Investors in international stocks in 2017 have been more “lucky” than “good” as the majority of their gains haven’t come from fundamental moves in the market, rather they have primarily come from currency fluctuations. In fact, the majority of these gains came from something likely completely overlooked: the currency risk they were subjecting their portfolio to.

Insights Overview

MACRO INSIGHTS: International stocks have been performing phenomenally…or have they? What’s really behind the big run these equities have had so far year to date, but more importantly, will it continue?

PORTFOLIO INSIGHTS: Investing is much like trying to sail with the wind at our backs while trying to dodge a hurricane. Our proprietary tactical rotation strategy seeks to mathematically find positive trends while avoiding negative ones.

MARKET MICROSCOPE: The market has confirmed its short term pullback with another new low reached this week. Our eyes are wide open as to the real reasons international stocks have been outperforming. As such we also are aware of the risks in chasing such a trend.

On Our Radar

NORTH KOREA: As expected, heightened tensions proved transitory, and the situation did not have a lasting impact on equity markets.

JACKSON HOLE: The Fed’s annual Jackson Hole event has wrapped up and the biggest takeaway from Yellen’s speech is she “fears risks of excessive optimism will return sooner rather than later”. Like most things Fed related, it’s more talk than action.

MARKET CALM: The last week in August is historically the lowest volume week of the year. This can exacerbate moves up or down.

HURRICANE HARVEY: Our thoughts are with our readers, clients, friends and family in the Texas coastal regions as Hurricane Harvey makes landfall.

FIT Model Update: Consolidation

Fundamental Overview: Another measure of valuation, a variant of the PEG ratio (Price to Earnings growth), just reached an all time high and is 60% above its long term average going back to the 1950s. By almost all historical accounts, the market’s valuation remains extreme.

Investor Sentiment Overview: After pulling back in May and June, margin debt on the NYSE is again at an all time high. Margin debt expands as the markets rise and it contracts as they fall. It also reveals that risk appetites remain bullish, but the more debt to buy equities increases, the bigger the risk declines will be exacerbated.

Technical Overview: The market has recently broken to new all time highs after consolidating, but failed to hold those all time highs. This pushed the market back into its consolidating range as we look out for an intermediate top.

Focus Chart

Generals and Soldiers

Although we have seen a short term pullback, the S&P still remains within 3% of its all time high. We can’t say that for a lot of its 500 constituents though, as 175 of them now trade below their respective 200 day moving averages.

The Focus Chart below warns that there are some cracks forming in the foundation of the market. Historically these cracks have lead to larger pullbacks as the generals keep charging the mountain only to find fewer and fewer soldiers following them into battle.

Macro Insight

What You See is not Always What You Get

Is it a Good Time to Add To International Stocks?

Thus far in 2017, one of the hottest topics has been the performance of the European equity markets. However, if you talk to a German, they aren’t near as excited as Americans are about this trend. The reality is the outperformance of most international ETFs is being driven by the currency’s change in value, not that country’s stock market changes.

Case in point: the German market is actually down around 7% from its peak back in June. So far this year, the German equity market ETF is up almost 20%. It has been a wonderful place for anyone invested in it. The top half of the graphic below reveals this performance. However, what has really been driving its returns will probably surprise most investors.

The middle section of the graphic reveals the “real” performance of Germany’s stock market (the $DAX) in 2017…up just a relatively measly 6.5%. So what gives? Why is the German ETF up more than 3x the actual German stock market? The final clue to this puzzle is revealed through the bottom line in the graphic.

The European currency, the Euro, is up over 13% this year, a really big move for a currency in such a short time, bridging the gap between what the German stock market is actually doing versus what the U.S. Dollar based ETF implies.

What does it all mean? It means that the returns many are touting from being in international stocks are actually not being driven by equities, but instead by currencies. Furthermore, to be bullish international stocks here, you actually must be bullish the Euro, or other foreign currencies. Further thoughts and analysis surrounding international stocks and the Euro can be found in the Market Microscope section of this report.

To answer our own question, international stocks are not showing fundamental reasons to move higher, other than being cheaper than US stocks on some measures. This by itself is not a reason to invest in international stocks.

Portfolio Insight

Sail with the Winds at Your Back

As Hurricane Harvey threatens the Texas coast, we thought this an appropriate time to discuss to one of our investment themes: Invest when the environment is favorable and control risk when it is not.

Don’t Fight the Trend

Exposure: Tactical Rotation including US stocks, international stocks, government bonds, corporate bonds, hedging strategies, and more.

Investment Thesis: Find trends and participate in those trends, wherever they may be.

Commentary: A famous quote is “Don’t Fight the Trend”. Within client portfolios we have a Tactical “sleeve”, or sub-component, where we allocate a portion of portfolios to a strategy that mathematically seeks out markets that are outperforming. The idea is to invest where and when the trend is favorable, while attempting to avoid markets that are showing signs of stress.

Market Hurricanes and Calmer Seas

Market hurricanes are less frequent than financial media would like us to believe, but in the markets there are plenty of long stormy stretches and many more sunny and calm periods. But how can we tell when it will be sunny and when we need to buy canned beans to wait out a storm.

Unfortunately, we can’t always tell. But we can use data from underneath the surface of various markets and apply a strict discipline to gain exposure to places that are showing out-performance and favorable momentum.

We are not attempting to guess where the market will go next, and move in-and-out of investments hoping to guess correctly. It is quite the opposite…market prices tend to move in cycles, and these cycles can be identified with regularity based our statistical calculations.

Some cycles are small and short in duration, while others persist much longer than anyone can predict. The move higher in stocks from the 2009 lows is an excellent example. So is the decline from 2007 to those lows.

Just as we discussed last issue that risk management is not achieved by using only one strategy, attempting to sail with the wind at our backs (or to avoid the hurricane) also requires multiple layers of analysis to achieve success. Thus, we use a variety of tools to determine trend:

- Technical Analysis, such as the concepts we discuss in our Market Microscope section.

- Fundamental Analysis, including P/E ratios, Price-to-book, Price-to-sales, Free Cash Flow, etc.

Macro Analysis, or identifying bigger global trends involving GDP growth, global debt loads, and other factors.

Market Microscope

Market Choppiness Continues, Your Breadth Stinks

The selloff that started two weeks ago continues through this week as the market confirmed the short term move by making another short term low. Weakening momentum and waning market breadth helped warn of the risk that was in place and it may also help warn us when this decline is nearing its completion. International stocks aren’t looking near as rosy as they do on the surface. To be a buyer of Europe here you must be very bullish the Euro.

US Equities: Weakening but Not Alarming

The one day selloff in the markets that occurred around the time this publication was last penned followed through again last week as the first chart below reveals. The waning momentum (as depicted by the divergence discussed on the graphic) that had plagued the market’s rather mundane rise since its March 1 top weighed the market down enough it fell through its 60 day moving average as well as the August Pivot point (both shown on the chart). This price action confirms the short term trend has indeed turned lower.

As a result, our models have told us it is prudent to raise cash temporarily in portfolios until this volatility passes. We don’t know how long or how deep a correction may be, so we have specific re-entry points mapped out for all clients if and when the market reverses higher. Late in the market cycle we must pay attention to draw-down risk.

At IronBridge we follow over 25 “official” indicators as part of our FIT Model. A few of those are discussed in the above chart, but we also keep our pulse on hundreds (if not thousands) of other market indicators. One such indicator is discussed next.

Take My Breadth Away

The stock market indexes can be misleading. What do we mean by that? Well, each index is just a function of all its components. The S&P, for instance, is made up of 500 stocks that are weighted in the index by market cap. Its top 5 components make up over 10% of the entire Index’s performance on any given day. The S&P is truly an example of the 80/20 rule. Over 80% of the stocks in the index make up less than 20% of its performance.

A great way to show how just a few companies can move the S&P 500 is shown by the next graphic.

The chart below shows the number of S&P 500 stocks that are above their own 200 day moving averages. The S&P itself is well above its own 200 day moving average, by over 4%, but the same cannot be said for many of its components. In fact, quite contrary.

Currently only 65% of the S&P 500 (325 companies) are above their own 200 day moving averages. This means there are 175 companies withing the S&P 500 that are in a bear market, with price below the last 200 day average price.

Analysis like this pertaining to the market’s components’ participation or not in trends is generally called breadth analysis and is a way to help peel back the onion that is the market.

So what does the chart reveal the onion looks like underneath? Well, with just 65% of components above their own 200 day moving averages, the market is approaching levels associated with larger selloffs. Notice the commentary on the chart reveals that typically the more significant market bottoms occur when this indicator falls below the 50th percentile. So from that aspect, the market could have more room to fall.

However, we prefer to use this indicator as more of a leading one, as revealed by the annotations. Market tops often form after there is a divergence between the S&P 500’s price and this indicator (as has been occurring since March). Notice that the top back in 2007 occurred when the S&P made a new price high in October (a higher high formed in price), but this breadth indicator was making a lower high.

Similarly, the strong rally off of 2009’s bottom ended in 2010 with a sign from this indicator’s slight divergence. Finally, the long topping process of 2015 was preceded by a slow decay in the number of stocks above their 200 day moving averages.

Generals and Soldiers

So why could this indicator be a good signal for market tops? We like to think of breadth in terms of generals and soldiers. The generals of the market (the top 20% of its constituents by market weight) continue their trends of higher prices, while the soldiers are dropping off. The generals and the market can continue to charge the mountain, but eventually if too few soldiers are following them, they too must retreat.

Recently, the FAANG stocks (Facebook, Apple, Amazon, Netflix, and Google) have been the generals, but even they are starting to show signs of slowing as the Nasdaq (an index made up largely of technology stocks) has started to lag (GOOGL is down 6%, AMZN is down 10%, and FB is down 5% from their recent all time highs). If the generals are also starting to also fade from their bullish trends, then we may see breadth indicators such as this one slip below the 50th percentile, and offer a larger pullback than we already have had.

One final takeaway from this chart. If we look back at the divergences that have formed. We can notice that when the market finally does pullback, it often pulls back to a price level that was associated with the former peak in the breadth indicator.

The start of the black lines drawn on the chart of the S&P 500 shows when the peak in the breadth indicator occurred. The price that coincides with the beginning of that line seems to be a good downside target. In this case it is the March 1, 2017 price of $2400 that would satisfy that rule. Last week’s low of $2417 has come close to that price. Is that enough to satisfy the rule, or will we see another decline through $2400 first?

Euro Currency in Counter-Trend Correction

As discussed in the Macro Insights section, the Euro has been on a tear this year, up over 13%. However, if we zoom out and look at the longer-term, it appears the Euro is actually in a major downtrend, and if that’s the case then the recent tailwind that most European ETFs have enjoyed may soon be coming to an end.

The first chart below shows the current, longer-term, technical picture of the Euro’s ETF. Even with the relatively large rally this year, it has done little to change the long term bearish trend in the Euro.

Picking up where the Macro Insights section left off, the next chart shows the relative performance between two European focused ETFs that invest in basically the same stocks. Can you guess what the difference between the two are?

One ETF has currency exposure. One does not.

In orange, the Vanguard European ETF, VGK, does not hedge its currency exposure, so it is exposed to all the ups and downs of the Euro currency. As a result it has gained significantly more than the WisdomTree European Hedged ETF, in green, even though they invest in the same companies!

VGK is up almost 18% this year while HEDJ is up less than 7%. This is a similar corollary to the Macro Insight’s analysis of EWG and the German stock market. Unhedged, European stocks are up almost 18% and German stocks are up 19%, but if one were to hedge the currency risk (a truer equity investment), a U.S. investor in Europe would be up around 6.5% and up similarly in Germany.

Another way to look at the difference between two investment potentials is to compare them relatively.

The bottom segment of the chart reveals one technique to help decide which ETF is in the stronger trend. By dividing the two prices by one another through time we can see relative performance. Clearly the last few months it has been better to be in VGK and exposed to the Euro currency. However, one is taking a large leap of faith to conclude that European equities are actually doing better than U.S. equities. In reality the Euro is doing better than the U.S. Dollar.

Emerging Markets and the Euro

Friday, Aug 25, is a great example of how the Euro’s performance actually drives a large bulk of these ETF’s performance. Mid-morning the Euro was up 0.53% while EEM (the most popular emerging markets ETF) was up the exact same amount! One snapshot in time may not prove much, but the chart below sure does.

This chart displays the Euro’s price over the last year (as represented by its tracking ETF, FXE) compared to the price of EEM (in orange). Their trends have been largely the same, but more importantly check out the bottom indicator, which measures the 100 day correlation between EEM and FXE.

That correlation is at 95% and has been that way for weeks. When dealing with correlations one must always be careful not to assume causation, but in this case it makes perfect sense since the Euro is actually a large part of EEM’s performance. Why is that?

The reality is investors may be fooling themselves when thinking that international stocks are the place to be. In fact, if you take the currency out of the equation, the U.S. market remains dominant.

Better Lucky than Good?

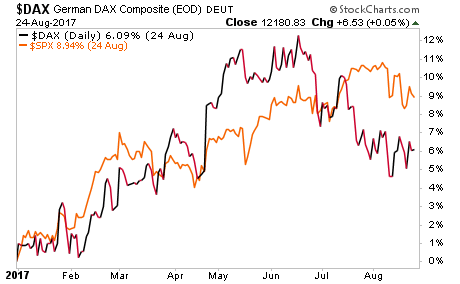

The chart below shows the S&P 500 in orange with the German Dax Index along side it. The S&P is up 9% year to date versus a German market that is up just 6% in local currency. Put another way, investors in international stocks in 2017 have been more “lucky” than “good” as the majority of their gains haven’t come from fundamental moves in the market, rather they have primarily come from currency fluctuations.

Instead, the majority of their gains came from something they likely completely overlooked when building their investment thesis: the currency risk they were subjecting their portfolio to.

Our clients have unique and meaningful goals.

We help clients achieve those goals through forward-thinking portfolios, principled advice, a deep understanding of financial markets, and an innovative fee structure.

Contact us for a Consultation.