Just wanted to provide a quick update as everyone prepares for the holiday week. We’ll send out a more detailed report next week.

Big Picture

- Markets have remained calm after the massive gain two weeks ago following a milder than expected inflation number.

- Earnings for the most part have been better than feared.

- Markets are entering a seasonally strong period. From the Tuesday before Thanksgiving thru January 2nd, markets are up on average 79% of the time, averaging a 2.7% gain. This is what is commonly known as the “Santa Rally”.

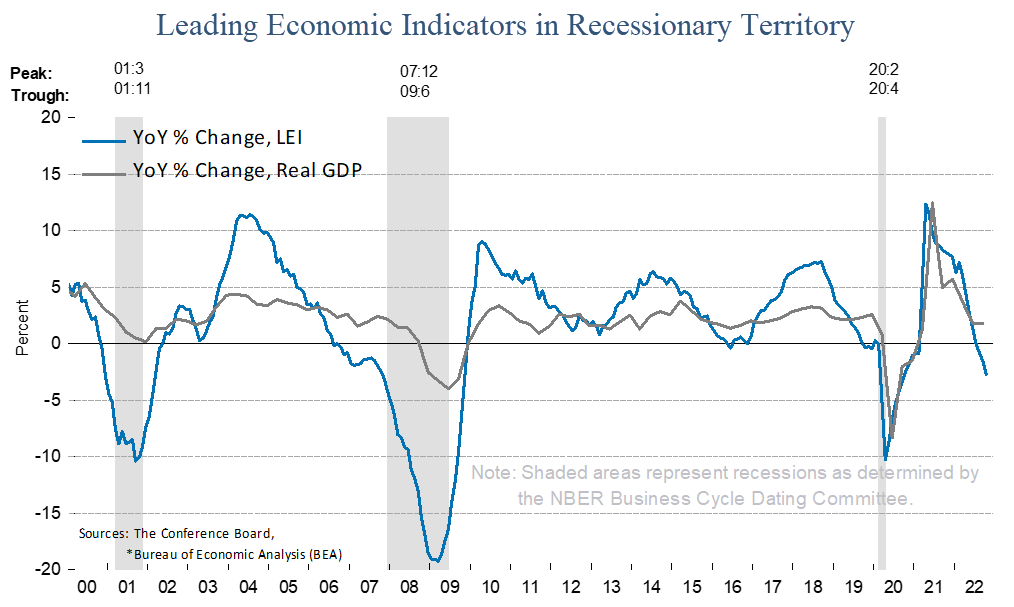

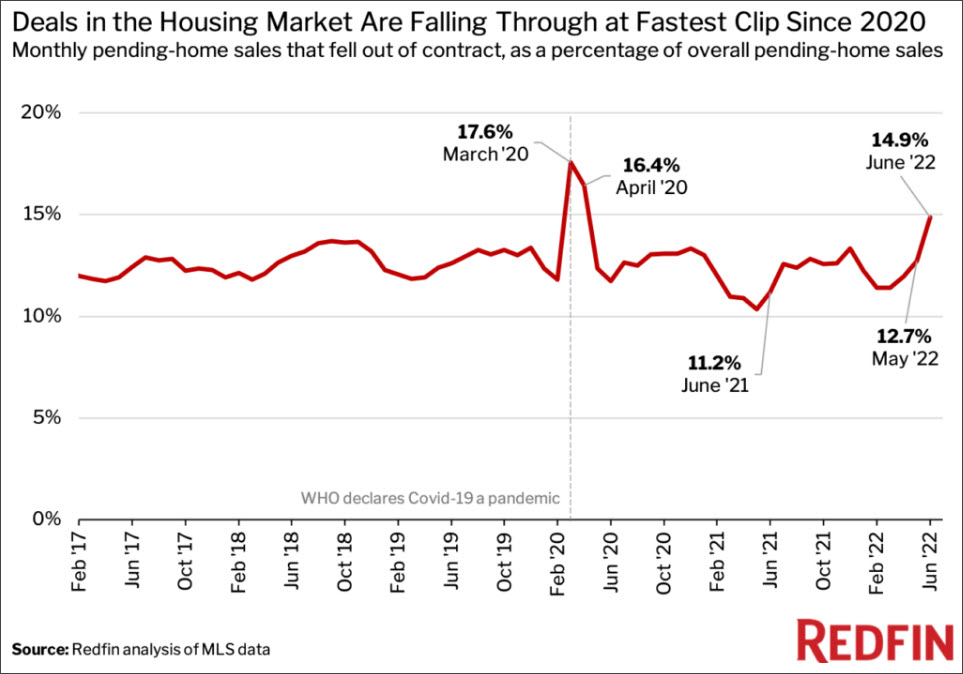

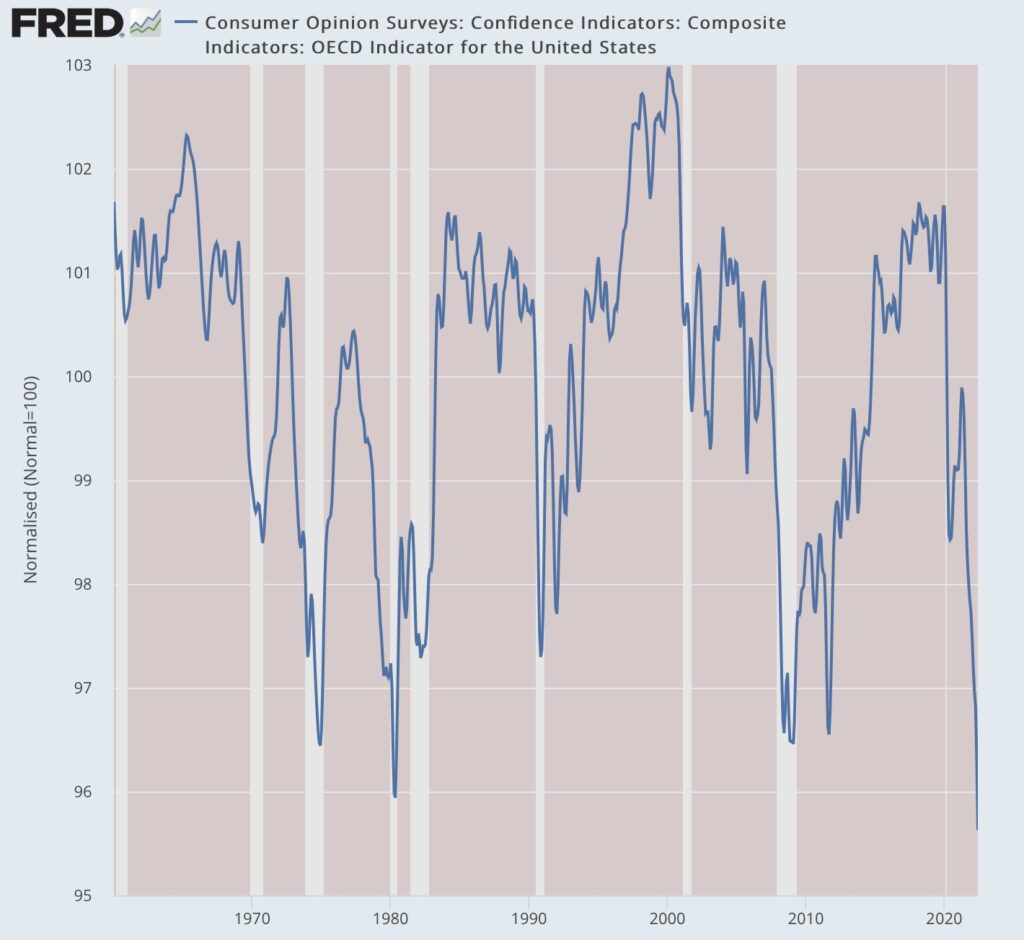

- Despite these positives, many

warning signs still exist: leading economic indicators are weak, overall

financial conditions are deteriorating, and the housing market is under

stress. These conditions have not shown up in economic numbers (yet).

Economy

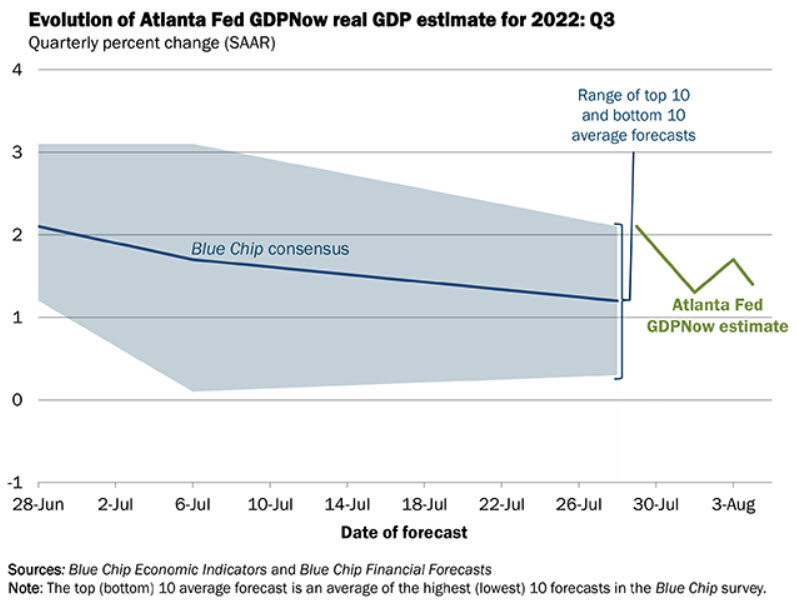

- The good news: Economic activity remains resilient. GDP was up 2.6% in the 3rd quarter. 4th quarter GDP, according to GDPNow, is tracking up 4.2%. View it HERE.

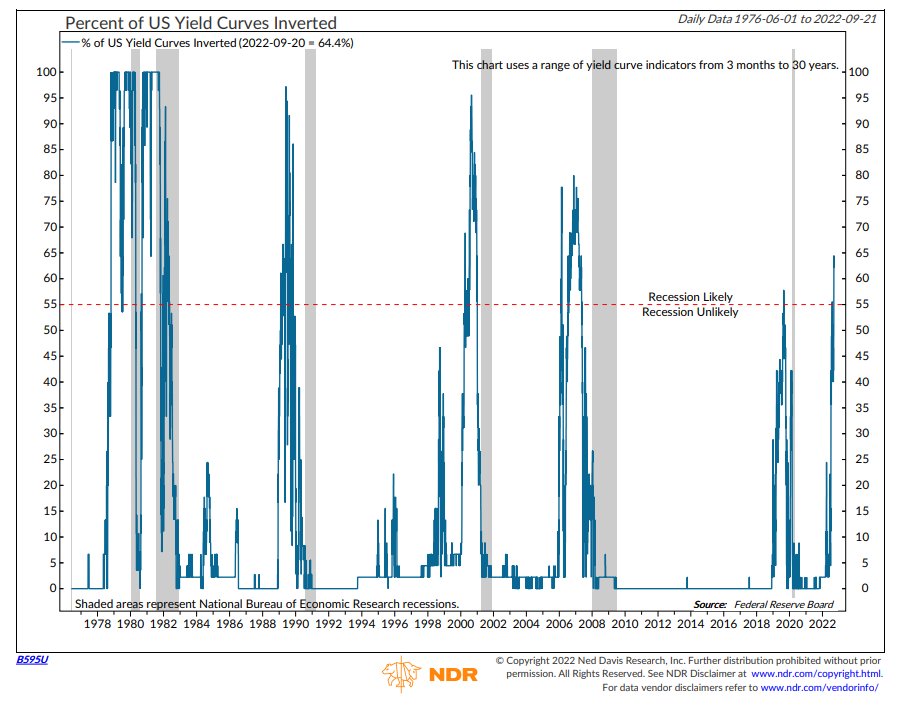

- The bad news: Leading economic activity is at recessionary levels as shown in the first chart below.

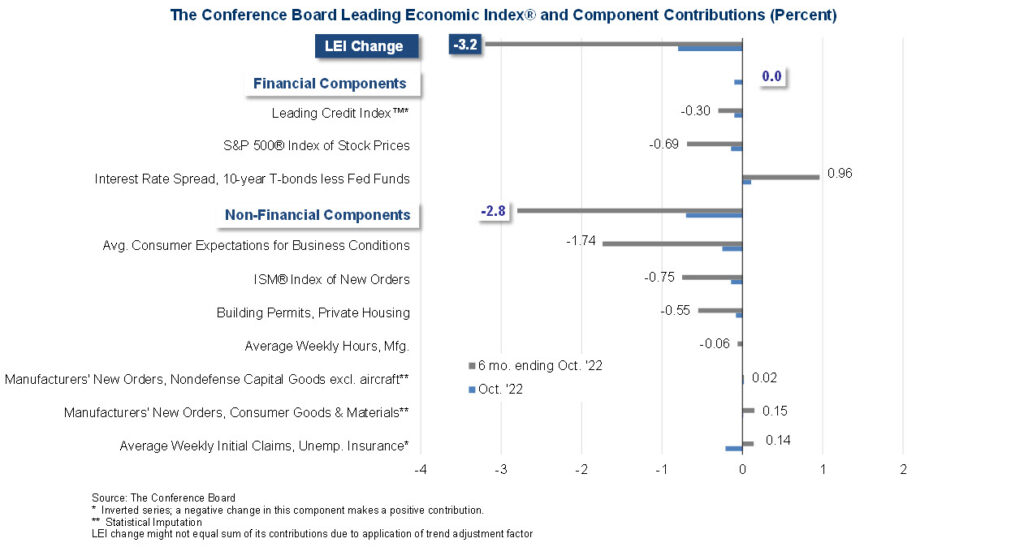

- If you’re curious as to what makes up the Leading Economic Index, the second chart below shows the ten components with contribution from each.

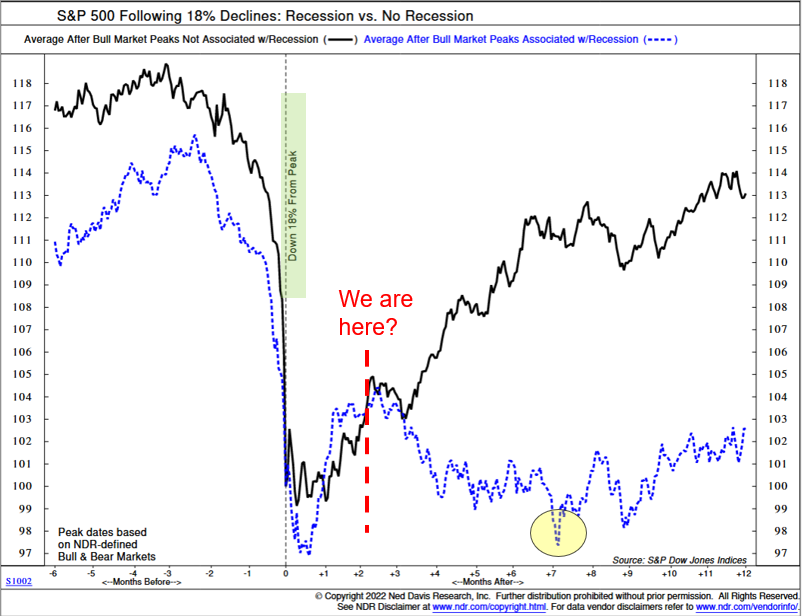

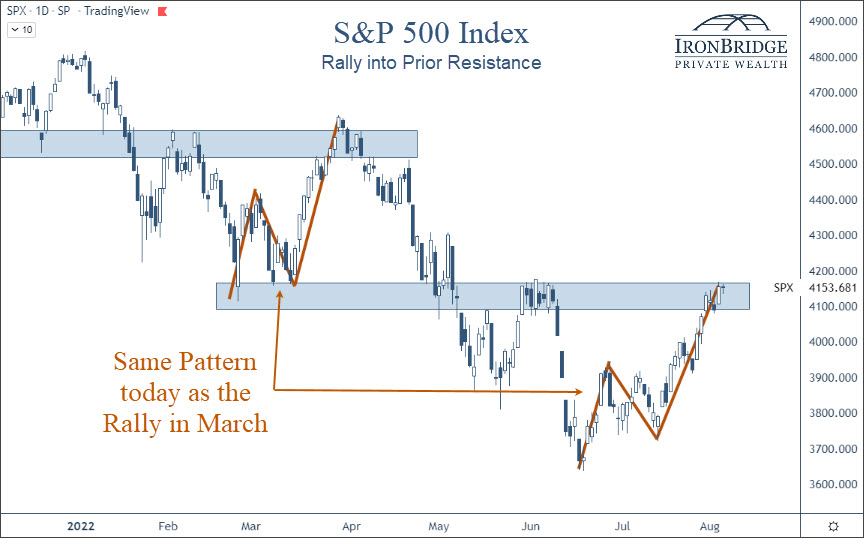

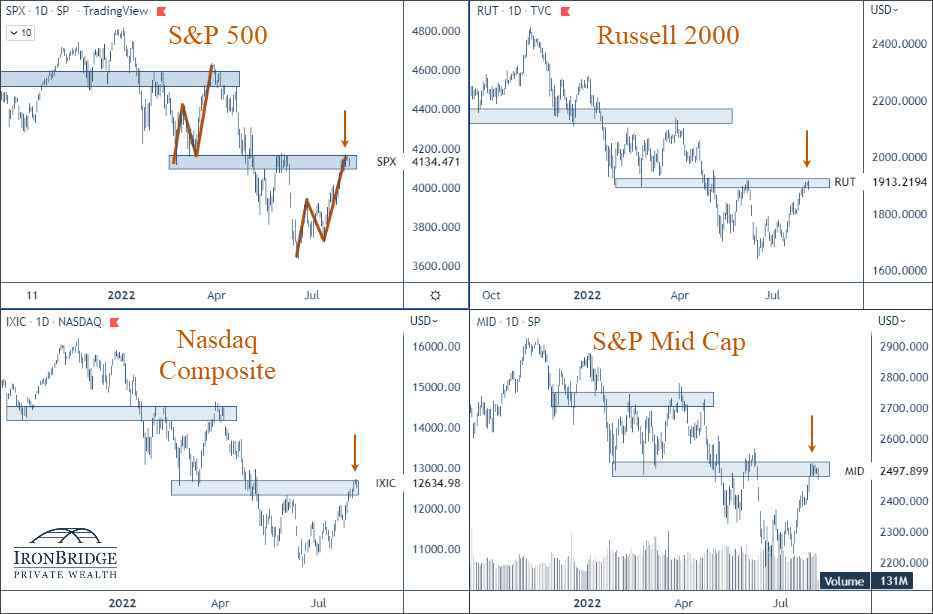

Equity Markets

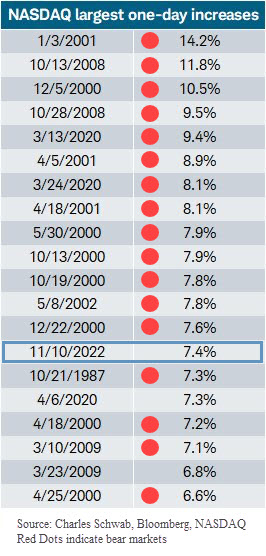

- On November 10th, the S&P was up nearly 6%, and the Nasdaq was up 7.4%. This accounts for more than half of the return in the past two months.

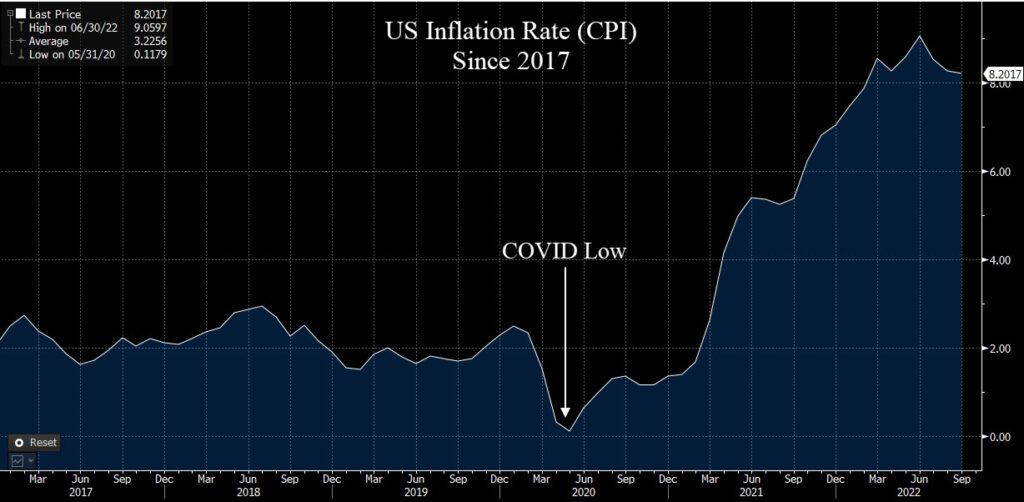

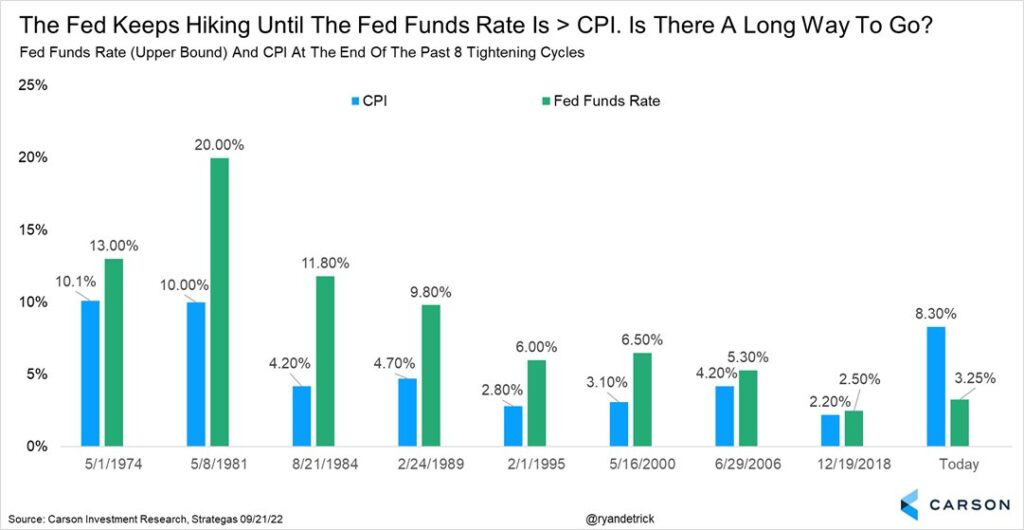

- The big jump in markets on was due to inflation coming in at 7.7% instead of 7.9%.

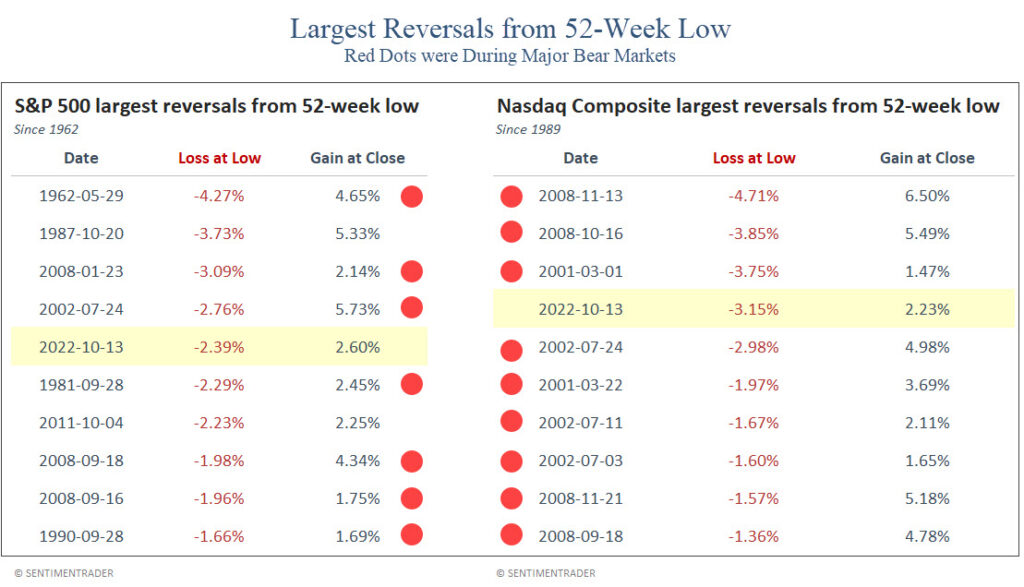

- Big daily increases like this do not occur in good markets. The chart below shows the 20 largest increases in Nasdaq history.

- 17 of the previous 19 largest daily increases occurred during major bear markets and did not mark the bottom.

- The other 2 happened one week after the ultimate bear markets lows in 2009 and 2020 under very different conditions than we have now (VIX then was above 80, while VIX currently is at 22.)

- Near-term, markets could continue to drift higher. Looking past the next few weeks, things appear to be very weak. Caution is advised.

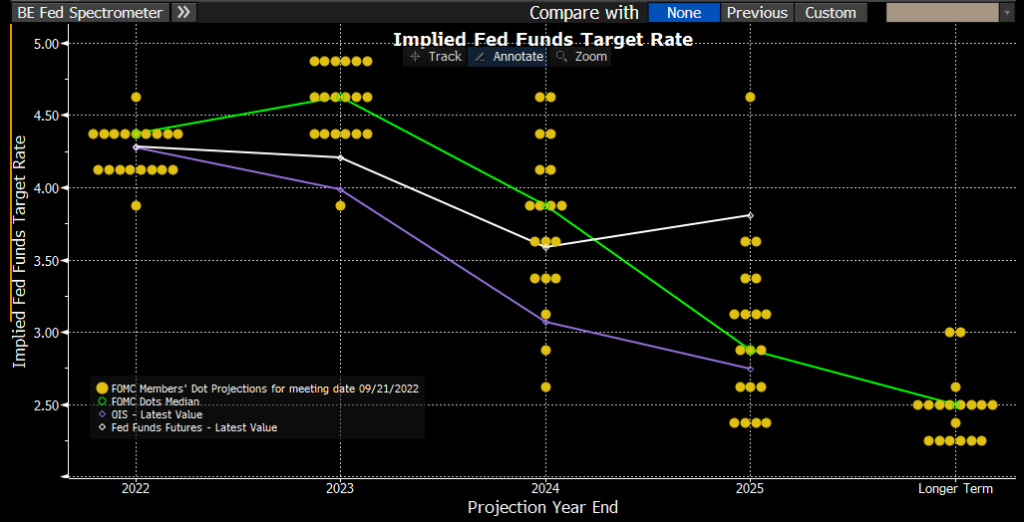

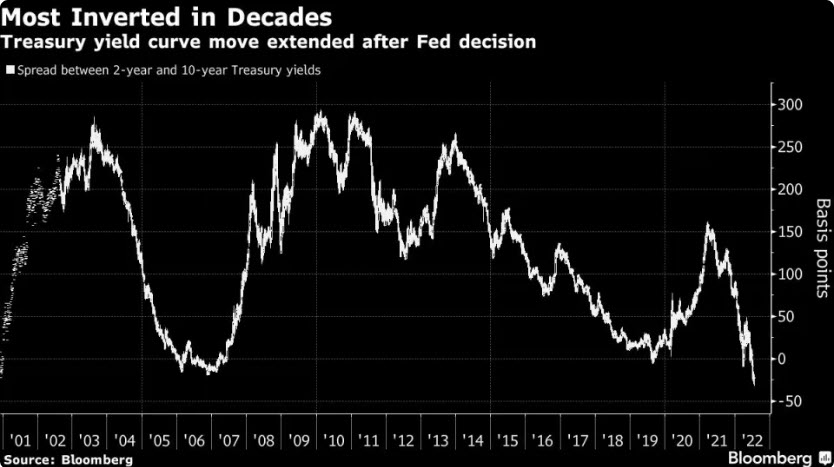

Interest Rates

- The Fed is likely to increase rates by 0.50% in December, then another 0.25% in February. The market anticipates that the Fed will stop raising rates after that.

- Longer term rates appear to be calming down, and may be starting to price in recessionary risks.

Bottom Line

While the relative calmness has been a welcome respite from the volatility this year, we do not believe this is a time for complacency.

We would love to believe that the bear market is over. At our core, we are optimists.

But more importantly, we are realists.

Equity exposure has steadily increased in client portfolios this quarter. If market and economic conditions continue to improve, we will continue to do so.

But we view any new equity exposure as potentially having a very short shelf-life.

We will not hesitate to reduce equity exposure, increase cash levels, and do more hedging to protect portfolio values if and when these actions are warranted.

We hope you and your loved ones have a wonderful Thanksgiving holiday.

Invest wisely!