There is a LOT happening in markets this week. As we said in our email on Monday, this may be the most important week since the 2008 financial crisis.

Today we’ll discuss a few of the major issues we’re watching:

- Sanctions against Russia (the Financial War)

- S&P 500

- The Fed

As a note, we’ve put together a series of resources that we have been tracking, which you can reference here:

Let’s get started.

Sanctions against Russia (aka, the Financial War)

Once Russia invaded Ukraine last Thursday, the U.S. and the European Union announced a series of initial sanctions against Russia and various Russian companies. These sanctions were quick and were very coordinated among nations.

This immediately caused Putin to fight three separate wars: a military one in Ukraine, a financial war with the global financial system, and a war of perception at home.

Let’s focus on the financial war.

Frankly, once the initial sanctions were announced last week, we perceived them as basically useless.

Nearly every one allowed the entities and individuals sanctioned a 30-day window to comply with the sanctions. This meant that they weren’t going to take effect until potentially AFTER the war was over.

However, over the weekend, the sanctions became much more punitive.

They were also universally approved by the US, European Union, and the UK. Other countries such as Switzerland, Australia, Japan, New Zealand and Taiwan have all made their own sanctions against Russia as well.

There are essentially four types of sanctions being imposed:

- Financial

- Trade-Related

- Sanctions on Individuals

- Travel

Here’s our overview of these sanctions:

All of these sanctions have two goals:

- Punish Russia financially by freezing financial resources and removing them from the global financial system.

- Turn global and Russian sentiment against Putin.

So far these are working well in the short time they have been in effect.

Russia has $640 billion in foreign reserves that have now been frozen. The war is costing them approximately $20 billion per day. By most estimates, Russia has $200 billion of unencumbered assets within Russia that have not been frozen by sanctions.

That means that financially, Russia could possibly run out of money in 10 days.

We shall see, but the initial response is that the sanctions have indeed put Putin in a tough situation.

But what impact has the war had on the stock market?

S&P 500 Index

Historically, when wars begin, the stock market tends to bottom near the time of the initial invasion. This has been true for every major war since the Germans invaded Poland at the start of World War II.

So far, markets have responded to the Russian/Ukraine war as markets historically have done…by rallying higher against almost every ounce of common sense any of us possess.

As of today (March 2nd), the low point of the market happened on Thursday, February 24th. This was the day that Russia invaded Ukraine.

Since then, the S&P 500 is UP nearly 7%.

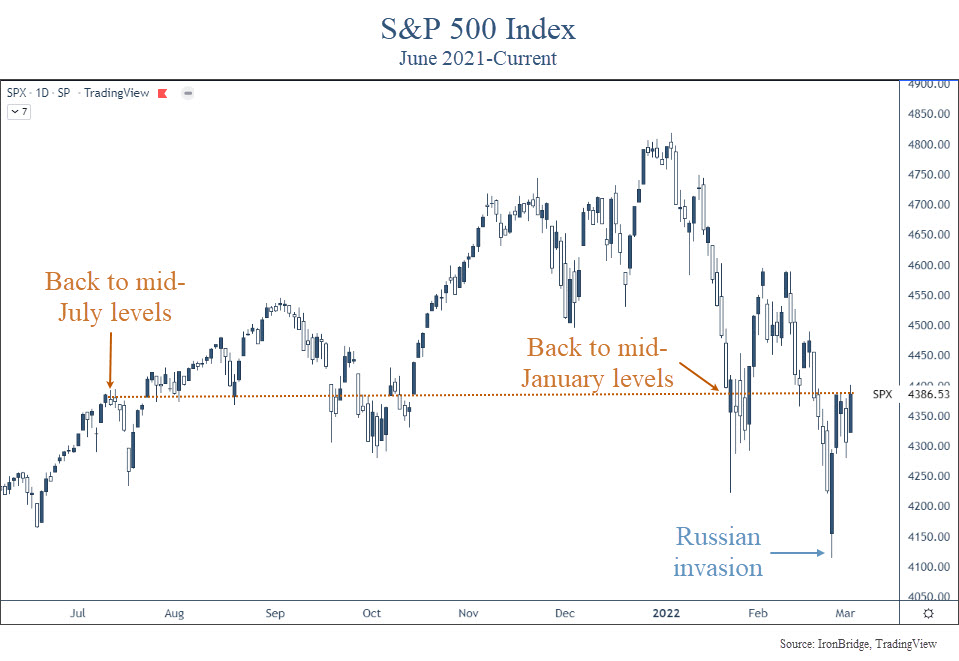

The chart below shows the S&P 500 Index since last June.

The first thing we notice is that the low point of the market thus far was immediately following the invasion. Despite the onset of this war, markets are essentially the same place they were in mid-January.

The second thing we notice is that the market was down “only” 2% the morning of the invasion.

That sounds like a lot, but relative to the volatility that occurred during the COVID crash, when markets moved nearly 10% any given day, a 2% move isn’t overwhelmingly bad. Especially given the fact that many people think this could lead to a nuclear war.

However, during the COVID crash, and also during the bear market of late 2018, markets regularly moved 2% a day.

But this pullback feels worse, doesn’t it?

That could be because we have been lulled to sleep by a very calm market in the past couple of years. It also could be that the risk of nuclear war seems like a reality for the first time in decades, which is obviously nothing to ignore.

Either way, people in general seem to have a more negative feeling towards these developments.

While the invasion itself didn’t cause much volatility, markets definitely anticipated volatility prior to the onset of this unnecessary war.

In fact, the S&P 500 was down 14% from peak-to-trough intraday in 2022, while the Nasdaq and Russell 2000 were both down over 20% peak-to-trough.

Does the fact that we didn’t see much volatility since war began mean we’re in the clear?

The answer is both “maybe” and “absolutely not”.

There are a number of positives that could result in a strong market if the Ukraine war comes to a peaceful and quick resolution:

- The economy is strong.

- The consumer is strong.

- The Fed is now likely to slow down their pace of interest rate increases, resulting in continued support of financial markets.

- The world is unified against Russia, making a coordinated effort to overcome the fallout from sanctions more economically and politically realistic. (Supplying Europe with gas from the US, for example.)

So if we get a peaceful resolution, there are reasons to be optimistic.

However, the elephant in the room is Putin. More accurately, he is the wild animal who is cornered and scared.

Dictators have one goal: to remain in power.

And Putin’s reputation has been greatly diminished both globally and domestically.

If he can’t get out of this situation peacefully, save face, and retain power all at the same time, there is no telling what he might do. And this is the risk we all fear.

Let’s refocus on the financial markets.

Prior to the Ukraine mess, the markets were selling off because concerns on inflation and the speed at which the Fed might act.

What should we expect from the Federal Reserve now?

The Fed

What might the fed do now?

The easiest way to look at this is what the anticipation of Federal Reserve rate hikes might be.

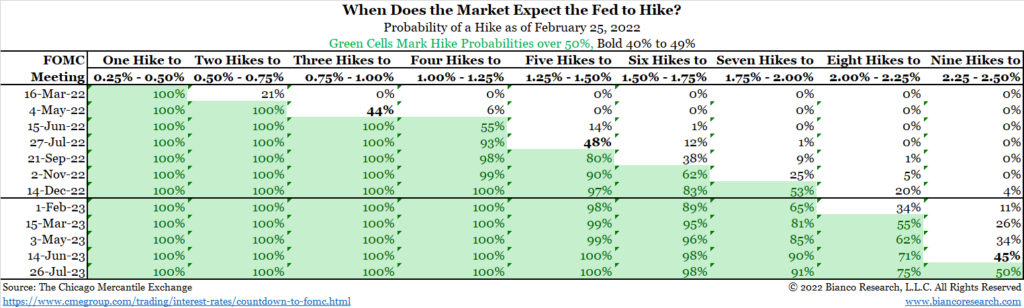

The next chart, from Bianco Research, shows the probability of Fed rate hikes at each upcoming Fed meeting.

Here’s how to read this table.

On the top left, the FOMC Meeting on 16-Mar-22 shows (from left to right across the table) a 100% probability of a hike of 0.25-0.50%, a 21% probability of a 0.50-0.75% hike, and so on. (FOMC stands for “Federal Open Market Committee”)

This tells us that the market is now pricing a 0.25% hike in March, and a total of four rate hikes this year.

Three weeks ago, there was a probability of over 90% of a 0.50% rate hike in March, with 6-7 hikes likely this year.

So the Ukraine situation is causing the Fed to pause slightly, at least for now.

That could create a tailwind for stocks as well.

But they are definitely behind the curve.

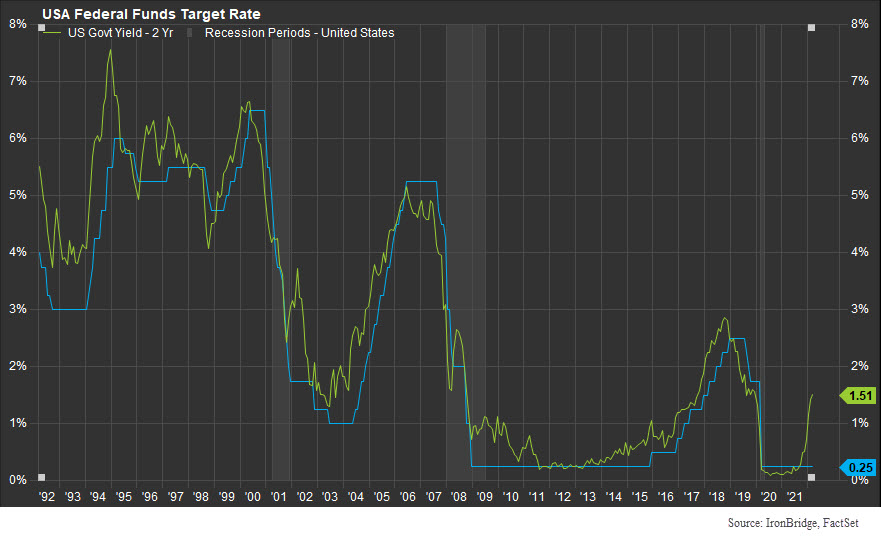

For the past 30 years, the Fed Funds rate has essentially mirrored the 2-year US Treasury yield, as shown in the next chart.

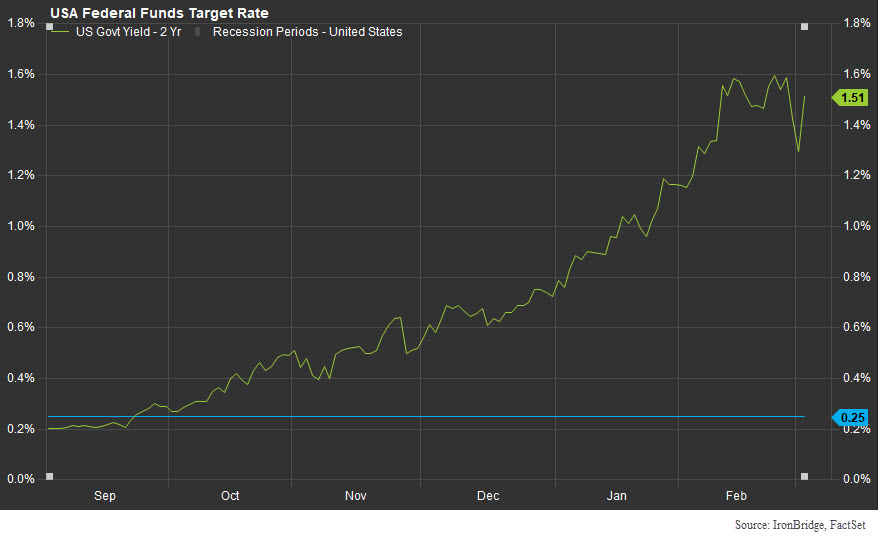

But if we zoom in to the recent rise in the 2-year Treasury yield, we see just how far the Fed needs to go to catch up.

Six months ago, these rates were the same.

Now, the Fed would need to hike 6 times to catch up to the 2-year yield.

This is their dilemma.

The other thing to note on the chart above is that the 2-year Treasury yield barely moved in response to the Ukraine war.

Globally, investors have not been moving into safe havens like we would normally expect.

Bottom line, we are not seeing the type of volatility that we would probably expect in a conflict with the implications of this one.

That leads us to believe one of two things will happen:

- Markets are correct. This implies that the Ukraine conflict will come to a conclusion within a week or two.

- Markets are unprepared. This implies that the real volatility is yet to come.

We don’t like to think about what happens in scenario 2.

But we must think through it and be prepared for any scenario, for that is our job as fiduciaries of your capital.

On Friday, we will give you a portfolio update and look at the specific levels on the markets that we are watching.

Invest wisely!