Despite economic data showing massive improvement from the COVID recession and inflation running hot across all parts of the economy, the Fed continues to pump trillions of dollars into the financial system. Why? They know that if they stop, things will come crashing down.

It is well that the people of the nation do not understand our banking and monetary system, for if they did, I believe there would be a revolution before tomorrow morning.”

Henry Ford

The Federal Reserve board met earlier this month to discuss their interest rate and bond purchase strategy.

Following the meeting, markets fell nearly 2% on terrible news that surely signaled the Fed was going to finally pop the massive bubbles across the markets and economy.

What news was that?

Instead of raising interest rates in 2024, they were considering doing it in 2023 instead.

WHAT???

You can’t make this stuff up. Markets sold off hard because the FIRST interest rate hike might occur 2 years from now instead of 3.

Granted, markets (as they often do), reassessed the situation and realized that the Fed just brought a huge case of booze to spike the punch bowl even more, despite the party-goers being ragingly inebriated and in no shape to consume more. Markets promptly recovered those big losses.

But inflation is obviously running hot. The economy is obviously improving. There are millions of job openings. Employment data would be incredibly strong if government stimulus had not made it more profitable for people to not work than getting many lower waged jobs.

Despite things being in much better shape than it was a year ago when the Fed flooded the market with liquidity, they continue to add $80 Billion each WEEK into the financial system.

Why?

The answer is pretty simple…they are stuck.

They will tell you the reason is that inflation is “transitory”. (This is a word you are likely to hear way too much of in the coming months.)

In some ways, inflation is transitory. We recently shared a brief blog post “The First Wave of Inflation is Receding“, where we showed that lumber prices fell over 50% from recent highs.

Let’s share the chart of lumber in case you missed that report. (We published it on social media, so be sure to follow us for the latest reports.)

In just over one year, lumber prices went from under $300 per unit to over $1700.

These are crazy price movements.

As soon as everyone was predicting that inflation was here to stay, lumber prices fell 52% in a matter of weeks.

Human Behavior and History

The price of lumber is exactly what we are talking about when we discuss inflation waves. Our thesis is that inflation will not just immediately come upon us and stay. Instead, it will ebb and flow into the economy in gradually increasing levels.

This thesis is based on both human behavior and history.

The impact from human behavior is pretty easy to think about. Let’s look at the recent increase in home values and lumber as our primary example:

- The pandemic locked people in their homes.

- People became tired of their homes. They wanted a bigger/nicer/different place from which to live and work.

- Demand for homes started to increase.

- Increased demand for homes caused increasing demand for lumber.

- Homebuilders and other opportunists saw the price of lumber increasing and started to purchase lumber for future projects. Aka, “hoarding”.

This is how inflation works. Prices begin to rise, and it makes more sense to buy something now, because it will most likely become more expensive in the future.

Inflation can, in fact, be self-fulfilling. High prices tend to lead to even higher prices. It’s FOMO, the “fear of missing out”.

While at first inflation supports even more inflation, there comes a point where it is also self-correcting.

Prices reach a level where it simply doesn’t make any sense to buy it. Whatever “it” is.

This is what happened with lumber. Prices simply became too expensive and people stopped buying it.

We’re not winning any Nobel prizes in economics for this one.

The pace of home building slowed down, and people stopped hoarding lumber. Things just got too expensive. When demand slows, prices tend to fall. Voila. Lower prices.

This is what the Fed is banking on. They believe that inflation is “transitory” because they believe in the self-correcting mechanism of inflation itself. They believe that human behavior will naturally keep a lid on the inflation rate.

Janet Yellen, the US Treasury Secretary and former Fed Chair, said last week that she expects to see 5% inflation this year, but that it will drop to 2% by sometime later this year or in 2022.

Current Fed Chair Jerome Powell blamed inflation on supply bottlenecks in various ports across the globe. He suggests that once this bottleneck gets resolved, inflation will decrease as a result.

Here’s a great article from Reuters about it:

In the short-term, they are probably right…inflation does tend to self correct.

But higher prices also can be sticky.

Why? The expectations of sellers increase.

Let’s say you are going to sell your home. Over the past few years, homes have sold for $800k-900k pretty regularly in your neighborhood. So you list your home for $900k.

But you just saw ten of your neighbors’ homes sell for $1.2MM. Two even sold for over $1.4MM, but maybe they had done some upgrades. What would you do? Probably increase your sales price (either officially or just mentally) to $1.2MM. That is the new floor.

Homes didn’t stay at the peak sales price. But they stuck at a level higher than the previous prices. Not quite as high as the highest price point, but significantly higher nonetheless.

Outside of a crisis, either personally or economically, you’re probably not going to ask for less than what the average or most common sales price has been. Your expectations have caused a stair-step higher in price. Two steps forward, one-step back.

Thus, we have our first inflation wave.

Simply from human behavior.

These inflation waves happened before. We are no different than previous generations, other than the fact that our access to information is much more easily and quickly accessible than in the past.

We discussed the historical reasons for this theory in “The Coming Inflation Waves“, so we won’t go back over the details. We’ll only say that every inflationary cycle over the past 300 years has started in this way, so it’s a pretty easy bet that it will happen the same way again this time. Humans are, after all, still human.

That does not mean the coming inflation cycle will be easy to predict with regards to timing and magnitude.

The price of lumber should not have risen by THAT much over the past year. But it did. And we have one group to thank…the Fed.

The Fed’s easy money policy for over a decade has put massive amounts of liquidity into the markets and economy. And that makes the inflation cycles much more difficult to predict.

The Wildcard: The Fed

There are smart people on the Federal Reserve Board.

The people at the Fed know that the financial system has become dependent on the easy money policies instituted over the past 13 years.

And they know that if they start to reduce the amount of liquidity they are injecting into the markets that they will lose control of both the narrative of financial stability and the upward support of asset prices.

Let’s look at a couple charts that shows results of the Fed’s actions.

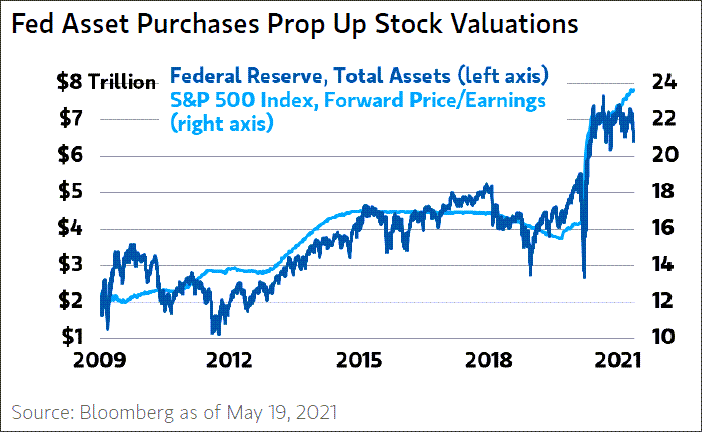

First is a chart of the Fed’s balance sheet versus the S&P 500 Index, courtesy of Lance Roberts of Real Investment Advice.

It doesn’t take a professional statistician to see that there is a correlation between how much money the Fed is printing and stock prices.

This chart is all over the investment industry, and the Fed certainly knows of this correlation as well.

Former Fed Chair Ben Bernanke said back in 2010 that stock prices were a way to deliver confidence into the economy. Read it HERE.

Ever since then, the Fed has viewed their role as the driver of stock prices.

But why would increasing liquidity support stock prices?

Simple…it increases valuations.

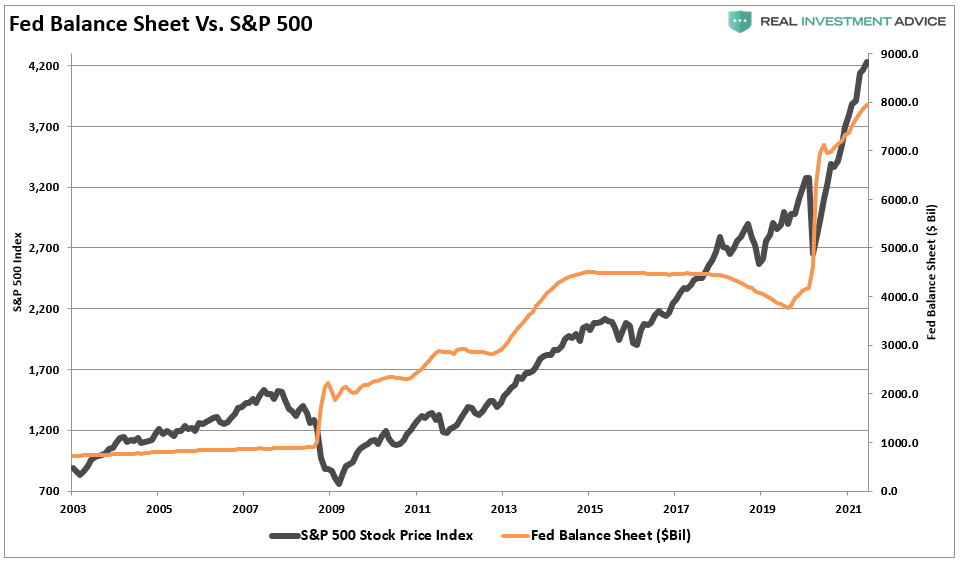

The next chart, courtesy of Bloomberg, shows an even higher correlation between the Fed and stocks. And it shows the REASON why stocks prices have gone up with the Fed balance sheet.

This chart shows the Fed’s balance sheet versus the P/E ratio of the S&P 500. P/E ratios are the most common way to show valuations in the stock market by taking the price per share of a company’s stock and dividing it by the earnings per share.

This chart is much more in sync than the first chart. For example, in the chart above of the Fed vs the S&P 500 Index, there was a period between 2017 and 2019 where the Fed’s balance sheet declined, but stock prices rose.

When we look at the chart of valuations, we can see that between 2017 and 2019 valuations actually declined as prices rose. Valuations reflected the reduction of the Fed balance sheet while prices kept moving higher.

The secret to the Fed’s ability to impact stock prices, it seems, is by increasing valuations.

The primary way valuations are affected is by investor sentiment.

So what this really tells us is that the Fed is driving investor behavior by flooding the market with trillions of dollars of liquidity.

Exactly like Mr. Bernanke said.

And here lies the problem.

The Fed needs to pump the markets with so much liquidity that the economy becomes so strong that stocks will remain stable even if they stop asset purchases. God forbid they actually go so far as reducing their balance sheet.

More accurately, the Fed needs to pump so much liquidity into the market that they generate so much CONFIDENCE in the economy that the Fed can taper without crashing the system.

So far it is working.

Markets have become dependent on the Fed to keep prices afloat. They expect it.

If the Fed tells the market that they will raise rates in two years, it is similar to telling a drug addict that they are going to rehab in a couple months.

What would that addict do? They would binge on everything they could get their hands on and roll into Betty Ford in a stupor.

That’s what we’re witnessing in financial markets. Risk taking is everywhere. Assets of all types have been sought after. Prices across the board have gone up. We’re in an environment where even fake digital assets with dog memes are being coveted.

This speculative attitude towards risk could contribute to a massive rally over the coming months or years. Similar to the tech mania in the late 1990’s. Unbridled speculation would lead to one final blow-off top that puts a cherry on top of the bull market. Chef’s kiss.

Unfortunately, the same support of massive risk taking today is laying the groundwork of the volatility that will follow.

The Fed knows this as well.

Thus, they are stuck.

Do they rip off the Band-Aid now and stop the party? Or do they continue to support the craziness?

It comes down to one thing: they don’t want the party to stop on their watch.

It is easy to criticize from the outside. But no one wants to be in charge when it comes crashing down.

And that’s what we’re dealing with.

No matter how well-intentioned the people at the Fed may be, they are still human too. And they don’t want to go down in history as presiding over the end of the golden era of speculation investing.

So we’re likely to continue on the current path until someone is forced into action.

And inflation is the likely culprit.

The Fed will likely change the narrative before they start to tighten. They will start to blame something other than their own policies. They will blame bottlenecks or China or Congress or us. Anything but their own policies.

And that’s when we’ll know the cycle is truly changing.

When the consequences of the Fed’s actions are eventually felt, Henry Ford’s quote in the beginning of this report will most likely prove significant. For there is likely to be a backlash against the Fed for the reckless behavior and influence.

Until then, we must be prepared for volatility, but we must be prepared for an out-of-control stock market first. And out-of-control markets can be a lot of fun.

But now is not the time for complacency. And it is not the time to be stubbornly bullish or bearish.

Now is the time to be stoic. Be completely in tune and at peace with reality. When investing, that’s a good state of mind to be in anyways.

We can’t unstick the Fed. But we can try to navigate the consequences of their actions, whether good or bad.

Invest wisely!