International Women’s Day started over 100 years ago as a labor movement in New York City.

Women workers in the needle trades began to demand fair wages and workplace limits and protections. Women did not have the right to vote, so to effect change and call attention to the cause, they organized a march through New York City’s Lower East Side.

From the beginning, women’s day has focused on economic equality across every dimension of life, education, and work.

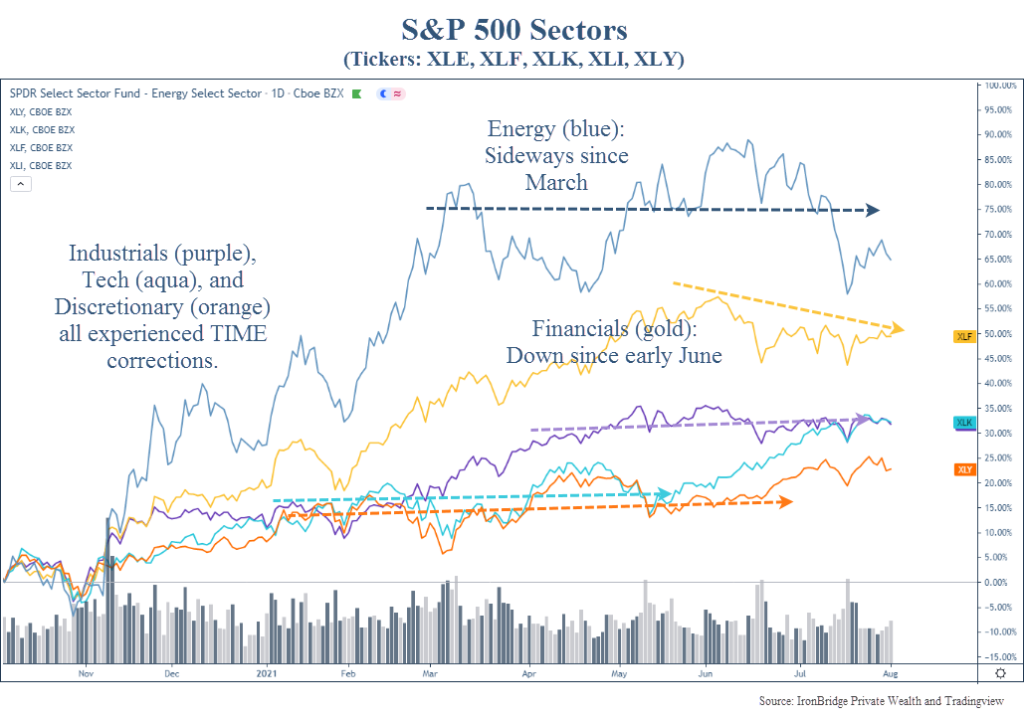

There is excellent news on increasing women’s participation in traditionally higher-paid, male-dominated professions. The now decades-long focus on encouraging STEM education for girls and women has dramatically increased participation in related vocations.

The U.S. Census Bureau reports that while overall women’s workforce participation is up slightly in the 20 years between 2000 and 2019, certain careers have seen tremendous inflows of women. The number of women becoming veterinarians has doubled. Women are becoming chemists and other scientists, mathematicians, and dentists at impressive growth rates.

As women enter higher-paid professions at increasing numbers, they lower the gap between male and female salaries. And as women are creating their wealth, they are doing it in ways that reflect their lifelong needs, habits, and goals. These are – and should be – different from men at every life stage.

Here’s our round-up of some things women should consider as they work to create lasting wealth at every stage of their financial journey.

The Early Stage of Your Career

Income has likely increased substantially, but debt is often still significant at this stage. One other danger is “lifestyle inflation” – being careful to live within your means and save for the future is the foundation of wealth. Your goal in this stage is to create financial security as a baseline and then work to build flexibility. You may want to change careers, go back to school, even take time off. Saving and investing can make those choices possible.

- Lower Debt. Strategies to lower debt quickly include refinancing to a lower interest rate, paying more than the minimum every month, and automating your payments.

- Create a Cash Flow Plan. This isn’t about budgeting – it’s about lining up your money with your short- and long-term goals. Especially if you have lumpy income from bonuses or variable work hours, you’ll want to map out a strategy to put your money to work. Hint: open separate bank accounts to align with goals.

- Take Advantage of Employee Benefits. Employee benefits are where it’s at to increase income and reduce taxes. Contribute at least enough to a 401(k) to get the employer match and strive for 15% of salary. Take advantage of healthcare and commuter benefits.

- Begin Saving. Saving into an emergency fund is critical. Automate the process until you have 3-6 months of saved income.

The Mid-Career Stage

For most women, mid-career is the busiest stage. You’re focused on work, but you’re also likely getting married, having kids, buying a home, etc. Besides being the mainstay of your partner’s and kid’s lives, you need to be the CEO of your career to be sure you get paid what you deserve and that you can have the career flexibility you want.

- Love and marriage (and finances). Yours, mine, and ours is how you create trust and set a precedent for open, honest conversations about money and goals. Begin the conversation before you get married.

- Maximize retirement savings as soon as possible. Women have longer retirements. If you’ve left the workforce and your spouse is still working, contribute to a spousal IRA annually to keep retirement saving on track.

- Put Investing on a Schedule. Open a taxable investment account and set up an automatic contribution schedule. Be thoughtful and understand your risk parameters – but get invested.

- Proactively Advance your Career. Benchmark your career every year. Don’t wait to get promoted or get a raise. You can hire a consultant, build a relationship with a good recruiter, or use Linkedin effectively.

Retirement Planning

It’s finally here! You’ve built a solid retirement savings account; now you’re ready to enjoy your new life. Setting up income in retirement looks different for women than for men, because of their longer life expectancy. Think through:

- Social Security Income. Delay claiming social security if possible. This can provide a much larger lifetime benefit.

- Consider working for a few years. Social security bases your benefits on your 35 highest-earning years, so replacing an early career year with a much more highly paid later year can bump up your payments.

- Life Insurance. If you’re married, think about a spousal life insurance policy.

- Long Term Care Insurance. Get a long-term care policy in place.

- Estate Planning. Update your estate plan and talk through everyone’s wishes for what will happen as you age. Doing it now while you’re healthy and creating a funding source will help ensure a graceful, happy older stage.

The Bottom Line

Women continue to make tremendous progress on all fronts while guiding and leading us towards a more inclusive world. Taking time to take care of your finances at every stage can put you on the path to lasting wealth.

This work is powered by Seven Group under the Terms of Service and may be a derivative of the original. More information can be found here.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation.