Market volatility has risen dramatically this year. In this episode, we discuss:

1. Market Overview

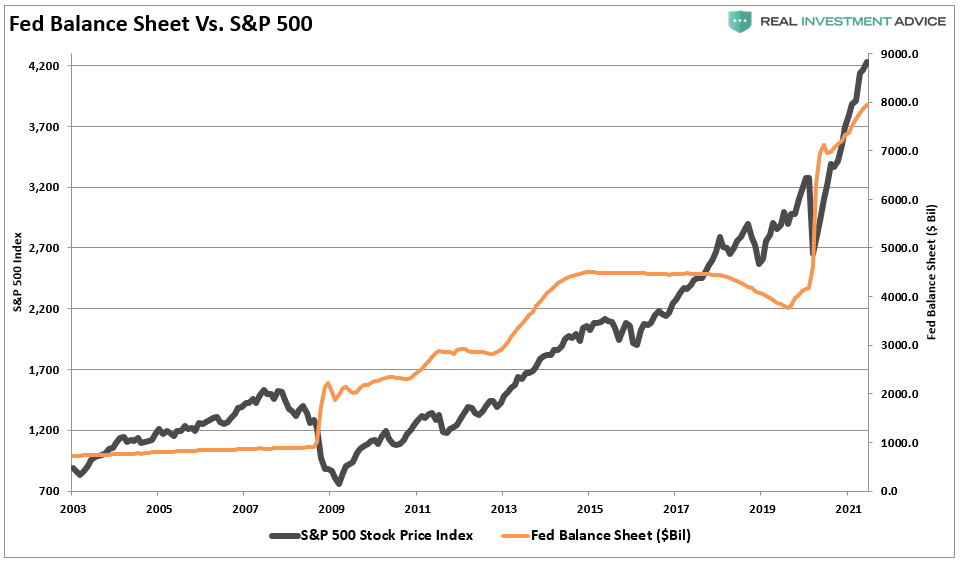

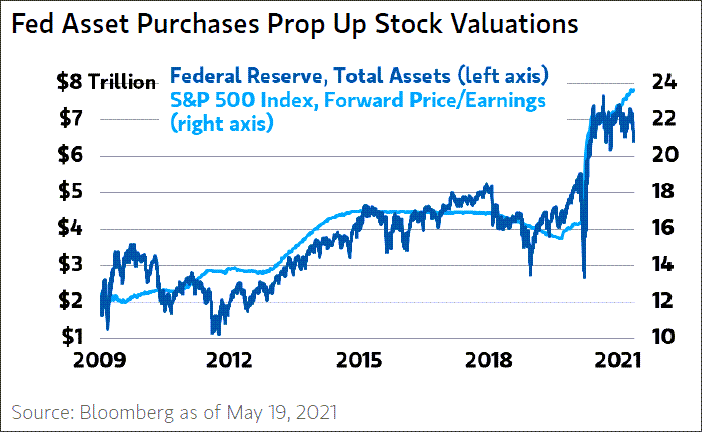

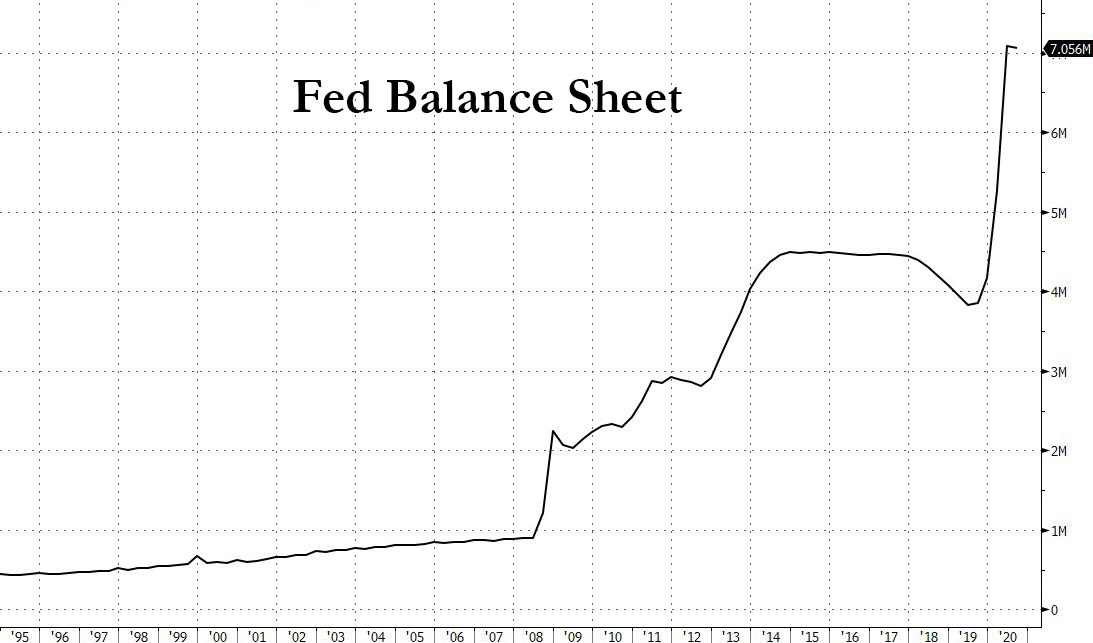

2. Fed Policy Change (they are stuck)

3. S&P 500 Index Levels

4. The Big Four Stocks (Microsoft, Apple, Amazon and Google)

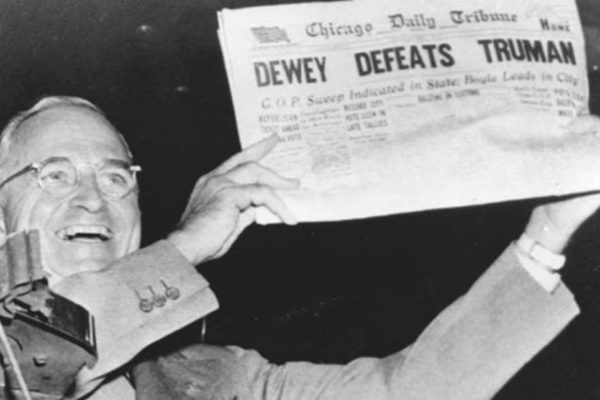

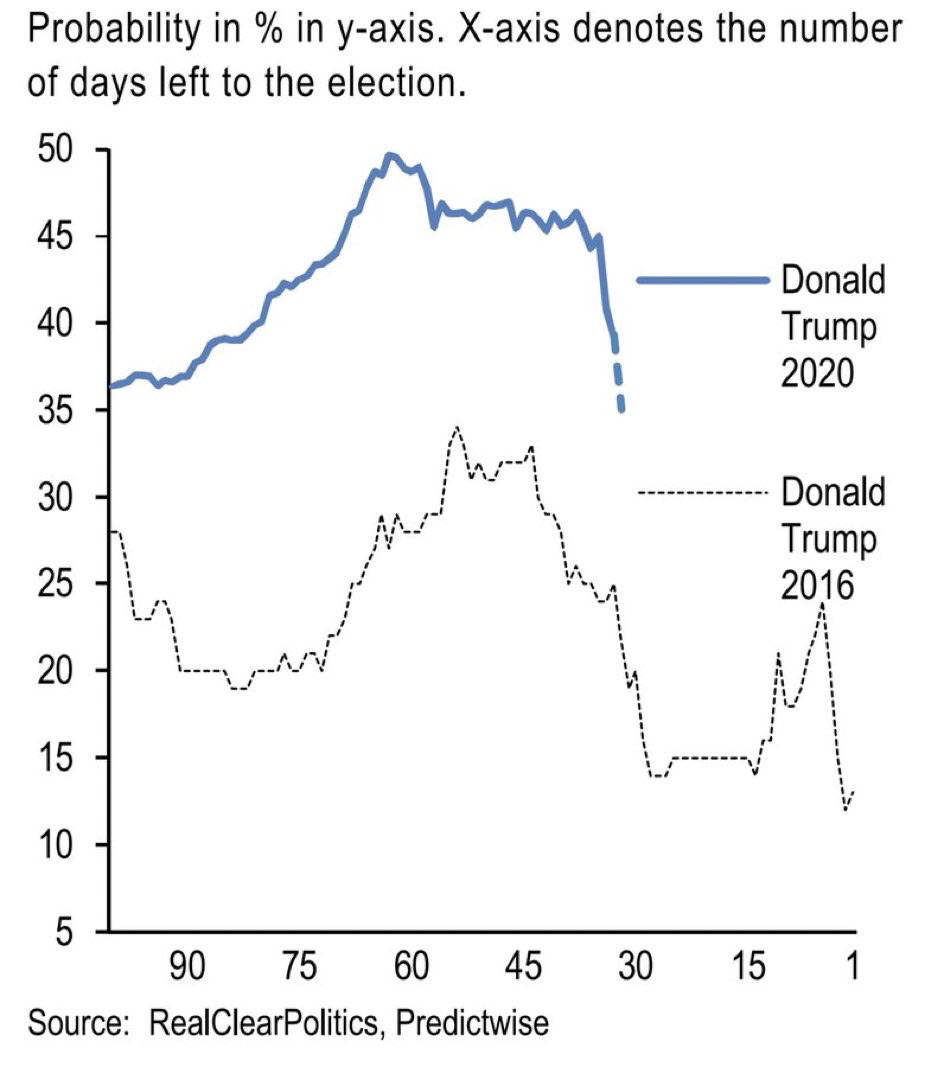

5. Potential Outcomes

6. Portfolio Positioning