View the recording of our 2023 Mid-Year Outlook webinar.

Here are the topics we discussed and the time in the recording it happens so you can fast-forward to topics you find most relevant:

- Recession probabilities (1:29)

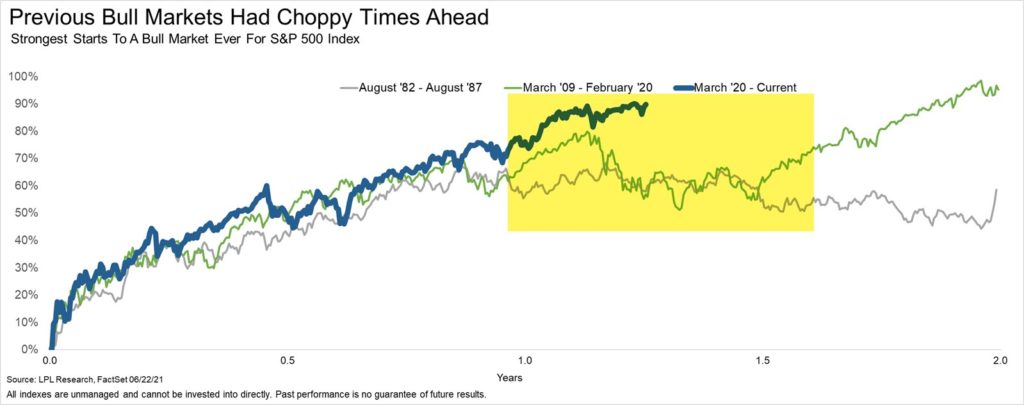

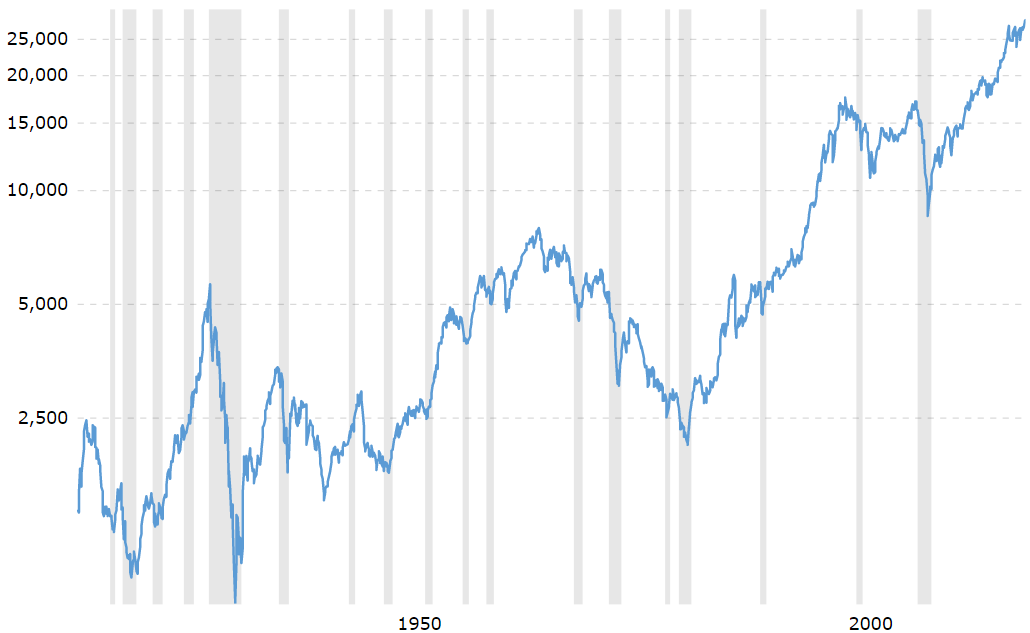

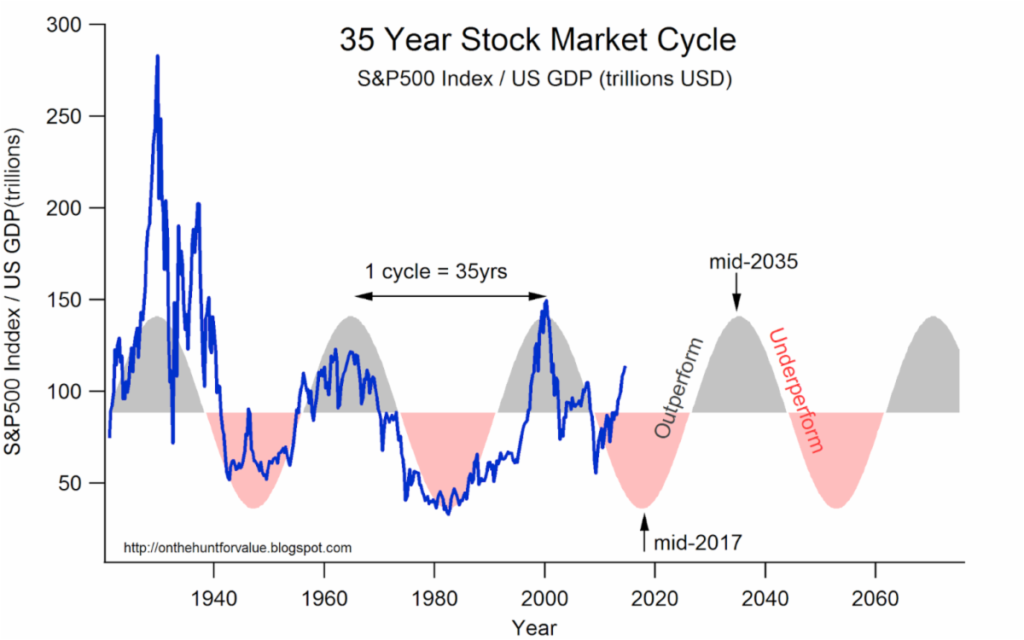

- S&P 500, Dow Jones & Russell 2000 (4:51)

- Concentrated performance contribution YTD (8:48)

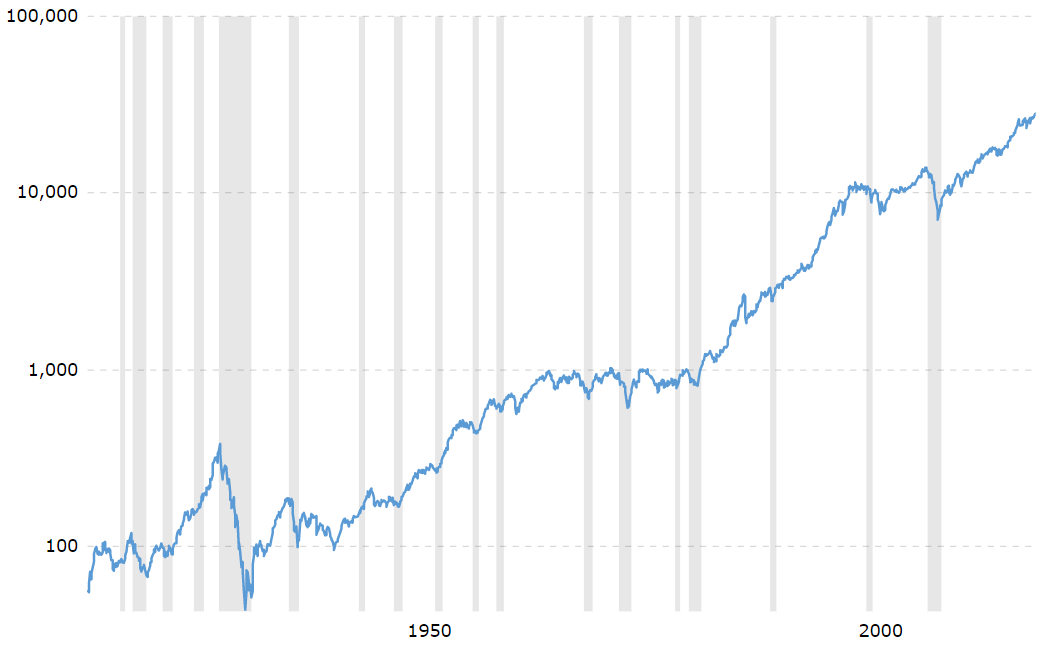

- S&P 500 Index (10:11)

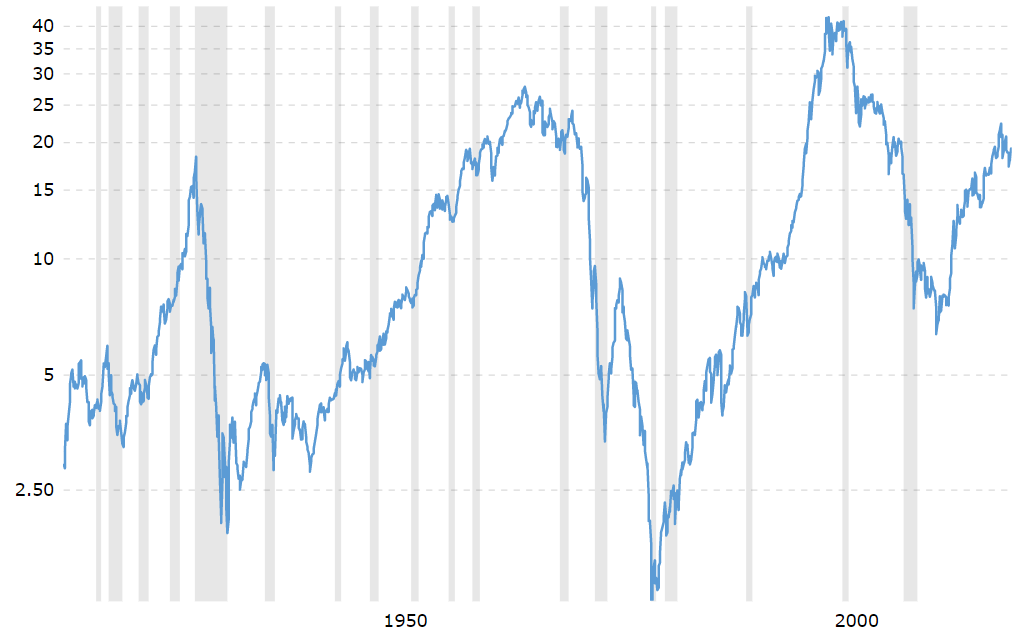

- Russell 2000 small cap stock index (14:37)

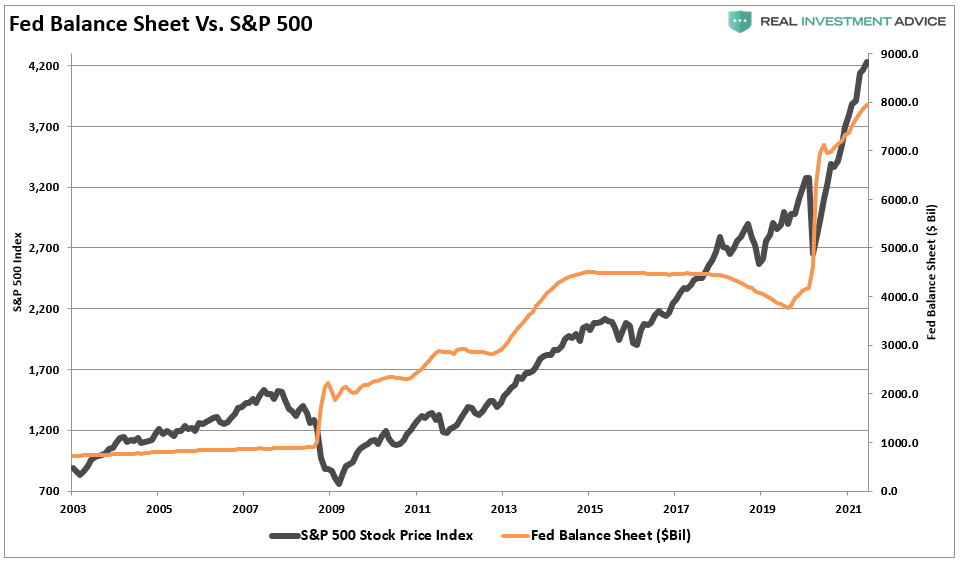

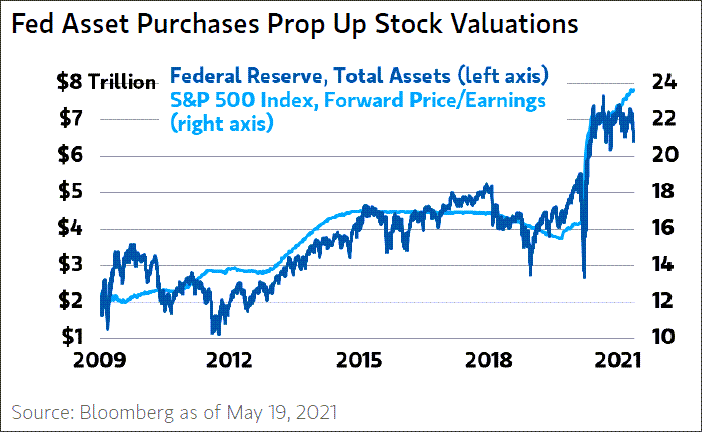

- Fed Balance sheet vs S&P 500 (16:14)

- Banking stocks still under pressure (18:01)

- Commercial real estate loans maturing over the next 5 years (19:24)

- Yield curve (24:56)

- Manufacturing PMIs and activity (29:10)

- Portfolio Equity Positioning (31:27)

- Scenarios, Risks & Opportunities (35:00)

- Upside and Downside potential performance based on three scenarios (39:40)

Invest wisely!