In Greek mythology, Ares was the God of War.

He was one of the 12 original Olympians, and a son of Zeus. He symbolized both the valor and brutality of war.

Much of Greek mythology comes from ancient writings, such as Homer’s Iliad.

In the Iliad, Zeus tells his son, Ares:

To me you are the most hateful of all gods who hold Olympus. Forever quarreling is dear to your heart, wars and battle.

zeus to his son ares, in Homer’s iliad

It is telling that the Greeks chose to have War represented in their 12 primary deities. But it is most telling that they portrayed the God of War as the worst one of the bunch.

28 centuries later, humanity still faces those who feel the pull of Ares. Specifically, Vladimir Putin. And his drumbeats of war are growing louder by the day.

The possibility of a Russian invasion into the Ukraine has been increasing for at least two months now. It now appears almost inevitable that Russia will invade.

(Unless, of course, this was a pre-planned show of force with a pre-negotiated peaceful resolution that helps both Putin and Biden with their constituents.)

But we digress.

We will not discuss the human impact of a potential invasion or war. We only hope that if an invasion occurs, death and destruction are minimized as much as possible. And we hope it does not escalate into a more broad conflict that includes China, European nations or the United States.

What we will do is focus on the potential impact on the markets. Specifically, we discuss:

- Timing of a Potential Invasion

- Are Markets Pricing in the Risk of War?

- What happened after Previous Geopolitical Events?

- What is the risk of Russian Attacks on our Infrastructure?

Let’s get to it.

Timing of a Potential Invasion

First of all, Russia has a history of invading countries when the US is preoccupied with other things.

- They invaded Afghanistan on Christmas Eve in 1979.

- They invaded Hungary two days before the Presidential election in 1956.

Russia’s two biggest adversaries, the US and China, are both pre-occupied right now.

- China is hosting the winter Olympics, and are trying to look good on the world stage (although nobody seems to be watching).

- The Super Bowl is this weekend in the US. It is annually one of the most-watched television events of the year.

So it appears that this weekend may make sense if they are going to invade.

However, people said that in December as well, projecting that Russia might again invade around Christmas and that didn’t happen.

We are no geopolitical experts, but we would not be surprised if an invasion happened this weekend.

Are Financial Markets Pricing in an Invasion?

Bottom line, no, they are not. And if they are, they simply don’t care.

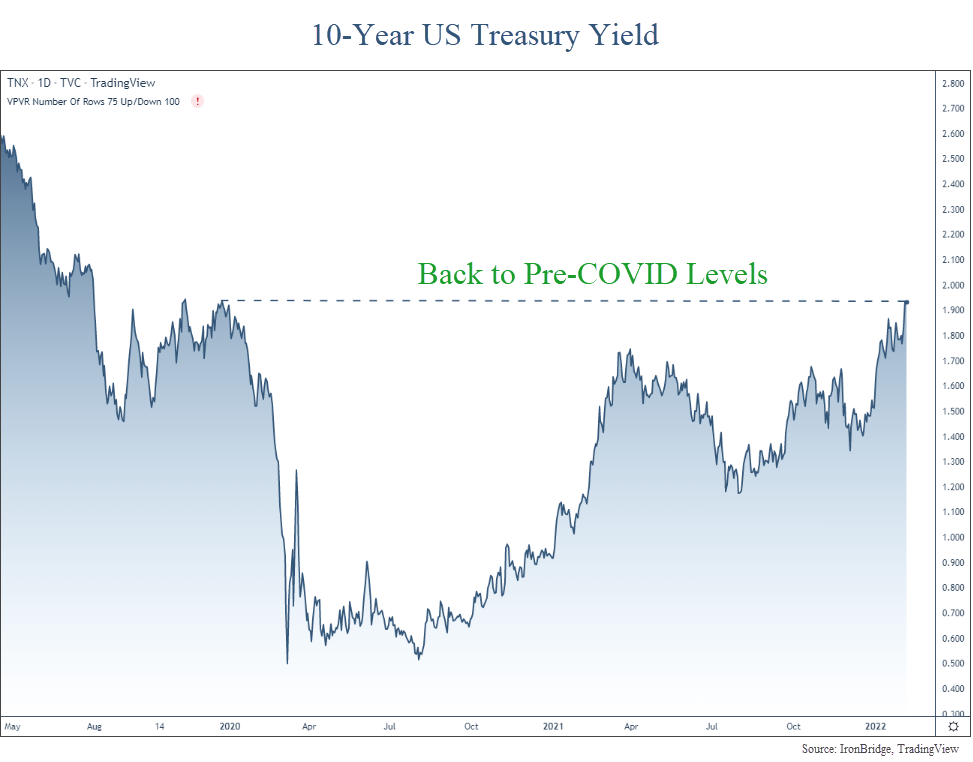

Typically when financial markets are concerned about a negative potential event, money flows into US Treasuries, causing yields to go down. However, yields have risen recently, and there has been no flight into the safety of US Treasuries.

In fact, US Treasury yields have continued moving HIGHER, and are now back to pre-COVID levels, as shown in the chart below.

The spike higher on the far right side of the chart shows a bond market that is decidedly NOT pricing in any global instability.

If the global financial markets were concerned about this invasion, we would first see it expressed in lower yields, not higher ones.

In fact, since late November and early December (when rumors about a Russian invasion began), yields have only risen. They are up over 65 basis points in that time, which is a very large move in yields for the Treasury market.

Simply put, this is not a bond market that is concerned about an invasion.

The stock market isn’t much different.

Yes, we have seen volatility this year. But it appears for now that the choppiness this year is simply a market working off the froth after large gains over the past two years. Not an anticipation of further escalation in the conflict.

As invasion rumors have continued to gain momentum over the past couple of weeks, US markets have rallied.

What about in Europe?

Germany appears to be the biggest loser (besides Ukraine) in all of this. They get energy from Ukranian pipelines, and their economy appears to have the most to lose.

Well, European markets are basically telling the same story…that there isn’t much to worry about.

The next chart shows the Euro STOXX 50, an index of the 50 of the largest companies in 8 European countries, and the German DAX, which is Germany’s equivalent of the Dow Jones Index.

This chart shows European markets that have been choppy since last summer. You’d never know by this chart that there was about to be a war any day.

In fact, European stocks have fared much better than US stocks over the past month, despite having much more to lose if Russia invades Ukraine.

Bottom line, financial markets across the globe simply aren’t predicting any lasting impact of the potential conflict.

What Happened in Previous Geopolitical Events?

This isn’t the first time we’ve had geopolitical scares.

In fact, we wrote about this exact thing in 2017 when there was sabre rattling as tensions with North Korea began to flare. Read it HERE.

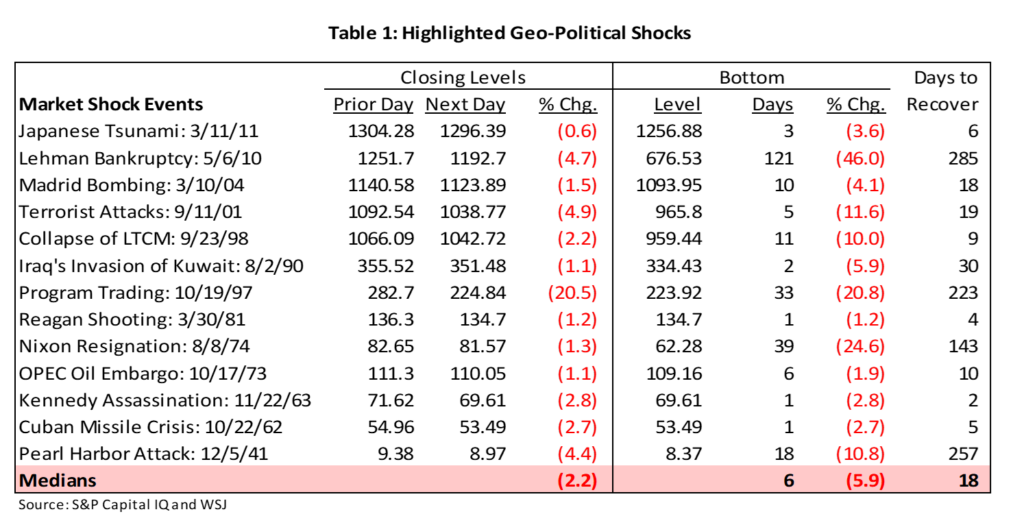

Somewhat to our surprise, we found that geopolitics simply don’t have the negative effect that many people think.

The next table shows the performance of the S&P 500 Index following major geopolitical shocks, courtesy of S&P Capital and the Wall Street Journal.

Essentially there were 3 events in the past 100 years that caused markets to fall more than 12%:

- Lehman Bankruptcy (that started the global financial crisis)

- The minor bear market in 1997 during the tech bubble

- Nixon Resignation during the sideways bear market of the 1970’s.

In fact, EVERY war in the past century was a non-event to markets.

Surprising, huh?

Pearl Harbor, the Cuban Missile Crisis, JFK assasination, the first Iraq war, 9/11…all resulted in only moderate declines the day it was announced, and all resulted in completely normal pullbacks.

In January, we saw the S&P 500 fall 12%. It has recovered about half of that move so far.

So maybe the market ALREADY priced in Russia invading Ukraine, based on how stocks have responded to the start of previous wars.

What if Russia Attacks Infrastructure in the U.S.?

This is the biggest wildcard.

One of the concerns by some is if the United States put punitive sanctions on Russia, they would retaliate with an attack on our infrastructure.

An attack on our digital infrastructure would be a problem, but it appears that would be a temporary one. There is not just one internet or communication provider. There are many. So while a localized attack may cause localized disruption, it would be very difficult to stop the “web” of communication that exists across this country. Landlines, cell towers, satellites, all provide data to people. It is a very decentralized system that would be hard to attack.

Water and electricity resources is another potential target. But as we’ve witnessed in Texas over the past year, the power grid going down or water supply being compromised does indeed cause inconveniences. But it would not necessarily cause permanent or irreparable damage to the country.

So what would Russia have to gain? They cause major inconveniences to us? Just keep robo-calling us about our expired car warranties and call it a day.

Is the inconvenience worth starting World War III? It doesn’t seem like it.

Conclusion

Bottom line, financial markets aren’t concerned. There isn’t enough tension, risks and potential benefits to Russia to warrant expanded conflict. And expanded conflict is the real risk.

Ukraine is a strategic benefit for Russia, but is not crucial to the global economic or market infrastructure.

Financial markets are taking the approach that there will always be conflict. Humans will be forever quarreling. And they are taking the view that minor conflicts are not important enough to change the overall market and economic cycle.

We’re not saying that it for sure WON’T turn into something bigger. If it does, we will adjust portfolios accordingly. After all, the market can change its mind anytime.

But for now, it appears that if Russia does in fact invade Ukraine, there is not much to worry about when it comes to your portfolio.

Invest wisely!