The CARES Act provides an estimated $2 trillion in fiscal stimulus to combat the economic impact of COVID-19 and provides the healthcare industry the financial support, equipment and protection it needs to help combat the virus.

“The purpose of government is to enable the people of a nation to live in safety and happiness.”

-Thomas Jefferson

On Friday, March 30th, the US Congress passed the “Coronavirus Aid, Relief and Economic Security Act”, or the “CARES Act”.

The $2 Trillion stimulus package has many aspects to it. (If you’d like to read the entire 335-page bill, you can read it HERE.)

But just in case you don’t have the time or inclination to read through 335 pages of congressional drivel, we have sifted through it for you. Below, we have prepared an overview of the important features that may apply to your individual situation. This includes items relating to your retirement accounts, stimulus payments for individuals, small business support and charitable giving.

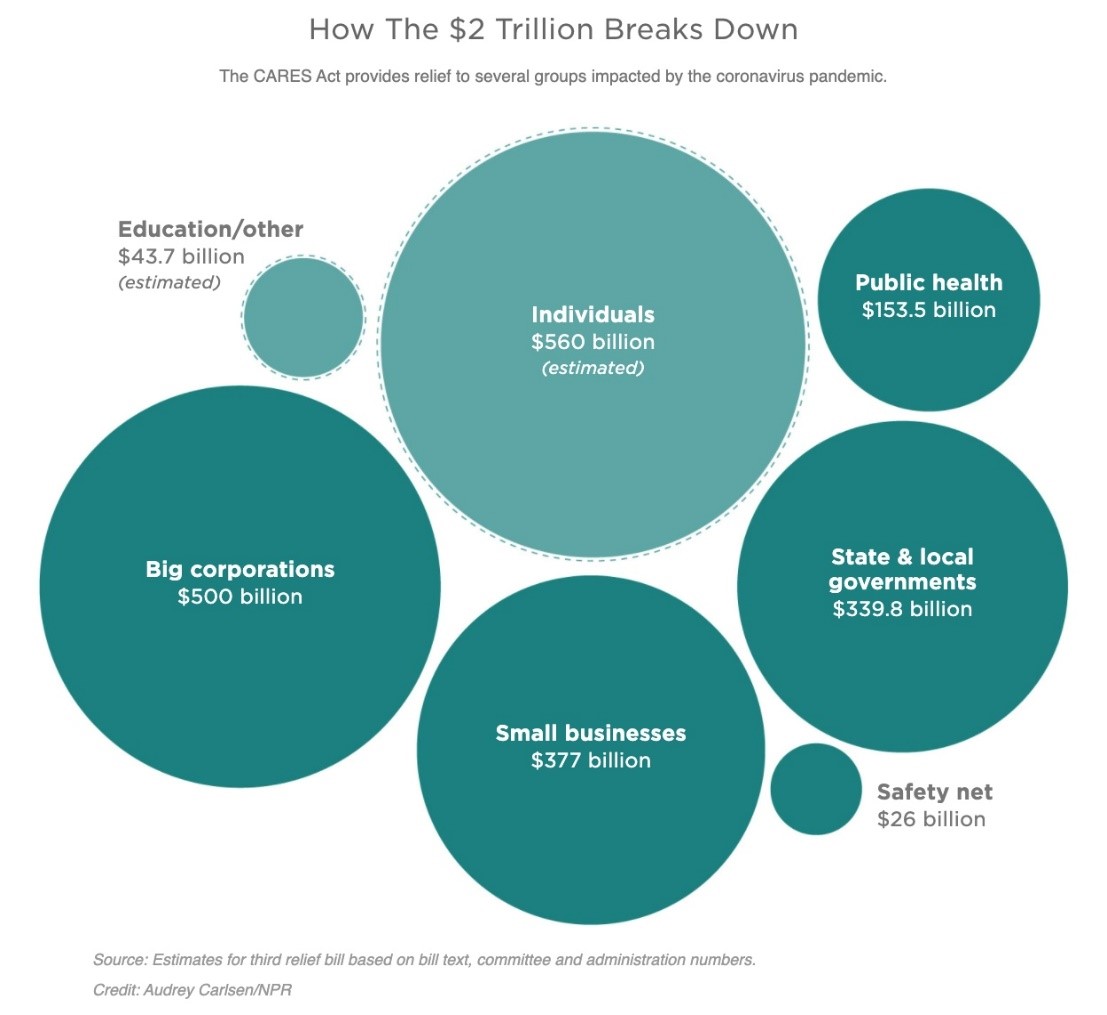

$2 Trillion is a lot of money. Where will it go?

The illustration below shows how the $2 Trillion is allocated across various types of potential beneficiaries. This is an ambitious bill to say the least. It is relatively equally split between individuals, big corporations, small businesses and local governments.

This is an ambitious bill to say the least. It is relatively equally split between individuals, big corporations, small businesses and local governments.

For our purposes, we’ll focus on the important aspects relating to individuals and small businesses.

The two aspects of the bill that have received the most news coverage are the direct payments to taxpayers and the Paycheck Protection Program for small businesses.

But there are many additional provisions that may impact our clients and their families.

Retirement Plan Provisions

- Required Minimum Distributions (RMDs) are waived in 2020 for qualified account holders including inherited or beneficiary-qualified accounts.

- Loans from Qualified Plans – Up to 100% of the vested account balance up to $100,000 may be borrowed from an employer sponsored retirement plan during the 180-day period beginning on the date of enactment. In addition, current loans are given an extra year for repayment.

- A penalty free coronavirus-related distribution of up to $100,000 can be made from IRAs, employer-sponsored retirement plans or a mix of both for individuals impacted by COVID-19. The amount will still be income taxable but for individuals under age 59.5, there will be no 10% penalty. There are many qualifying events beyond being diagnosed with COVID-19 including lay-offs, reduced work hours, lack of childcare, and more. Income taxes may be spread over three years.

- Pension plan sponsors are permitted to delay 2020 plan contributions until January 1, 2021 at which time the contributions will be due with interest accrued at the plan’s effective rate.

Individual Payments and Unemployment

- Most individuals earning less than $75,000 will receive a one-time cash payment of $1,200. Married couples receive two checks, plus $500 per child.

- Self-employed people are allowed to apply for unemployment through the Pandemic Unemployment Assistance program.

- Employers are permitted to provide up to $5,250 in tax-free student loan repayment benefits. This money will not be considered income for the workers that receive support.

- The Federal Government will add $600 to every unemployment check and coverage is now expanded to independent contractors and the self-employed.

- The CARES Act will waive the one-week elimination period to begin benefits, and it extends the length of time an individual may receive benefits for an additional 13 weeks beyond the state maximum.

Business Stabilization

- Paycheck Protection Program (suspended) – As of April 16, this program has run out of funding but essentially it authorizes up to $349 billion in forgivable loans to small businesses to pay employees. The loans are forgiven as long as the proceeds are used to cover payroll costs, mortgage interest, rent, and utility costs over the 8 week period after the loan is made. There is an expectation that more funds will be approved by Congress, but nothing has been passed yet. More details can be found on the Treasury’s website.

- Employee Retention Credits – This is a fully refundable tax credit (can exceed tax liability) for employers equal to 50% of qualified wages that Eligible Employers pay their employees. This credit applies to wages paid after March 12, 2020 and before January 1, 2021. The maximum amount of qualified wages taken into account for each employee is $10,000, so the maximum credit for an Eligible Employer for qualified wages paid to any employee is $5,000. If a business qualifies for and receives a Paycheck Protection Program loan, they do not qualify for the employee retention tax credits. Additional details can be found HERE.

- Disaster Loans – Funded through the SBA disaster loan program, it includes a $10,000 loan advance that does not need to be repaid. It is intended for any eligible small business with fewer than 500 employees.

Charitable Contribution Changes

- The CARES Act allows cash charitable contributions made in 2020 to be deducted up to 100% of adjusted gross income (AGI). Prior to the change, a taxpayer could only deduct up to 60% of AGI for cash contributions. Excess contributions can still be carried over for five years.

- The act allows taxpayers who cannot itemize deductions a new ‘above-the-line’ deduction. The maximum amount is $300, and the contributions must be made in cash. There is no stated expiration of this provision in the Act.

If you would like to discuss specifics on whether these may apply to you, please do not hesitate to reach out. And as always, consult your tax advisor on how your specific situation may be impacted as well.

Our clients have unique and meaningful goals.

We help clients achieve those goals through forward-thinking portfolios, principled advice, a deep understanding of financial markets, and an innovative fee structure.

Contact us for a Consultation.

Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness. Disclaimer This presentation is for informational purposes only. All opinions and estimates constitute our judgment as of the date of this communication and are subject to change without notice. > Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness.