The GameStop saga represents an investment fervor that has gripped the media and markets over the past few weeks. What really happened, and what are the takeaways from yet another strange environment we find ourselves in?

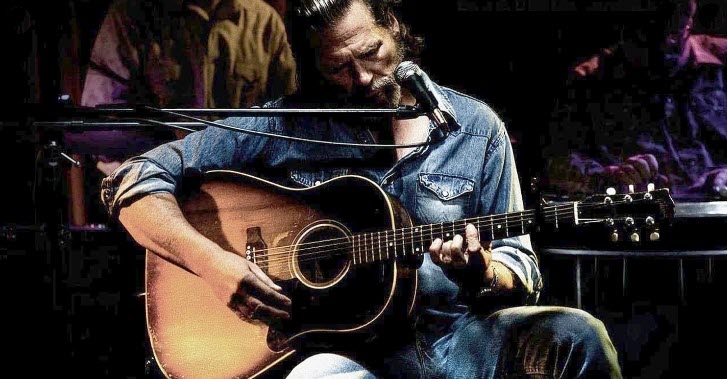

“Ain’t it funny how falling feels like flying, for a little while.”

-Jeff Bridges in the movie “Crazy Heart”

In the movie Crazy Heart, there’s a song called “Ain’t it Funny how Falling Feels Like Flying, for a Little While”. The lead character in the movie is played by Jeff Bridges, who writes songs and scrapes by a meager living most of his adult life.

This song represents the musician’s attitude that just when he thinks he is on his way to commercial success, is only dealt with more and more setbacks in his career and personal life.

As soon as we think the craziness emitting from 2020 has passed, another string of strange circumstances emerges.

This time it involved a set of poorly run companies struggling to survive, an army of individual traders on a social media app, and a small group of heavy-weight institutional investment firms, all wrapped up in an investment frenzy.

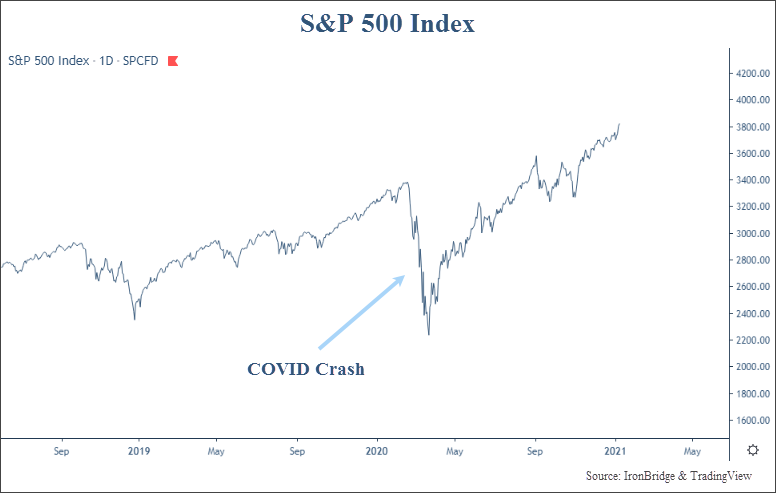

There have only been a few times that we have received questions as consistently and repeatedly about a single topic in the markets as we have had with GameStop. It obviously happened with the COVID crash last year, and happened with Bitcoin a few years ago, but not since the Flash Crash in 2010 or even back to the financial crisis have we seen and heard such intense media focus as we have with this topic over the past couple of weeks.

Virtually every one of our circle of friends was talking about it at some point last week. Golfers in clubhouses were overheard chattering about it. High schoolers at lunch talked about the gamification of the stock market. Every area of the social media and online sphere was discussing some aspect of what was occurring. Was it time to buy? Should you buy put options? What happened? Is this normal? Were all questions we were hearing and fielding last week.

So what is this mess about GameStop really all about?

Background

GameStop is a retail company that sells physical video games in the form of DVDs. It is a very poorly run company that has been 10 years late to everything. They are the Blockbuster video of the gaming world. GameStop tried to rebrand themselves as selling “collectibles” and virtual reality devices. But they are selling things that people no longer need. Games can now be downloaded instantly.

There are many people, including a few large hedge funds, who think it will go bankrupt. They are probably right. So they have shorted the stock, betting that the stock price will go down in value, possibly to zero.

Shorting a stock is like borrowing someone’s car and selling it. Then before the owner of the car asks for it back, you try to buy the same exact car at a cheaper price. Voila, you made money. Your profit is the difference between what you sold the car at initially, minus the price of the replacement car plus some minor carrying costs.

This is what happens when you short a stock. You borrow shares, sell it at today’s market price, and hope the price falls before you have to buy it back.

This works great if the replacement car is cheaper than the original one you sold. However, if the price of the car goes up, you now have to buy a higher priced car to replace it. Congratulations, you are now losing money.

With stocks, unlike cars, prices tend to move higher over time. Shorting stocks is very difficult and requires a great amount of luck skill to be good at doing it.

What Happened?

Over the past two weeks, GameStop (ticker: GME) stock has been amazingly volatile.

The media over the past couple of weeks has been calling this a “short squeeze”. Sticking with our car analogy, a short squeeze is like having hundreds of people in a small town borrow the same kind of car, and they all sold it to the same dealer (these people “shorted” the car). Then when the car dealer starts to have people wanting to buy that car back, he starts to raise the price. Demand is now out-pacing supply. That dealer is “squeezing” the buyer to get more money out of him.

To make matters worse, with GameStop, more people had sold cars than there were cars in existence. 140% of the totals shares outstanding were short. So there was literally no inventory of shares (cars) that could be bought back anywhere near the market price from a couple weeks ago.

That’s okay if no one wants to buy that car. Maybe it’s an ugly car that breaks down all the time. It probably is worthless, and who in their right mind would want to buy it? But in GameStop’s case, a bunch of people decided they were all going to start buying ugly cars that broke down all the time. The people who borrowed and sold these cars had to scramble to find cars to buy and deliver back to the original owner.

In the stock market, there is not just one buyer of shares. There are millions of different buyers.

But a coordinated effort took place in GameStop and a handful of other stocks that sparked a buying frenzy. A group of young people on a social media platform named Reddit banded together to stage a “short attack”. They recognized that there was an imbalance in the amount of shares that were “short” GME stock. They were trying to “squeeze” the hedge funds that were irresponsibly short.

These hedge funds were the ones who had borrowed and sold the ugly cars. And they were incredibly irresponsible how many they sold.

A key feature of selling a stock short is that when it goes up in price, it becomes a larger position in your portfolio. If you buy a stock for $100,000 and it goes down 50%, then your exposure to that stock falls. It was worth $100,000, but now it is only worth $50,000. Not fun, but technically your risk reduces as it falls.

When shorting a stock, your risk exposure increases. If you short a stock with $100,000, if it goes up 50%, you now have to pay $150,000 to buy it back. It has become a larger risk in your portfolio.

Imagine what happens if a stock goes from $16 to $480?

One key theme over the past few weeks is the idea among these young traders that buying GameStop stock was a form of protest. We have seen protests take many forms over the years. But this is a new one.

The thing is, it worked. They were flying. For a little while.

Let’s take a look at GME stock over the past month.

In the span of a couple weeks, GME stock rose from $16/share on January 12th, to over $480/share on January 28th. This is a staggering 3,000% return.

Some of these young traders were proudly showing off their gains. One of the ringleaders, 34-year-old Keith Gill (pictured below), showed daily snapshots of his trading portfolio. At one point, it showed a balance over $50,000,000. Holy cow, talk about flying.

It wasn’t just Mr. Gill who was showing off. Many people on social media, from the marketing genius behind Barstool Sports, Dave Portnoy, to tech entrepreneur and Dallas Mavericks’ owner Mark Cuban jumped on the bandwagon. Most likely in attempts to enhance their popularity among this “Reddit” crowd.

Many people were advocating to buy GameStop stock. Many others said to “Hold the Line” and not sell the stock. They were bankrupting a hedge fund. Hear me roar!

However, there are a few problems. First, a stock that go up 3,000% in a couple weeks probably won’t stay at that price very long. Anyone who has been in the investing world knows that. In the least surprising development of all, the stock has collapsed back down to the $60s, as seen on the GME chart above.

Another problem is that you aren’t supposed to give investing advice without the proper licensing. A public mention on social media to buy or hold a stock is technically a recommendation. Doing so without a license is illegal. Oops.

What is even wackier is that Mr. Gill himself is actually registered to recommend securities with an insurance firm called MassMutual. Because of this, he is now under investigation by the SEC and may have to testify in front of Congress. Read more about that part of this crazy story at the NYTimes HERE.

Of course, now that the stock has cratered, likely with further to fall, Mr. Gill has not shared a screenshot of his winnings.

These traders now realize they are falling.

But there is much more to this story than just a group of small traders banning together to “stick it to the man” in protest. So let’s instead focus on some of the things that the media is not talking about.

Stop Squeezing my Gamma

First of all, short squeezes happen all the time.

In fact, the alt-news website ZeroHedge has been tracking short squeezes back to at least 2013. And it surely has been happening much longer than that. The next chart below, from ZeroHedge, shows that short squeezes can perform very well. Since October, the most shorted stocks are up over 3x the Russell 3000.

The stocks that were the most shorted are companies that are likely in the most financial peril. When these companies outperform the broader market handily on a regular basis, then it’s probably safe to say that there is something way beyond fundamentals driving these price trends.

Back to the earlier chart of GME. Once the price of GME started to move higher, the short squeeze added fuel to the fire. Those who are short the stock have to “cover” their positions (buy back the car they sold), buy buying back those shares in the open market.

A short squeeze in many ways is a self-fulfilling prophecy. The higher the price goes, the more shorts need to cover. Rising prices cause more short covering, until eventually existing holders decide prices have swung too high and decide to sell, helping stop the squeeze.

But the real gasoline that was thrown on the stock was likely what’s referred to as a “gamma squeeze”. A gamma squeeze is more of a function of how markets work than anything to do specifically with GameStop stock. It has to do with the options market, which is like the stock market on steroids.

An option is an investment vehicle where investors buy or sell a stock at an agreed upon price and date in the future. Instead of selling that car immediately, you come to an agreement that by next week you will sell it as long as it is above a certain price.

Prices of options change in value daily, and typically move in a much larger percentage than the price of the underlying stock.

One way to measure how quickly the price of these options change is called “Gamma”. It is a term used to describe the rate of change of the price of the option compared to the rate of change in the price of its underlying stock. A gamma squeeze is a necessary by-product of having liquidity in an options market with speculators and hedgers.

Generally, a higher gamma results in more hedging that needs to occur by the writer of that option. As volatility increases, so does an option’s gamma. Gamma is what tells the option seller how much of a stock he needs to buy to hedge his position and in GameStop’s case, Gamma was getting higher and higher and hedgers needed to hedge with more and more GameStop stock.

The real takeaway from a GameStop perspective is that all of this had very little to do with its underlying business, except for the fact there were a lot of shorts in the stock.

But that is rather normal on Wall Street, and it is far from a “crisis” as some have been touting. Anyone that has been in the markets long enough knows that these kinds of things happen all of the time, just not to this extreme.

Both short squeezes and gamma squeezes are primarily driven by a stock’s price, not its fundamentals and is a result of its price rising faster than initial risk management expected. Prices rising quickly could be the giveaway that one of these squeezes is occurring.

What is also especially different with GameStop is who was at the epicenter of the trading tsunami.

My Name is Robinhood and I’m Here to Help

Robinhood is an online trading platform directed at younger investors. It is trying to make investing fun by looking and feeling much like a video game.

Most trading is done via an app on your phone. When someone makes a trade through this app, it looks similar to winning on a slot machine. Bells ring, digital confetti falls across your phone’s screen, and the brain gets a rush of cortisol as a reward. All by design.

The Robinhood app has exploded in popularity. Millions of investors, mostly younger, have used it to start investing. That’s a great thing.

Robinhood’s biggest selling point to these younger investors is that there are no fees. Well, if something is free, you are probably the product. That is what is happening at Robinhood.

The primary source of revenue for Robinhood is that they sell order flow to large firms. The biggest buyer is Citadel.

Citadel is a behemoth in the trading world. By purchasing order flow from Robinhood, they are purchasing information. They know what stock is being traded and at what price. They claim that they use this information to get the individual investor the best possible price on the stock order they just placed.

But in actuality, they do what is called “front-running”. Here’s an example.

A Robinhood investor wants to buy 100 shares of Apple stock at $134 per share. They get on their app, enter the order, and revel in the digital confetti. Because Citadel paid for this information, they know that there is an order to buy 100 shares of a stock at $134/share before the trade is actually executed. Citadel then goes out and buys Apple for $133.9999 and sells it to this investor for $134.00. The investor gets the price they wanted, but Citadel just made a fraction of a penny on the trade.

Repeat this millions of times each day and you have Citadel’s business model. And Robinhood is not the only firm from which they purchase this order flow.

In the real world, front-running is illegal. At IronBridge, we are required by the SEC to review brokerage statements to see if any an employee is buying a stock before we buy it for clients. Because it is illegal.

Why can Citadel do that? Good question. The SEC has been trying to figure out exactly what they are doing, and have not been successful. Citadel did, however, sue the SEC to try to keep what they are doing private. Citadel has felt like it has been flying. Will they eventually fall?

One thing is for sure, the Reddit traders sure want them to. In the middle of the mania last week, Robinhood halted trading in GME.

This was not an attempt by the “suits” to screw the little guy. This was a result of Robinhood’s own risk management needs as regulated by the SEC.

But it is understandable that the Robinhood crowd is up in arms. In the traditional story, Robin Hood steals from the rich and gives to the poor. The younger traders feel like the opposite has happened. Once they started to really make a lot of money, they genuinely feel they were cut off from trading. The “rich” stepped in and stole from them.

But Robinhood may not be as big a culprit here as claimed. Yes, they do sell information about its users to big hedge funds and yes, they do sell information that allows those hedge funds to front run their clients’ purchases. But that’s always been the case. After all, “if you don’t pay for the product, you are the product”. Robinhood has been doing that from day one. (Whether it should be legal or not is a different story.)

What really happened is that as the accounts in Robinhood got larger and larger, Robinhood’s capital base couldn’t support it. Risk Management stepped in and a decision was made to both: 1) lessen the potential volatility – how to do that? You lessen the trading in volatile stocks and then ultimately 2) Raise billions of $$$s of outside capital in order to shore up Robinhood’s balance sheet and increase their cash deposits.

Robinhood takes on a slight amount of credit risk due two what is called “T+2 Settlement. This antiquated system says that if you buy a stock, it doesn’t “settle” in your account for two days. If you make a trade and immediately withdraw funds, the brokerage firm has to pony up the money for that trade. Granted, they will go after you and get their money back, but they still have risk between the trade date and settlement date.

This is not so different from normal banks and the entire fractional reserve banking system. Banks must hold a percentage of their clients’ accounts assets in reserve, and so too must a Robinhood and other brokerages. As client accounts grow, so too must the Robinhood Capital base.

Robinhood actually provided a great blog post that helps summarize how the system works. If you want to be mad at someone for inhibiting the rights of traders, be mad at the the risk management department of Robinhood (you live by the sword you die by the sword), or be upset with the traders themselves for choosing a less financially stable firm, like Robin Hood, for doing their trading.

Or go even higher and get upset with the clearinghouses and ultimately the Depository Trust Clearing Corporation. Is Robinhood completely innocent? Probably not. But it doesn’t seem that Robinhood is as evil as the Reddit crowd has portrayed them. They operate in a much more regulated world than the Robinhooders probably realized.

Bloomberg explains the back-office part of it pretty well in this piece, and the Observer supports Robinhood’s decision in this piece.

Now did the hedge funds that were getting hosed make a few calls to some friends? Our guess would be yes. In a perfect world we will learn more about that come mid-February when the parties involved have hearings on Capital Hill.

What are the Takeaways?

This is a complicated issue, but there are some very clear takeaways.

Short Selling is not a bad thing. Maybe there should be some limits to it, but any structural problems in our markets today are not due to short sellers. The hedge funds who lost money got what they deserved by not appropriately managing risk.

T+2 Settlement is outdated and should be changed. There is no way in today’s technology environment it should take two days for cash to exchange hands when a stock is bought or sold.

Don’t get over your skis. Markets are complex, and if you don’t know what you are doing you probably shouldn’t be doing it. You can only stay lucky for so long.

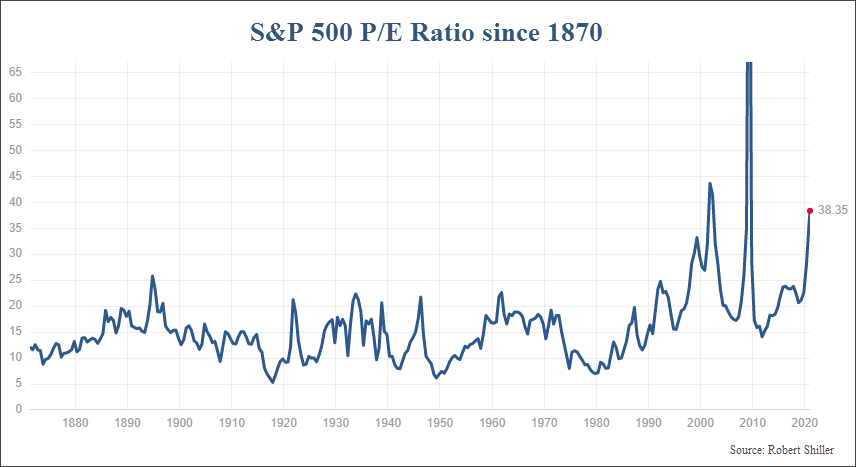

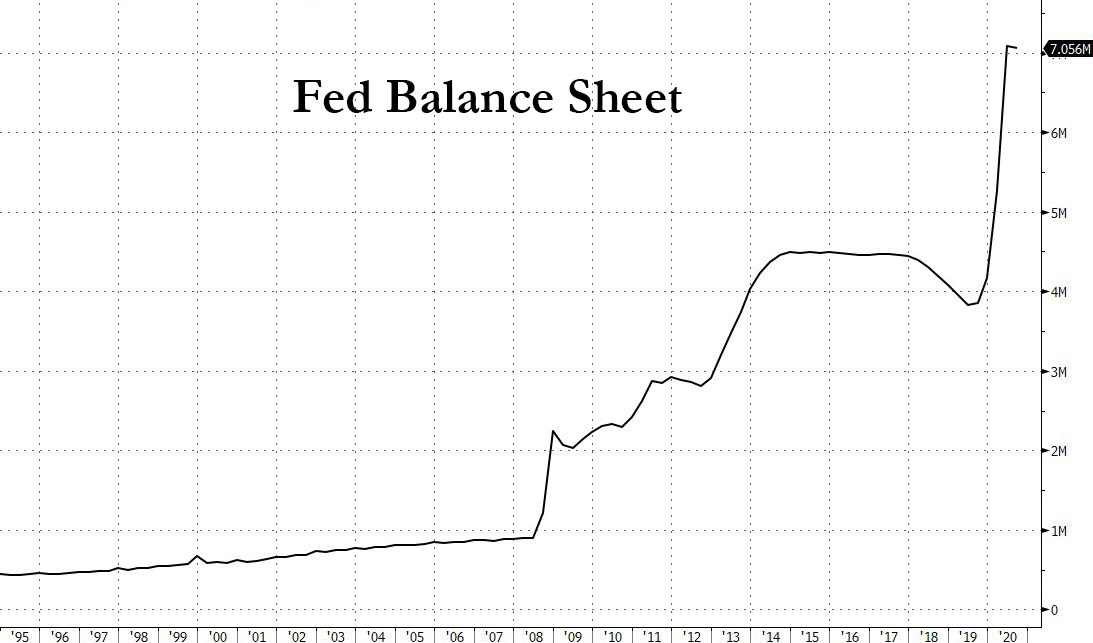

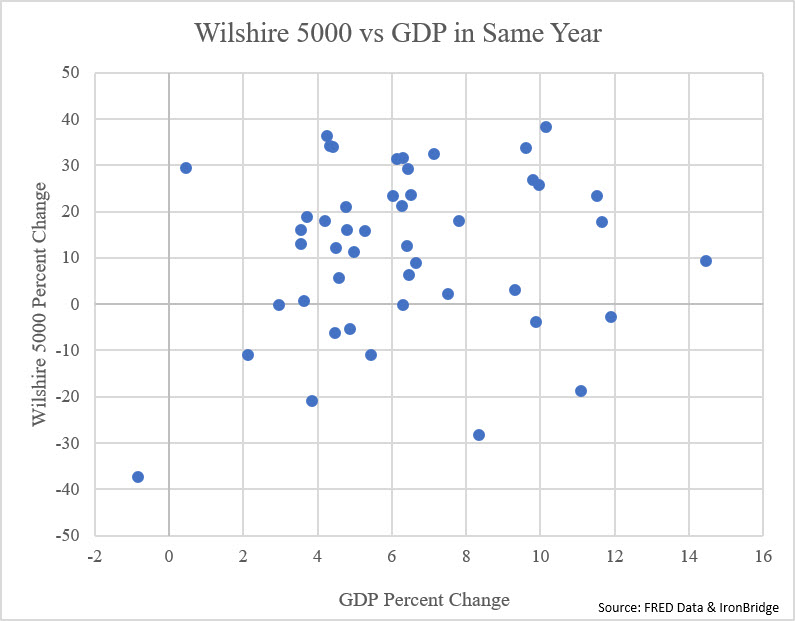

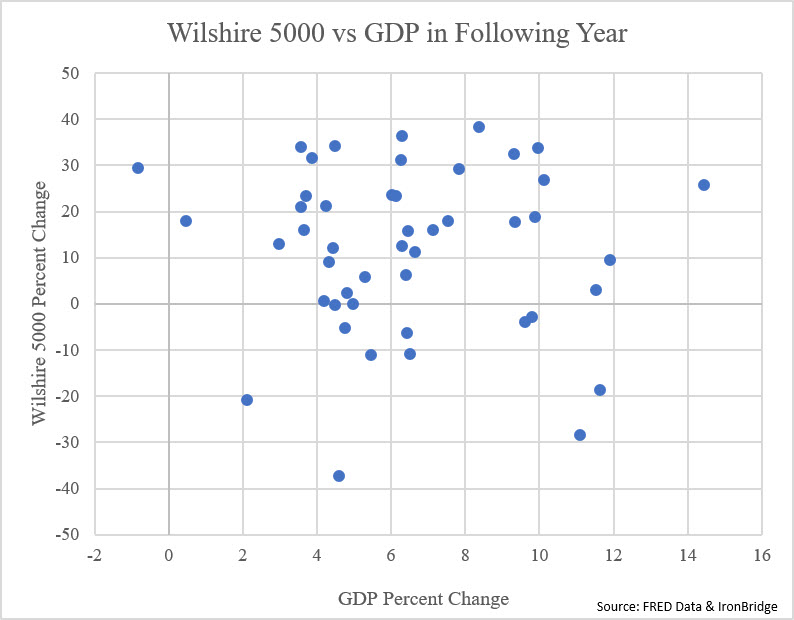

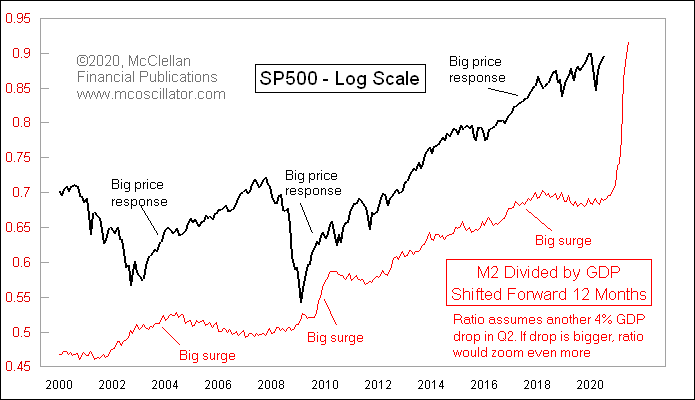

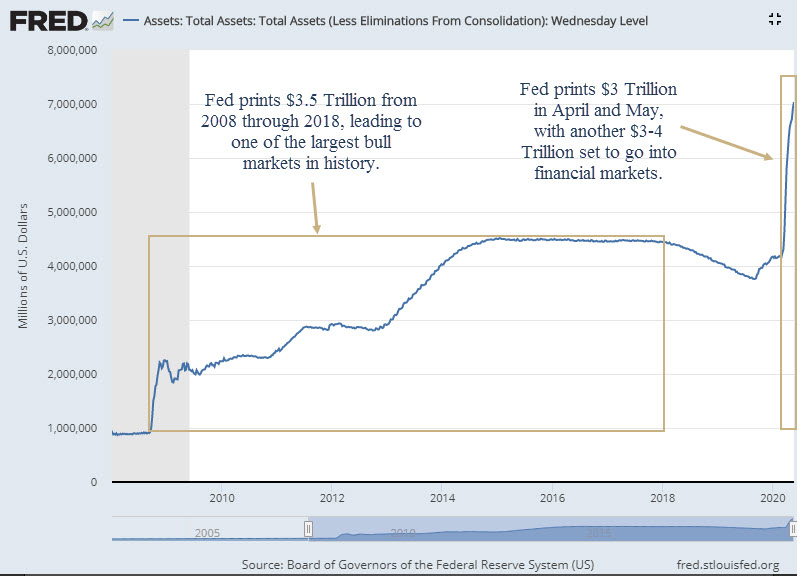

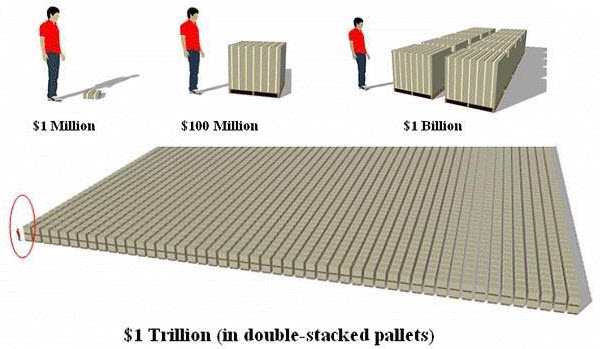

Markets are not efficient. Spoiler alert…they never have been. Things like GameStop happen every day. Just on a much smaller scale. The Fed printing gobs of money only serves to exacerbate it.

There are regulatory loop holes that favor the well connected. We are already starting to hear how there should be increased regulation by the politicians. Guess what? They are the ones who created these rules in the first place. Complex systems like global financial markets don’t have sound-bite solutions to their problems. It’s just not that easy.

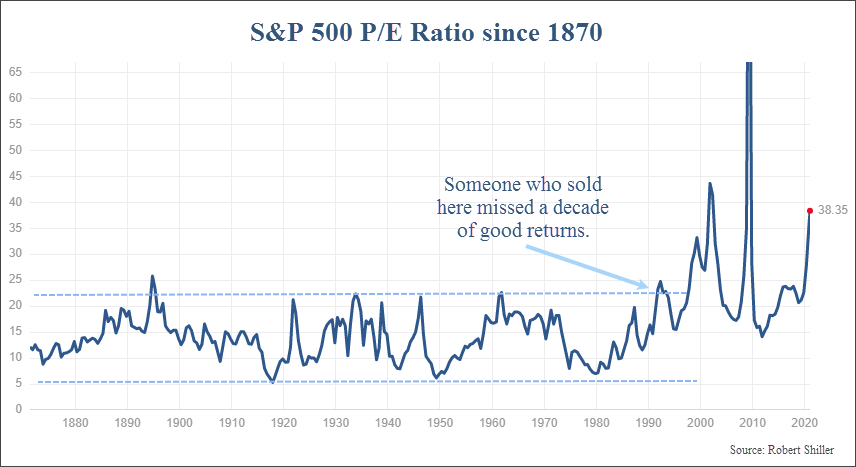

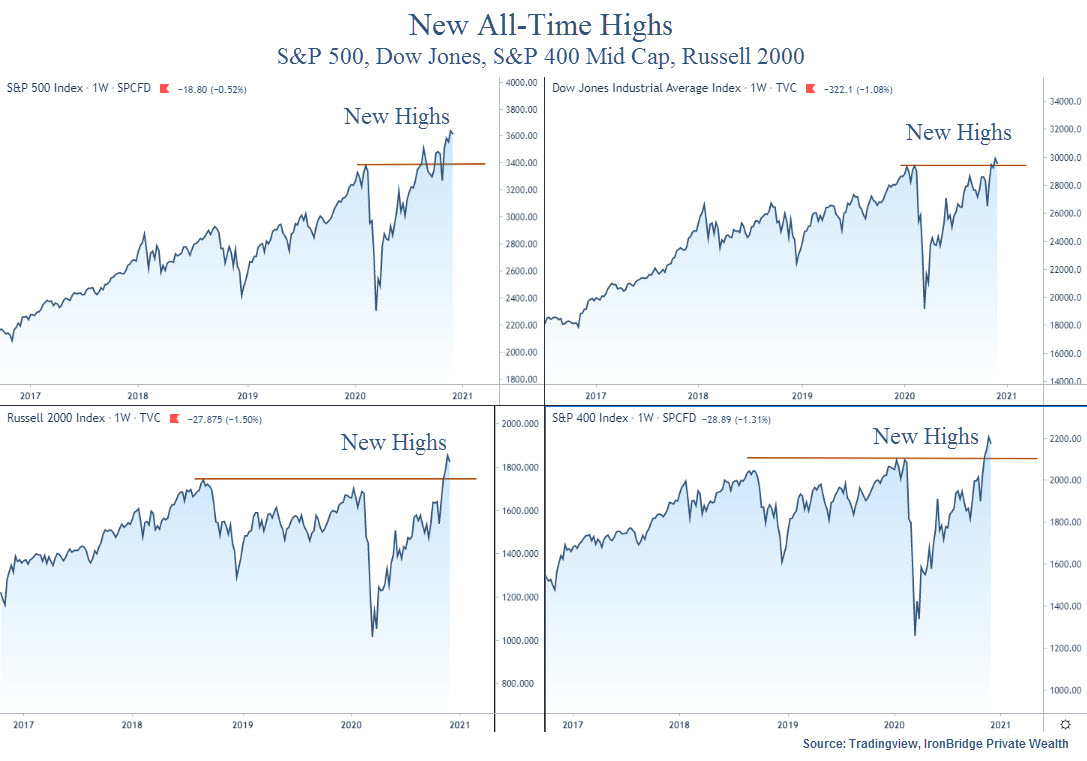

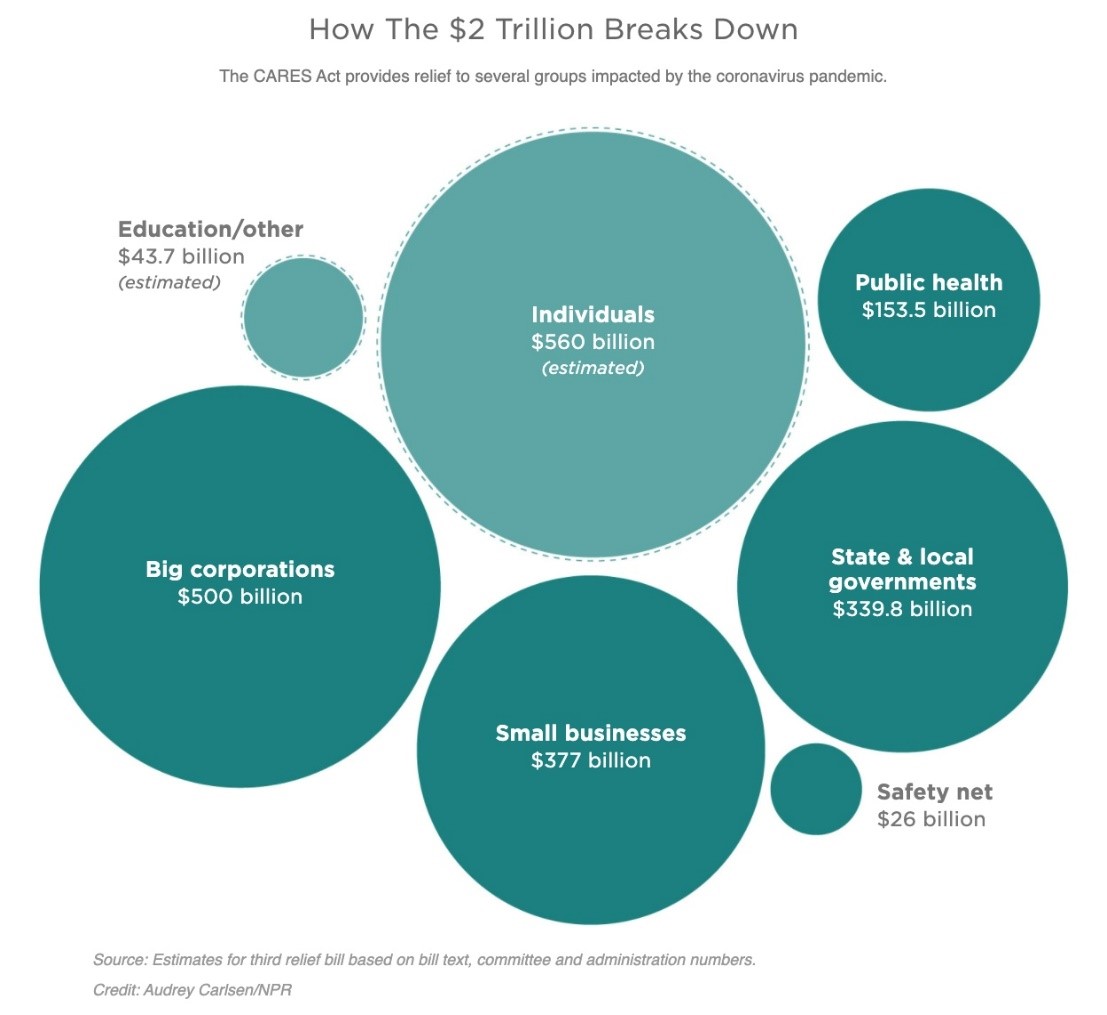

Perhaps the single largest takeaway from this saga is this: The GameStop saga is a reflection of the speculative fervor that is gripping the financial markets.

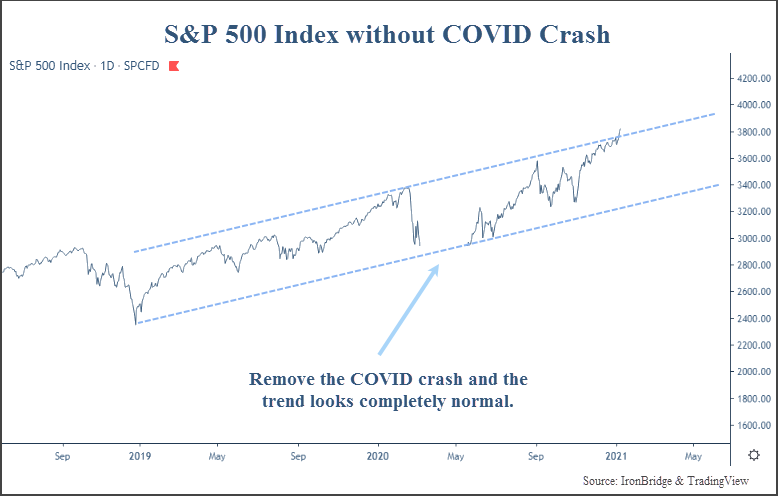

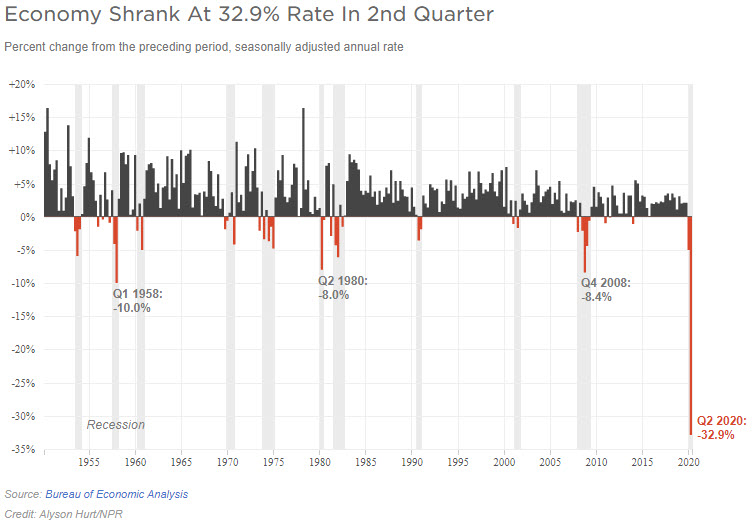

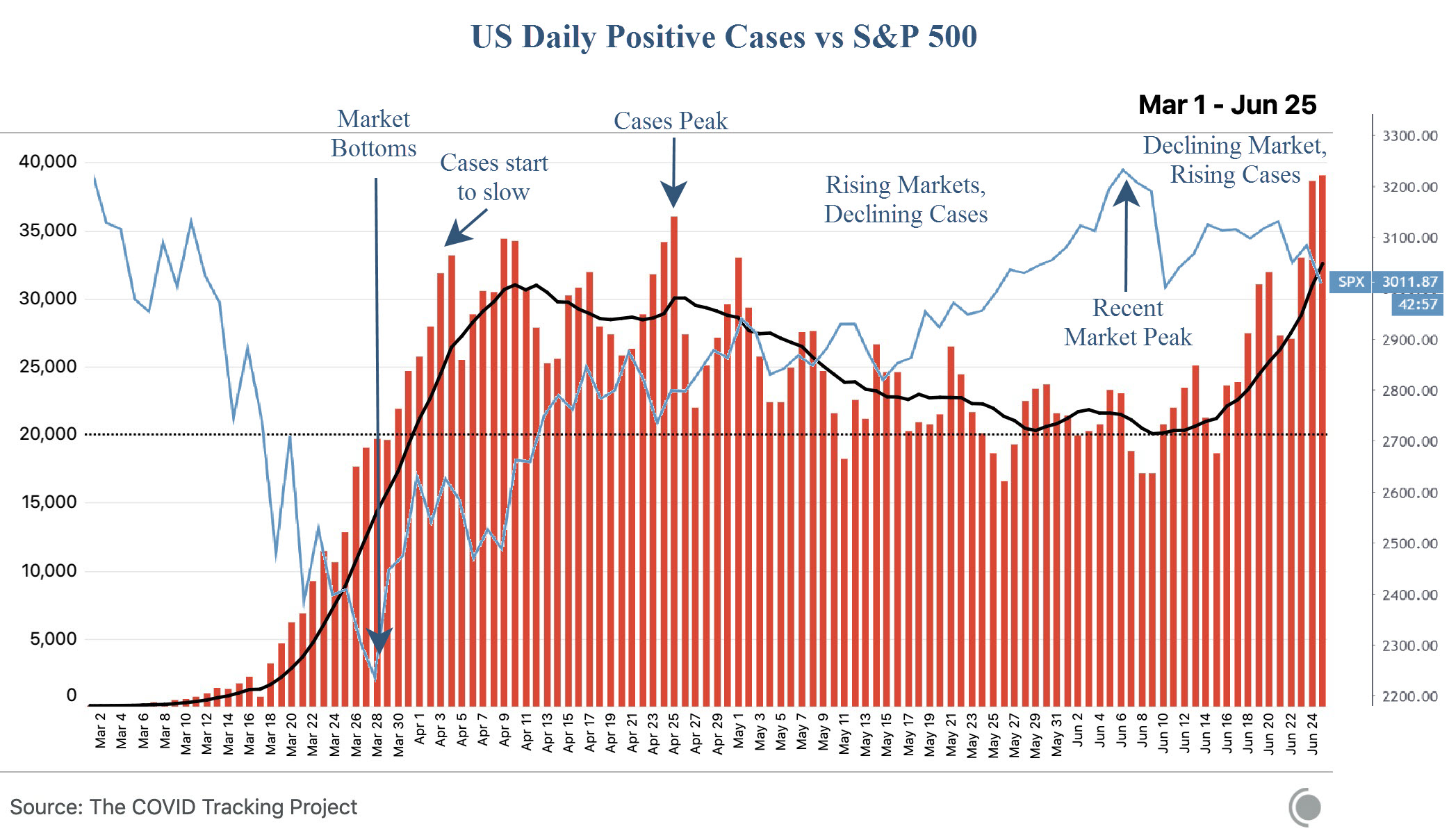

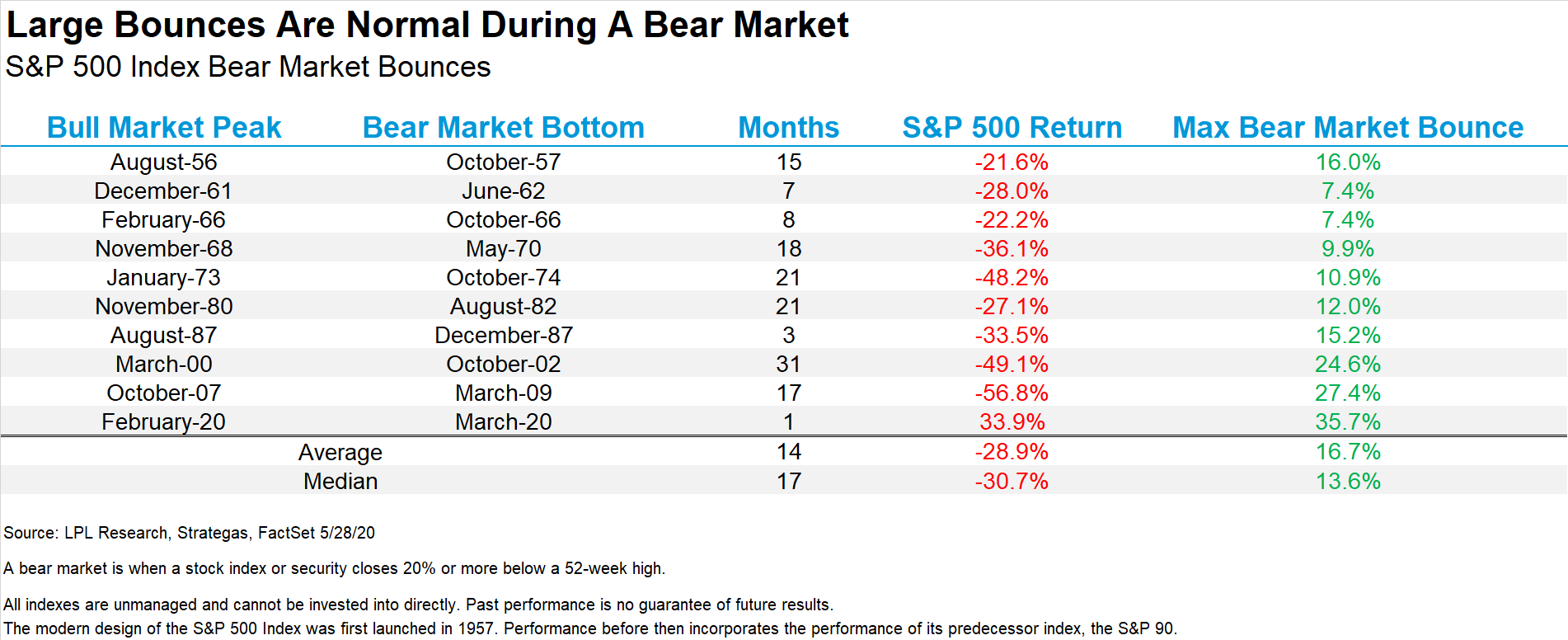

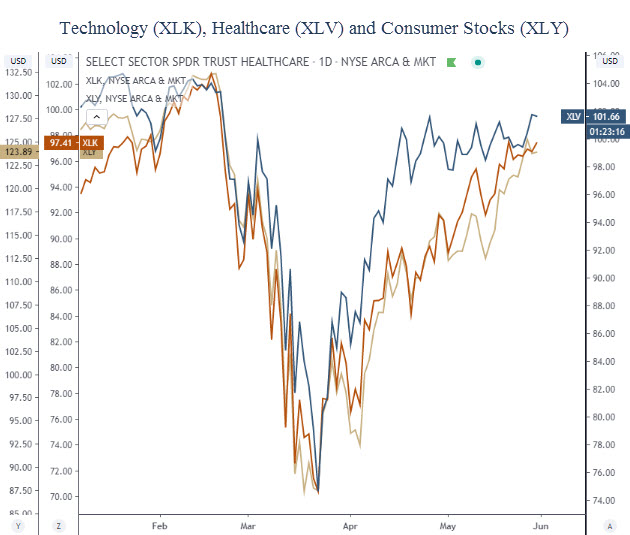

This didn’t happen last March when markets were collapsing. This occurred after a massive rally in the markets. This fervor has permeated the fringes of the financial markets. It is happening in these Reddit stocks like GameStop. It is happening in assets like Bitcoin. Heck, it is even happening in residential real estate.

This is an environment where anything can happen. It is reminiscent of the late 1990’s. This same type of fervor took hold in the fringes of the markets in stocks like Pets.com. Just take a look at the cover of Fortune magazine from October of 1999.

The Nasdaq rose over 100% in the 6 months after this magazine cover was published. And it could have been published today.

The fervor in smaller internet stocks in the late 90’s eventually made its way into the broad markets and formed a massive bubble of epic proportions.

Will that happen today? That kind of flying would be pretty fun for a little while, wouldn’t it? But who knows if it will happen or not. We prefer boring markets. But we don’t get what we prefer. As our kids say, “You get what you get, so don’t throw a fit”.

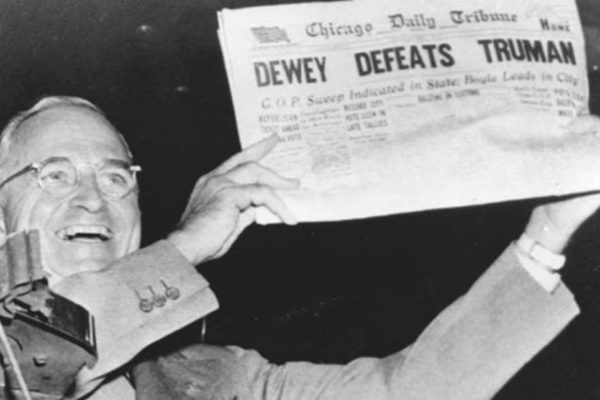

Actually, there is more wisdom in that phrase than we would like to admit. (Being the highbrow, stuffy, intellectual types that we are.) The key is to not get emotional. The Reddit crowd got emotional. The hedge funds got emotional. The social media personalities got emotional. The politicians are getting emotional. They all have let their emotions control their actions, and they ultimately paid (or will pay) the price. You cannot do that when investing.

Making money is fun. But don’t get caught up feeling like you’re flying when you may about to be falling.

Invest wisely!

Disclaimer This presentation is for informational purposes only. All opinions and estimates constitute our judgment as of the date of this communication and are subject to change without notice. > Neither the information provided nor any opinion expressed constitutes a solicitation for the purchase or sale of any security. The investments and investment strategies identified herein may not be suitable for all investors. The appropriateness of a particular investment will depend upon an investor’s individual circumstances and objectives. *The information contained herein has been obtained from sources that are believed to be reliable. However, IronBridge does not independently verify the accuracy of this information and makes no representations as to its accuracy or completeness.