We shared two other reports this week regarding the Ukraine War:

- Informational Resources: View Report

- Market Update: View Report

Today, we’ll give a brief update on our clients’ portfolio positioning given the uncertainties in Ukraine.

This report will be brief. Please reach out to us directly if you would like to discuss your individual portfolio in more detail.

We will provide another market update next week.

For now, let’s focus on three primary asset classes:

- Cash

- US Equity

- International Equity

We will look at two basic portfolios today: Balanced and Aggressive Growth.

We do have clients with custom portfolios, so please reach out if you would like a detailed snapshot of your account.

Balanced Portfolios

Let’s look at balanced portfolios this year.

Specifically, let’s look at the change in allocation from the start of the year.

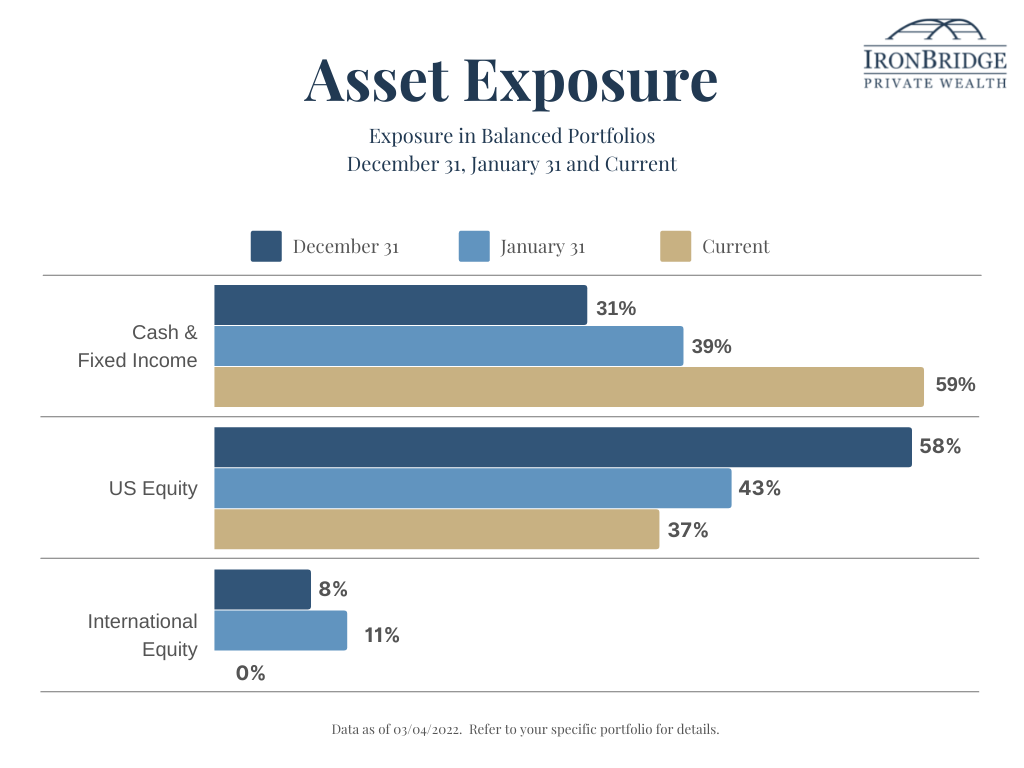

The chart below shows three major asset groups (Cash/Fixed Income, US Equities and International Equities), and how much of a balanced portfolio was invested in each on three different points this year:

- December 31

- January 31

- Current (March 4)

In this chart, the dark blue is the exposure to each asset class on December 31st. The lighter blue shows exposure on January 31st, and the gold is the current allocation to that asset class.

Broadly, this chart shows the following changes from the end of last year to now:

- Cash/Fixed Income: increased from 31% to 59%

- US Equity: decreased from 58% to 37%

- International equity: decreased to 0% once Russia invaded Ukraine.

Since the start of the year, overall stock exposure (US plus International) fell from 66% to 37%.

This is very large increase to safer assets this year, especially given that there has only been roughly a 10% decline in the S&P 500 so far this year.

Now, let’s look at the same chart for more aggressive portfolio.

Aggressive Portfolios

Here is the same chart as above, only for portfolios that are more aggressive.

This tells the same story:

- Cash/Fixed Income: increased from 6% to 40%

- US Equity: decreased from 82% to 55%

- International equity: decreased to 0% once Russia invaded Ukraine.

For both portfolios, clients should expect to see lower volatility now than in the first few weeks of the year.

This also speaks directly to one of our core objectives at IronBridge: to eliminate the big downside scenario.

We cannot avoid volatility, nor do we want to. You must have volatility if you want to try to achieve decent returns over time.

But by reducing exposure to risk on a total portfolio basis, you can greatly reduce the risk of having large, damaging returns.

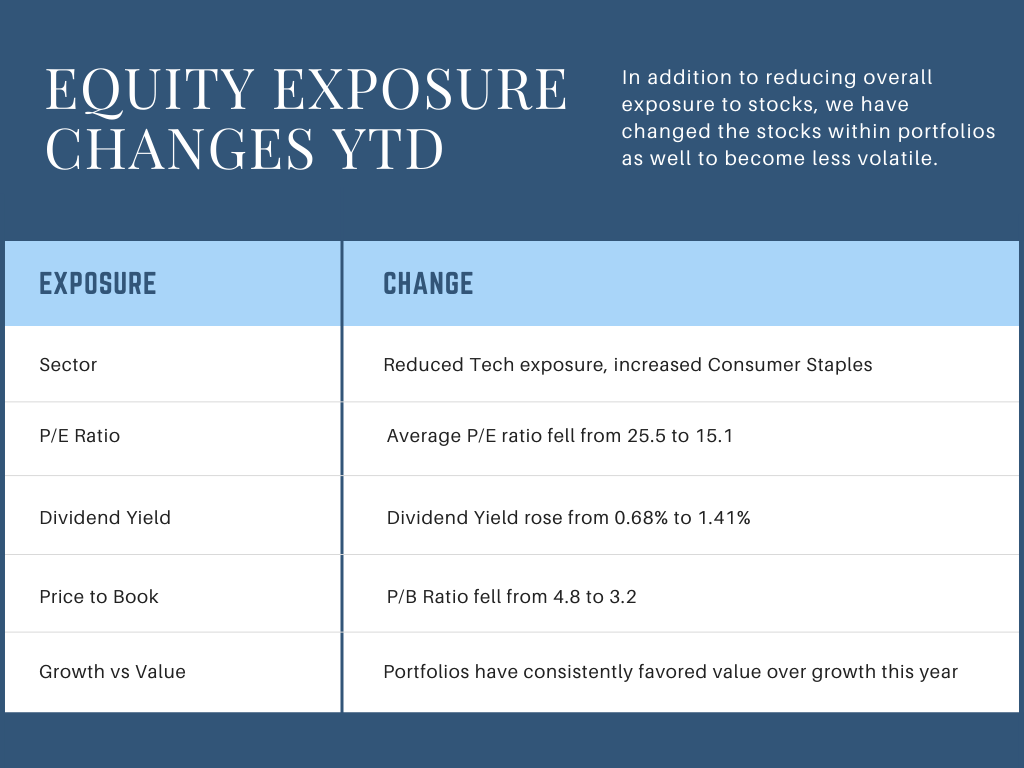

Changes in the Composition of Equity Exposure

If the first tool in your risk management toolbox is your overall exposure to cash, the second tool is the characteristics of the assets that are still invested.

The charts above show that overall stock exposure has decreased this year.

The other thing that has happened is that the stocks in which you were invested changed as well. Specifically, the characteristics of those stocks changed.

Here are various ways the amount invested in stocks has changed this year:

All of the items listed above should contribute to lower volatility in the stocks you are still invested in.

Sector exposure changed from aggressive (technology) to defensive (consumer staples).

Stocks with lower P/E ratios and price-to-book ratios typically have lower volatility.

And we have had a very distinct shift from growth to value in your portfolio as well.

Why we like Cash for Risk Management

As shown above, cash exposure for all clients has increased substantially this year.

We strongly believe that cash is THE BEST way to manage risk.

Why?

Cash is predictable.

There are other ways to manage risk: hedging, asset allocation, derivatives in futures markets, certain options strategies and shorting stocks.

Each of these can be effectively used. But they are complex and have various other risks that come along with them.

To do this effectively, you MUST have a process. You cannot have emotion be a part of the decision.

Why? Because we are humans and we are not very good at combining rational actions with emotional feelings.

Bottom Line

We have continued making portfolios less aggressive and less exposed to risk. As long as the market is showing volatility, we will continue doing that.

Given the continued approach by Putin to dig in his heels and extend the duration of this war, markets are likely to remain volatile.

We are positioned for volatility now, and may become more defensive as time goes by.

As always, please let us know if you have any questions.

Invest wisely!