it’s the right data, but you just don’t know how to properly use it? It’s not the ability to have information that is important. It’s the ability to find information that can give you an advantage that is important.

The most important aspect to using technology is discipline. There are many times that the data and the human brain are in conflict. What then? If you don’t have a repeatable process that has been tested in various conditions, then human nature takes over, and decisions are made on fear and greed rather than being rooted in probabilities.

But a system that is reliant on technology alone misses the fundamental concept that markets are not physics. Markets and economies are the broad collection of billions of individual decisions. An economy is not a “thing” by itself. An economy is someone deciding to buy a sandwich. And to buy a car. And to give flowers to their significant other. And to fall behind on payments on the car they just bought (more on that in the Market Microscope section below).

Likewise, the market is not a “thing” by itself either. It is someone buying 100 shares of Apple from someone who is selling 100 shares of Apple. Repeat that a couple billion times every day and you have the stock market.

But on a scale as large as the market and the economy, it DOES start to display its own behaviors as if it were an independent “thing”. A wonderful book was written on this called “Extraordinary Popular Delusions and the Madness of Crowds”, by Scottish journalist Charles Mackay. (Available on Amazon HERE).

In it, Mackay analyzes the great financial bubbles of history, such as the tulip bubble and South Sea bubble, but also explores societal manias like the Crusades and Witch Manias in Europe that lasted for two centuries. It is as applicable today as it was when it was written. In 1841.

That is because the human psyche has not changed. Yes, we now have iPhones and centralized plumbing and tall buildings, but we’re still humans. And subject to all the same flaws that humans have repeated for thousands of years.

The lesson is that while technology can crunch numbers, it is not yet very effective at contextualizing data. In our opinion, the ideal combination of humans and technology is for humans to create the structure, technology to do the mining of data, and then humans to approve and act on the data.

This is exactly how we build portfolios. We create portfolio sub-structures that have very specific goals, with specific sets of rules. Then we let the computers take over and analyze data. Using this process, we can then customize portfolios for clients with varying objectives and risk tolerances.

Taking this “cyborg” approach, we believe we can both leverage technology to fill the gaps in analysis that cannot possibly be achieved by humans, but still have a human over-ride to contextualize portfolio decisions to act in the best interest of our clients.

With any human involvement in a decision-making process, the experience and background of the decision-maker becomes an important factor. This brings us to the other important requirement to successfully invest, which is mindset.

Mindset

In January, we discussed the difference between being right and making money (found HERE). What we primarily mean when we say this is that we frankly don’t care if we’re right about the direction of the market. No investor’s goal should be to try to predict the market. If it is, then the entire portfolio foundation is built on sand, not concrete.

The goal is to make the greatest return possible with the least amount of risk. Period. It’s about probabilities, not predictions. Discussions around mindset are geared primarily at behavioral finance topics. We discussed various cognitive biases in late 2017 (read it HERE).

When left unchecked, the human brain will wreak havoc on an investment portfolio. Fear will make you sell low, greed will make you buy high.

But the most harmful situation is a stealth one, and is called “anchoring”. This is what we see every day in the investment world. Recently, the largest investment firms came out with their 2019 forecasts. Not only is this useless in that these predictions are statistically awful at being “right”, but it causes people to now put a stake in the ground on what their prediction is.

The reason this is so harmful is because once someone makes a prediction, it is psychologically extremely difficult to admit you’re wrong. So the investment committee of these large firms say that the market should go up over 20% this year. The financial advisors listen to their investment committee, and then tell their clients the markets are going to go up by 20% this year. Then these clients tell their friends the market is going up 20% this year.

Now everyone is “anchored” to this prediction.

Anchoring becomes the most harmful when markets change. When anchored to the belief in an outcome, people become slower to listen to data that contradicts this belief. Changing data is ignored, or at least made to sound less relevant.

This is why so many mistakes happen at market peaks and market bottoms. People buy the high-flying stocks at the top and ride them down. People panic at the lows and miss the rallies. Rinse and repeat.

When investing, you must be able to admit defeat and move on from an investment. To do otherwise inevitably results in the loss of capital. Yes, maybe you held on during the volatility last fall, and the market rebounded (at least partially).

Maybe the market will continue to go up for another few years. But in the part of the market cycle where we find ourselves today, you must be willing to objectively look at all data and not get dogmatic about what you think will happen.

Your mindset becomes an active factor in your investment returns. Awareness of your own mindset becomes a way to minimize the negative effects on returns from our human behaviors.

Thus, we strive to combine the benefits of both the human mind and the machine technology into a cyborg-like process, using advanced technologies, a prudent overall portfolio structure, and an rigorously open mindset to be aware of both risks and opportunities in today’s world.

Market Microscope

Recession on the Horizon?

“Most people get interested in stocks when everyone else is. The time to get interested is when nobody else is. You can’t buy what is popular and do well.

-Warren Buffett

Webster’s dictionary has been the predominant source for definitions and the meanings of words for over two centuries. Interestingly, they offer online their 1828 version (visit HERE) which should be void of any modern day influence to language. Utilizing this version can sometimes provide a more interesting angle to language and meaning.

When we look up the word ‘Skeptic’ in the 1828 dictionary (or Sceptic as that version has the word), we see that a Sceptic is one who doubts the truth and reality of any system or doctrine. Also, the definition continues, in philosophy sceptic is a follower of Pyrho, the leader of a sect that maintained that “no certain inferences can be drawn from the reports of the senses”. So essentially a skeptic is one who doubts all he/she encounters in systems, documents, and his or her own senses.

That seems pretty extreme, but the Warren Buffett quote above is a testament to skeptical investing (or what some may refer to as contrarian investing), something many would agree Buffett has mastered. Generally speaking Buffett buys up out of favor companies, and as a result of their dislike, he typically gets them at deeply discounted prices. After all, the crowd majority’s lack of interest is what provides him his out of favor opportunities at deeply discounted prices. He is a skeptic of the crowd’s consensus.

Putting on our own skeptic hat, how should we view the following two recent “news” headlines”. Which of these two statements is the crowd consensus currently?

- CNBC – Jan 22, 2019 – “Bank of America CEO, ‘U.S. consumer is very strong'”

- CNBC – Feb 12, 2019 – “A record number of Americans are 90 days behind on their car payments”

We see a lot of presentations. We get presentations from Goldman Sachs, from First Trust, from Pimco, from Wells Fargo, from hedge funds, from analysts, even from the government. Most of the recent presentations have the same takeaway: The U.S. economy is strong, the consumer is strong, and therefore the stock market will be strong.

The first headline above paints a similar picture as most other presentations we’ve come across. This positive outlook is likely where the crowd currently resides. But in a world where the consumer is very strong, how can we have data points as suggested by headline #2 and supported by the 2 charts on this page? The consumer is as strong as ever, yet 7 million of them are “deciding” not to make their car payments? If it is true, then it means there are more people delinquent today than ever, even during and coming out of the financial crisis. WOW!

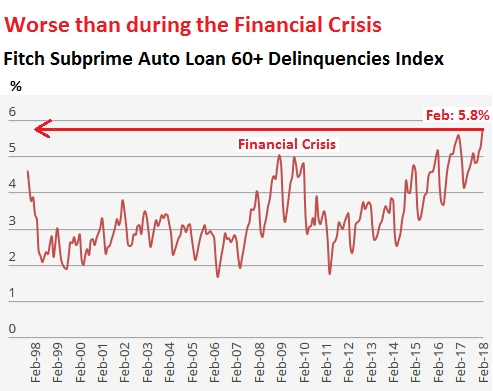

The first chart below reveals, at the subprime level anyways, the number of delinquencies as a % of auto loans outstanding has also never been higher…and this data only is updated through the 1Q of 2018. We wonder how the 4Q’s volatility affected this number.

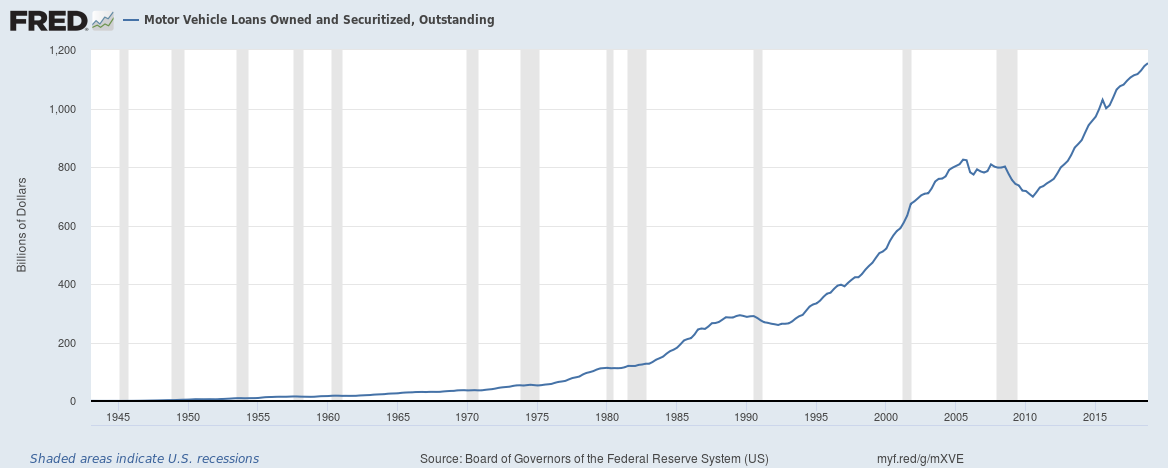

Additionally the next chart shows the massive ballooning of auto loans, a new record, and now well over $1 Trillion.

The skeptic in us has to be questioning the real “strength” of the American consumer here. This should not be occurring in a robust economy still in its uptrend. Look at 2007’s subprime delinquencies as an example. There were less than 4% delinquent, even in early 2008. This data suggests the lower end of the consumer sphere is in worse shape today than prior to the financial crisis.

Last week we took a look at the corporate balance sheet and discussed how things have seemingly gotten worse, not better, since the financial crisis, contrary to the popular opinion as businesses have grown their debt loads more than their assets. It seems we were contrarians concerning the corporate balance sheet and now, putting on our skeptic hat, we are not so fast to jump to the popular conclusion that the consumer is “very strong” either.

There’s certainly a case to be made that both business and consumers are masking underlying issues with growing debt.

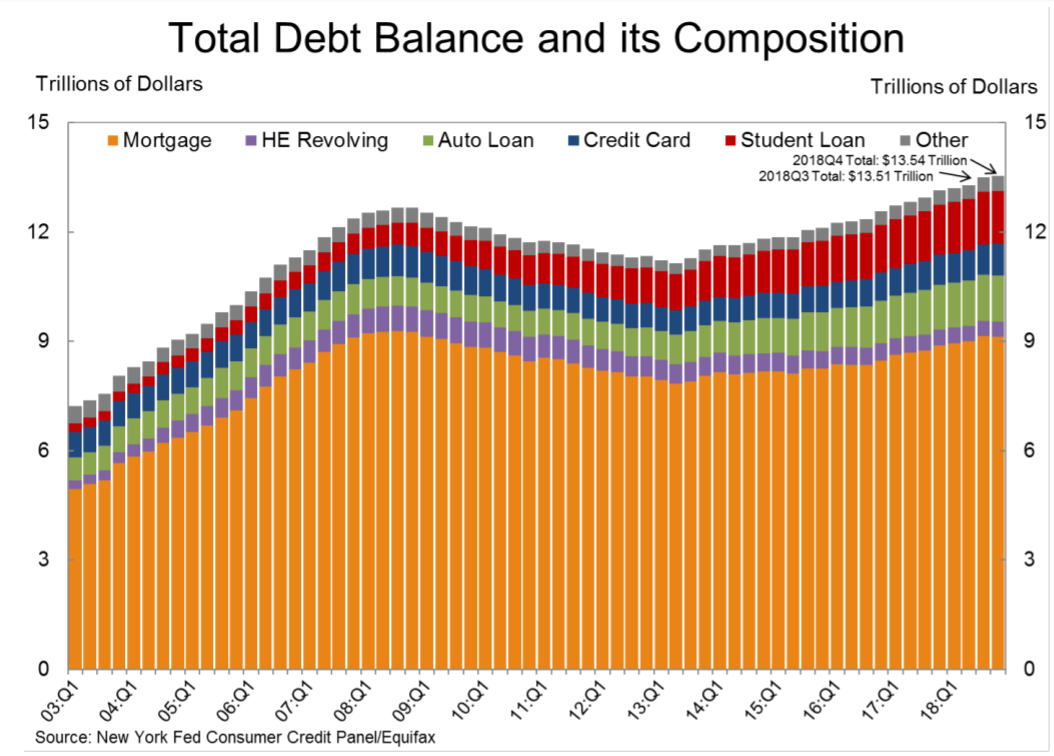

The chart above also helps support this conclusion. Why is the consumer today taking on more debt than they did prior to the financial crisis? When this chart is adjusted for the number of households in America, the debt today per household is on par with the debt per household 10 years ago. It seems we are back where we started as the consumer once again levers up to participate in the trend, only this is likely way too late. The time to lever up is after a large downtrend, not after 10 years of uptrend.

Some debt is arguably better than others. Many would agree that mortgage debt is probably the best kind. The interest is tax deductible, the life of the asset is potentially infinite, and it provides a fundamental human need of shelter. If mortgage debt were rising and other debt was falling, it could be a signal of a positive move by consumers, funding fundamental needs versus wants, but take a look at the next chart below.

Non-Housing consumer debt has skyrocketed almost 50% since the financial crisis.

In 2008 there were 117 million households. Today there are 128 million. This means there was $22 thousand dollars of non-housing debt per household in 2008. Today each household owes over $30 thousand, a 36% increase. During 2008, median household income peaked at $51,800. Today it is $62,000, unadjusted for inflation. This is a 20% increase in income.

Median household income has increased by 20% since the financial crisis, but non-housing debt for each household has increased by 36%.

Call us contrarians, but debt at both the corporate and household levels are increasing, and we are now starting to see signs of strain in the auto loan market. The economy continues to show signs of slowing and potentially rolling over.

Adding insult to injury on Thursday, Feb 14 December retail sales numbers were released and it was a disaster. Estimates were for growth of retail sales (which includes both online and store bought) of slight growth of 0.1% year over year.

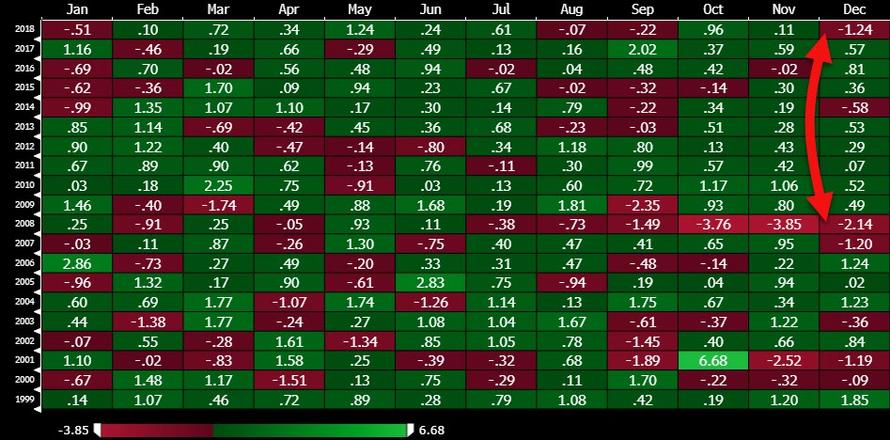

Instead, and shown in the chart below, retail sales cratered by -1.2%, the largest December decline since 2008 and the 2nd worst December on record. The graphic shows each month’s year over year retail sales growth.

What does it all mean? It means we are indeed likely headed for recession.

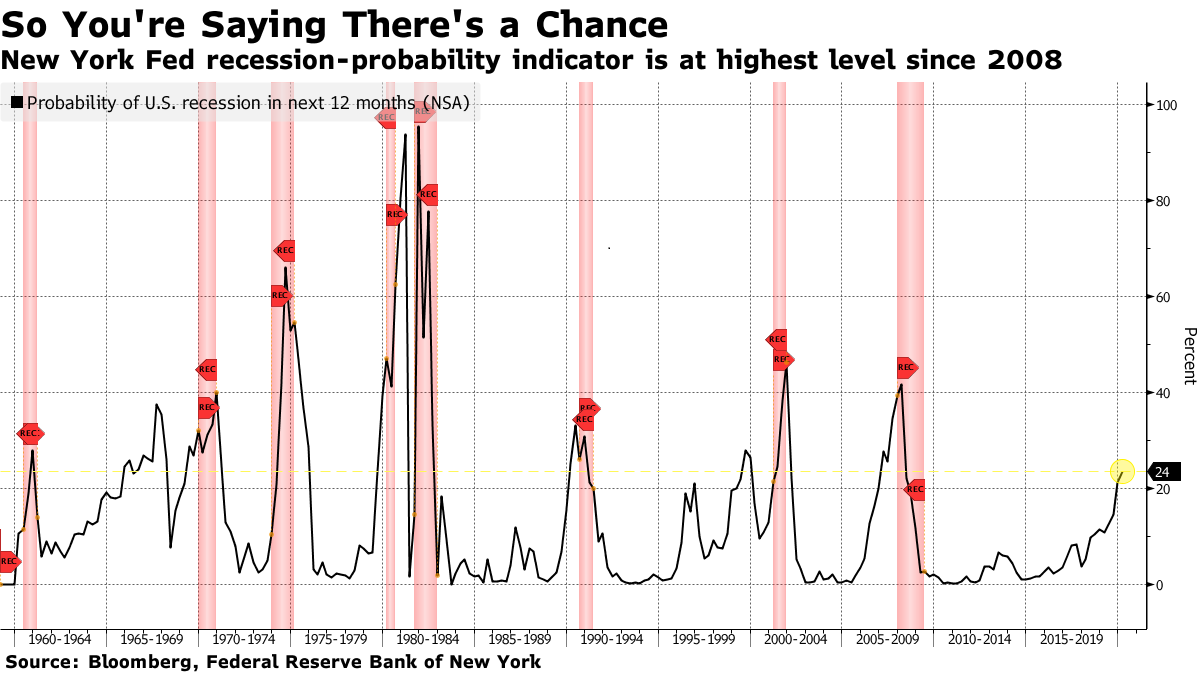

The final graph shows the history of the Federal Reserve’s recession probability tracker. Before this week’s dismal retail sales number and auto loan deterioration the number was already the highest, at 24%, since the financial crisis, and now this model will likely continue higher as the year progresses.

The odds of a recession in the next 12 months continue to increase and is probably one reason Fed Chair Powell but the brakes on rate hikes and even hinted at slowing, stopping, or even reversing the Fed’s balance sheet normalization program. The Fed is now more worried about a recession on the horizon than it is inflation, and that is clear as depicted in their model above.

For months now analysts have been pointing to the consumer as the stronghold for the economy, but given the level of debt and also the increasing number of defaults in the auto loan industry as well as the deteriorating December retail sales number, that mantra is breaking down.

The Fed is also now clearly worried that such deterioration will lead to recession, and it seems the stock market also priced some of this in during December’s selloff.

The question now is has the stock market also priced in a full blown recession that seems ever more likely to occur?

Invest Wisely.

Our clients have unique and meaningful goals.

We help clients achieve those goals through forward-thinking portfolios, principled advice, a deep understanding of financial markets, and an innovative fee structure.

Contact us for a Consultation.

Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness. Disclaimer This presentation is for informational purposes only. All opinions and estimates constitute our judgment as of the date of this communication and are subject to change without notice. > Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness.