The Federal Reserve cut its target interest rate by 0.50% on Wednesday, with stock markets at or near all-time-highs. What does that signal for the economy and markets?

“Interest rates are to asset prices what gravity is to the apple. When there are low interest rates, there is a very low gravitational pull on asset prices.”

warren buffet

Focus on economic data and the weirdest presidential election in memory took a pause on Wednesday as the Federal Reserve met and reduced interest rates by a half of a percent.

Side Note: We will publish an election report in the coming weeks with our analysis of the potential election outcomes.

When the Fed cuts rates, it is important to understand the context in which the cut happens.

Essentially there are two environments to consider:

- Deteriorating economy and market

- Stable/Improving economy and market

Today, there is little question that the economy and market are stable.

Things can always change. And can change quickly.

But as of right now, stocks are at all-time-highs and gaining momentum. Economic data is holding up just fine, and we’re not seeing stress in the places that would be concerning.

So why cut?

Why did the Fed cut rates now?

In the two rate cutting environments mentioned above (deteriorating or stable data), interest rate cuts take on different roles.

When economic data is starting to weaken and markets are showing signs of stress, rate cuts help to pump liquidity into financial markets.

In theory, lower rates help to lessen the negative effects of a recession.

The idea is that lower rates decrease the cost of debt (consumer, corporate and government debt), helping the overall economy reduce costs to offset the potential for reduced economic output during a recession.

But today’s data is not recessionary.

In fact, we’re simply not seeing many signs at all of stress in financial markets that would be worrisome.

That means that this rate cut is likely a “normalization” rate cut.

Normalization Rate Cut

Normalization rate cuts are nothing more than cuts that happen outside of a pending recession.

The Federal Reserve spent over a decade at “abnormal” rates. (Zero percent rates for well over a decade is not normal).

This week’s cut appears to be a normalization with regards to inflation, not with regards to unemployment or the economy.

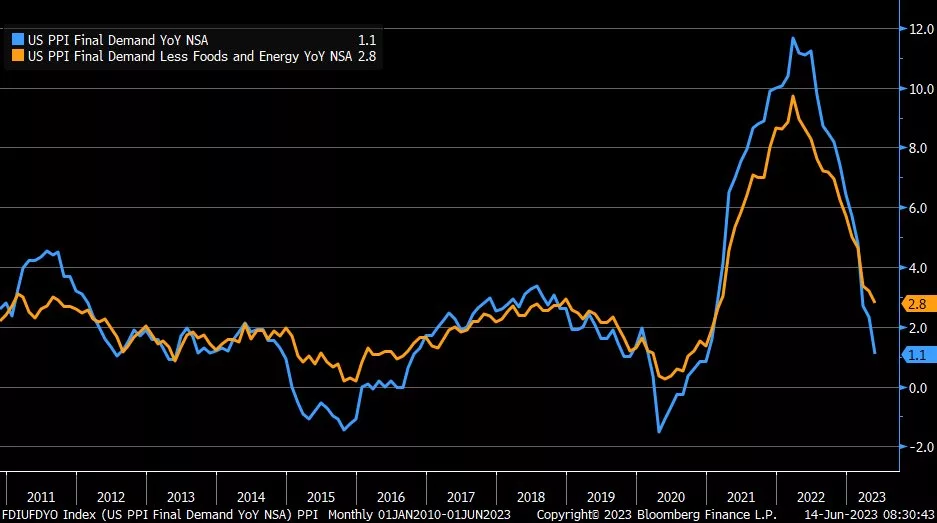

When inflation went from 1% to 9%, the Fed raised rates to slow inflation.

Then, inflation went from 9% to 3%. So the Fed cut rates this week.

Not because the economy is falling off a cliff, and not because unemployment ticked higher. (Higher unemployment numbers occurred because the government is now beginning to count illegal aliens in the number of unemployed people).

Anyone else getting frustrated with data manipulation?

But we digress.

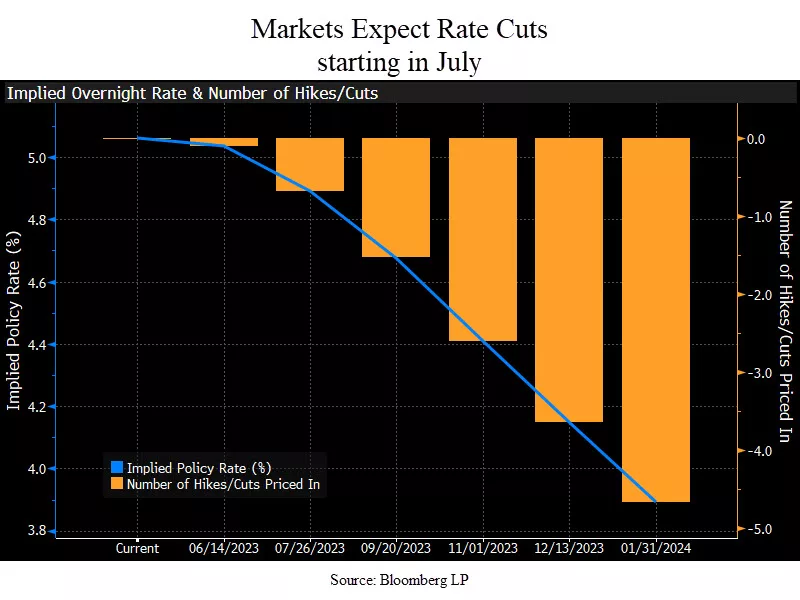

With the cut this week, the Fed simply made the rates more in line with what the market is telling them they should be, and it appears the Fed is doing two things:

- The Fed is continuing to normalize interest rate policy after the chaotic inflation during COVID (caused by the Fed and other government policies).

- The Fed Funds rate is substantially higher than the 2-year Treasury yield, implying that the Fed is too restrictive with current rates, especially given the decline in inflation.

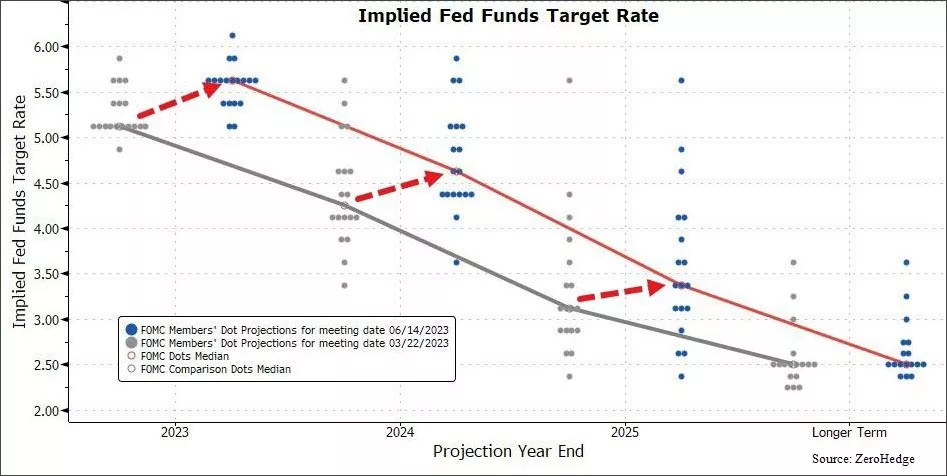

Our first chart shows these two yields.

This chart shows the 2-year Treasury yield (orange) versus the Fed Funds Rate (blue).

When the 2-year Treasury is higher than the Fed Funds rate (on the left side of the chart), the Fed is being restrictive in its policy. This is because the market is pricing in rates that are higher than what the 400 PhD. economists at the Fed think should be the proper rate.

The opposite is also true. When the 2-year Treasury yield is lower than the Fed Funds rate, they are being restrictive, as the market is telling them that rates should be reduced.

That has been the case for all of 2023 and 2024.

In this sense, the rate cuts were justified.

If we don’t see any further deterioration in the economy, this rate cut should be bullish.

Based on the initial reaction in stocks, the market agrees.

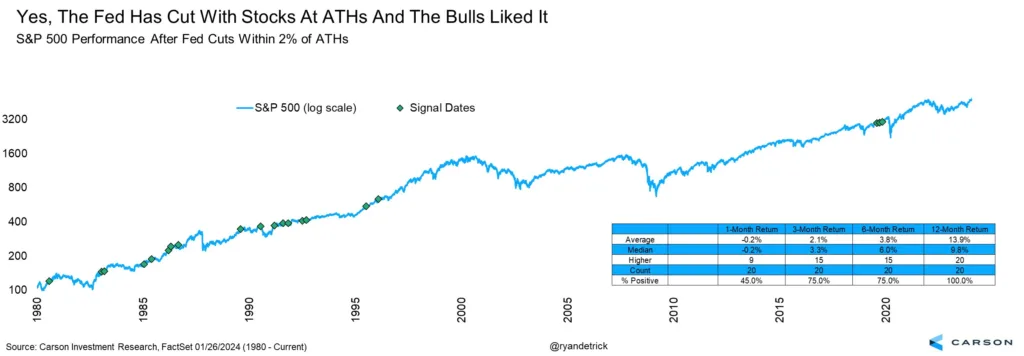

Normalization cuts overwhelmingly happen at or near all-time-highs, and they typically don’t signal an end to the bull market.

What has happened in the past when the Fed cut with markets at highs?

Rate Cuts with Stocks at All-Time-Highs

Another important data point when it comes to rate cuts is the timing of the first cut.

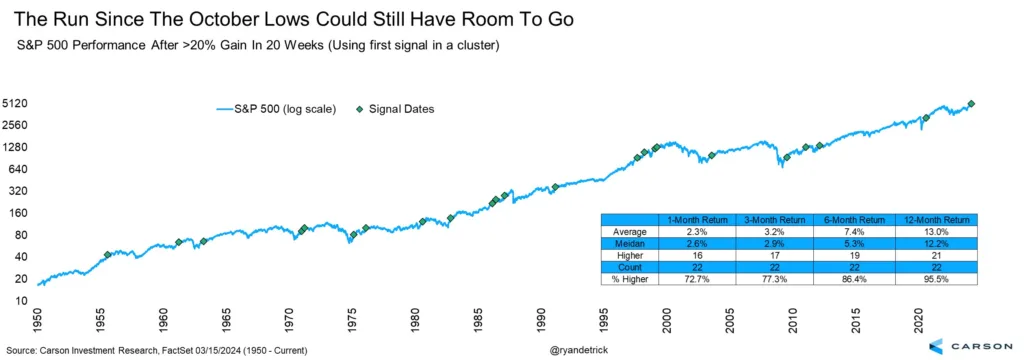

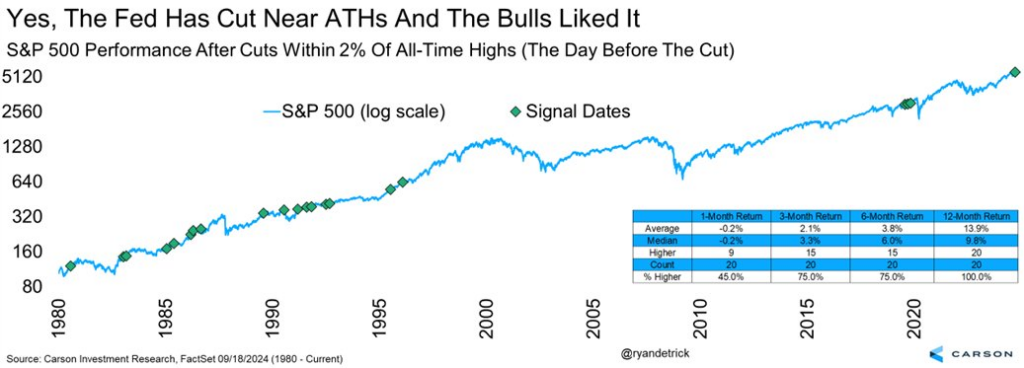

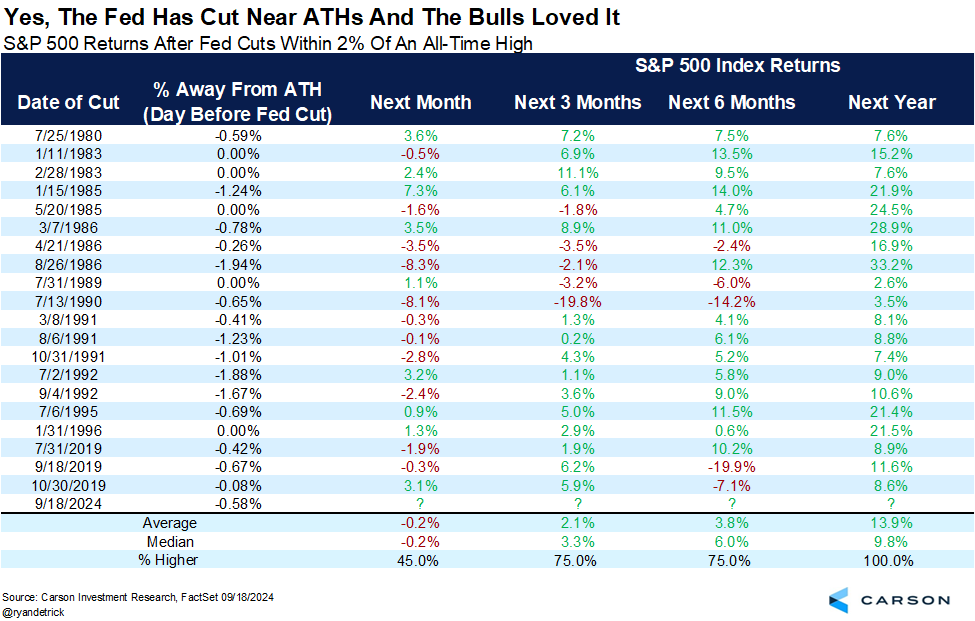

Our friend, Ryan Detrick, with the Carson Group, consistently has excellent charts about historical market reactions.

The two charts below show the times since 1980 that the Fed has cut rates when the S&P 500 Index was within 2% of an all-time-high.

Historically, when the Fed cuts rates with markets at all-time-highs, the market is higher one year later 100% of the time with an average gain of nearly 14%.

Bottom line is that being bearish on the markets at this point does not appear justified by the data.

Again, this can change and change quickly.

But for now, things look pretty good.

What Does Well After the First Rate Cut?

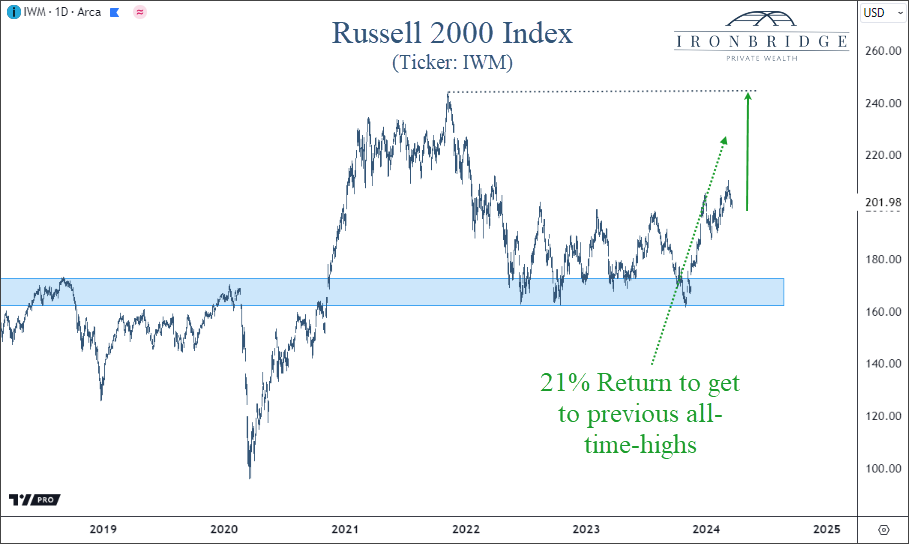

Another bullish development over the summer was a broadening out of participation in the bull market.

We have consistently been saying that small cap US stocks should play catch-up to the mega-cap tech that has done so well over the past two years.

This is supported also by stock performance after the first rate cut.

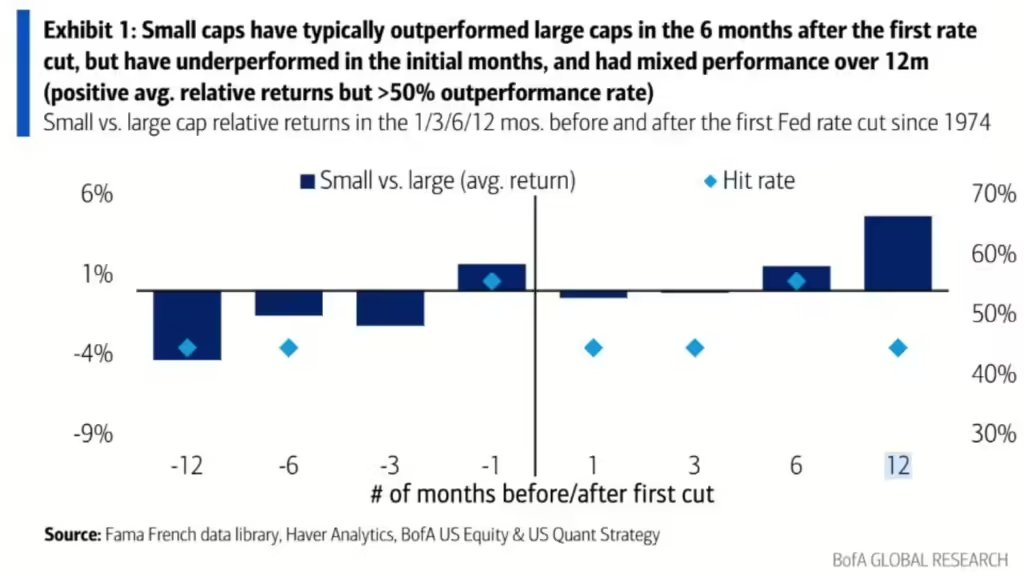

The next chart, courtesy of Bank of America, shows that small caps tend to outperform following the first rate cut.

This chart shows that over the next 6 and 12 months, small caps should outperform large caps if this historical relationship continues.

The reason this works is that smaller companies are more sensitive to bank interest rates than their large counterparts.

A 0.50% decrease in interest rates go mostly to the bottom line for smaller companies with debt.

This increases profitability and free cash flow, so it is logical that this would be the case.

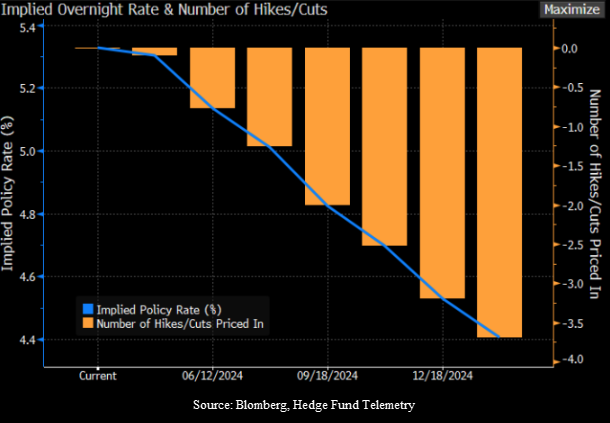

More Rate Cuts?

Should we expect more rate cuts?

The real discussion is around the future path of interest rates.

Some people are predicting another 2% of cuts by the end of 2025.

It is our position that if we see another 1-2 rate cuts of 0.25% each, that would signal that we are likely headed to a recession.

It also would make sense that the Fed did a larger, 0.50% rate cut (instead of just 0.25%), so they wouldn’t have the appearance of propping up markets too close to the election.

Bottom Line

Bottom line is that this cut does not appear to be a signal that doom and gloom is headed our way.

That can happen, but the probabilities are not high that it will.

Instead, this rate cut looks like a normal response to declining inflation, and not a signal that the economy is deteriorating.

The market will now start to focus on earnings and the election.

We’ll put out another report discussing the election in the next few weeks.

Until then, invest wisely!