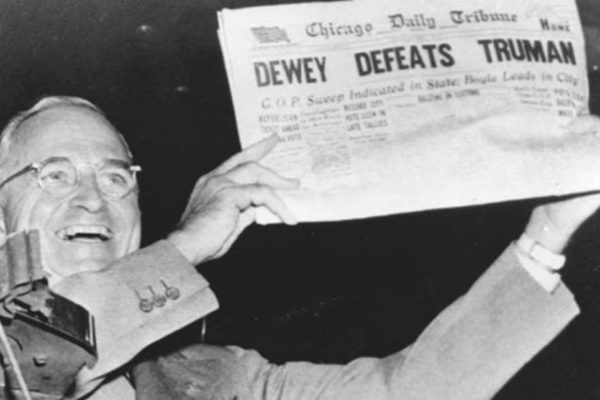

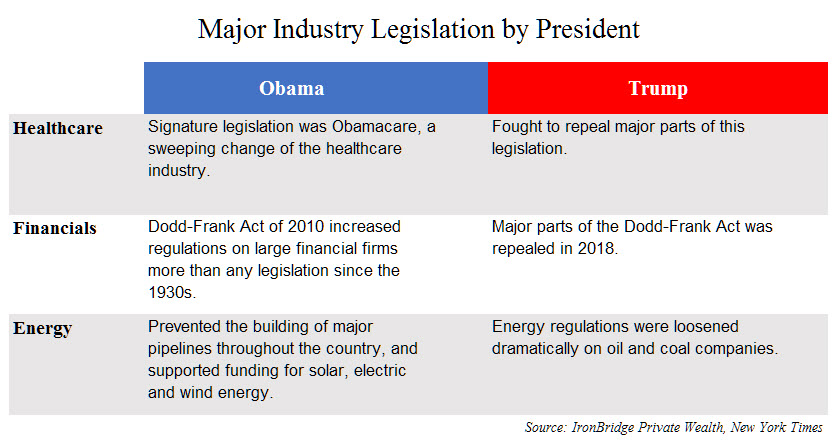

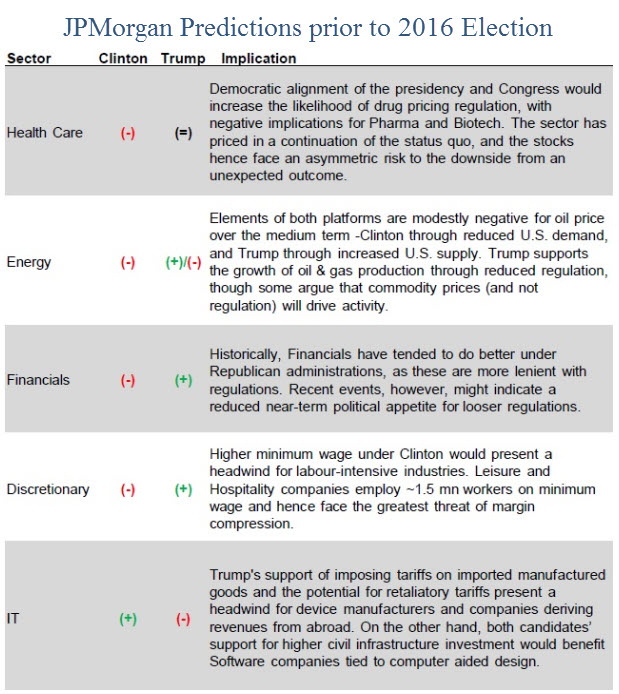

Changing legislation is an unavoidable part of investing. We’re still only a few months into the Biden administration, but there are already multiple major legislative agendas being presented by the president Biden that could affect many investors.

One aspect of his agenda was revealed in late April when President Biden proposed an increase in the tax on capital gains to 39.6% from 20% for those Americans who earn more than $1 million.1

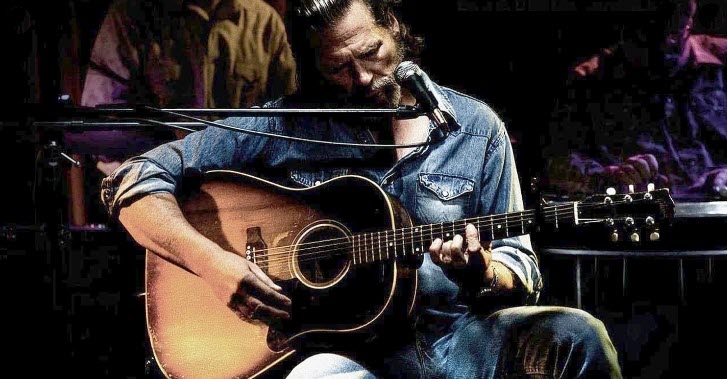

Stocks dropped on the news, with the Standard & Poor’s 500 index down nearly 1% for the day.2

The “sell first, analyze later” reaction was curious since both Main Street and Wall Street largely expected the proposal. Several times on the campaign trail Biden said he wanted America’s wealthiest households to contribute more as a percentage of their income.3

However, the speed at which the legislation was proposed caught many off guard, including us.

A Long Road Ahead

It’s critical to remember that any capital gains tax proposal will likely face a long, uphill battle before becoming law. One prominent investment bank already has said it projects a more modest increase in the rate, which may land at around 28%.4

So at this point, it’s uncertain what type of legislation will be taken up by Congress. Challenge yourself to be patient during this period of debate and uncertainty.

We’re keeping a close eye on the process, and we are starting to analyze what a higher capital gains tax may mean for portfolios.

Some initial thoughts are:

- Tactical portfolios may become more attractive than traditional buy-and-hold strategies. If long-term gains don’t provide any real tax benefit, it could make sense to have a shorter timeframe when thinking about how long to hold an investment.

- A big benefit of holding real estate longer term may go away. There is a proposal to eliminate, or at least drastically change, the 1031 tax deferral option.

- The situation is very fluid. Many times, so-called “trial balloons” are floated in the public to gauge how people may respond to parts of major legislation. This helps politicians avoid putting something into law that is extremely unfavorable to a majority of Americans.

If you are concerned about capital gains—or any other proposals being debated on Capitol Hill—please give us a call. We’d welcome the chance to hear your perspective, and while we’re not CPAs, we can provide some guidance on strategies for your portfolio.

1. Bloomberg.com, April 22, 2021

2. FoxBusiness.com, April 22, 2021

3. CNBC.com, April 22, 2021

4. Markets.BusinessInsider.com, April 23, 2021