What if we told you that we knew what the Fed was looking at in their meetings? That we knew their secret? It would take the guesswork out of trying to predict what the Fed was going to do. Well, it may just be hiding in plain sight.

“Secrets aren’t secret. They’re just hidden treasures waiting to be exploited.”

-Stephen White, Author

The Fed’s Secret Indicator

This week the Federal Reserve Bank of the United States did something that surprised absolutely no one. They cut their Fed Funds rate (the rate that they charge banks to borrow) another 25 basis points. This had been telegraphed to exhaustion, and the only real unknown coming out of the meeting was what will happen in the near future.

Chairman Powell did not help this uncertainty as he pushed back on every question asked of him about the Fed’s next move. It is worth noting the Fed was the most divided they have been in recent history, with 3 members opposing the 25 basis point cut. So it seems, even the Fed doesn’t know what it is going to do over the coming months (spoiler alert: we do!).

The Fed has two official mandates: price stability in the overall economy and maximum employment. Since 2008, the Fed has done two things to attempt to achieve these mandates: control short-term interest rates and print money to help boost asset prices.

We won’t get into the merits or criticisms of various Quantitative Easing programs the Fed has done over the past 10 years. Instead, let’s focus on how the Fed “controls” short-term interest rates.

The Fed looks at a tremendous amount of data. Economic numbers, employment information, and endless data on global markets. They must have a process on how to analyze all of this information, right? They have dozens of PhD economists who know how to interpret all of this data and use it to formulate a comprehensive and effective strategy to determine what they should do at their next meeting.

They definitely have employees that should be able to do the work. The Federal Reserve has over 17,000 employees with an annual payroll in excess of $3.5B per year. (Read the Federal Reserve Annual Report HERE.)

The main question is…why?

Many of their employees serve in the regulatory arm that governs various banking institutions. We get that. But setting the Fed Funds rate doesn’t need to be a primary function. In fact, we don’t think the Fed is actually doing ANYTHING when it comes to setting rates.

We know their secret.

And unfortunately, it’s not very exciting.

The Fed simply follows the rate that the market sets. Period.

Our apologies if we got you too excited about their secret. (Editor’s note…If you did get too excited, then you probably need to get out more).

This is one primary reason why they are continuously behind the curve and cannot prevent recessions or business cycles. They would admit they “look at a lot of different indicators”, but the reality is they only need to look at one…the US Treasury market.

Looking back over the past 25 years, the Treasury market has consistently moved ahead of the Fed. The chart below, courtesy of McClellan Financial Publications, shows how the 2-Year Treasury yield led the Fed Funds rate during each and every turning point, as well as the majority of the time in between.

Shouldn’t the Fed Funds rate be LEADING market rates?

It sure does look like market rates are ahead of the Fed.

But what if the short-term treasury markets are in fact following the Fed? After all, the Fed has regularly scheduled press conferences, and various members speak about interest rates and the economy in between meetings. Maybe the Fed is guiding the short-term rates?

Again, we don’t think so. To make the point, let’s look closer at 2008. Why did the Fed need to have 3 unscheduled/ emergency rate cuts during the financial crisis (which still did not help prevent the worst recession since the Great Depression)? If they actually set interest rate policy instead of following it they would have just moved the Fed Funds rate to 0% during their October 2008 meeting rather than waiting until December of that year to do so. Or at a minimum, the short-term Treasury rates should quickly adjust once the Fed announced their rate cut. But that didn’t happen.

Maybe they thought things would get better. The more likely scenario is that they realized the treasury markets were pricing in far worse outcomes than their “experts” though. In fairness to them, they do have something to worry about that the bond market doesn’t necessarily have to worry about…politics. The Fed is supposed to be non-political, but they absolutely have to worry about the optics of their policies, US Senate oversight, and overall public perception. In reality, the perception problem is most likely as important to their jobs as being correct in their policy decisions. Nevertheless, the Fed is continuously behind the eight ball because they must follow the bond market for their signals.

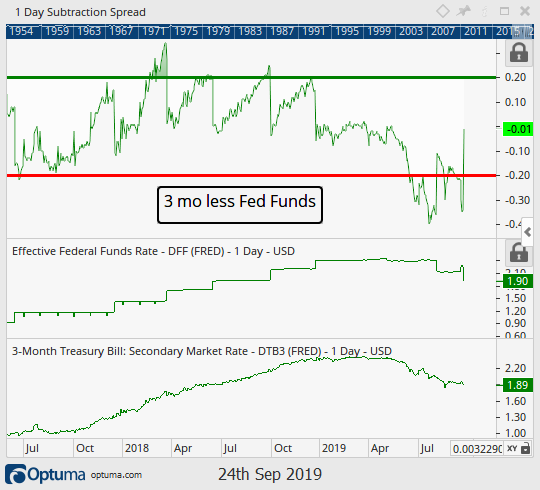

The next chart below shows what we consider to be the best leading indicator of the Fed Funds rate…the 3 month Treasury bill’s interest rate. The first chart below is zoomed into 2008 to further the discussion.

The 3 month Treasury rate is at the bottom of the chart, and the Fed Funds rate itself in shown the middle section. The top portion is the difference between the two. Notice the significant lag between the two, especially in September of 2008?

This lag is shown more clearly in the top portion of the chart. During the majority of 2008, the Fed Funds rate was higher than the 3 month Treasury bill, oftentimes much higher. This meant they were chasing the 3 month bill all the way down.

In short, the Fed easily could have justified cutting more throughout 2008, but for whatever reason, they didn’t. By September of 2008, the Fed’s rate was over 2% higher than the 3 month Treasury bill’s rate, highlighting how policy could not keep up with the reality of the situation.

In 2008, the Fed was obviously slow to recognize what needed to be done, and took its cue from the market.

Now let’s fast forward to today as we have seen two 25 basis point cuts over the past two months. The next chart zooms into the last 3 years.

Notice a pattern? Every time the 3 month Treasury yield was 20 basis points above the Fed Funds rate, the Fed raised rates at their next meeting.

But then it changed. In June of this year, the difference between the Fed Funds rate and the 3 month Treasury dipped below 20 basis points (and stayed below longer than a few days). In our view, this was the catalyst that sent the Fed cutting interest rates on July 31 (effective in August).

We also should note this spread never got more than 40 basis points wide, and is the reason why the Fed did not cave to the President’s calls to cut 50 basis points at the time.

But what about this most recent September announcement where they cut an additional 25 basis points? This was the most controversial one in recent history (at least from the Fed’s internal Committee’s perspective with 2 members voting for no change and 1 voting for a 50 bp cut).

The most recent cut was also justified, and so was the size of it at 25 basis points. This is shown by the chart above that reveals with the effective rate between 2.00% and 2.25% the spread between it and the 3 month Treasury was once again over 20 basis points wide. Today it is spot on with just 1 basis point difference.

So what will the Federal Reserve do at the October meeting? Based on the 3 month Treasury they won’t do anything (not unless the market causes a major shift in that interest rate). This will more than likely make a number of people unhappy. The Commander in Chief for one, but also there is currently a 65% chance of another rate cut in October. These folks may be disappointed as well.

Investment firms will put in way too much effort and gnashing their teeth over trying to predict the Fed’s next move, when in reality all we need to do is watch the 3 month Treasury for any signals that may suggest otherwise.

If the difference between the 3 month rate and Fed Funds rate is large enough, they will cut. If not, they won’t. Thanks for playing.

In the meantime, we will make the suggestion that the Fed should simply announce that the Fed Funds rate will be pegged to the 3-month Treasury. That would save us all quite a bit of time and energy, and most likely improve the odds that the Fed can actually accomplish its dual mandates.

Stock Market Update: Buy High, Sell Higher?

It seems we were well on our ways to finally breaking out to new all time highs when the Fed’s lack of future transparency threw a wrench into that plan. Immediately on the Fed’s announcement Wednesday, September 18 the market sold off. It recovered by the end of the day but has since tread sideways as price remains between recent support and all time highs resistance.

After all was said and done, the stock market remained within a couple of percent of new all time highs, as we continue to wait for a breakout to new all time highs before we allocate more capital to equities. This essentially means we are willing to buy at higher prices, what why is this?

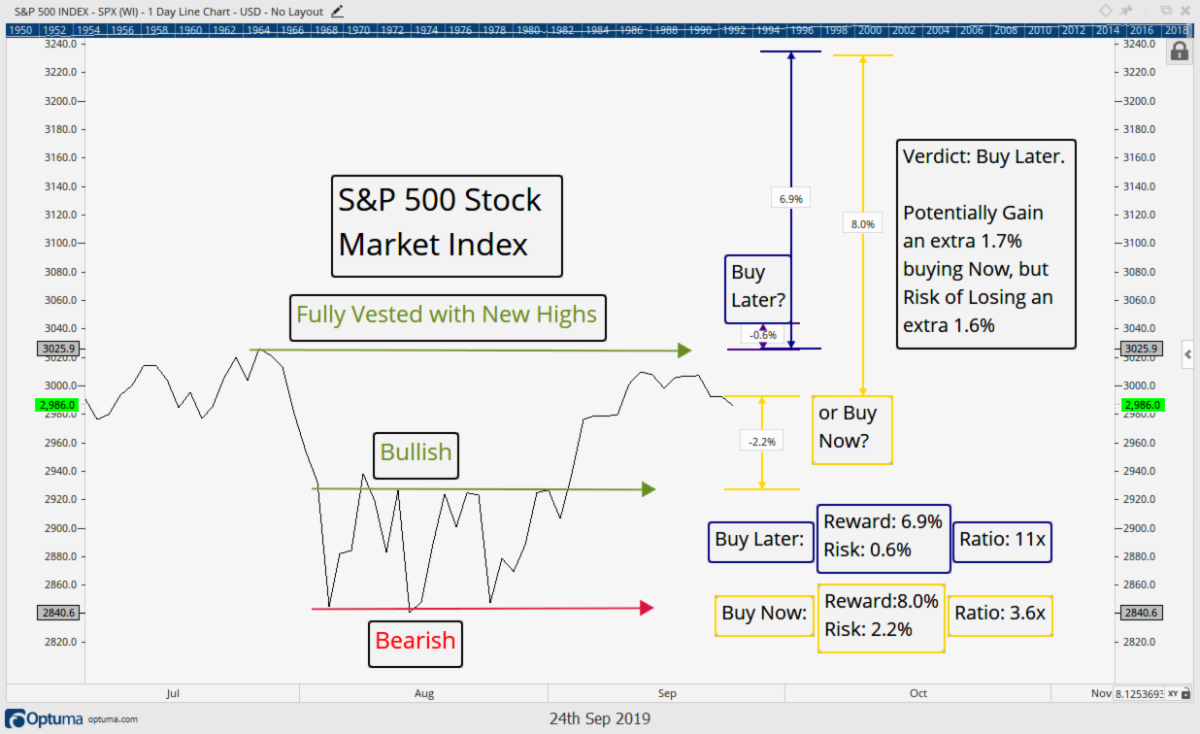

The chart below is the same one we have discussed the past few ‘Insights’, but we have added some trading math to help show why sometimes it is better to buy high rather than buy low.

Doesn’t it seem counter-intuitive to wait for higher prices before adding exposure to equities? We have been ingrained to think that buying low and selling high is the appropriate chain of events, however, that certainly is not always the case. The reason is because of the risk side of the equation. Sometimes there is less risk when purchasing at a higher price.

The chart below helps explain this philosophy, but in general, we look for at a minimum a 3:1 return to risk ratio on every position we buy. What this means is we are looking for a security that has equal chance of rising at least three times what it could decline.

In the example below the reward to risk ratio is significantly improved if we wait for new highs before buying. Note in yellow the math around buying right now and the summary of that trade in yellow in the bottom right. A 3.6x reward to risk ratio is not bad, and is one reason why we added some positions in early September. That ratio was improved when price was closer to those August levels, so what we added in September had a reward to risk ratio around 5.0x.

Buying right now there is a hypothetical potential 8% gain, but a potential 2.2% loss. That 2.2% loss is identified by the next logical level of support (where price spent all of August). This is the likely level price would pull back if it were to fall from here. Although still a decent trading opportunity (with a reward to risk ratio of 3.6x), it is not as good an option as the navy blue, buy later, option.

If we wait to buy on a breakout, we can then utilize the all time high at $3025 as the next logical support zone, resulting in risk of only 0.6% in buying once that breakout occurs. Waiting to buy results in us missing out on 1.7% (0.6% +(8.0%-6.9%)) of potential upside, but it also results in us potentially not losing 1.6% (2.2%-0.6%). Waiting for a breakout before buying offers an 11x reward to risk ratio in this scenario, which is a lot more attractive than a 3.6x ratio.

That said, we have added stock exposure to client portfolios over the past month, as certain investments did meet our 3-to-1 principle. But the remaining cash will be allocated if the market does indeed break to new all-time highs.

Sometimes it does make more sense to wait for higher prices before buying with the primary reason being the risk that can be avoided by doing so. Buying low and selling high sometimes is not as good as buying high and selling higher.

Invest Wisely!

Our clients have unique and meaningful goals.

We help clients achieve those goals through forward-thinking portfolios, principled advice, a deep understanding of financial markets, and an innovative fee structure.

Contact us for a Consultation.

Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness. Disclaimer This presentation is for informational purposes only. All opinions and estimates constitute our judgment as of the date of this communication and are subject to change without notice. > Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness.