Today, Silicon Valley Bank became the second largest bank failure in US history. What happened and what does it mean going forward?

Who is Silicon Valley Bank?

- Silicon Valley Bank, or SVB, was the 16th largest bank in the US.

- This was the second largest bank failure in US history.

- Based in Santa Clara, California, they focused on startups, founders and private equity investors.

- Frankly, this was a great bank with fantastic employees, seemingly well capitalized, that went under incredibly quickly. So what happened?

How did SVB get into this Situation?

In order to fully understand the events that transpired this week, we first need to look at the past few years.

The roots of their collapse started in 2021. Their deposit base jumped from $61 billion at the end of 2019 to $189 billion at the end of 2021.

When banks bring in deposits, they have to do something with them.

Like all banks, the goal is to lend the money out, and earn profits by charging higher interest rates on loans than what they pay on deposits. This difference is called “Net Interest Margin”, or NIM. Banks charge you 6% on a loan, and they pay you 0.5% on your cash. Voila, they earn 5.5% in NIM.

Because their deposit base grew so quickly, they couldn’t underwrite enough loans to put that money to work. In order for them to earn a higher yield on their customers’ deposits, they purchased over $80 billion worth of Mortgage Backed Securities, or MBS. These are financial instruments similar to bonds that are made of up of many different mortgages.

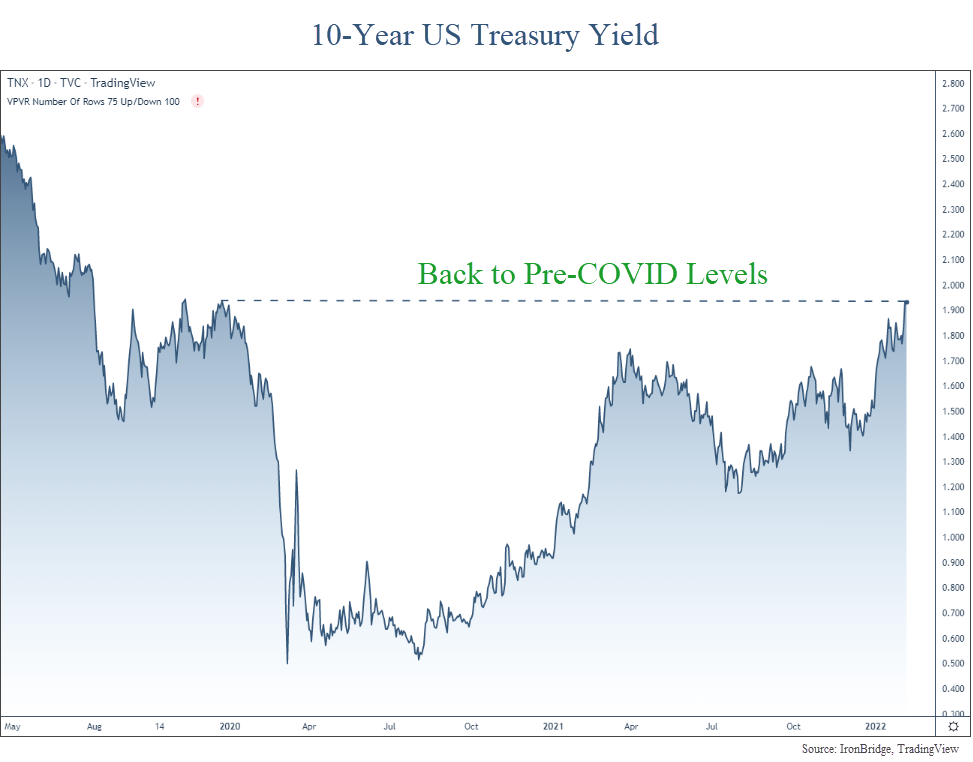

97% of the MBS they purchased had maturities of longer than 10 years. These were purchased before interest rates began to increase last year. (This is important.)

Why did they Go Under?

When banks buy securities with customer deposits, they have to put them in one of two buckets: 1) Available-for-Sale, or 2) Hold-to-Maturity.

Available-for-Sale assets must be “marked-to-market”. This simply means they report the current market value of each investment they hold, just like you see on your investment statements each month.

Hold-to-Maturity securities, on the other hand, don’t have to be reported that way. If you bought your house for a million dollars, and the value fell, you could still report the value as a million dollars.

The $80 billion of MBS were held in the Hold-to-Maturity bucket.

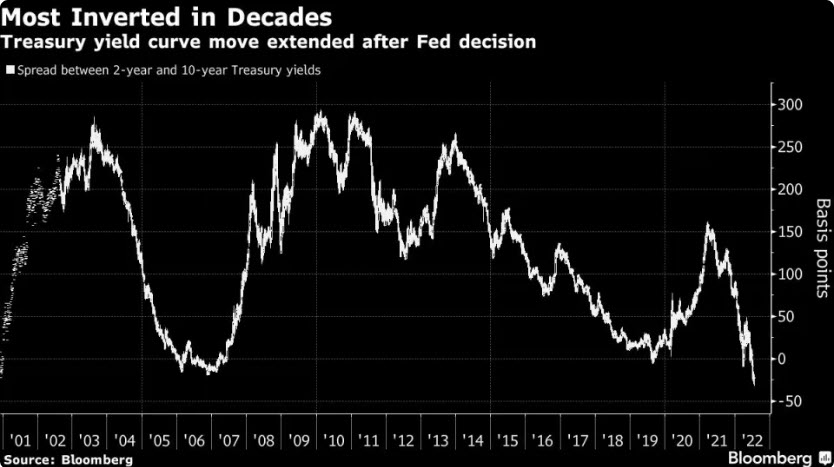

Last year, when interest rates rose so dramatically, the value of these securities fell. A lot. They lost billions of dollars. And because SVB had longer-maturity securities, they fell more that shorter-duration ones would have.

This week, they had to sell at least $21 billion of assets to meet withdrawal requests after depositors essentially made a run on the bank.

Once Hold-to-Maturity assets are sold, any gains or losses must be disclosed and reported. The sells they had to make this week resulted in a nearly $2 billion loss.

Between the MBS losses and continued customer withdrawals, the bank was forced into receivership by the FDIC.

What Does it Mean for You?

First, recognize what a bank deposit really is. Banks do not have a safe where they keep your money.

The following clip from “It’s a Wonderful Life” perfectly exemplifies what really happens when depositors want to withdraw money from a bank. (Fast forward to 3:50 in the clip to view the most relevant part.)

Banks don’t keep your funds. They lend them out, and invest it, and do other things to make themselves a profit.

As George Bailey says, “You’re money is not here.”

Why do you think the new account agreement is so big when you open a new checking or savings account?

You are not an account owner of a bank account. You are a bank creditor.

You lend the bank your money.

They do with it what they want.

Now that people can earn a decent yield on short-term cash funds and US Treasuries, there is competition for those deposits.

This is a good reminder to pay attention to your deposits, especially now that there are good alternatives.

Is there Risk of Contagion?

Quite frankly, yes there is.

That doesn’t mean that other banks will definitely go under, but it is absolutely possible.

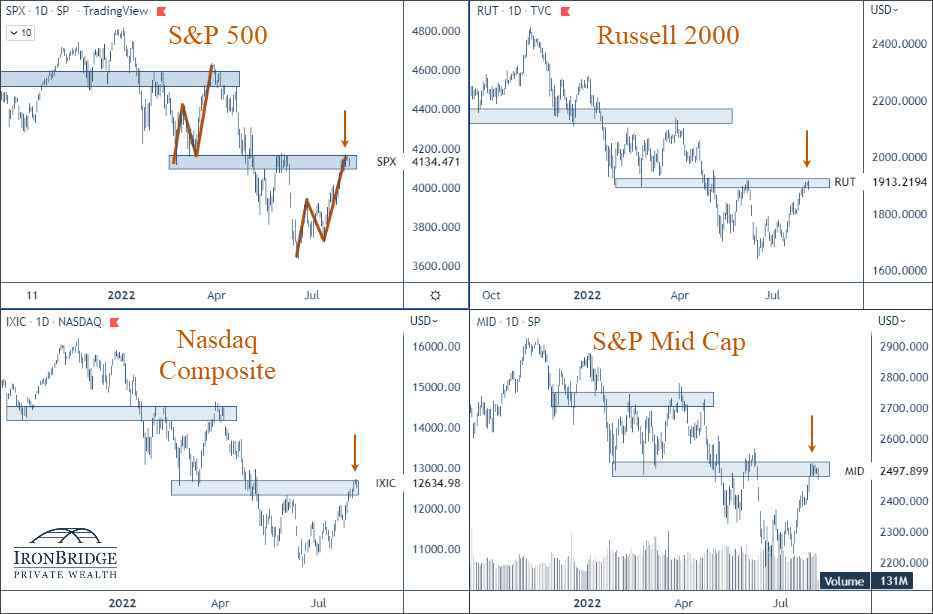

Smaller and regional banks are most at risk right now, but there is also risk to the broader markets.

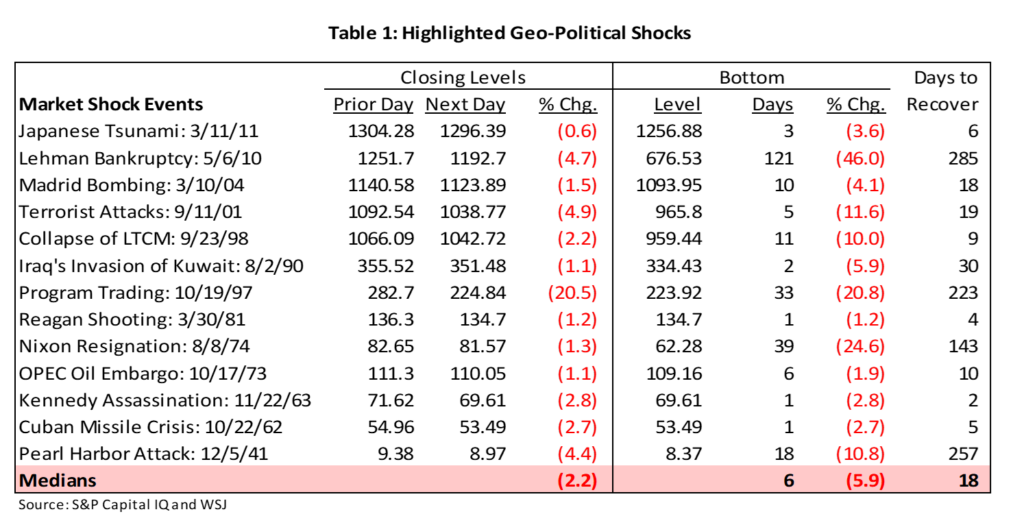

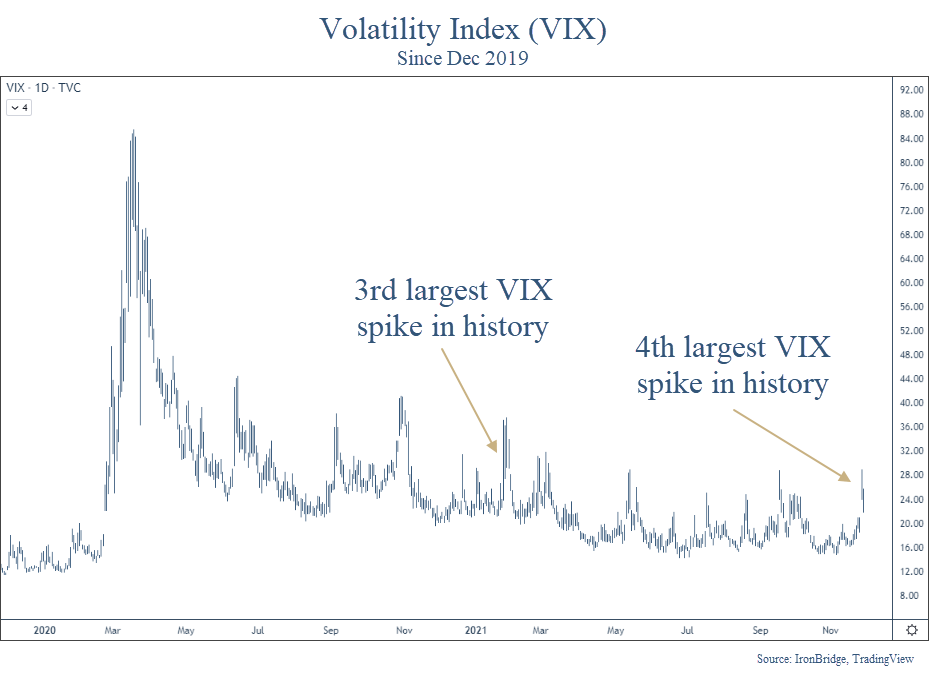

We have long been saying that risks are incredibly elevated right now. This is a good example of what can happen when risks are high. Banks don’t tend to fail in bull markets.

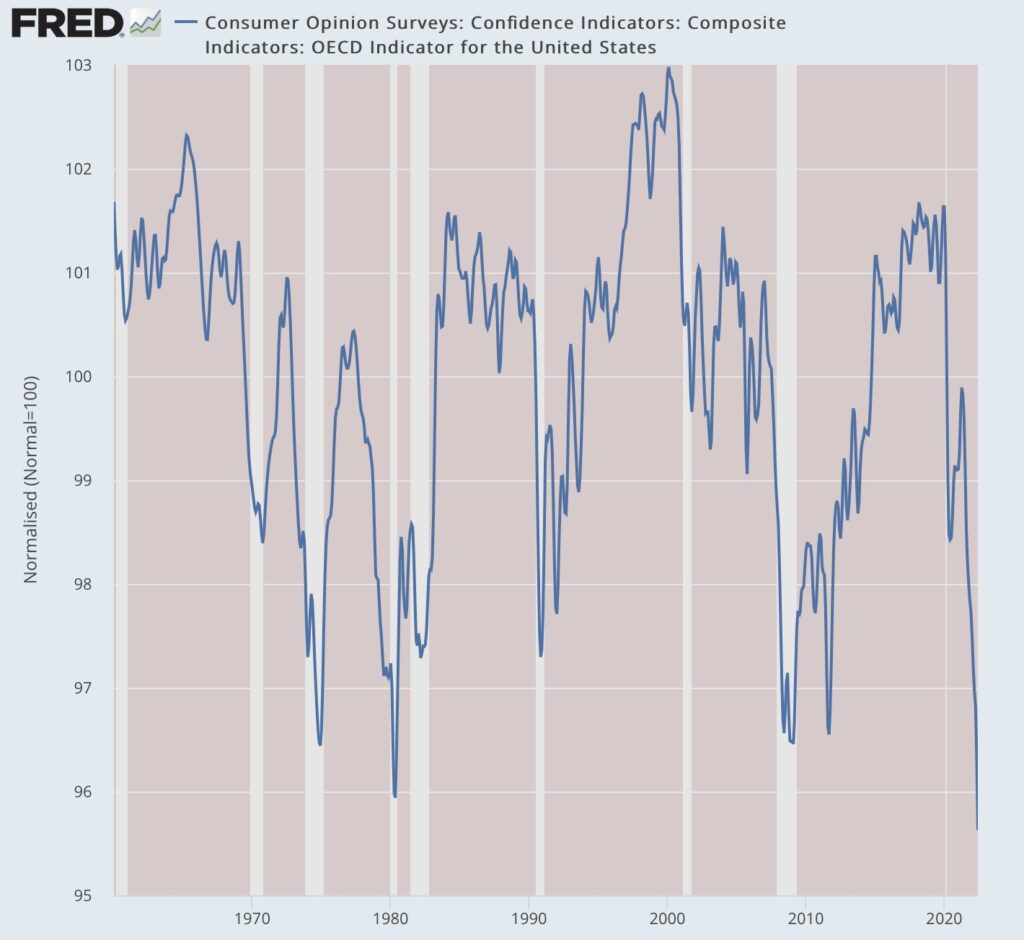

In our opinion, the full effects of higher interest rates have not been felt yet.

This is a major example of the unintended consequences that can happen in a complex system like financial markets.

Portfolio Implications

IronBridge clients continue to be very underweight risk exposure right now.

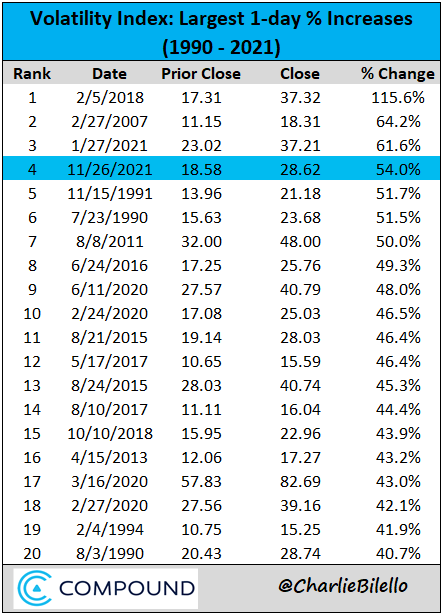

We believe that risks will remain elevated at least through this summer, and you should position your portfolio for continued volatility.

We discussed the two most likely scenarios in our recent video from last week.

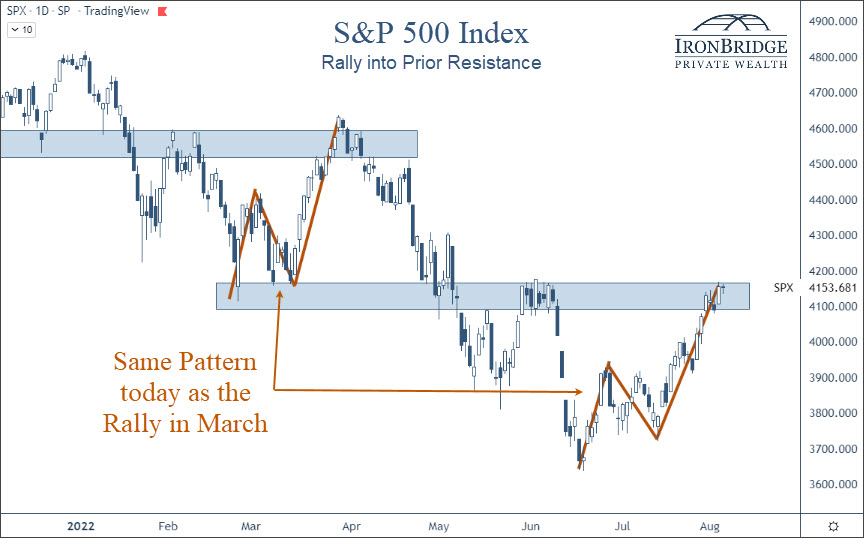

We further reduced risk this week for clients, and view any rallies attempts in markets as good opportunities to de-risk even further.

It is much better to not participate in short-term rallies than to participate in long-term declines.

As always, let us know if you have any questions.

Invest wisely!