Midterm elections occur next Tuesday, and there is plenty of discussion on how the outcome may affect stock prices. But what does the data tell us from previous elections? Also, volatility, whether due to elections or not, is a common measure of risk. But is the “VIX” the best way to analyze it?

[maxbutton id=”5″ url=”https://ironbridge360.com/wp-content/uploads/2018/11/IronBridge-Insights-2018-11-02-Elections-Volatility.pdf” text=”View PDF” ]

Election Insights

Do Elections Affect Markets?

“People never lie so much as after a hunt, during a war or before an election.”

– Otto von Bismark, Chancellor of the German Empire from 1871-1890

Elections Matter (?)

It’s election time again…time for the American electorate to become more divided and angry than usual, followed by the immediate spin of greatness and/or doom by each side once the results are announced. Maybe we’re skeptical (actually, yes, we’re very skeptical), but don’t we inevitably end up with the “same ol’ thing” regardless of the outcome?

Skepticism aside, there is no shortage of predictions about how the outcome of the midterm elections next week may affect the stock market. However, in recent memory, these wild guesses predictions have not been tremendously accurate. We prefer to let the data to the talking…so what does the data say?

Much of our investment philosophy is based on properly identifying trends. So naturally, we went in search of “Post-Mid-Term-Election-Trends”. During our research, we uncovered some interesting items.

TREND #1: The sitting President’s party usually loses seats.

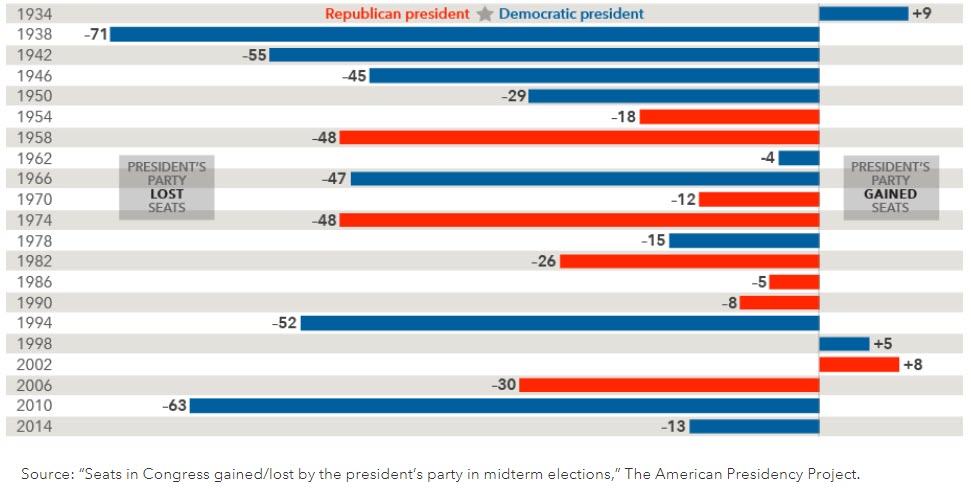

This was somewhat surprising to us, but going back to 1934, there have only been three times that the President’s party gained seats in a mid-term election. As shown on the chart below, courtesy of “American Presidency Project”, the only presidents to gain seats in a mid-term was Franklin Roosevelt in 1934, Bill Clinton in 1998, and George Bush in 2002.

What conditions were present during the mid-term elections where Presidents gained seats? FDR was in the throes of the Great Depression, Clinton was in the middle of one of the biggest stock market booms in history, and G.W. was still in the post-9/11 terrorism uncertainty. They all had extenuating circumstances that logically allowed the country to want “more of the same”.

The only other two elections that were even close was Kennedy in 1962 and Reagan in 1986. Two overwhelmingly popular presidents during times of relative peace and prosperity. The current President is not exactly popular, the market has been very choppy this year, and the US is not in a major conflict (yet). So it seems reasonable to us that this election should resemble previous elections where the sitting President lost seats.

Most polls as of this publication have Democrats gaining an average of 39 seats in the House and no real change in the Senate. The average loss is 27 seats since 1934. So this year’s results would be slightly higher than average, but still in a reasonable range for the typical mid-term election cycle.

We don’t see anything that should surprise the markets here.

TREND #2: Volatility tends to pick up in the months prior to a midterm election.

We discuss volatility more deeply in the Market Microscope section below. But history tells us that as an election gets closer, volatility tends to increase. It seems that the market begins to price in the uncertainty involved with a potential change in political power, along with the associated economic policy ramifications.

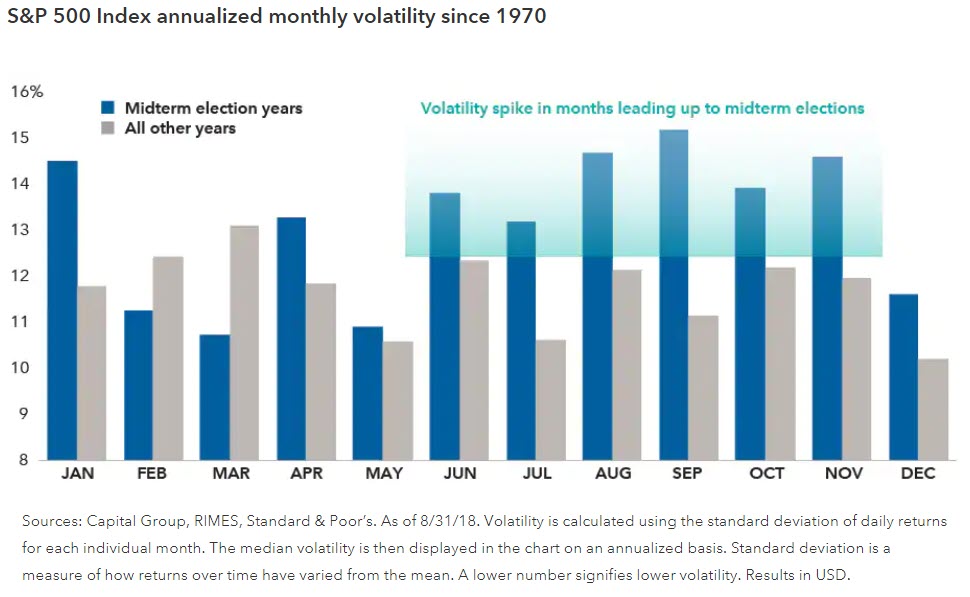

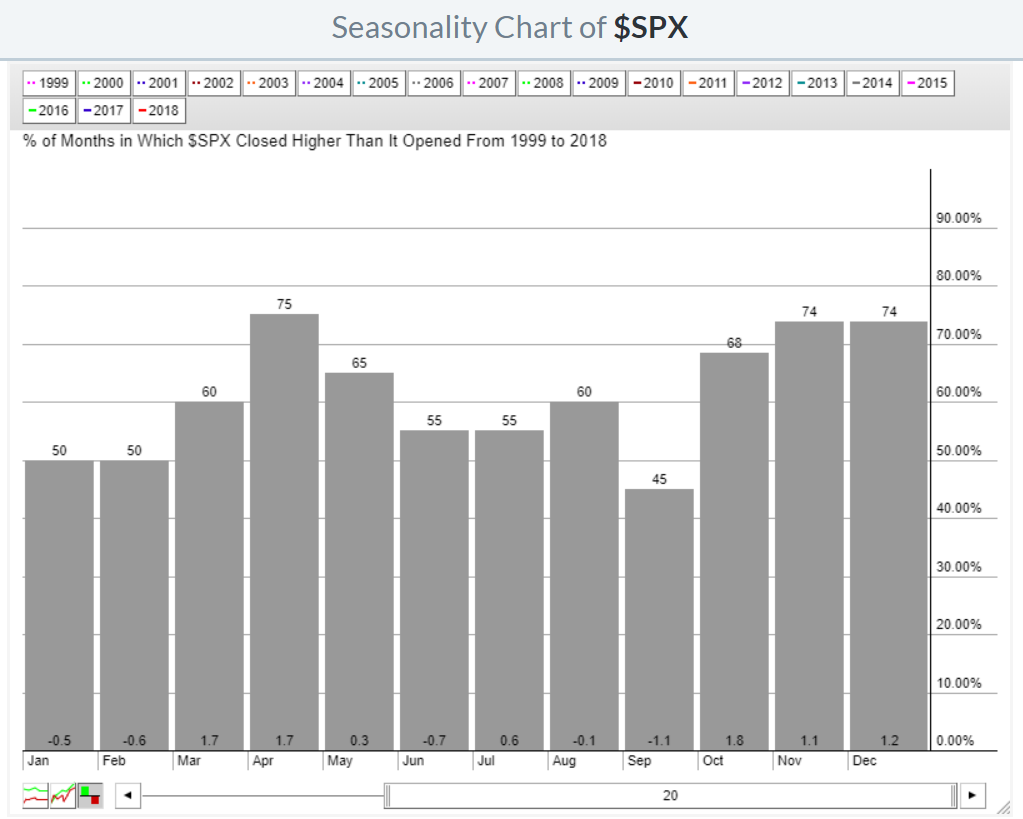

The next chart looks at annualized monthly volatility since 1970. The blue bars show the midterm election years, while the gray bars represent the monthly volatility of all other years.

There is a distinct difference in the numbers between July and November, with midterm years being decidedly more volatile. Actually, the volatility is higher in 10 of the 12 months using this comparison.

Why would this happen? One logical reason is that a sitting President makes a pretty good “villain” for the opposing party to rally against. Looking back at the first chart, both FDR and Clinton had net gains in Congressional seats in one election, but they also had some of the worst losses of seats in their other mid-terms.

Maybe investors get nervous with all the divisive rhetoric. Maybe every mid-term since 1934 had the potential to change the overall direction of the markets. Or maybe the markets are simply a collection of human beings subject to the same influence of fear and greed during and after each election cycle.

Frankly, we don’t care why volatility might pick up, we just care whether it does or not. This year seems to fit with the historical trend, as volatility has risen substantially in the past month.

In fact, 2018 has closely followed a typical midterm election cycle pattern. So once again, we don’t see anything here that would suggest a surprise to the markets next week. What is left to learn is whether things will calm down following the election as it has in the past.

TREND #3: The previous direction tends to resume once the election is done.

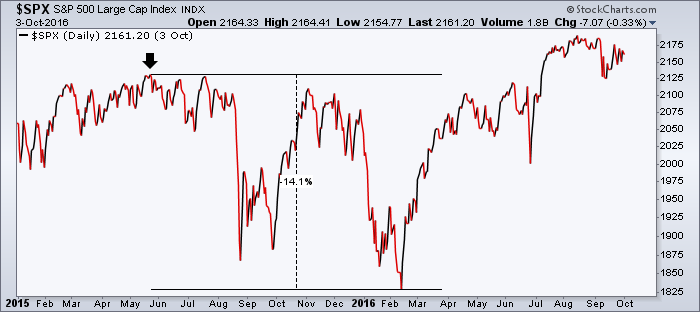

When international tensions were escalating between the US and North Korea in August of 2017, our research told us that geopolitics only has a temporary effect on market performance. (Read the report HERE.) Even such large events as 9/11, the Korean War and the Cuban Missile Crisis only had an affect on stock prices for 60 days at the most.

History tells us that elections have a similar, temporary impact. There is typically a bit of a pause leading up to the election, volatility picks up for a few months, then the previous direction (up or down) continues once it is over.

What has happened in recent history?

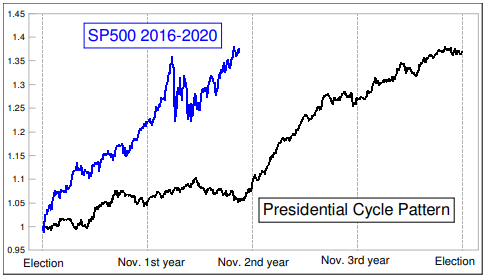

- In 2016, almost everyone predicted that if “The Donald” won, markets would tank. They did, for about 5 hours at 2am on election night. By the open, it had fully recovered and the market went on to rise for 14 months. The fact is, once the election was done, uncertainty was removed. The trend was up before the election and continued after the votes were tallied.

- In 2014, the market slowed in October and November, but promptly resumed the uptrend after the election.

- 2012 is almost identical to 2014.

- In 2010, the market was soft from May to July, and resumed its uptrend in September and continued into the next year.

- 2008 also shows no noticeable affect from the election. The trend here was down, and continued down post-election.

We could continue this exercise for the past 100 years, but you get the point. Each of these recent elections were extremely volatile from a political standpoint, which should have produced much larger swings in the market if elections truly have an impact on asset prices. But the data suggests they don’t.

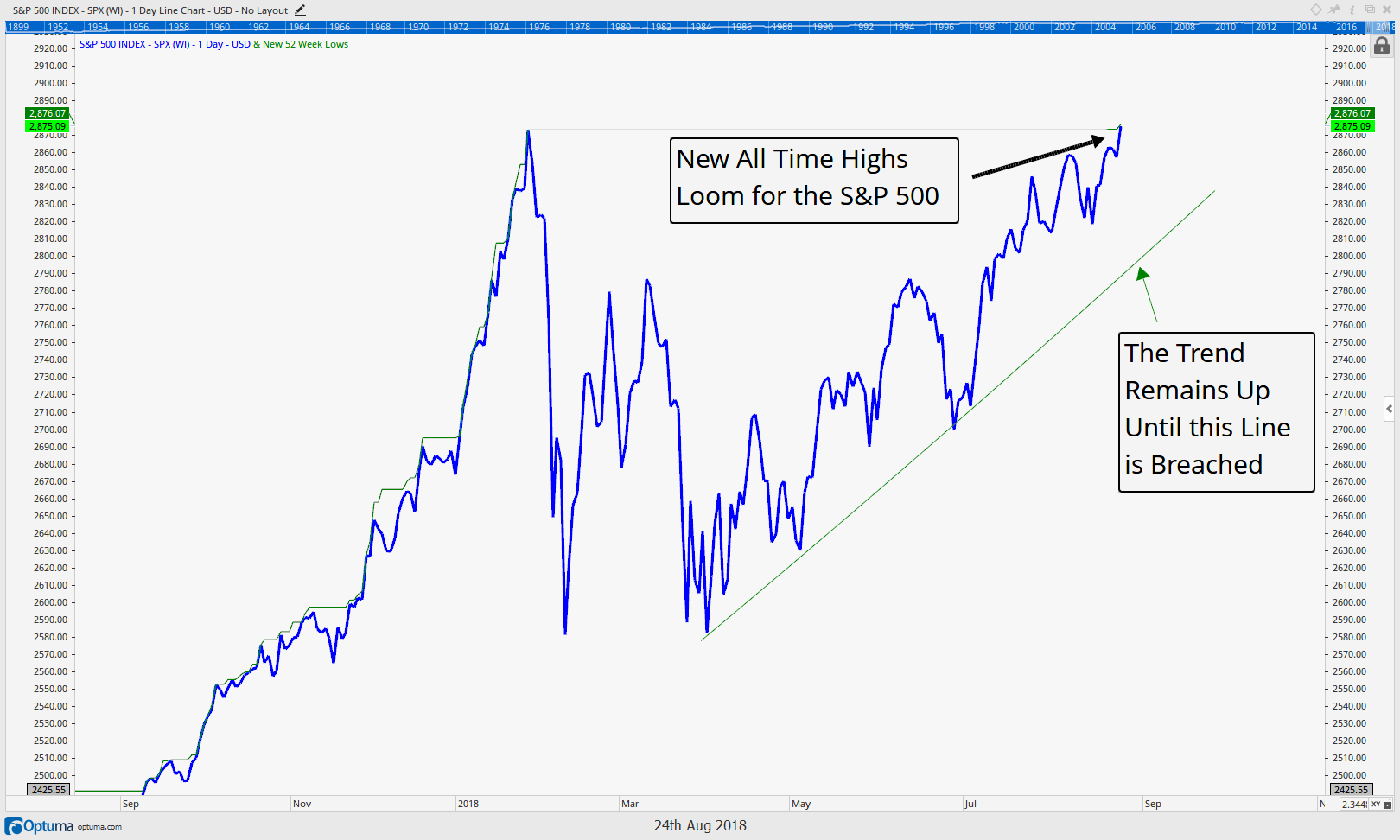

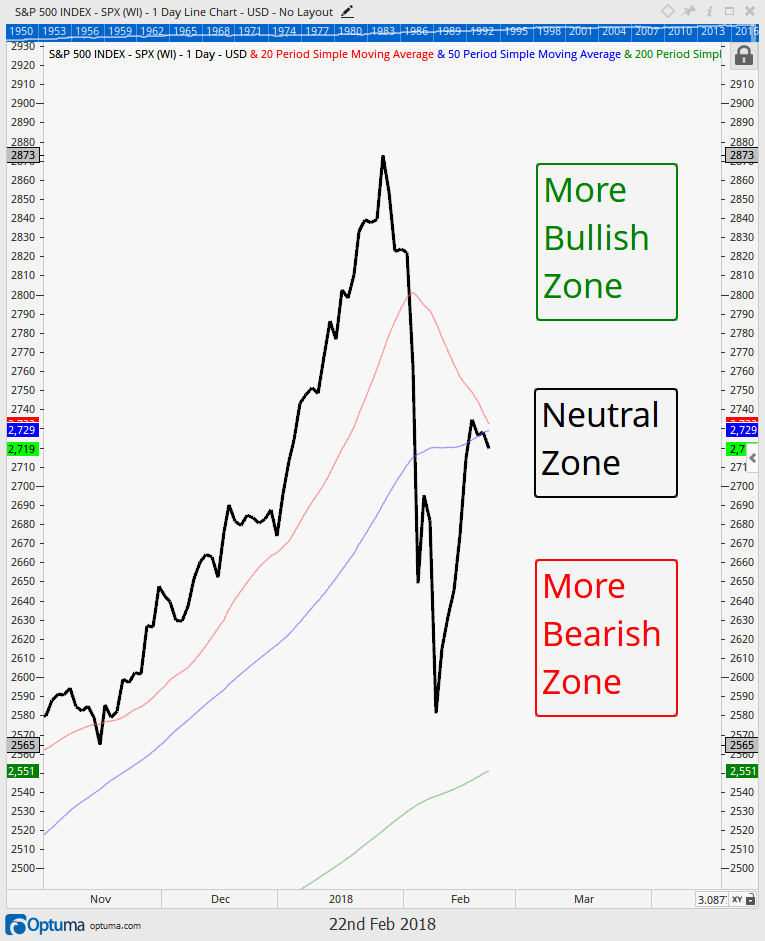

The most important question about 2018 and the midterm election is: “What was the trend going into the election?”. This is the hard part. For most of the past year, the market has been indecisive and sloppy. There have been four distinct “seasons” this year…UP until January, DOWN through May, UP to September and DOWN since.

So what should we expect?

Well, since there hasn’t been any real trend this year, we don’t see how the results next week really change anything. The market is likely to remain indecisive and sloppy until the new trend emerges, regardless of the Congressional outcome.

Yes, there are policy implications; yes, there may be tax implications; maybe it throws the US into total chaos. Maybe “this time is different”, but that is always a sucker’s bet.

So we wait with anticipation for the outcomes next Tuesday, but history tells us not to change our investment process simply because it is the first Tuesday of November.

Market Microscope

Volatility Picks Up, but is that Bad?

There are many kinds of risks, but volatility may be the least relevant of them all”

– Howard Marks, Investor

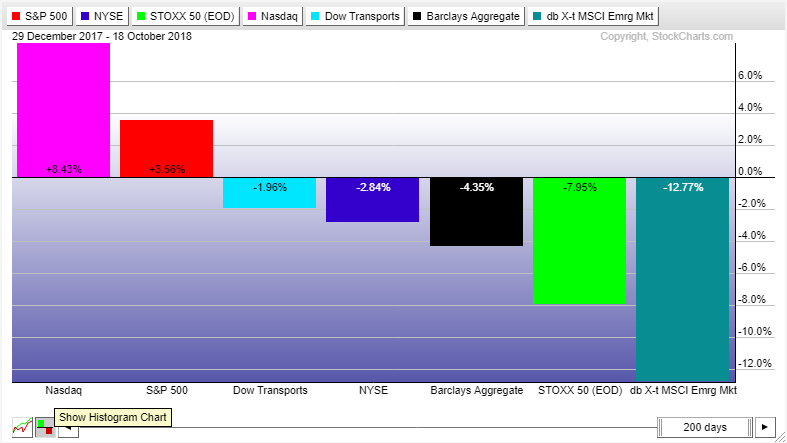

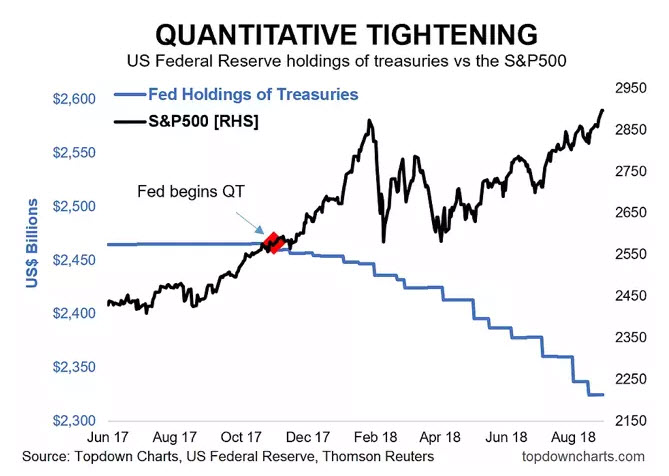

October’s pickup in market volatility has certainly caught the eye of market participants as the 4th quarter is off to its roughest start since the financial crisis with October in the books and down over (-7%). The increased downside price pressure is (rightly) on everyone’s mind.

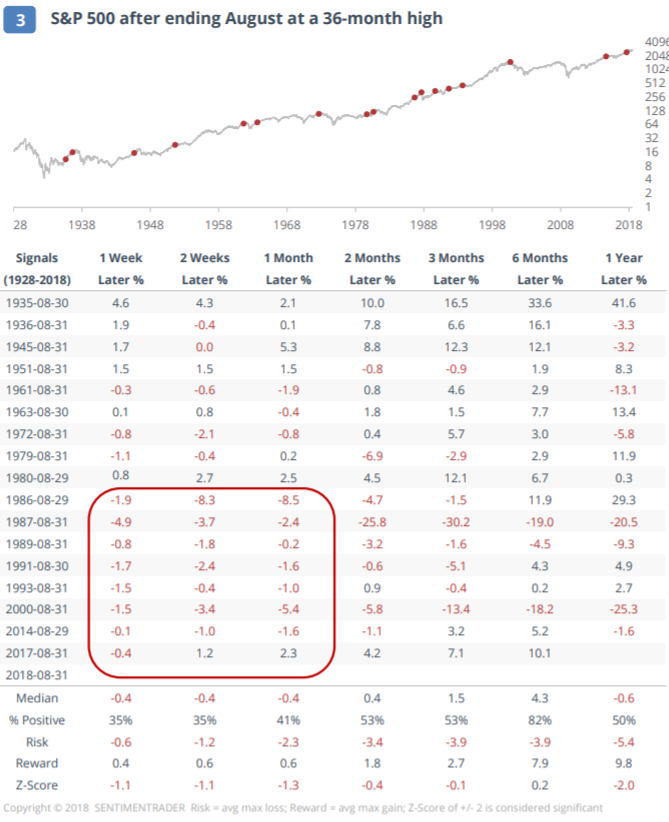

There were 16 negative days in October, the most down days in any one month since 1970 and tied for the 3rd worst since 1928! SentimenTrader.com points out that statistically whenever a month has seen 15 or more down days (12 prior occurrences), future returns were on average negative throughout the following 6 months, so this increase in volatility certainly deserves all the attention it is getting.

The most popular measure of volatility pertaining to the stock market is the VIX Index, but let’s take a step back and first discuss what volatility actually means because there are countless ways to actually measure volatility. Case in point, even the VIX Index is not just a measure of “volatility”. It is a measure of “implied volatility”, meaning people’s expectations for future volatility are also an input to the VIX Index. We also shouldn’t make the mistake of limiting our thoughts of volatility to the mathematical standard deviation, often referred to as realized volatility. Volatility is much more than just standard deviations and variances.

Alluded to in the opening quote by Mr. Marks, volatility can mean a lot of different things to a lot of different people, but generally speaking volatility can be thought of through its definition: “liability to change rapidly and unpredictably”. The volatility of the stock market, for instance, is how quickly it is changing and that is often measured through its price measurements (but it doesn’t have to be limited to price measurements – more on that later). The controversy (if we can call it a controversy) around volatility is more around the way to measure it as opposed to what it is. We can all agree that volatility is the liability to change rapidly, but what we can’t necessarily agree on is exactly how to measure it, if it is “bad”, or predict when it will occur and won’t occur.

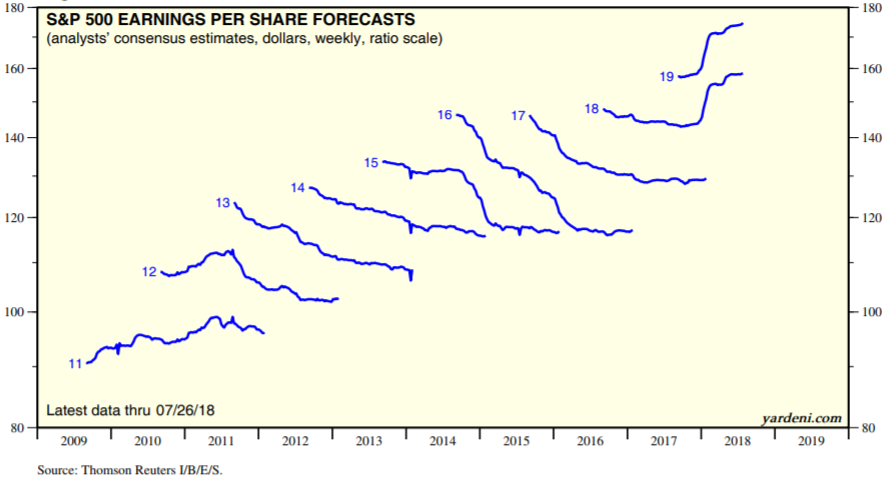

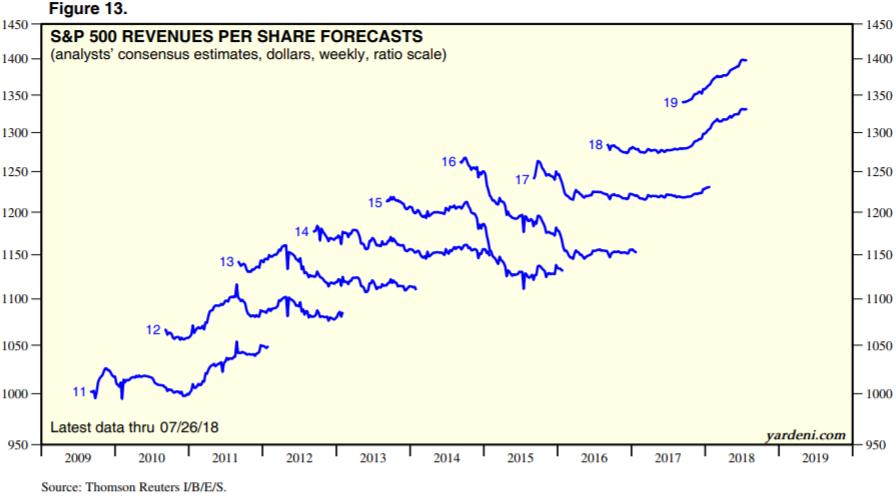

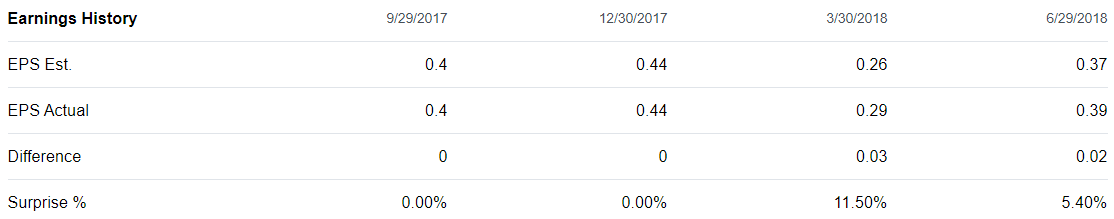

Many investors associate increased volatility with increased risk, but that also does not necessarily have to be the case. After this October’s (-7%) decline, stocks are cheaper and may offer more opportunity for value seekers. Has anything changed for these stocks besides their prices? Valuations have indeed come down. In this case more volatility could actually mean decreased risk as securities with the same fundamentals can now be bought cheaper. Some investors look forward to bouts of volatility as an opportunity creator. And, indeed, they may be onto something.

Although it may not feel that way (we are all subject to recency bias), what if we were to tell you the current volatility is actually rather average and by some measures, on the lower end of the spectrum? Even though the 16 down days in October is one of the worst on records, there are many examples that suggest the volatility we just witnessed is actually not that elevated. Again, it depends on how you want to measure volatility.

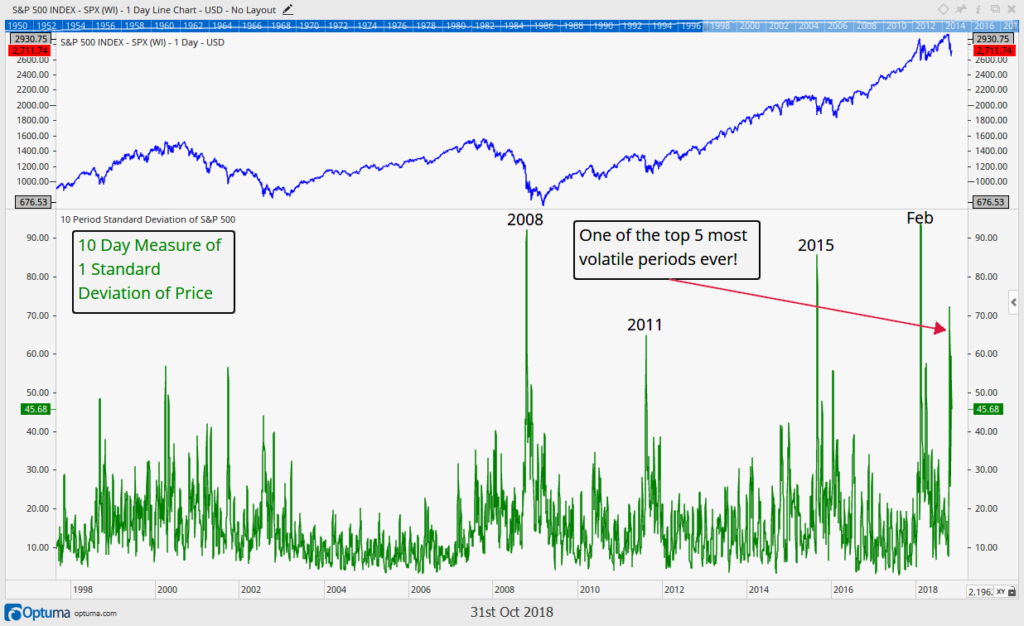

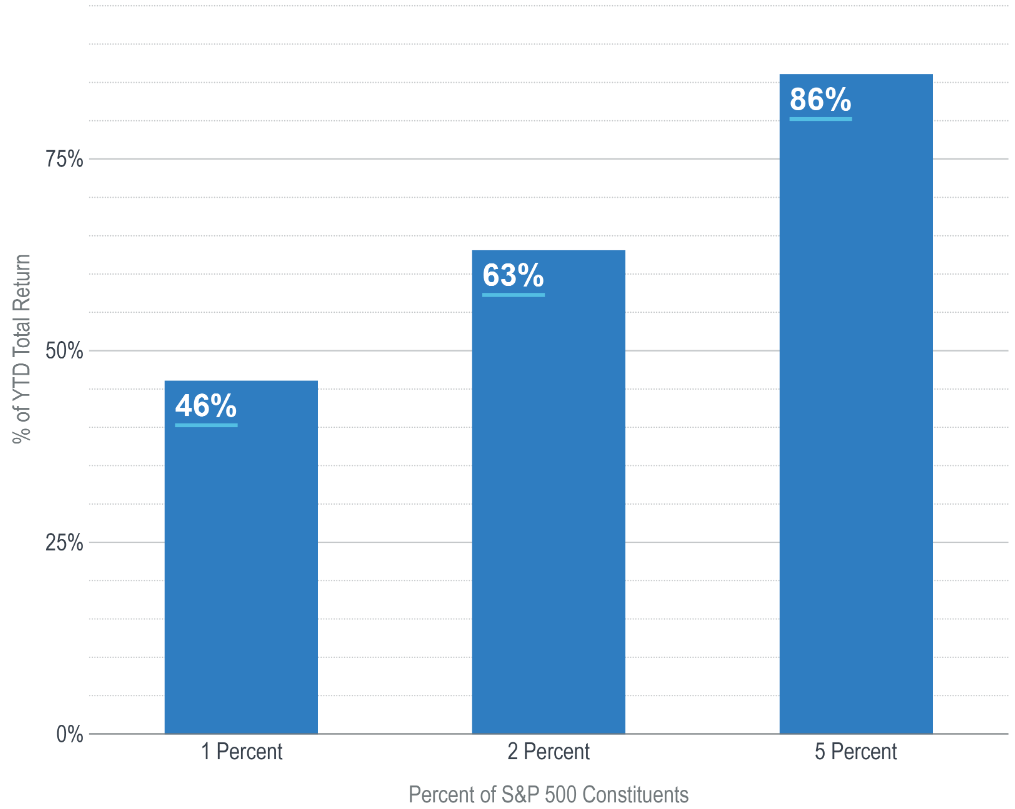

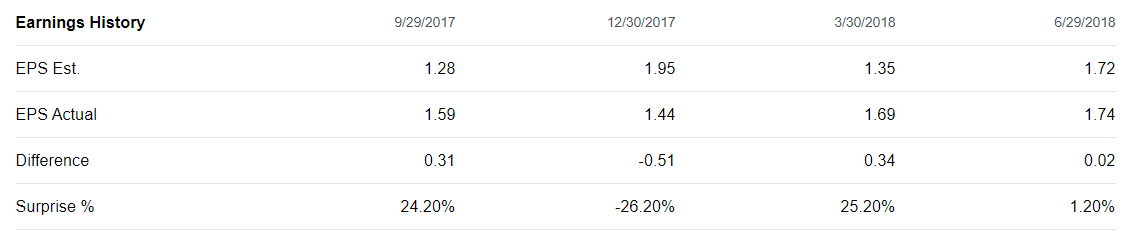

The first chart (above) is an excellent example of this because a very straightforward math calculation of price changes (realized volatility) provides us with two completely different takeaways.

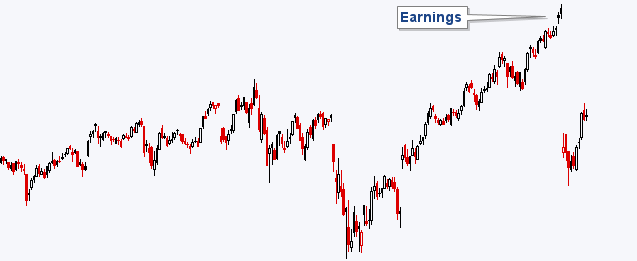

The first chart shows us the S&P 500 with a simple calculation of its 10 day standard deviation of price. Based on this volatility measure, the S&P is seeing one of its most volatile periods ever with a peak 10 day standard deviation of over 70 points!

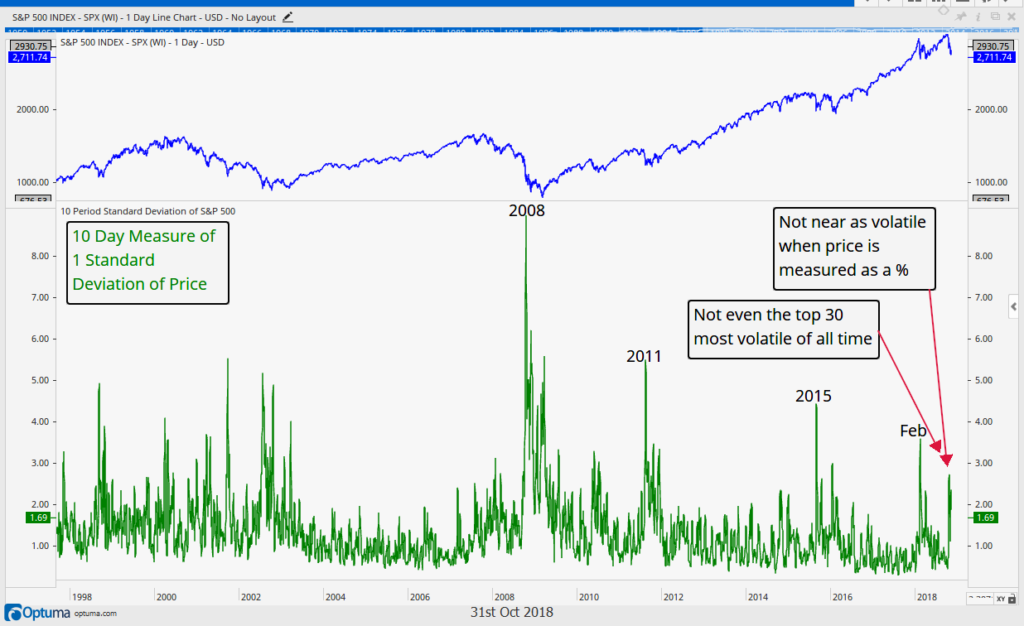

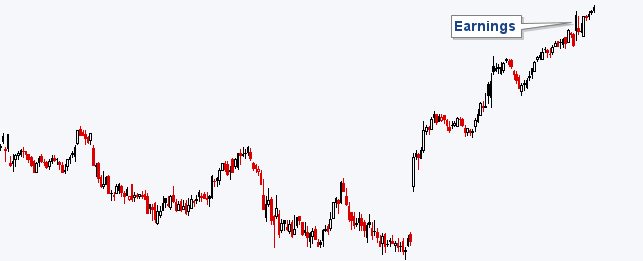

But, let’s take a look at the next chart, which is the exact same calculation, with one small difference. Can you spot the discrepancy?

This is the exact same 10 day standard deviation in price, just with one key difference. Instead of a measure of absolute price changes (70+ point standard deviation) it is a measure of relative (percentage based) price changes (peaking slightly above 2%). A 10 day standard deviation of 2% doesn’t even register on history’s top 30 ten day standard deviation events. On a percentage basis, realized volatility is thus far not very extreme and still very much in the realm of “average”, a far cry from the non-normalized measure of standard deviation shown previously utilizing price alone.

There’s a few other measures of volatility we would like to draw your attention to as well. One way volatility can be measured is by drawdowns (distance from the high to the low). Thus far the S&P has “only” declined 10% from its highs one month ago with its worse day around a (-3%) decline.

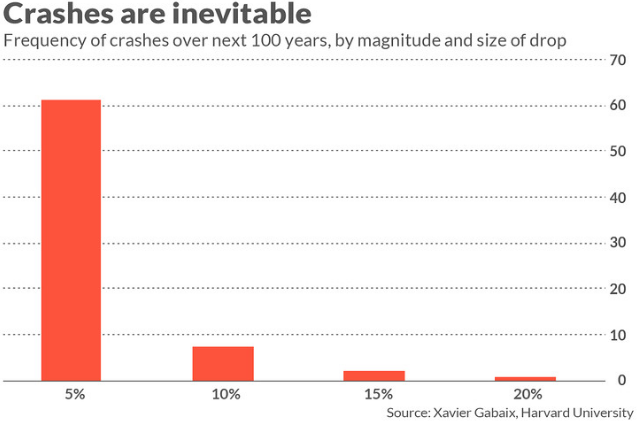

Where does that stand historically? One recent research study suggests that a (-3%) decline is well within normalcy. Some of the study’s takeaways are shown in the table to the right and reveals the reality is volatility remains pretty tame today. Extrapolating these statistics suggests a (-5%) daily decline should occur on average every 1.6 years, yet it’s been over 7 years since we have seen a daily decline of more than 5%.

So from this aspect the market is either/or 1) long overdue and 2) been in a period of extremely low volatility given the lack of occurrence recently.

Similarly, a 10% daily decline should occur 8 times in a 100 year period (or once every 12 years), yet its been since 1987 since that’s occurred (31 years).

We like to look at statistics, but would never make investment decisions based solely on them. In this case the takeaway is statistics do help provide some historical perspective that we have been in a period of very low volatility, even when we include this October’s selloff.

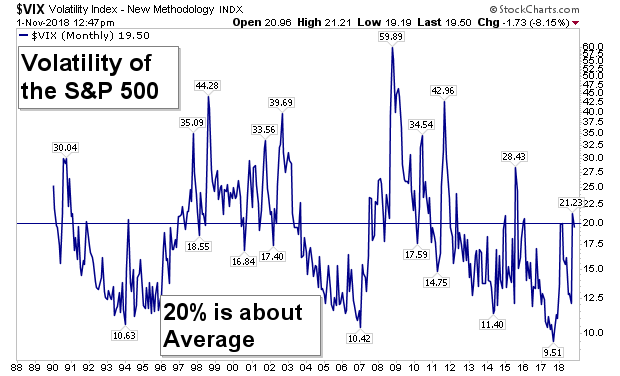

Let’s look at two more measure of volatility, the most popular measure, the VIX, as well as a different approach to measuring volatility.

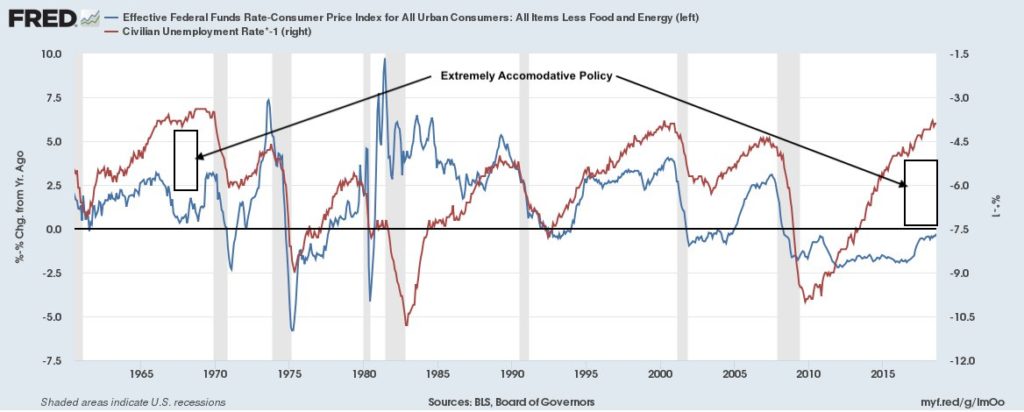

The first chart on this page shows the popular VIX Index charted monthly , currently residing around the 20 level (the VIX level at the end of each month). Since the VIX was first created (late 1980s) this is about average. Notice that the period from 1997 through 2004 was essentially spent in its entirety with a VIX above the 20 level, similar to 2008 through 2012.

Although the recent move from a low below 10 to a high above 20 is rather large, it is by no means abnormal, especially if we are kicking off a new cycle of higher volatility in general.

The VIX index tells us the volatility we have seen thus far in 2018 is really not that extreme as both February and October closed near the long term average of just 20.

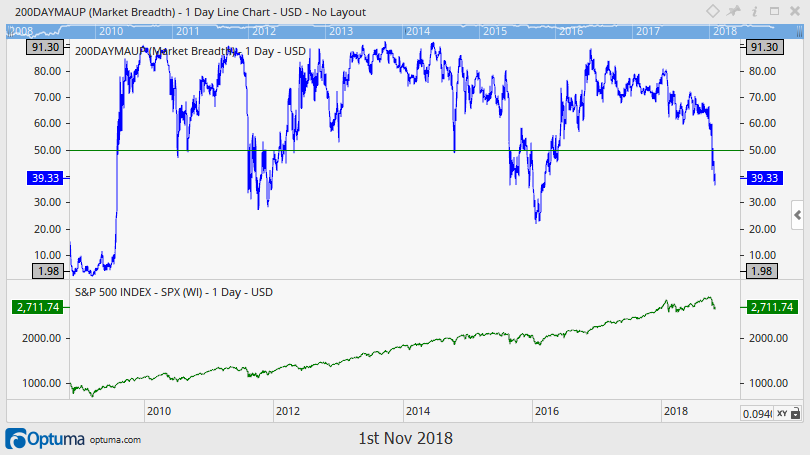

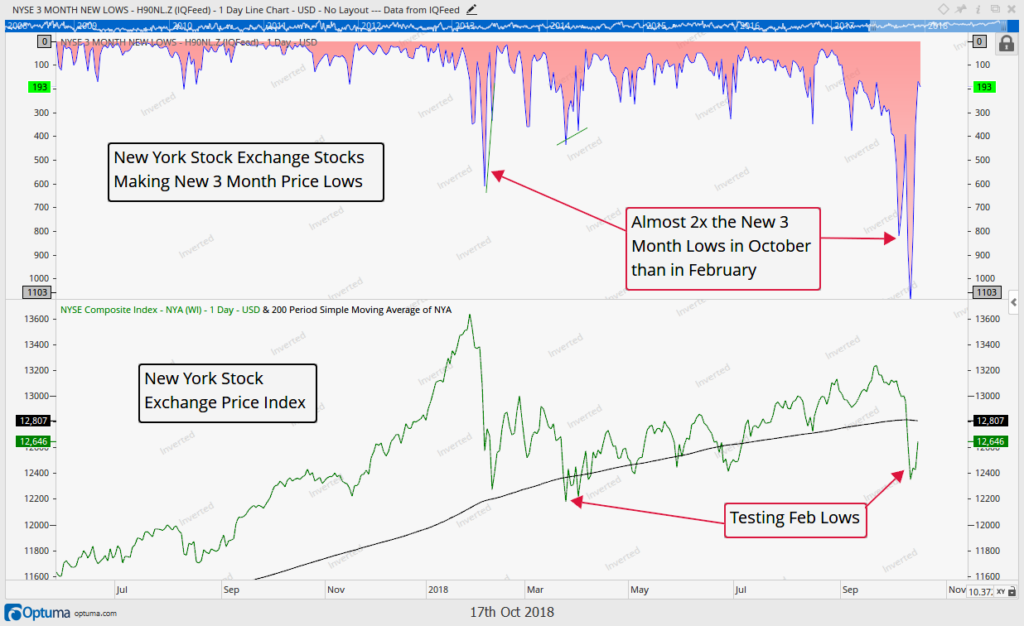

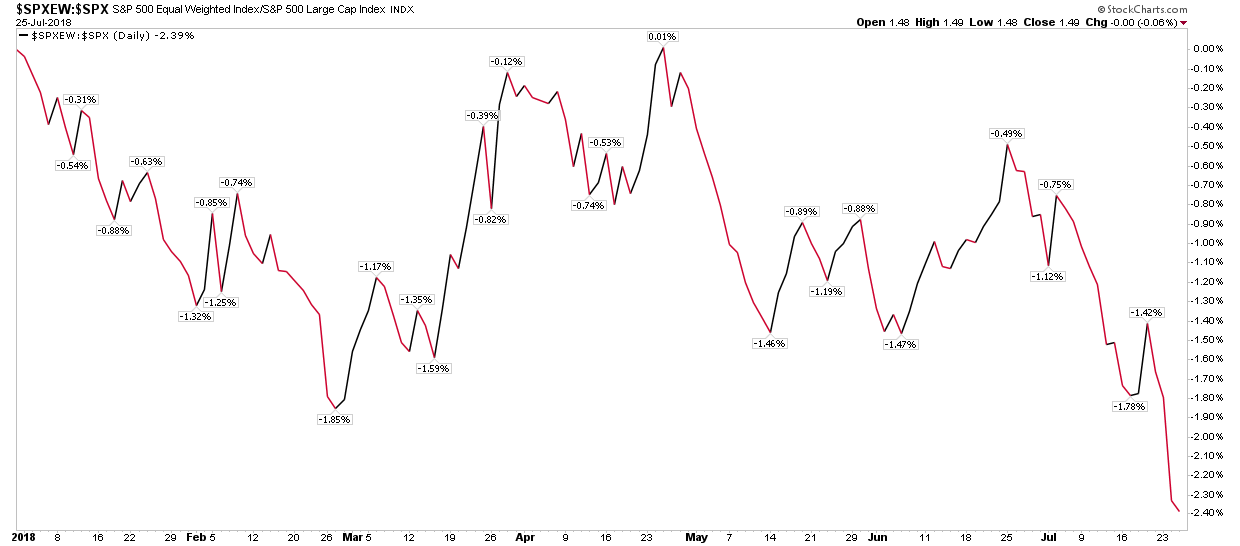

The next chart is one we think a lot of investors are referring to when they speak of volatility. What most interests investors is not necessarily if there is volatility or not, but rather if “things” are moving up or moving down. This next chart shows us just that.

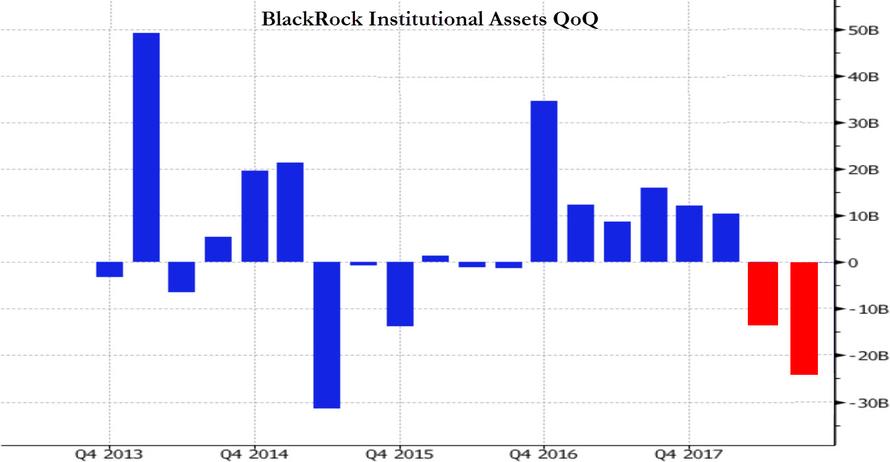

Below is a plot of the percentage of S&P 500 constituents that have their 200 day moving averages moving up. In general the direction the 200 day moving average moves reveals what trend a stock is in. If the 200 day moving average is sloping up, that means prices have been generally rising over the prior 10 months. The opposite is true as well. If the 200 day moving average has a downward trajectory then it means the average price of that security is trending downward.

This chart helps us answer the question of whether stocks are generally moving up or moving down.

The blue line at the top of the graphic plots the percentage of the 500 S&P companies that have a 200 day moving average that is sloping upward (a rising price trend). That level has now dipped below 40% for the first time since 2015, so more than 60% of S&P 500 stocks (303 of them to be exact) are now in downtrends.

This level is much lower than what was witnessed back in February. The average S&P 500 stock’s average price over the last 10 months is in a downtrend.

Notice that the prior two large pullbacks (2011 and 2015) were double bottom affairs, similar to 2018, with two moves down. Both of those bottoms saw this indicator dip to around 30% before the ultimate bottom was in. 2008 is the clear outlier as this ratio botttomed at less than 2% of stocks showing uptrends.

Volatility has picked up, but is it extreme? By some measures it is, but in our opinion the weight of the evidence suggests we are not in abnormal times and may just be moving back toward historical average volatility.

We tend to agree with Mr. Marks and his quote, volatility may have picked up, but that doesn’t have to scare us. After all, lower prices can be a good thing if you’re prepared to take advantage of them.

Invest wisely.

Our clients have unique and meaningful goals.

We help clients achieve those goals through forward-thinking portfolios, principled advice, a deep understanding of financial markets, and an innovative fee structure.

Contact us for a Consultation.

Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness. Disclaimer This presentation is for informational purposes only. All opinions and estimates constitute our judgment as of the date of this communication and are subject to change without notice. > Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness.