Following a strong year in 2023, financial markets enter 2024 with strong momentum. Will this momentum continue? Or will one of the risks push the market off it’s high wire?

In our 2024 Outlook report, we discuss the following:

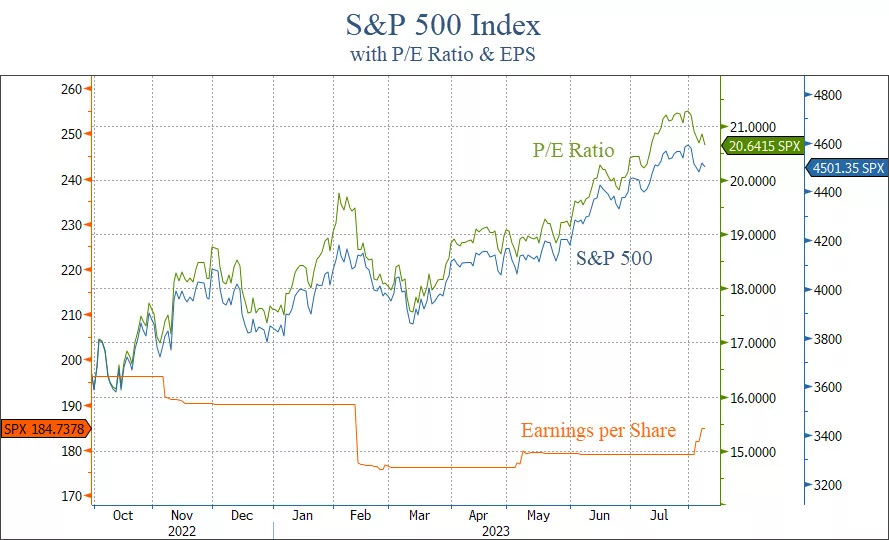

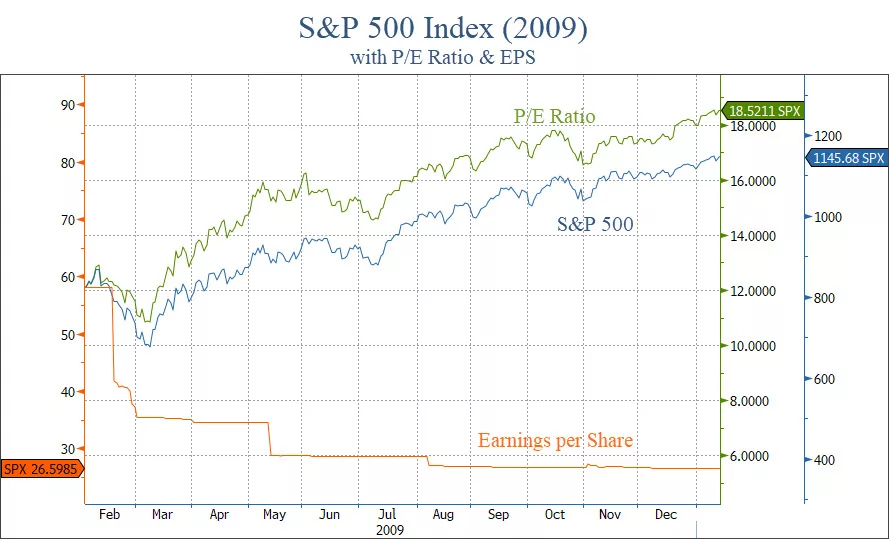

- S&P 500 – New Highs are Bullish

- Liquidity Waterfall

- Small/Mid Caps Look Attractive

- Financial Conditions are Loose

- Signs of Stress not Apparent

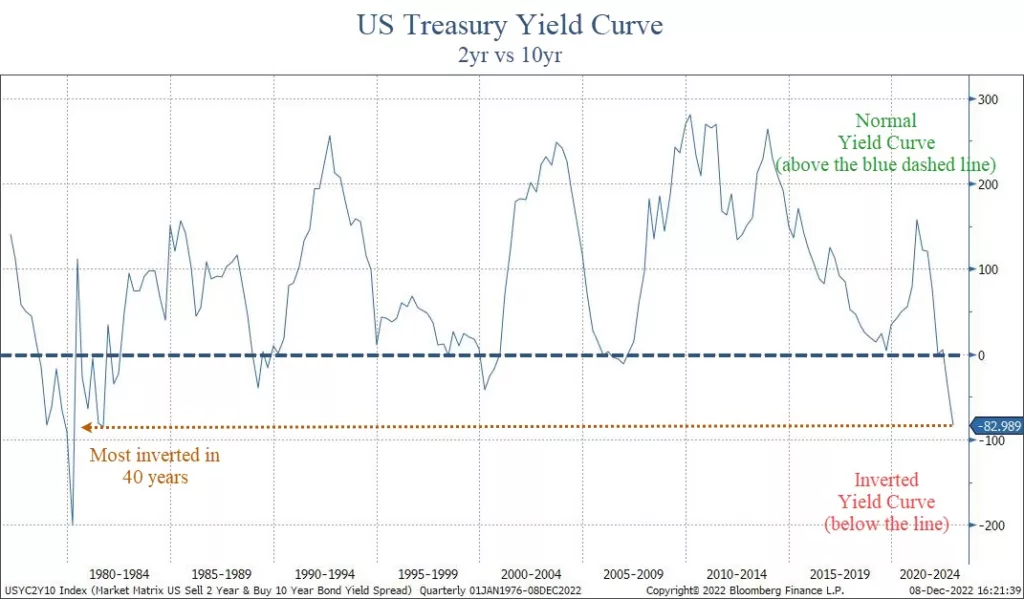

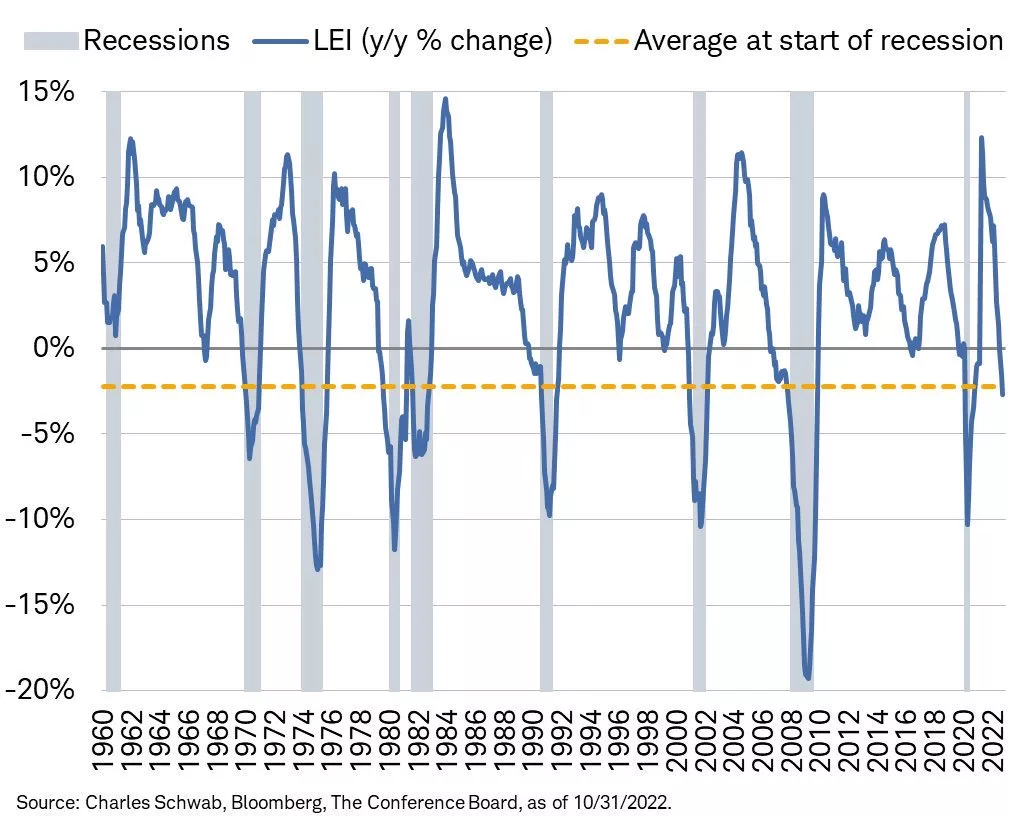

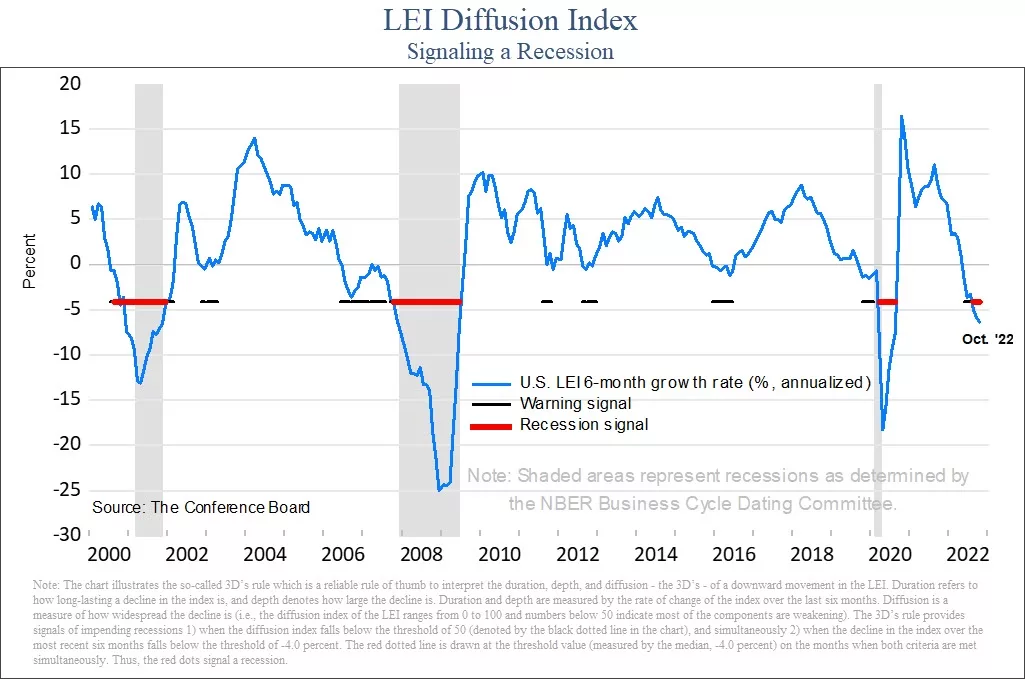

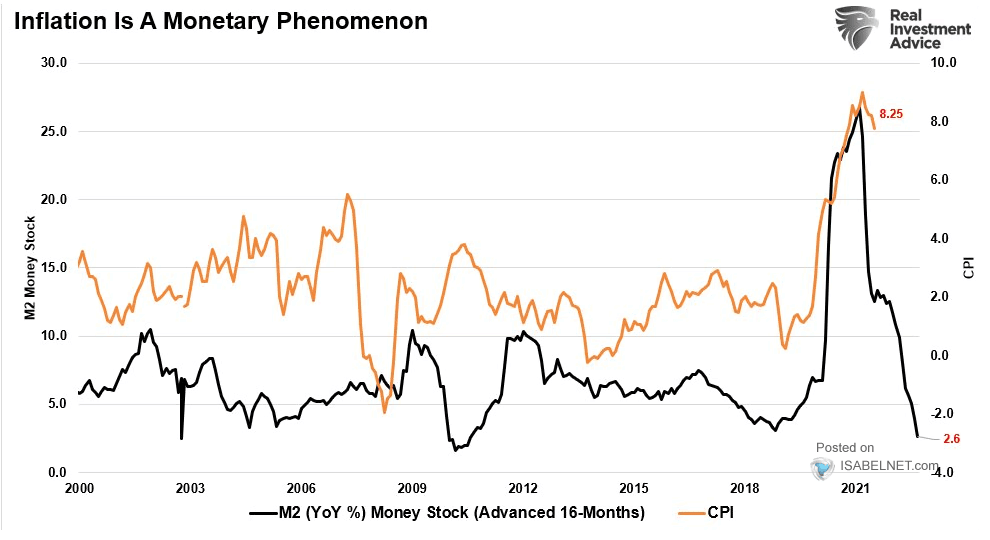

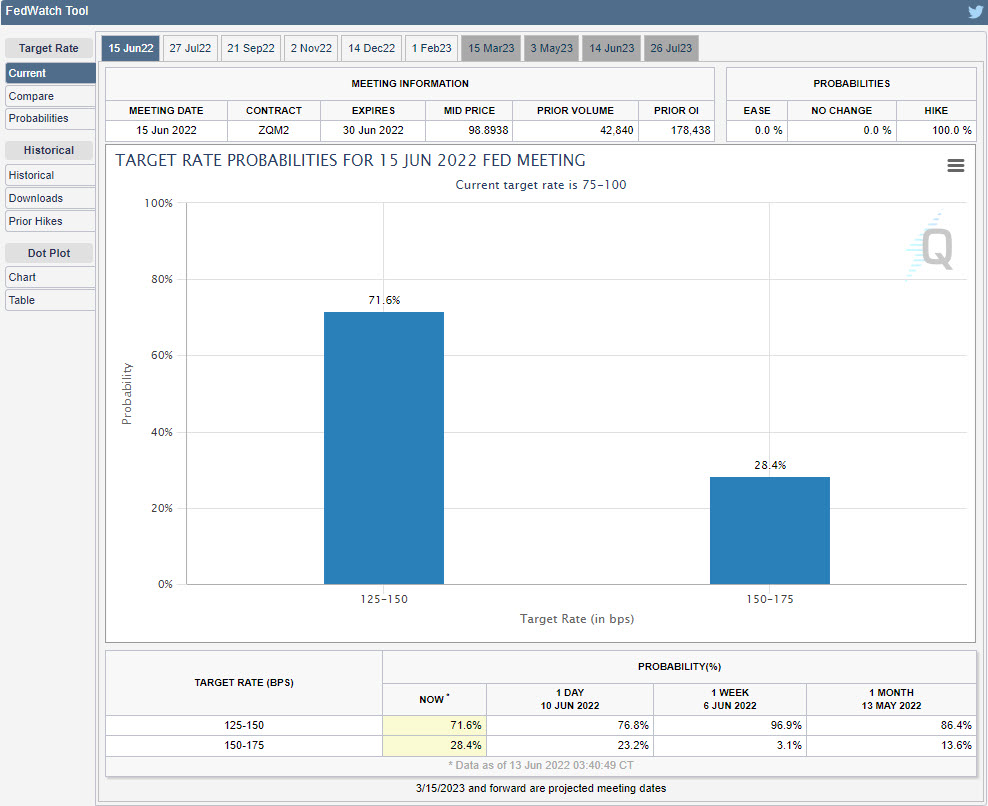

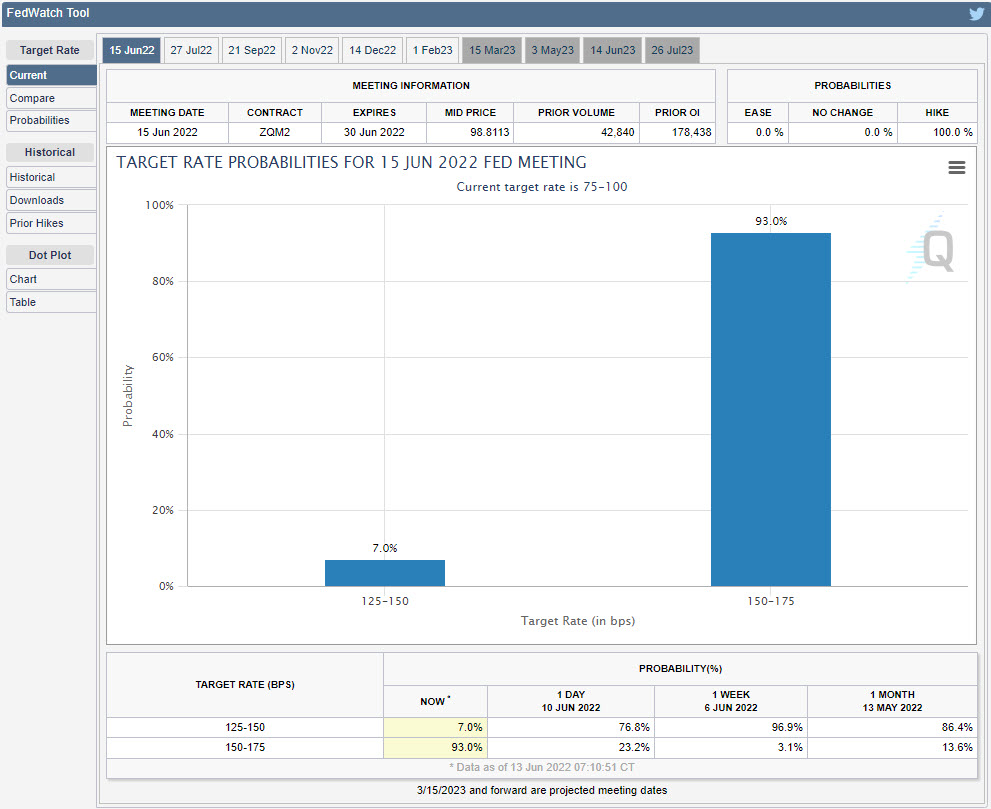

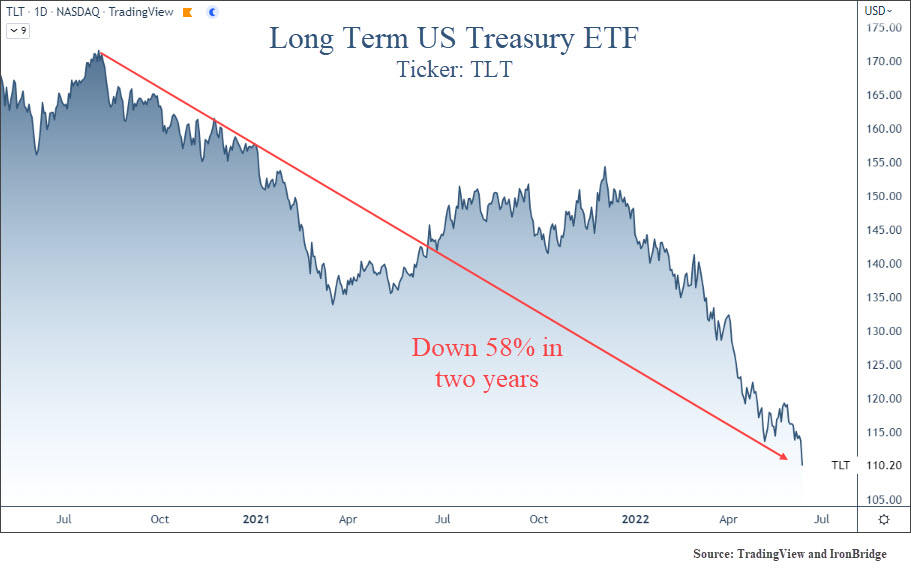

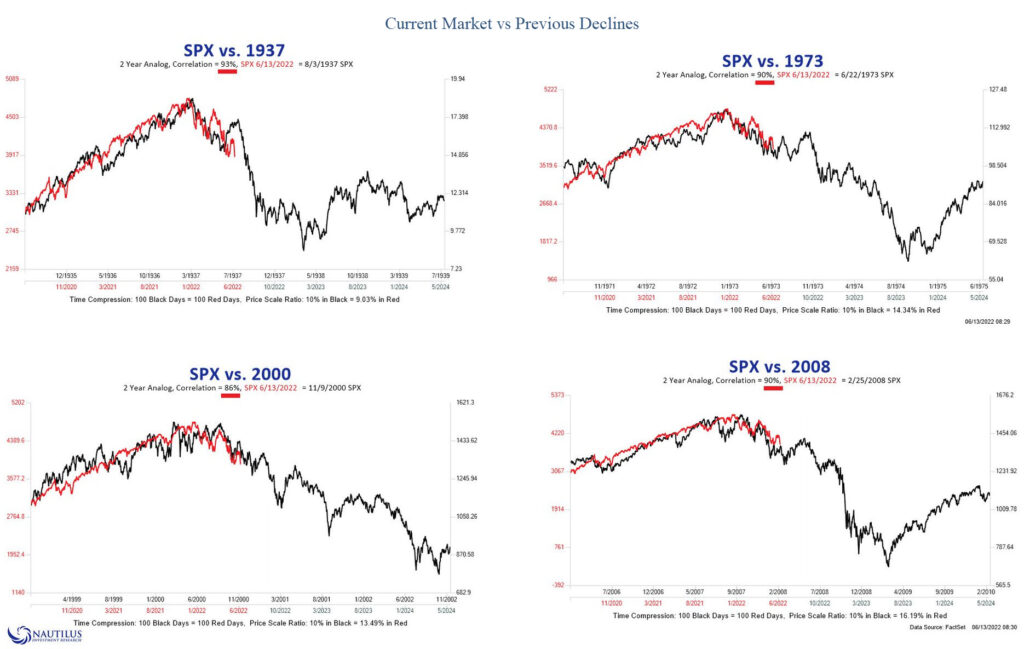

- Risk #1: Inflation & Interest Rates

- Risk #2: Commercial Real Estate Risks

- Risk #3: Presidential Election

- Risk #4: De-Globalization

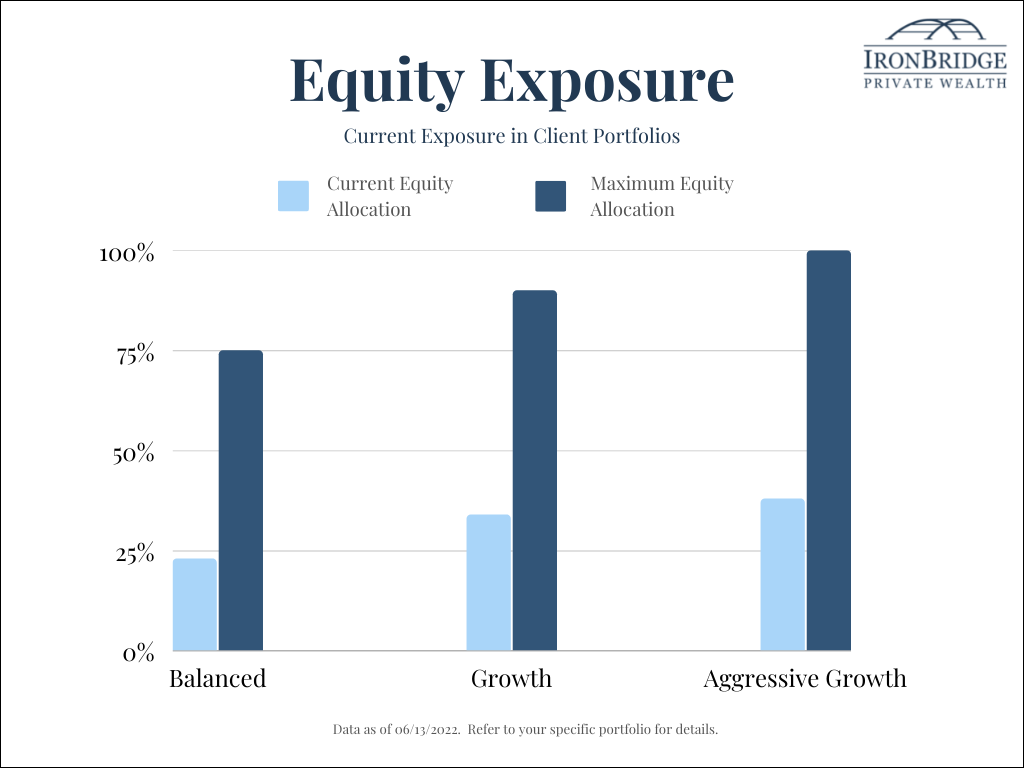

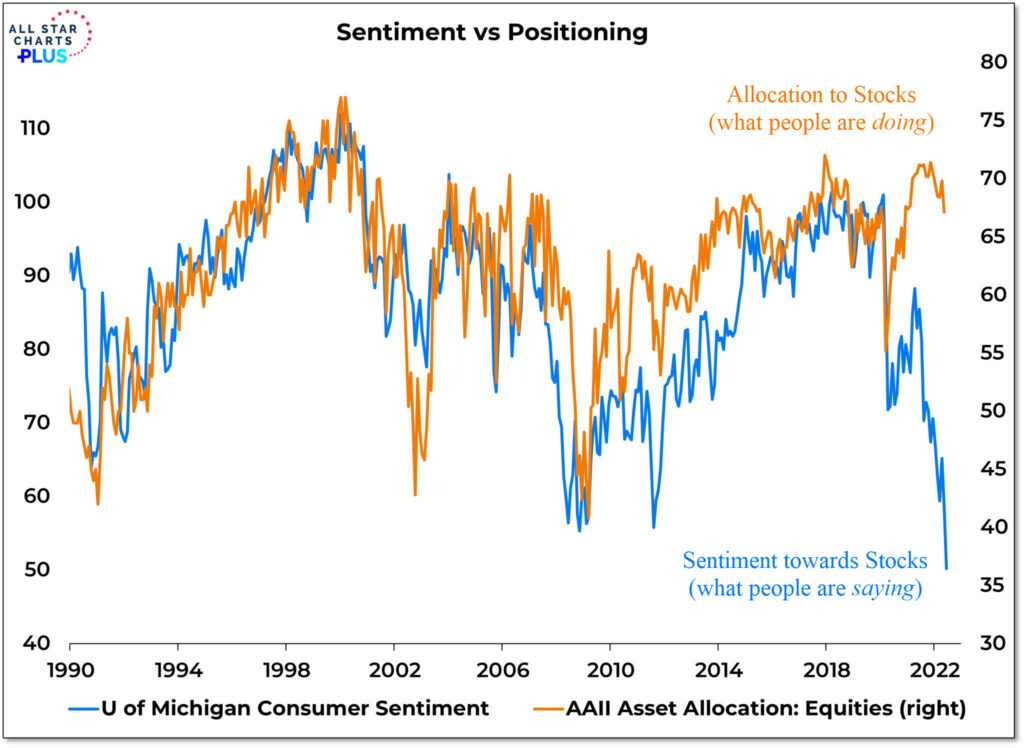

- Positioning

- Answer Your Questions

Invest wisely!