IronBridge Insights

Commentary on the important issues driving trends in today’s markets. Presented without confusing industry jargon.

Join our Email Community!

Selloff Over or Just Getting Started?

The S&P 500 officially fell 20% from it’s highs this morning. But last Thursday morning, it was down only 7% from its highs. Then Trump unleashed his tariff “plan”. Stocks were down over 10% in two days last Thursday and Friday, and another 4%…

Correction Nearing an End?

Volatility over the past month was fast, but positive signs suggest the recent correction may be over.

Rate Cuts at New Highs

The Federal Reserve cut its target interest rate by 0.50% on Wednesday, with stock markets at or near all-time-highs. What does that signal for the economy and markets?

Can Market Strength Continue?

Will the exceptionally strong markets over the past four months finally come to an end? Or should we expect higher prices ahead?

Where Oceans Meet but Don’t Mix

Transitioning between investment cycles can be difficult. What impacts will the current transition from a declining interest rate environment to a rising one have on global markets and your financial goals?

Price versus Earnings

The stock market’s rise this year has been exclusively due to an increase in valuations. If earnings can catch up to valuations, probabilities of a major bear market are greatly reduced.

The Fed’s Mixed Messages

The Fed met today and kept interest rates unchanged. However, their rationale was convoluted and confusing, resulting in a number of mixed messages.

Debt Ceiling: More Smoke than Fire

Negotiations on the debt limit are heating up in Washington. What implications may it have? In our view, negotiations are mostly political posturing by both sides trying to gauge the likelihood that the “other side” will ultimately be blamed from bad things that may…

Et Tu Brute

After the Fed’s rate hike, regional bank executives must feel the same betrayal Julius Caesar did when murdered by his most trusted confidant. What is next for the banking crisis?

Bank Run: Silicon Valley Bank Goes Under

Today, Silicon Valley Bank became the second largest bank failure in US history. What happened and what does it mean going forward?

Recession Risks Remain High

Despite recent market strength, recession risks remain elevated. What does the data say?

Scrooged?

Major economic data is in direct conflict with an equity market that has improved recently.

Thanksgiving Appetizer Report

Just wanted to provide a quick update as everyone prepares for the holiday week. We’ll send out a more detailed report next week. Big Picture Markets have remained calm after the massive gain two weeks ago following a milder than expected inflation number.Earnings for…

Are We There Yet?

We’ve all been there. (At least those of us with kids have been.) The start of a long road trip. Everyone is excited to get going. Then you get 8 minutes into an 11-hour drive, and you hear the famous words emanate from the…

Don’t Fight the Fed

The Federal Reserve met today and increased rates by 0.75%. After a volatile trading session, stocks finished down almost 2%. When might the Fed be done raising rates?

A Recession or Not a Recession, That is the Question

Markets have rebounded from the lows in June. Can we assume that the lows are in place for this bear market? It may be dependent on whether we are in a recession or not.

Continue Reading… A Recession or Not a Recession, That is the Question

7 Lessons for Any Bear Market

Markets continue to be volatile. What lessons have we learned from previous bear markets that we can apply today?

Gimme Shelter

Market volatility has risen over the past few days, and risks have increased dramatically. We are reducing equity exposure to find shelter from this market storm.

Stick Save

Last week, the market made an important move higher just when it needed to. This sets up for the most important two weeks of the year. Will the move higher continue?

Wise Men and Fools

An important skill in volatile markets is to acknowledge that you don’t know what will happen. We review the conflicting signals to help understand the current environment.

Ukraine War: Portfolio Update

When changes happen in markets, you must adapt. Here are the changes we have made in client portfolio so far this year.

Ukraine War: Market Update

This may be the most important few weeks since the 2008 financial crisis. We review the sanctions against Russia, look at the S&P 500, and discuss the Fed’s likely path forward.

Ukraine War: Informational Resources

During times of uncertainty, information is critical. We have been tracking multiple resources to follow developments in Ukraine, and wanted to share these with you. Unfortunately, the major US News outlets are filled with partisan slant. It is distracting, and more resembles propaganda most…

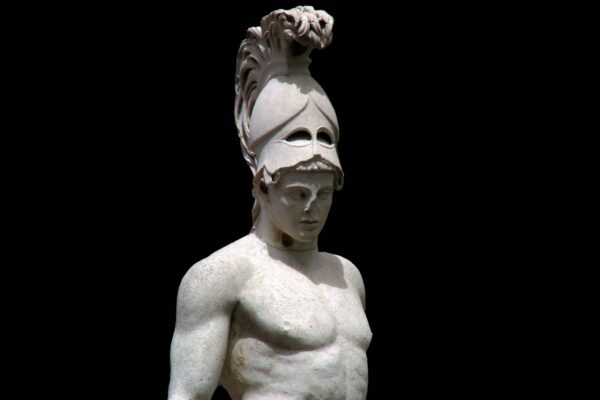

Ares: Forever Quarrelling

Tensions around a possible Russian invasion of Ukraine have dramatically increased in the past week. What impacts might it have on the markets?

Fed Meeting: Popping the Bubble or Normal Volatility?

So much for the New Year’s wish of putting 2020 and 2021 behind us and getting back to normal. Or are we? The markets had one of the calmest years in history last year, mainly on the back of the mega-cap tech firms. But…

Continue Reading… Fed Meeting: Popping the Bubble or Normal Volatility?

5 Themes for 2022 and Why We Hate Year-End Predictions

We hate year-end predictions. Maybe “hate” is the wrong word…it is far to kind. We absolutely despise the cringeworthy year-end predictions that accompany this time of year. (Feel free to imagine other colorful adjectives we may use to describe them.) Why? Because they are…

Continue Reading… 5 Themes for 2022 and Why We Hate Year-End Predictions

Houdini’s Hole

The Paramount Theatre in Austin, Texas is a city treasure. It has an amazing variety of shows, and the list of notable performers is unmatched. It was built in 1915, and began mostly as a vaudeville house. Just a few of the notable performers…

The Wolf and the Crane

Aesop was a Greek storyteller who lived from 620-564 BCE. His stories were verbally passed down through time, and often included tales of animals and inanimate objects that could speak and solve problems. Many of Aesop’s Fables are commonplace even to this day. We…

We’re All Cats on a Hot Stove

Waiting for a correction in the stock market? It may have already happened.

The Fed is Stuck

Despite economic data showing massive improvement from the COVID recession and inflation running hot across all parts of the economy, the Fed continues to pump trillions of dollars into the financial system. Why? They know that if they stop, things will come crashing down.…

The Coming Inflation Waves

We shouldn’t expect inflation to immediately get out of control. Instead, it should come at us in waves.

The Icarus Market

The myth of Icarus warned of the dangers of over-confidence. If we compared the markets to the flight of Icarus, how close are we to the sun? Close enough to melt our wings? “Well, I think we tried very hard not to be overconfident,…

Ain’t it Funny how Falling Feels like Flying

The GameStop saga represents an investment fervor that has gripped the media and markets over the past few weeks. What really happened, and what are the takeaways from yet another strange environment we find ourselves in? “Ain’t it funny how falling feels like flying,…

Continue Reading… Ain’t it Funny how Falling Feels like Flying

Twin Risks: Valuations and the Fed

Valuations and the Fed are two potential risks the market may face in 2021.

New Highs are Bullish

November was one of the strongest months in market history. Various markets across the globe are pushing to new all-time highs. When conditions are bullish, we should expect bullish outcomes. In this month’s report, we look at an important investing lesson and identify the…

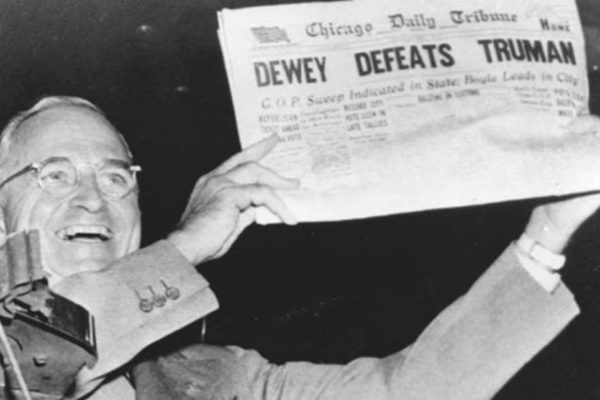

Elections and Overconfidence

With less than a month to the election, we look at the dangers of overconfidence, analyze sector performance under tremendously different legislative environments, and discuss whether you should reduce risk prior to November 3rd. “It ain’t what you don’t know that gets you into…

Does GDP Matter to Stocks?

Sometimes what should make sense simply doesn’t. This is especially true this year. We just witnessed the worst quarterly economic data in history, yet markets have now officially made up all of their losses from the COVID crash. This begs the question…does GDP matter…

COVID vs. The Fed

Something we at IronBridge have been discussing over the past month has been an expectation that COVID cases would rise following Memorial Day and the opening up of the economy and society. This is now happening. In financial markets, increased risks around COVID are…

Dispersion

A theme has developed over the past month that likely has a great deal of importance to investing over the next few years. It is called “dispersion.” We have seen financial markets disconnect from the real economy, and assets within markets are showing massive…

Making Sense of the CARES Act

The CARES Act provides an estimated $2 trillion in fiscal stimulus to combat the economic impact of COVID-19 and provides the healthcare industry the financial support, equipment and protection it needs to help combat the virus. “The purpose of government is to enable the…

Expectations vs Reality

In our previous report, we discussed how earnings for the next two quarters are likely to be some of the worst numbers in history. Does that mean markets will fall in response? Not necessarily. For it’s not the actual economic numbers that matter…it’s how…

Dare We Look at Earnings?

NOTE TO CLIENTS All of us at IronBridge are working from home over the coming weeks during Austin’s shelter-in-place order. Fortunately, we have had remote work capabilities for years. We will continue to serve your needs in an uninterrupted manner with access to our…

Unprecedented Decline from All-Time-Highs

Last week saw the fastest 10+% decline from a 52 week high in history. From peak-to-trough, the S&P 500 Index fell over 16% in 6 days. Additionally, all S&P 500 sectors declined 10% or more over the same period. This also occurred on a…

Corona-Virus & Volatility

After months of very low volatility, fears over the potential negative effects of the corona-virus on the global supply chain is causing markets to take an overdue pause. Markets underwent a large sell-off today. The Dow Jones fell 1,031 points, and the S&P 500 was…

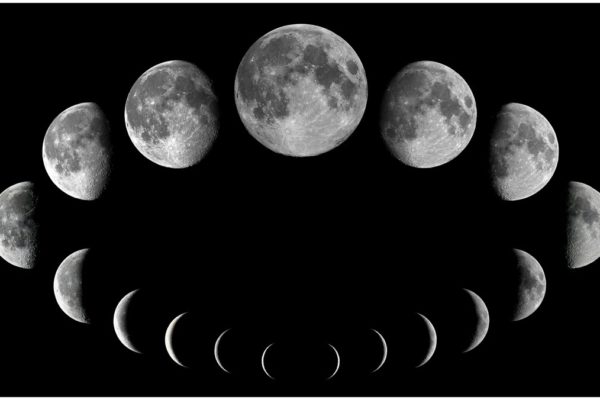

The One Thing

Successful investing over time comes down to one thing: markets work in cycles. In this issue we take a deeper dive into a topic we discuss relatively frequently, but one that is not addressed as much as it should be in the investment world…the…

Turn the Page

What a year 2019 has been. Despite trade wars with no resolution, weakening economic data, geopolitical uncertainty, impeachment, Brexit, and a whole list of other potential negatives, markets across the globe were strong and had very little volatility. In this issue, we review the…

Illusion vs Reality

As we continue the discussion of economic reality versus market reality from our previous Insights issue, we also look at the various illusions that are present in the investing world. This includes the illusion of one of the most over-used and misunderstood concepts in…

Weak Economic Data vs Strong Markets

There is an old saying that the stock market has predicted 10 of the last 7 recessions. (Meaning stocks are more volatile than actual economic data.) But what happens when it’s the economic data that is showing weakness, while the markets continue to show…

The Fed’s Secret Indicator

What if we told you that we knew what the Fed was looking at in their meetings? That we knew their secret? It would take the guesswork out of trying to predict what the Fed was going to do. Well, it may just be…

The Big Three

In investing there are three major disciplines that attempt to analyze the factors that drive investment performance. We take a look at the primary components we are watching in each of these three key areas in the markets to get clues as to what…

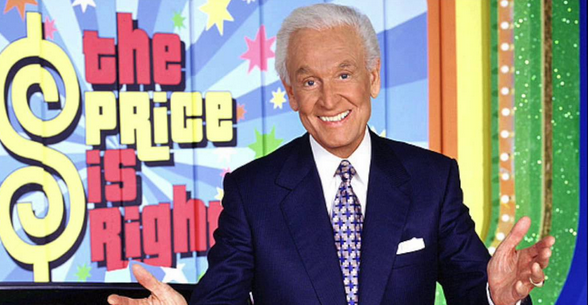

Price is Always Right

August has seen a massive pick up in volatility, and we are watching two key price levels to help us guide portfolios. After all, price is the single most important factor when making investment decisions. “I would much rather wait a few moments more…

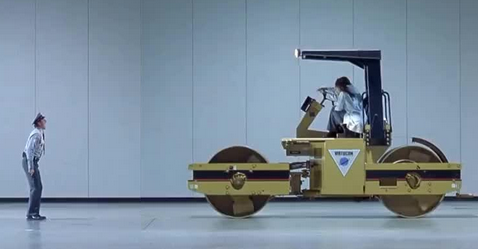

Central Bank Steamroller

Central banks have been the dominant factor in global markets for well over a decade now. It’s important to avoid getting steamrolled by their actions, good or bad. Recognizing what is in your control can help both financially and emotionally when markets become volatile.…

Feeling Sentimental

There are three primary components to market analysis: fundamentals, quantitative/technical analysis, and sentiment. Sentiment analysis, sometimes known as behavioral finance, can play a major part in the market’s movements. Investors are emotional, and understanding the emotional status of the market can give insights into…

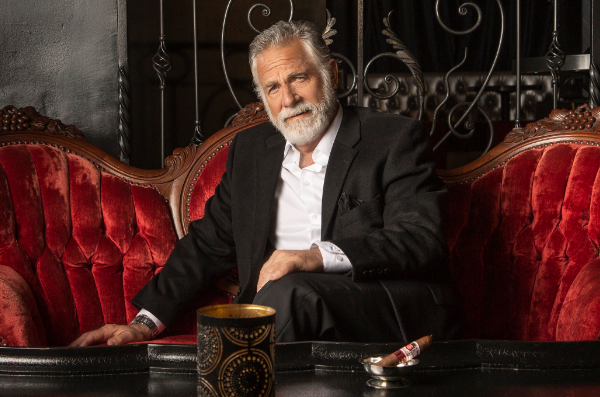

The Most Interesting Rate Cut in the World

Despite relatively good economic data, a record high stock market, and low unemployment, the Federal Reserve will likely cut rates at their next meeting on July 30-31. Why would they do this? And how should we think about the potential impact from the most…

Continue Reading… The Most Interesting Rate Cut in the World

Do Earnings Matter?

Earnings reports are one of the most watched and analyzed metrics in global markets today. Earnings declined in the first quarter of the year, and are currently at risk of printing back-to-back declines for the first time in 3 years. But do earnings matter?…

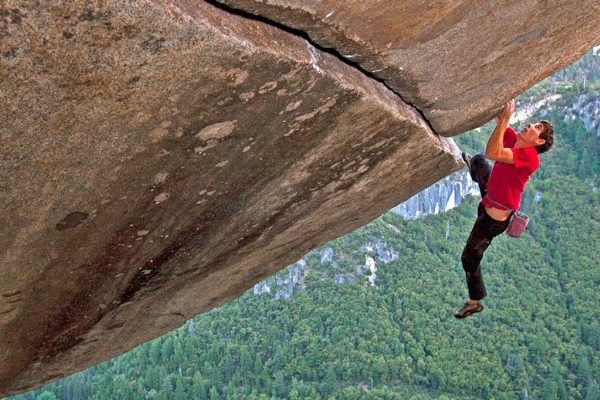

Climbing the Wall of Worry

There is an old saying that markets “climb a wall of worry” and “slide down a slope of hope”. Given the incredibly bizarre nature of today’s investment world, it seems the wall of worry is alive and well. We examine the effects of tariffs,…

Three Principles for a Better Portfolio

Markets are full of surprises. We have seen plenty over past the week, and even more over the past few years. Should we be surprised though? We discuss three principles to help improve portfolio construction to help deal with the inevitable surprises that will…

Yes Dear

The past six months have been good and bad to both bulls and bears. Bullish investors have participated in an amazingly strong 2019, but had to tolerate a loss of over 20% of their capital in Q4. While bearish investors were feeling great around…

We Were Inverted

Over the past week, parts of the yield curve have inverted for the first time since prior to the ’08 financial crisis. Many investors view an inverted yield curve as one of the first indications that the economy is entering into a recession. While…

Cycles & Anniversaries

Knowing where you are within an economic, investment, or social cycle may be the single most important factor in making an investment decision. History is rife with examples of cycle extremes, both on the upside and on the downside, offering excellent corollaries to today’s…

Cyborgs & Recessions

With rapid advancements in technology computing power, we now have access to information that was once unfathomable. But having information and properly using information are two very different things. A successful investment strategy must combine the benefits of both humans and machines. Numerous economic…

Dipping Our Toes

Prudent management of portfolios does not include an “all-in” clause. As the market continues to show resilience following the steep selloff in the fourth quarter last year, we are continuing to reallocate out of cash and into equity and other attractive investments. However, we’re…

Be Right or Make Money?

It’s that time of year when all of Wall Street makes their predictions on where the markets are headed in 2019. But beware, you are being sold something and you may not recognize it. Plus, as bulls and bears continue their tango, we ask…

You’re a Mean One…

Market stress continues, as the S&P 500 has fallen over 13% this month, and is on track to be the worst December in history. When used effectively, cash can be an incredibly effective way to manage risks during times of stress like we’re in…

Nowhere to Run

Over the past 18 months, we have been preparing portfolios for what we view as the inevitable risk that assets begin to move in sync with one another. This is typical late cycle behavior, and one that poses difficulty for traditional portfolio management. This…

Don’t be a Turkey

In his excellent book “Black Swan”, Nassim Taleb wrote: “A turkey is fed for a thousand days by a butcher; every day confirms to the turkey’s staff of analysts that butchers love turkeys ‘with increased statistical confidence.’ The butcher will keep feeding the turkey…

Elections and Volatility

Midterm elections occur next Tuesday, and there is plenty of discussion on how the outcome may affect stock prices. But what does the data tell us from previous elections? Also, volatility, whether due to elections or not, is a common measure of risk. But…

The Butterfly Effect

Chaos Theory is a branch of mathematics that focuses on the behavior of complex, dynamic systems such as the weather, fluid mechanics and financial markets. A popular expression from this theory tells of a butterfly that flaps its wings in China and causes a…

What do you See?

Confirmation bias is one of the most prevalent mistakes investors make in the market. They are bullish or bearish, likely for the wrong reasons. In reality a better approach is to not be bullish nor bearish, which will allow for a more well rounded…

Jumping off the Bridge

“If your friends were jumping off a bridge, would you jump too?” We have all heard that saying at some point in our lives. We might jump, if it was into the refreshing waters of Barton Springs, but would answer a resounding “no” if…

Investment Nirvana

The S&P 500 has broken out and hit a new all time high as we will allocate any remaining cash so that we may participate in the renewed bull trend. Also, we continue our discussion on the theme of over-diversification. It is a real…

Plan, Don’t Predict

Predicting what markets will do is an effort in futility. Too many people proclaim their brilliance by making guesses on where markets will be in 6 months, next year, or many years in the future. Sometimes they get it right, but that doesn’t mean…

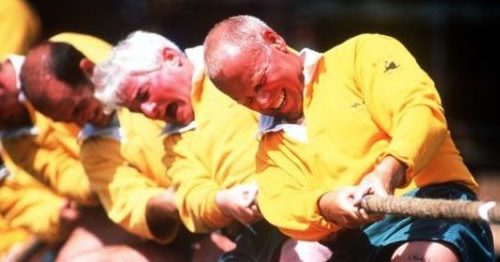

Tug of War

The mixed messages from the markets continue this week as we look at the tug of war between strong economic activity and the continued narrowing in the number of stocks participating in the market’s move higher. GDP growth and corporate earnings reports have shown…

Looking for Bubbles

Stocks are once again attempting to add more positive signs to the choppiness that has characterized the past six months. While the short-term signs are looking more and more positive as the days and weeks go by, longer term signs are showing extreme valuations…

Diversification Fatigue

Markets have calmed from the high volatility that has characterized 2018 thus far. However, the bond market has been showing consistent signs of stress, and traditional diversification is once again causing broadly diversified portfolios to suffer from underperformance. We call this “diversification fatigue”, and…

La Dolce Vita?

Italian bond yields and Italian bank stocks were pummeled this week, with fears returning of another European banking crisis similar to Greece in 2011. There are lessons when markets turn from calm to extremely volatile in short periods of time. Are markets currently undergoing…

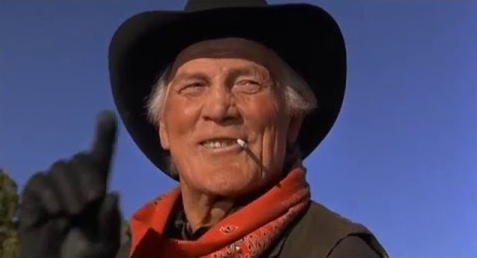

The Good, the Bad & the Ugly

Clint Eastwood turns 88 years old on May 31, and we are celebrating the legendary actor by looking at the Good, the Bad, and the Ugly in today’s market. We also celebrate him by incorporating truly awful puns in weak attempts to appear witty.…

Pay No Attention to the Man Behind the Curtain

It seems that the market’s mood may be changing. After blowout earnings from many companies, stock prices have fallen in price instead of rising as one might expect. When bullish events happen, yet bearish price action follows, the potential exists of a shift in…

Continue Reading… Pay No Attention to the Man Behind the Curtain

Soldiers are AWOL

An analogy we like to make is that markets are like armies composed of generals (leading stocks) and soldiers (the rest of the index). Currently, there are many soldiers that are AWOL. In this issue we review current portfolio positioning, update the scenarios outlined…

Charting the Course: Four Possible Market Outcomes

In this issue we chart the four likely paths the market may take over the coming weeks and months, update our “Two Most Important Days” analysis, and look again at the weakness in High Yield Bonds. [maxbutton id=”5″ url=”https://ironbridge360.com/wp-content/uploads/2018/03/IronBridge-Insights-2018-03-09-Charting-the-Course-Four-Potential-Outcomes.pdf” text=”View PDF” ] Executive Summary…

Continue Reading… Charting the Course: Four Possible Market Outcomes

Corrections are Not Healthy

In this issue we dig deeper into the possible market outcomes following the recent volatility, explain why market corrections are not healthy, and review portfolio changes and positioning. [maxbutton id=”5″ url=”https://ironbridge360.com/wp-content/uploads/2018/02/IronBridge-Insights-2018-02-23.pdf” text=”View PDF” ] Executive Summary On Thursday, February 15, 2018 in our interim…

It’s All Phil’s Fault & How to Invest Late in a Cycle

In this issue we discuss 6 Ways to Invest late in a market cycle, explore the past week’s volatility in more detail, and offer two explanations of why the markets fell so far so fast. [maxbutton id=”5″ url=”https://ironbridge360.com/wp-content/uploads/2018/02/IronBridge-Insights-2018-02-09-1.pdf” text=”View PDF” ] In This Issue:…

Continue Reading… It’s All Phil’s Fault & How to Invest Late in a Cycle

What Will be the Effects of the Tax Cut?

What will be the real effects of the new tax legislation? In this issue we discuss what companies may do with the extra funds from the tax cut, look at the announcements made thus far, and take another look at the hot stock market.…

The Slumber Issue: Investors Asleep at the Wheel, and Don’t Wake Up Rip Van Winkle

We’re not sure if it’s the cold weather, the post-holiday blues, or just too much Federal Reserve eggnog, but the markets are as calm now as at any point in history. In this “Slumber Issue”, we wonder if investors are falling asleep at the…

Continue Reading… The Slumber Issue: Investors Asleep at the Wheel, and Don’t Wake Up Rip Van Winkle

2018 Outlook

It’s that time of year again…the talking heads and ivory tower financial geniuses all disguise their wild guesses as well thought out analysis as to where markets will be at the end of next year. Without question, there is value in thinking deeply about…

Bitcoin, the Shoeshine Boy, and our Three Pillars of Investing

We discuss the basics of Bitcoin, examine its exuberance, review our three pillars of investing, and look at whether crypto currencies are affecting other areas of the markets. [maxbutton id=”5″ url=”https://ironbridge360.com/wp-content/uploads/2017/12/IronBridge-Insights-2017-12-01.pdf” text=”View PDF” ] Insights Overview MACRO Insights: What is Bitcoin? The big story…

Continue Reading… Bitcoin, the Shoeshine Boy, and our Three Pillars of Investing

Investor Sentiment and the Flaws in Modern Portfolio Theory

We explore Investor Sentiment, look at optimism in late stage bull markets, and discuss the three major flaws of modern portfolio theory. [maxbutton id=”1″ url=”https://ironbridge360.com/wp-content/uploads/2017/11/IronBridge-Insights-2017-11-10.pdf” text=”Read the PDF” ] Insights Overview Portfolio Insights: The Three Flaws of Modern Portfolio Theory Modern Portfolio Theory is…

Continue Reading… Investor Sentiment and the Flaws in Modern Portfolio Theory

What Does a Market Top Look Like?

We discuss what to look for when a stock market tops, look at the topping processes in 1987, 2000 and 2007, and reveal five ways to avoid the emotional market cycle. [maxbutton id=”1″ url=”https://ironbridge360.com/wp-content/uploads/2017/10/IronBridge-Insights-2017-10-27.pdf” text=”Read a PDF of the Report” ] Insights Overview Portfolio…

Cognitive Biases, Earnings Season, and one Very Over-Valued Market

We explore how cognitive biases like Anchoring and Confirmation bias affect predictions, discuss whether earnings are driving the market, and look at valuation levels that are near historical extremes. [maxbutton id=”1″ url=”https://ironbridge360.com/wp-content/uploads/2017/10/IronBridge-Insights-2017-10-13.pdf” text=”Read the Full Report” ] Insights Overview Macro Insights: It’s Earnings Season: When…

Continue Reading… Cognitive Biases, Earnings Season, and one Very Over-Valued Market

Time-Frame Diversification, Seasonality and a Deep Dive into Stock/Bond Relationship

Introducing a new way to diversify portfolios based on market cycles. Plus, September is historically the worst month for stocks, but not this year. And we take a deep dive into how bonds and interest rates affect stock prices. [maxbutton id=”1″ url=”https://ironbridge360.com/wp-content/uploads/2017/09/IronBridge-Insights-2017-09-29.pdf” text=”View the…

Broken Window Fallacy, Portfolio Construction & Performance after Hurricanes

Despite hurricanes, floods, fires and threats of nuclear war, markets continue their relentless push higher. In this issue we analyze the economic impact after previous hurricanes, discuss why financial stocks are leading the markets, and feature a discussion on how we construct portfolios. [maxbutton…

Continue Reading… Broken Window Fallacy, Portfolio Construction & Performance after Hurricanes

Generals and Soldiers, Dodging Market Hurricanes, and Revealing the Real Driver of International Stock Performance

Investors in international stocks in 2017 have been more “lucky” than “good” as the majority of their gains haven’t come from fundamental moves in the market, rather they have primarily come from currency fluctuations. In fact, the majority of these gains came from something…

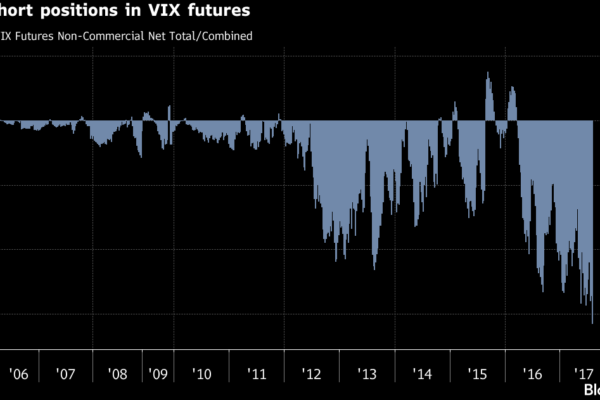

Geopolitics, Discipline and Record Short VIX

In this issue, we focus on how Geopolitics affects the markets, how we maintain discipline in portfolios, and update the charts based on the recent market volatility. On Our Radar NORTH KOREA: The saber rattling continues as tensions escalate. We discuss the affects of geopolitics…

Continue Reading… Geopolitics, Discipline and Record Short VIX

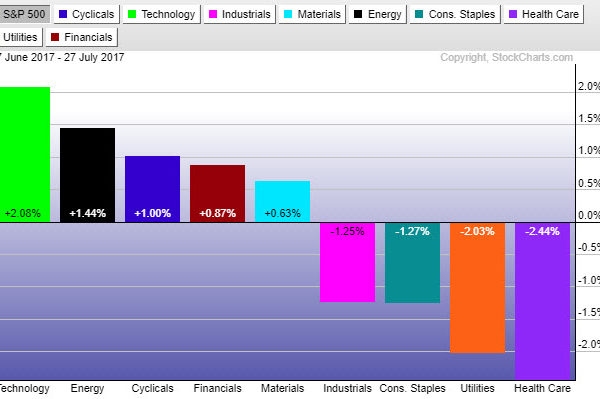

Sector Rotation, Breakout in Small Caps, Sectors as a Warning Signal

Sector rotation can be a powerful tool to stay ahead of key macro trends and outperform relative benchmarks. We have ranked sector performance over the last month. Currently, the sectors that are leading are Financials, Materials and Technology, which are more economically sensitive. At the same time, the…

Continue Reading… Sector Rotation, Breakout in Small Caps, Sectors as a Warning Signal

Yield Curve Rising could signal next Market Peak

The yield curve has been steadily declining since the end of QE3 in 2014. Historically, an inverted yield curve has preceded recessions. However, it is not until the yield curve starts to rise after being inverted that we should be on the lookout for…

Continue Reading… Yield Curve Rising could signal next Market Peak