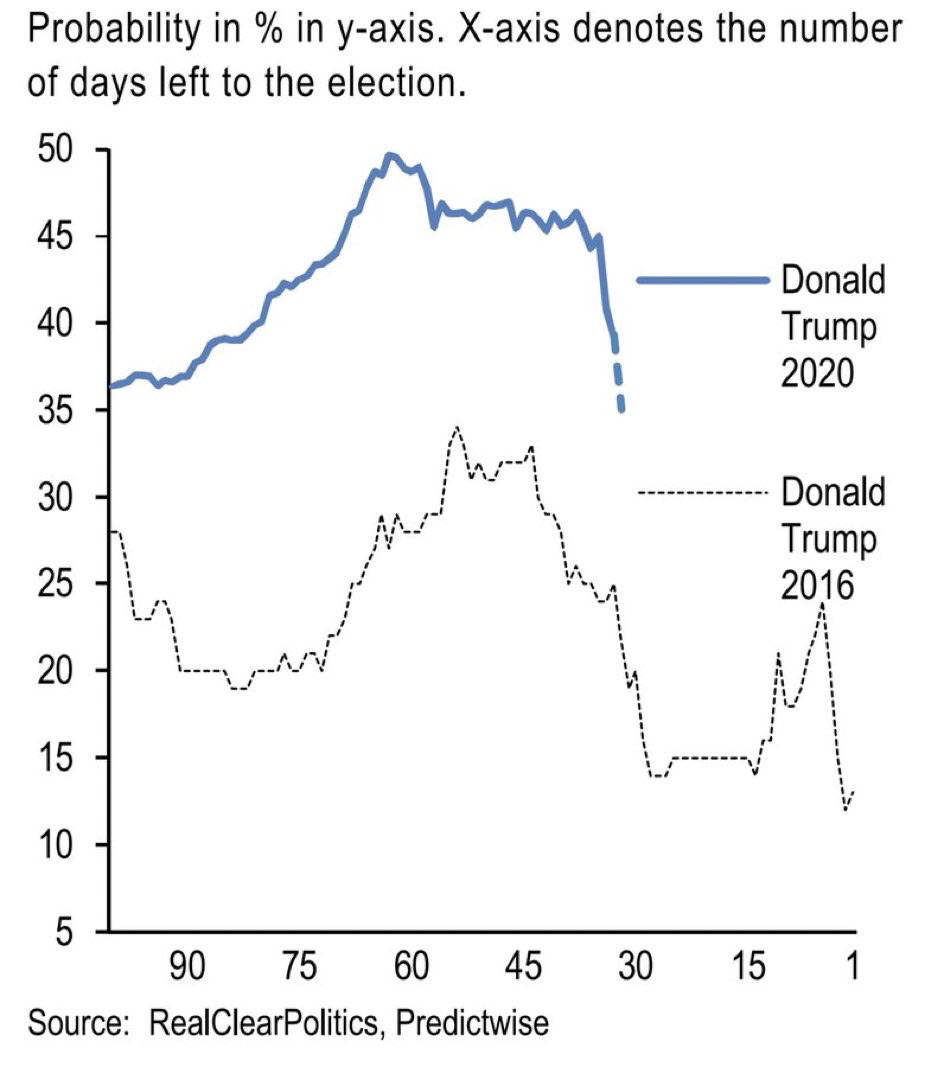

Markets across the globe surged today, despite election uncertainty. Just like in 2016, predictions about what would happen in the 2020 Presidential election were flat out wrong, as were market predictions for a market crash. It appears that gridlock, the Fed, and the potential for stimulus talks to resume are driving asset prices more than the uncertainty surrounding the election outcome.

“Gridlock is great. My motto is, ‘Don’t just do something. Stand there.'”

-William Safire, American author and New York Times political contributor

Given the fluid nature of the election results, we will be providing updates and context on portfolio positioning and analysis on how markets are responding.

Given the fluid nature of the election results, we will be providing updates and context on portfolio positioning and analysis on how markets are responding.

We’ll keep these updates relatively brief, and we will likely be sending multiple reports over the coming days and weeks. As of this report, there has been no declared winner of the presidential election. However, it is becoming more likely that Biden could be the next President of the United States.

There are three main areas to discuss from yesterday’s election:

- Key Takeaways

- Market Analysis

- Portfolio Positioning

Let’s dive in.

Key Takeaways

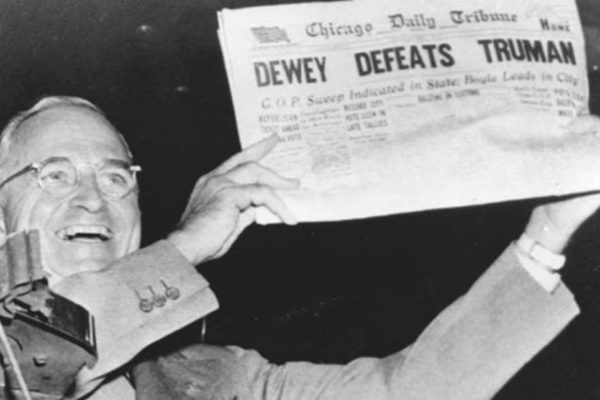

Many people predicted that a contested election would throw the markets into turmoil, with numerous “experts” predicting a market crash if this happened.

There was no clear winner on Tuesday or Wednesday. Multiple states are still too close to call. Trump is threatening lawsuits and recounts. Neither side is budging. Results may not be known this week.

This is the exact scenario “experts” predicted would crash the markets.

Instead, markets were up substantially today.

Why?

Here is our initial reaction to the election results thus far:

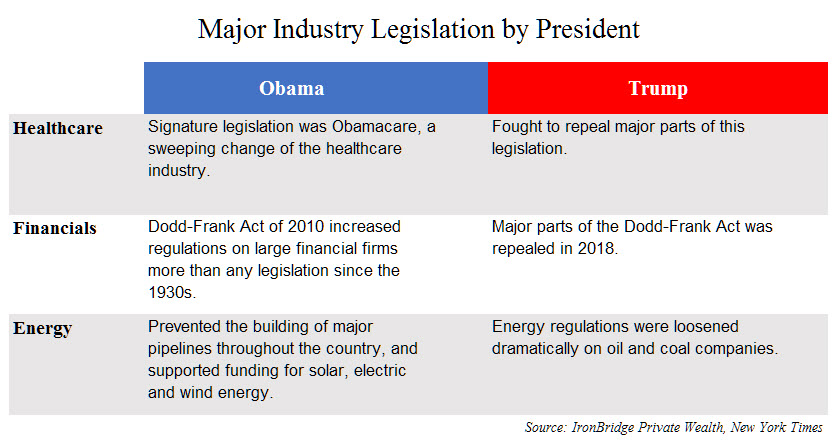

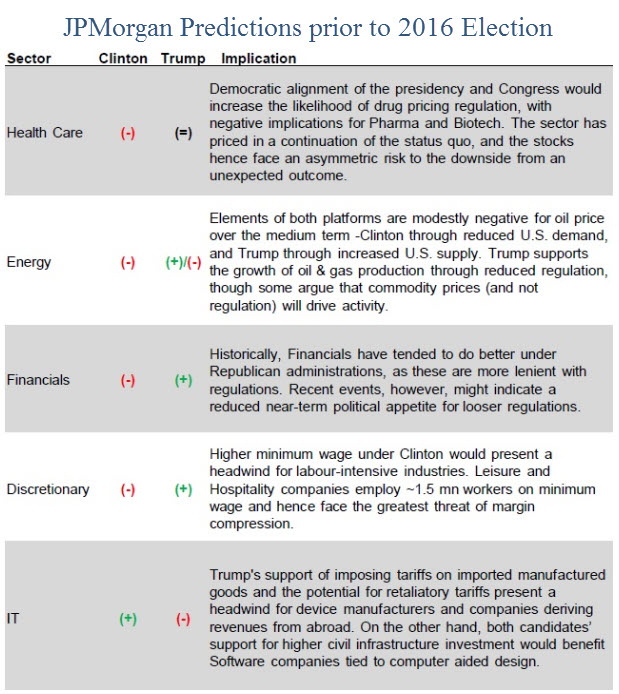

- Gridlock is good. There was no blue wave as many people predicted. The market is interpreting this to mean that massive tax increases on individuals or businesses will likely not happen. Some tax changes should be expected, but they may not be as punitive as many initially feared.

- Predictions are Useless. In 2020, as they did in 2016, the “expert” pollsters had it massively wrong. So did the “expert” investment firms predicting market turmoil. Don’t use predictions as a basis for making political or investment decisions.

- Price is King. Prices are ultimately all that matter to your account values. Our job is to grow your portfolio during times of opportunity and reduce volatility during times of stress. Prices are telling us it is a favorable time to be holding risk assets.

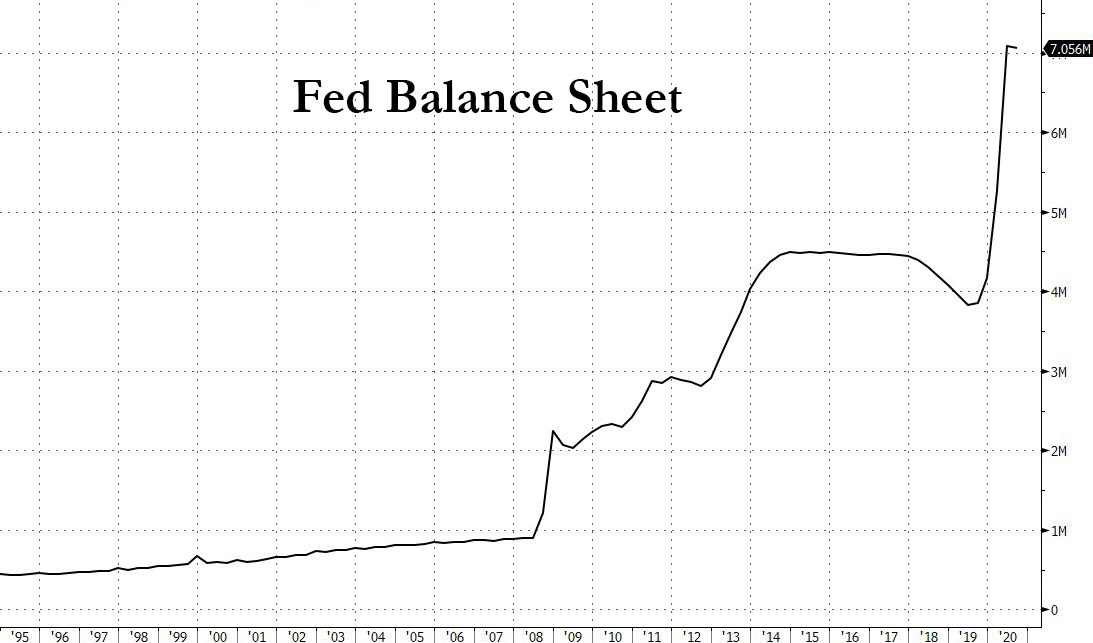

- It’s Still all about the Fed. We’ve been saying this for months, the primary driver of market prices is liquidity from the Fed. The election uncertainty and delayed outcome did not change that.

- Expect Stimulus Talks to Resume. With the election behind us (sort of), the market will likely focus on continued COVID-related stimulus packages, in addition to a multiple-trillion-dollar stimulus package in 2021 from whomever ultimately wins the presidency.

Bottom line, markets are reacting favorably to a balanced government, stimulus and continued Fed liquidity.

One interesting stat…this could be the first time in history that there is a Democratic president, a Democratic House, but a Republican Senate. The primary message from the US electorate: work together.

Market Analysis

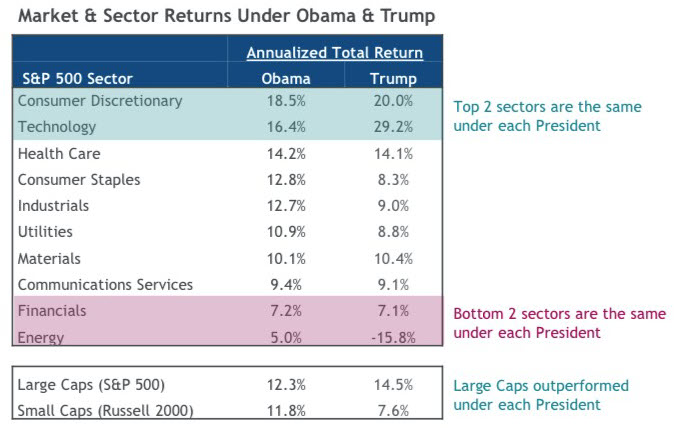

Stocks surged today. That may change tomorrow, but the initial reaction to the election was very strong. The leaders were large caps, technology, biotech and healthcare, and most were up over 4% today. It is not just stocks that are strong…market strength is widespread across asset classes. Stocks, bonds and commodities are all higher in response to the election.

Let’s take a quick look at a shorter-term chart of the S&P 500. The first chart below shows stock prices since October 19th.

After a nearly 10% selloff during the second half of October, the S&P has surged almost 8% from recent lows. It is up over 2% today alone.

So much for that contested-election market crash.

Bigger picture, it appears that the market is continuing to consolidate after the massive surge off of the March lows.

The next chart is the daily chart of the S&P 500 this year. Since the September highs, stocks have been moving in a sideways and choppy manner. Today’s action looks like a continuation of that sideways move.

The market is clearly defining what it views as important price levels.

On the upside, if prices can exceed the two blue lines near the top of the chart (roughly 3500 and 3600), then prices could explode to the upside and enter what is called a “melt-up” phase. This could result in dramatically higher prices in a fairly short period of time.

On the downside, stocks have found support in the 3200 area (the blue shaded area in the chart above) multiple times over the past few months. If prices fell below this very important 3200 level, then probabilities rise dramatically that we will see further declines in prices. For now, that probability appears to be the lower likelihood outcome.

Until we see a decisive break out of this range in one direction or another, we should expect markets to be choppy, especially if there are any surprises from the vote counting process.

But the initial strong response by the markets is encouraging. We should expect continued Fed support of the markets, and discussion from the winning side about a multiple trillion dollar stimulus package following inauguration. We should also expect the COVID-related stimulus discussions to restart in Congress now that the election is done.

This is an excellent example of just how little impact these types of events usually have. This is not unusual. The data consistently tells us to pay more attention to what’s really happening under the surface of the market instead of the media-induced frenzy surrounding big events like elections.

Portfolio Positioning

As we have stated before in both this newsletter and during discussions with our clients individually, we do not make allocation and investment decisions based on events. Rather, we simply follow our predetermined process.

What actions have we taken for clients?

- We have had increased cash exposure for clients since early September.

- Last week, we had more sell signals get triggered, and entered election day with 25-30% cash, depending on our individual client’s pre-determined risk levels.

- Today, we had a buy signal in our S&P 500 trend model. This moved 10-15% of portfolios from cash into the S&P 500 Index ETF this afternoon just before the market close.

- Our signals are showing multiple areas of strength following the recent surge, and anticipate that we will likely get more buy signals in the coming days.

Overall, we have been pleased that our proprietary system has had us with higher than normal cash levels over the past couple of months, and it was reassuring to have extra cash in portfolios going into election day.

For now, our system is telling us that the probabilities favor higher markets over the coming months, but that could change quickly.

During times of volatility, there is the potential for what we call “whipsaws”. This occurs when a buy signal is followed by a sell signal in a fairly quick period of time. In any investment system that analyzes and follows trends, this is a potential risk. We have processes in place to help reduce the negative effects of these whipsaws, but they still happen nonetheless.

We hope this doesn’t happen, but if our signals tell us to be more defensive, we will adjust accordingly.

So expect to have increased activity in your accounts if markets continue to be volatile. The goal is to be positioned correctly for the market we have, not the market we hope to have.

For now, election day is over. The Fed remains supportive. We continue to have a balanced government. These issues are proving to be more important to markets than the actual results of the election or the potential contested nature of it.

All sides of the political spectrum can view yesterday’s results favorably. Democrats appear likely to win the presidency, but Republicans held many seats in the House and will likely have the majority in the Senate.

Maybe this is exactly what we all need. This has been a difficult year for many people, and let’s hope that we can move forward together.

Invest wisely.