The fool doth think he is wise, but the wise man knows himself to be a fool.

“As you like it”, Act v scene i, by william shakespeare

Markets are never easy.

Granted, there are times when things seem easier than others.

Over the past 13 years, investors have grown increasingly complacent about how easy investing can be. After all, every time there was a blip in the market, prices came roaring back quickly.

When data and trends align well, we can make higher probability conclusions about the direction of the market.

But when we have conflicting data, as we have now, it becomes more difficult to identify the direction with any real confidence.

Shakespeare’s quote is appropriate for this environment.

To think we know for sure what will happen is foolish. It is much better to acknowledge that we don’t know what will happen, so we can view developments with objectivity.

There are strong reasons to be optimistic about the markets over the coming months and years.

However, there are strong reasons to be incredibly pessimistic about the markets as well.

An important skill in this type of environment is to be mentally flexible. To know that you don’t know what will happen.

Let’s look at both the positive and negative data in the economy and markets right now to get a better understanding of the investing environment.

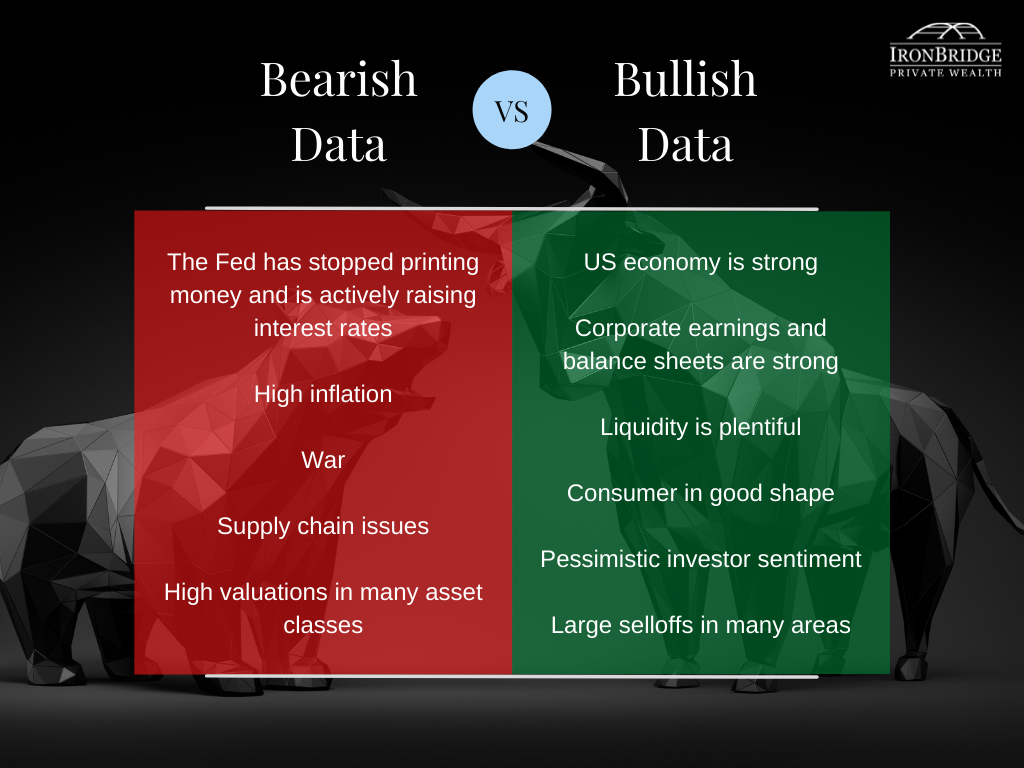

Bullish vs Bearish Data

First, let’s take a high-level look at the bearish and bullish arguments.

On one hand, we have plenty of reasons to be concerned:

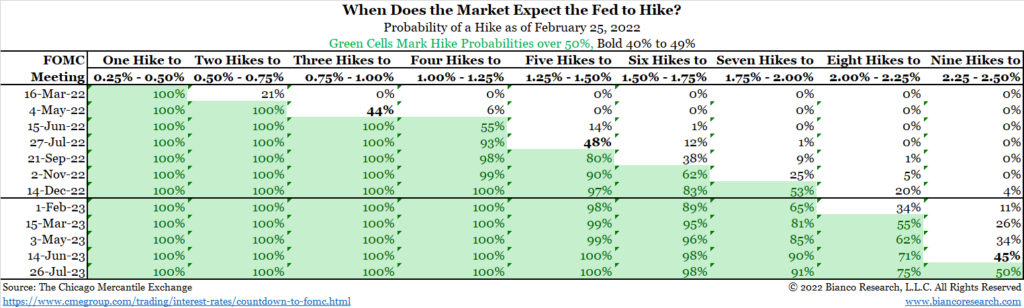

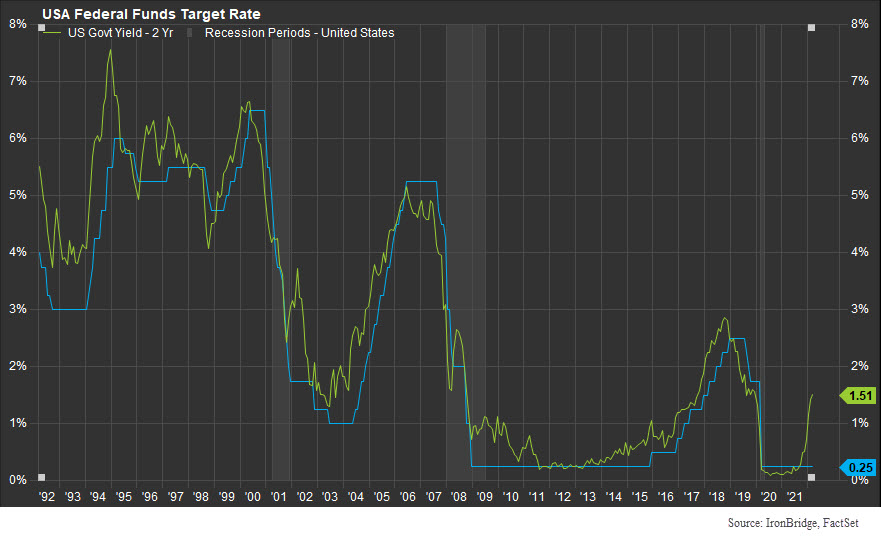

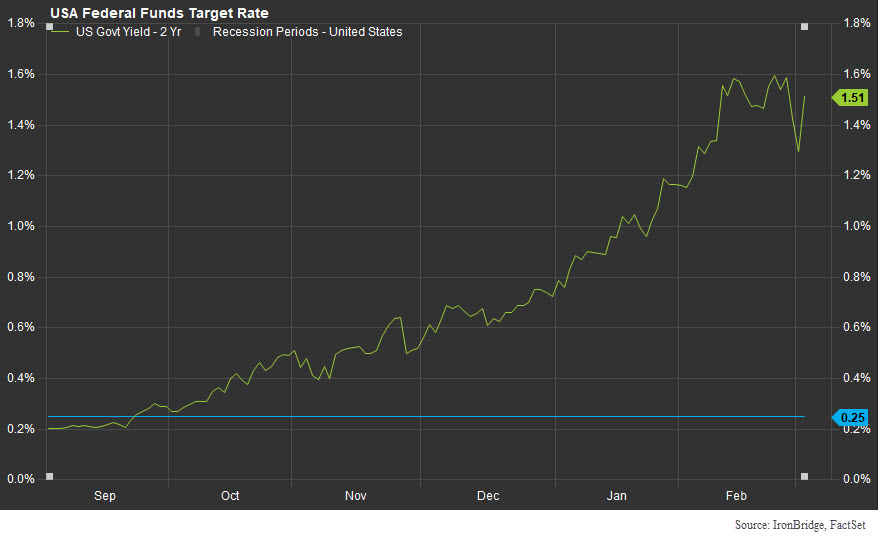

- The Fed is tightening

- Inflation is extremely high

- Ukraine War continues to be drawn out

- Supply chain issues and food shortages globally are concerning

- Valuations in many areas (stocks and real estate specifically) are still very high

We just need some turmoil in the Kardashian family and we have a cable news executive’s dream.

On the other hand, not everything is bad:

- The US economy is strong

- Corporate earnings and balance sheets are solid

- Liquidity is still readily available

- The US consumer is strong, on the back of high real estate valuations and increased incomes

- Investor sentiment is very pessimistic (this is a contrarian indicator where this much pessimism tends to happen at market lows)

- Some areas of the market have fallen 50-70% in value from last year, so some of the froth has been removed from various areas of the market.

Here’s an overview.

Let’s look at two paths: one to lower stock prices, and another to higher ones.

The Path to Lower Stock Prices

Looking at the issues above, the biggest one by far is the Fed.

Yes, the war in Ukraine continues to be drawn out. Yes, inflation is very high. Yes, supply chain issues continue to be a problem.

Recession risks have increased in the past few months as well. Goldman Sachs currently places a 35% likelihood of a recession this year.

But the Fed has been the 10,000-lb gorilla in the room for a decade.

And their policy of massive monetary stimulus has now officially ended. They are no longer printing money, and they have started to raise interest rates.

This is not a small change.

We would argue that the Fed is the single most-important reason the market has been so incredibly strong over the past decade.

A reversion of policy should have an impact.

Their belief is that the US economy is strong enough to not depend on their artificial liquidity as support. Maybe they are right. After all, the economy is pretty strong.

The main problem is that the inflation cat has left the proverbial bag.

And it’s still too early to know how much of a negative affect it will have on the economy.

In all reality, it will take a number of months before inflation has a notable impact on economic data.

But the longer that inflation stays high, the more we will start to see reduced demand for a variety of goods.

For those with an economic background, it’s called “elasticity” of demand. Consumers are only willing to pay for something up to a certain price.

When the price gets too high, consumers stop buying it. We haven’t seen this just yet, but it’s hard to imagine we’re too far away from it.

Here is the pickle the Fed finds itself in: reduced demand will help lower inflation, but it will also cause a recession.

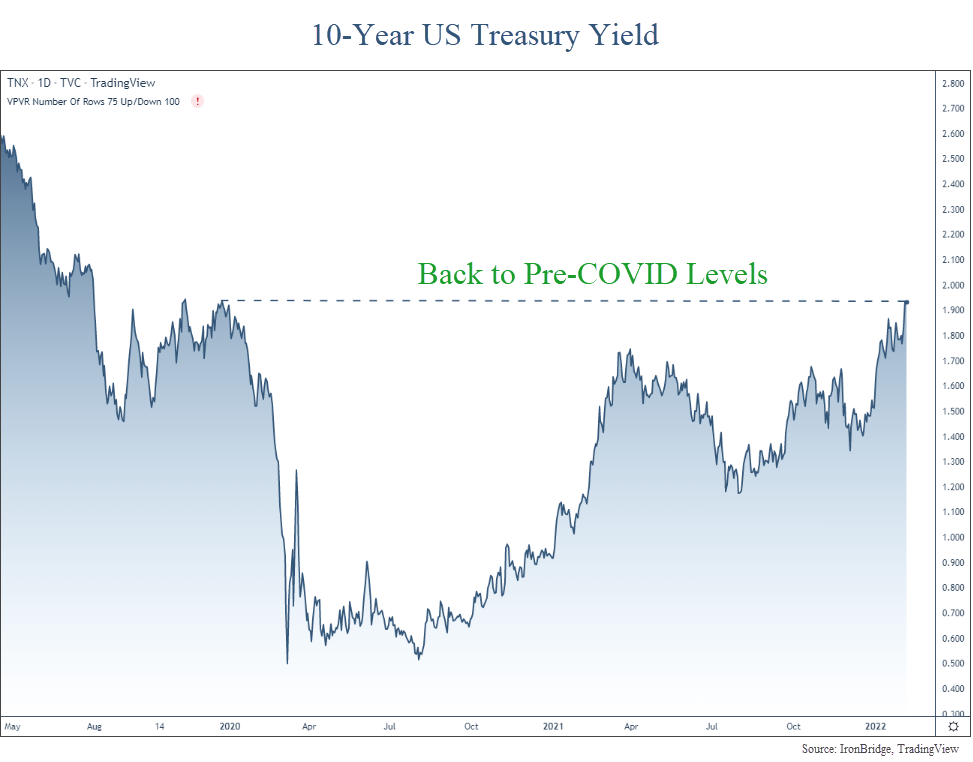

Not only is inflation rising, but so are interest rates. The combination of these two could wreak havoc on both the economy and financial markets.

But in an inflationary environment, not everything falls in price. There are many areas right now that are pushing to new highs, despite stock prices being lower.

The Nasdaq Composite index (mainly comprised of tech stocks) is now down over 20% from its highs. But consumer staples stocks pushed to new all-time highs last week.

While the broad market may not be very good right now, there are underlying pockets of strength.

These pockets of strength could be an indication that stock prices overall may resume their push higher soon. So let’s look at reasons we might need to be optimistic about the overall market environment going forward.

The Path to Higher Stock Prices

Yes, the Fed, inflation and interest rates are headwinds. But not everything is bad.

Earnings season picks up this week, and we should get more clarity on how companies are weathering the inflationary and uncertain geopolitical environment. So far, earnings have been good. Most estimates call for an increase in earnings of 4.5% year-over-year. Not great, but not bad either.

Just because we assume data should be negative doesn’t mean it will be.

One way that negative data isn’t quite showing up in the real economy has to do with mortgage rates.

The average 30-year mortgage is now above 5% for the first time in 11 years. But it hasn’t had a negative affect on homebuilders and home buyers just yet.

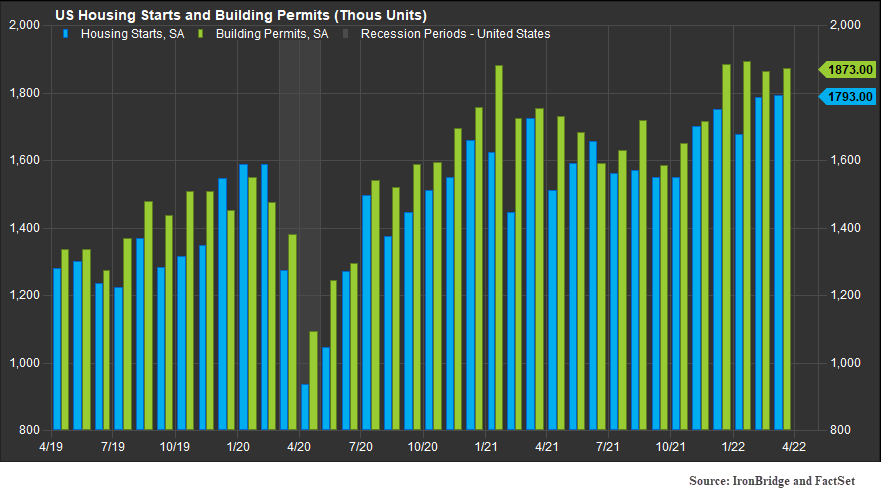

The next chart shows housing starts and building permits, one of the leading indicators of the housing market.

In this chart, the blue lines are housing starts and the green lines are new building permits. In the past few months, they have been steady. New housing starts have actually risen a bit.

This could be a last minute push of people trying to build homes before rates get too high. But if nothing else, it tells us that mortgage rates may not be high enough to cause a housing slowdown. Time will tell.

With home-buying season about to start, we should know a lot more about the health of the housing market in the next few months.

This points to a consumer who has had both asset values and incomes rise.

And the consumer accounts for 68% of the US economy.

We should not ignore the positive impact that an optimistic US consumer can have on the economy and stock prices.

S&P 500 Index Levels

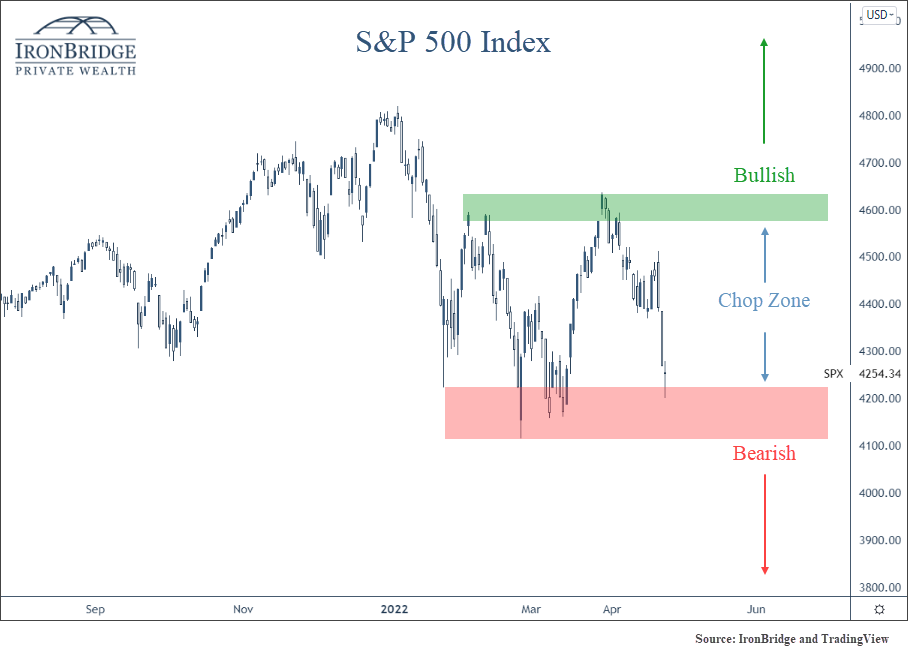

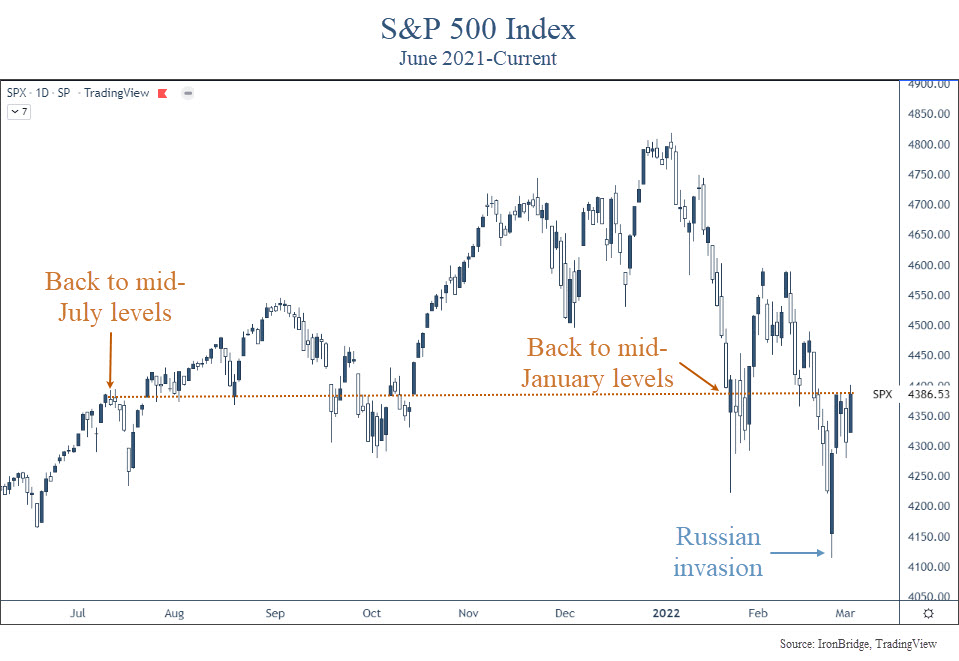

Let’s now look at the market itself.

Here’s an updated view of the S&P 500 Index, with the important levels to watch right now.

We’ve broadened out our chop zone from a month ago, as the market seems to be stuck in a range between 4100-4600. (We had previously identified the chop zone as a range between 4100-4400.)

The real risk now is a break below 4100, or the lower end of the red area in the chart above.

There is very little support below this level, and we could easily see a scenario where markets fall another 10-20% if 4100 does not hold.

If it does fail, we will aggressively raise cash further.

Until that time, however, we should not assume that it will fail. We should assume that the chop zone will continue until we start to see whether the Fed/inflation/interest rate combo starts to have negative effects.

Either way, we expect that increased volatility will continue for a while longer.

Bottom Line

There are risks out there right now. Major risks that should not be ignored.

But there are still reasons to not bury your cash in cans in the backyard, at least not yet.

At this point, most clients have roughly 20% of their portfolio that normally would be allocated to stocks in cash right now.

If markets do fall further, we want to be able to have cash available to take advantage of that decline. Which is why we created the ability to move to cash as a part of our base investment process.

And during times like these, it is imperative to have a process.

We find comfort in our processes, because we know we don’t have to try to predict or guess what will happen next. There are no perfect investment systems, and we don’t claim to have one.

Be creating a process, we like to think that we are smart enough to know we are fools, as Shakespeare references.

The primary focus is to avoid big declines in your portfolio. We can’t avoid declines in general. There will always be volatility, and account values will go up and down. No process can avoid that.

When the market is choppy and messy like it is now, we can get signals that are quickly reversed.

That’s okay, in our opinion.

Because at some point a trend is going to reassert itself, either higher or lower.

And when that happens, we have confidence that we can identify it and either benefit from a positive trend or avoid the large downtrends.

In the meantime, we’ll remain diligent and make adjustments to your portfolio as our signals tell us to.

As always, please do not ever hesitate to reach out with questions.

Invest wisely!