In the past three weeks, there have been three prominent Fed officials who have been caught in trading scandals.

For those not familiar with this scandal, you can read about it here:

https://news.yahoo.com/a-timeline-of-the-federal-reserves-trading-scandal-104415556.html

In summary, last week, Robert Kaplan and Eric Rosengren, Presidents of the Dallas and Boston Federal Reserves respectively, both “retired” amid revelations that they had actively traded stocks and investments that directly benefitted from the Fed’s actions.

Last Friday, yet another official, Richard Clarida, reportedly moved millions of dollars out of bonds and into stocks the DAY BEFORE the Fed announced trillions of dollars of market stimulus.

This is a conflict at best, and flat-out criminal at worst.

If an employee of any financial institution did this, they would be fired. And probably banned from the financial industry for life.

But the Fed officials simply “retired”.

The End Game: Losing Confidence

The financial markets have risen on the back of Fed printing for over a decade now.

For many years, our clients have been asking (and we have been wondering), “When will the next bear market begin?”

And for many years our answer has been, “When the market loses confidence in the Fed.”

Well, this may very well be how it starts.

In our opinion, the single biggest risk in global financial markets is a mistake by the Federal Reserve.

Thus far, they have consistently erred on the side of being supportive of financial markets. And prices have gone up in response.

But the recent tumult inside the Fed has a different feeling.

The blatant and intentional actions of these men were for one reason: to make money.

By itself, there’s nothing wrong with that.

But when you “front-run” major announcements intended to change the direction of global financial markets, you go from simply trying to make money to committing acts that violate any basic conflict of interest rule. And likely go far beyond that.

These men should be investigated. Just like any other member of the financial industry.

But unfortunately, they probably won’t.

Neither will the many people in Congress who do the same thing every week.

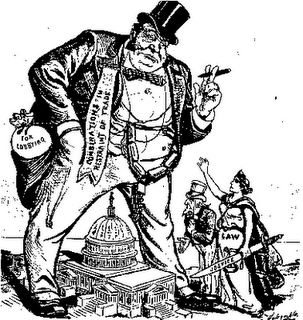

It’s almost as if there is a ruling class that is above the law.

Stock Market

What effect might this have on the stock market?

Markets have become volatile once again. Maybe it’s just a long overdue pause, or maybe it’s because of this scandal.

Either way, the Fed is such a HUGE part of the markets these days, anything they do (good or bad) will likely have an impact.

The extent of that impact is still unknown.

On the one hand, this could be the first domino to something bigger. A weakened Fed opens itself up to major criticism, and rightfully so.

Up to this point, the Fed hasn’t had to deal with much criticism. Trump was a vocal critic of the Fed, until he became president and wanted markets to remain strong. Ron and Rand Paul have both been critical, but their voices have quieted since COVID began.

And when new Fed chairs get appointed, they may or may not have the stomach to fight such criticism.

On the other hand, maybe this criticism causes the Fed to double down on their printing machine. Maybe they announce continued support of the markets because they don’t want the one-two punch of both bad publicity AND a weak stock market.

At this point, weakness in the market appears to be normal.

After all, we went nearly a year without a 5% correction. That’s pretty abnormal, as these types of declines happen 1-2 times per year on average.

But if the stock market has peaked (which we’re not certain that they have), then we very well may look back at these trading scandals as the moment the Titanic first ran into the iceberg.

Invest wisely.