Aesop was a Greek storyteller who lived from 620-564 BCE. His stories were verbally passed down through time, and often included tales of animals and inanimate objects that could speak and solve problems.

Many of Aesop’s Fables are commonplace even to this day. We are all familiar with the story of the tortoise and the hare.

But a lesser known fable is that of the Wolf and the Crane.

In the fable, the Wolf gets a bone stuck crosswise deep in his throat. He asks the Crane, with her long neck and lengthy bill, to reach in and pull the bone out. If she successfully removes the bone, he promises to reward her very handsomely in return.

So the Crane uneasily put her head into the Wolf’s throat, and removes the bone.

But when the Wolf felt that the bone was gone, he started to walk away.

The Crane anxiously asked, “But where is my reward?“

The Wolf whipped his head around and snarled, “Haven’t you already got your reward? Isn’t it enough that I let you take your head out of my mouth without snapping it off?”

The moral of this story is that you shouldn’t expect a reward when you are serving the wicked. (FYI, the full text of the fable is at the bottom of this page.)

This may seem harsh, but it is appearing more and more that the Fed is the Wolf.

And we are the Cranes.

We have benefitted from 12 years of strong markets on the back of the Fed printing press. The excesses of the banking and housing expansion before 2009 were never truly worked off. Only covered by a tsunami of digital dollars.

The Wolf, aka the Fed (and more broadly the largest U.S. banks), asked us to do something for them: increase consumption by using low-interest debt. Oh, and to buy stocks.

And we consumers obliged.

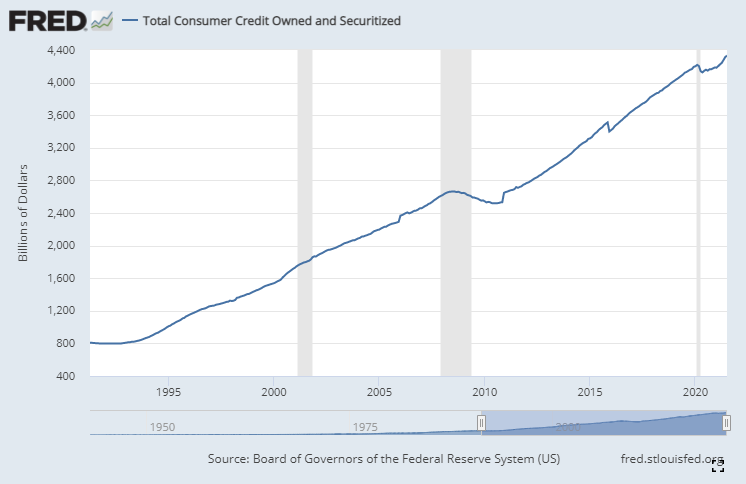

Total consumer debt has consistently risen over the past 30 years, as shown in the chart below.

Consumers benefitted in the form of easier access to credit and interest rates that are literally the lowest in recorded human history.

Investors benefitted as well.

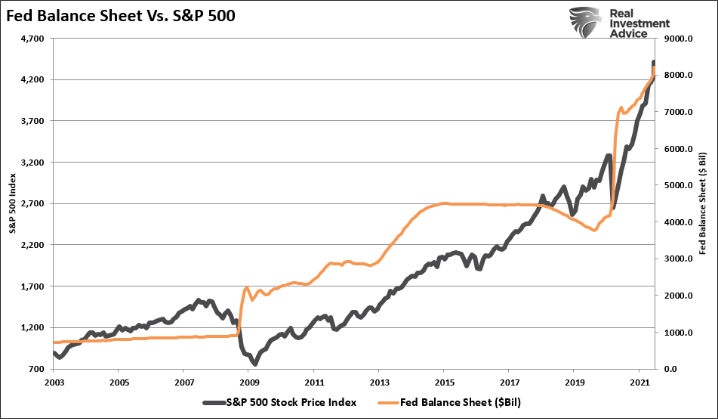

The next chart, courtesy of our friend Lance Roberts with Real Investment Advice, shows the Federal Reserve balance sheet versus the S&P 500 Index. We discussed this chart in our Strategic Growth video series HERE.

Each time the Fed turned on the printing press since 2008, stocks went up. After all, this was the goal of their policy. They wanted stocks to go up in order to create confidence in the real economy.

Flooding the financial system with liquidity worked, and it continues to work to this day. If we look at all the problems in the world right now, it is easy to see that U.S. stocks simply don’t care about any of them.

GDP cratered over 30% in the second quarter of 2020. We’re in a global pandemic that is nearly two years old. There is massive unemployment, huge inflationary pressures, supply chain disruptions, major tax legislation, self-induced geopolitical messes, natural disasters, generational social discord, increasing wealth disparity…the list goes on.

Despite all of this uncertainty, we haven’t had a 5% pullback in almost a year.

As Jay-Z might say, “I got 99 problems but the market ain’t one”.

At least not yet.

This summer we wrote The Fed is Stuck. In it, we discussed the mechanisms that allowed the Fed to have a direct impact on financial markets.

Now, there is discussion that the Fed will start to reverse course.

Over the next few months, you’re going to hear a LOT of the word “taper” from the financial media. And rightfully so.

The Fed has created an economy and financial system completely dependent on its easy money policies.

If we can agree that the massive liquidity injections had a positive effect on the markets, one would also assume the opposite to be true.

So it is logical to begin to discuss the potential consequences as the Fed begins to reduce its support of the financial markets.

What Happens when the Fed Tapers?

Merriam-Webster defines “taper” as a verb that means “to diminish gradually”.

When the Fed “tapers” its asset purchases, it simply means they will slowly reduce the amount of money they are force-feeding into the financial system.

This HAS to happen at some point.

There is no way to continually print trillions of dollars and expect to not have any consequences.

So far, the only “consequences” have been mostly positive.

Inflation has been a consequence, but up to this point it has only been in the form of asset price inflation. Stocks have risen, bonds have risen, and real estate of all kinds have risen.

What we haven’t seen is the negative inflation that will inevitably stall the economy. But it is starting to appear. In Austin, multiple restaurants have started to raise prices. Your grocery bill is likely a bit higher this fall than it was a year ago. Let’s not even talk about housing affordability.

At first, we the consumer will absorb the real economic inflation. But as these inflationary pressures build, the Fed simply can’t continue on its current path. We are nearing a point where the Fed must stop doing what it is doing.

So what is the Fed actually doing?

It is doing two things: shoveling $120 billion per month into the financial system and keeping interest rates artificially low.

So there are technically two things the Fed could start doing: reduce the $120 billion number, or increase rates.

Taper or Raise Rates?

At their meeting next week (September 21-22), it is widely expected that Jerome Powell will announce a tapering program.

This means that they are likely to reduce the $120 billion number. That leaves two very simple questions: By how much will they reduce it, and over what timeframe?

While most people are predicting the Fed to taper, it actually might make more sense for them to raise rates first.

The financial markets have been focused on the flow of assets into the system. The $120 billion per month results in a net increase in demand. When demand outpaces supply, prices go up. A reduction of the $120 billion would then logically either slow the rate of increase in the market, or at some point lead to an actual price decline.

But an increase in the interest rate environment would have a more subtle effect.

Adjustable rate debt would go up. The interest rates on new loans would likely go up. And what would essentially happen is the cost of funds would get slightly more expensive to slow down major purchases and leverage.

This would be a good thing in the early stages of an inflationary environment.

It also would result in a positive surprise to the financial markets.

That said, it’s very difficult to predict what the Fed will do. And even more difficult to predict how the market will react to it. We’ve yet to read much about the potential for the Fed to raise rates before slowing down their asset purchases.

Either way, it would be more of a surprise if they did NOT act next week.

So we should expect a clearer path forward from Mr. Powell next week, and a path that includes a slow down of Fed activity.

The Wolves Inside the Fed

One other reason to expect a tapering announcement next week is less grounded in economic reality, and has more to do with political grift.

Members of the Federal Reserve do not have major restrictions when it comes to their own personal investments. Or at least they didn’t until last week.

As former employees of large investment firms, we have dealt with trading restrictions for many years. Heck, even a small, independent firm like IronBridge has trading restrictions and requires disclosure of investment holdings. These are important so that we aren’t abusing our knowledge of future trades that we may do for all of our clients, and “front-run” the trade hoping our investment actions will boost the price of that stock.

However, the Federal friggin’ Reserve bank, the most powerful financial institution on the planet, does not have restrictions on what their active, policy-creating members can and can’t do.

Case in point…last week it was revealed that the Federal Reserve Bank of Dallas President Robert Kaplan (pictured below) owned nearly 30 positions in individual stocks valued at over $1MM per stock. He had 22 stock purchases last year of over $1MM per trade.

Mr. Kaplan actively sets monetary policy. And that policy is designed to literally make stocks go up.

Conveniently, as the Fed is about to change course and start to taper, he announced that he magically found his ethics and will sell all of his individual stock holdings.

Funny how that works.

Mr. Kaplan isn’t the only one either.

Boston Fed President Eric Rosengren conveniently found ethics as well. He announced he would be selling all of his individual stock holdings by September 30th.

There are only 12 people who officially vote on Fed policy. And two of them (that we know of) are going to liquidate their holdings at the same exact time the Fed is changing their easy money policy.

This is a different kind of wolf, but a wolf nonetheless.

Maybe it is coincidence. Maybe these gentlemen are noble, ethical people. Maybe the Fed won’t reverse course and will keep pumping. Maybe stopping the massive amounts of liquidity going into the system isn’t going to slow this market down.

Or maybe they know exactly what they are doing.

And maybe like the Wolf, they won’t care what happens to the market and economy when they stop.

After all, we Cranes escaped the financial crisis and COVID crash with stock prices and home prices higher than when it all started.

Cognitive Dissonance

The other thing to watch in next week’s meeting is that the Fed will likely blame everything but themselves for the inflationary pressures building in the real economy.

This cognitive dissonance is important because it allows them to change policy without worrying about the negative consequences of what their change in policy might do to asset prices and the real economy.

This allows them to sleep at night believing that what they did was noble.

And maybe it was noble.

But if there begins to be negative fallout from the Fed stopping the printing presses, we should not expect the Fed to reverse course this time. In fact, we should expect the opposite going forward.

The Fed believes we have already received our rewards. We were “saved” from the jaws of the financial crisis and COVID crash.

The Fed didn’t chew the heads off of us Cranes. They “let” us escape unharmed.

And for the first time in many, many years, it appears that they are truly about to change from an easy monetary environment to a less accommodative one.

Therefore, now is not a time for complacency.

The markets are getting closer to a major top. We may not be there just yet, but we are definitely getting closer.

We don’t know if it will be three months, six months or five years before things change, but we are closer today than we were yesterday.

So stick to the basics:

- Stay disciplined. Don’t let a small loss turn into a big loss.

- Do not let your emotions get the best of you. Don’t become overly bullish or overly bearish…anything can happen.

- It’s okay to be wrong. We can’t pick the top. And we won’t try. But if things are not working you need to change course. What’s not okay is to stay wrong and try to fight the market.

- Use data to make decisions, not narratives. Always remember that the media exists to sell commercials, not give you objective investment advice.

So let’s watch what the Wolves will do next week with great interest. Whatever the Fed may do, we will be prepared.

Invest wisely!

The Wolf and the Crane

“A Wolf had been feasting too greedily, and a bone had stuck crosswise in his throat. He could get it neither up nor down, and of course he could not eat a thing. Naturally that was an awful state of affairs for a greedy Wolf.

So away he hurried to the Crane. He was sure that she, with her long neck and bill, would easily be able to reach the bone and pull it out.

“I will reward you very handsomely,” said the Wolf, “if you pull that bone out for me.”

The Crane, as you can imagine, was very uneasy about putting her head in a Wolf’s throat. But she was grasping in nature, so she did what the Wolf asked her to do.

When the Wolf felt that the bone was gone, he started to walk away.

“But what about my reward!” called the Crane anxiously.

“What!” snarled the Wolf, whirling around. “Haven’t you got it? Isn’t it enough that I let you take your head out of my mouth without snapping it off?”