Stocks had the worst day since the depths of COVID after inflation data came in higher than expected.

We’ll discuss the following in this report:

- Market Overview

- What is the Reason for the Decline?

- Portfolio Updates

Let’s get to it.

Market Overview

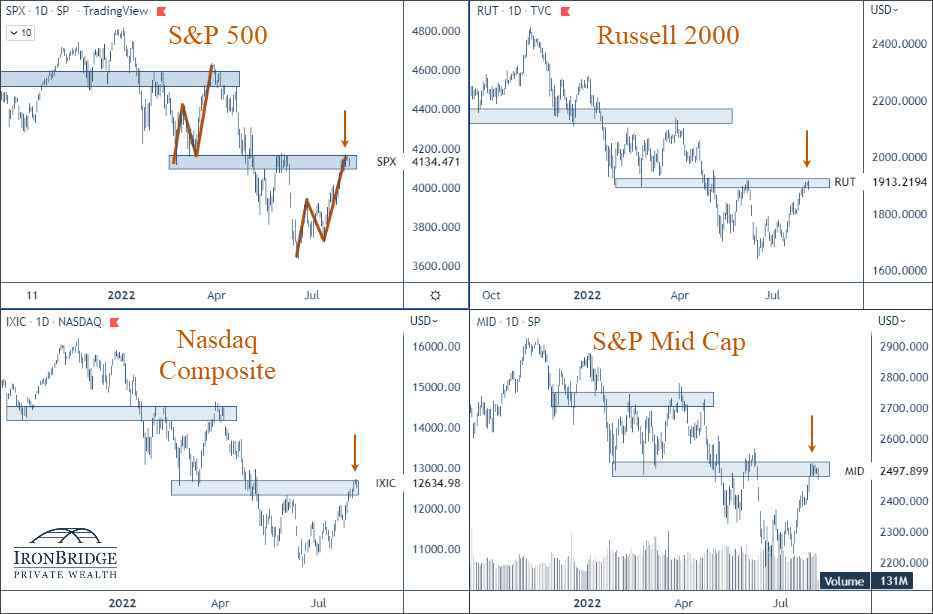

Major stock indexes had huge losses today:

- S&P 500 Index: Down 4.3%

- Dow Jones: Down 3.9%

- Nasdaq: Down 5.2%

Wow.

These are the biggest daily losses in over two years.

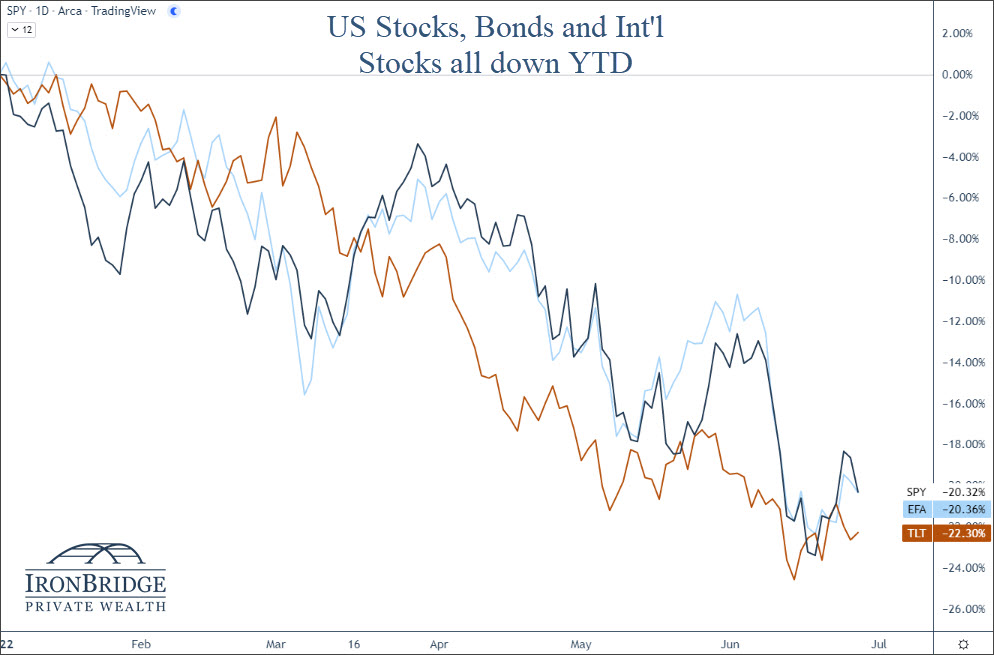

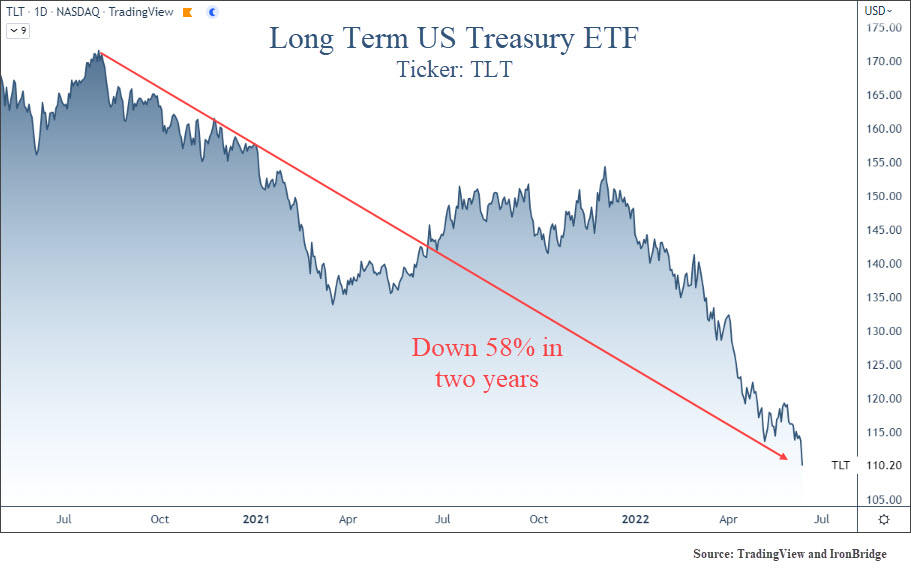

Bonds fell, international markets fell, commodities fell…everything was down.

This has not been a healthy market this year, and it looks to be worsening.

What is the Reason for the Decline?

The financial media is blaming inflation.

This morning, the Consumer Price Index (CPI) came in at 8.3% year-over-year, versus expectations of an 8% increase.

But do we really think the market would be up today if inflation was 7.9%? Is that 0.4% difference the real issue here?

We don’t think so.

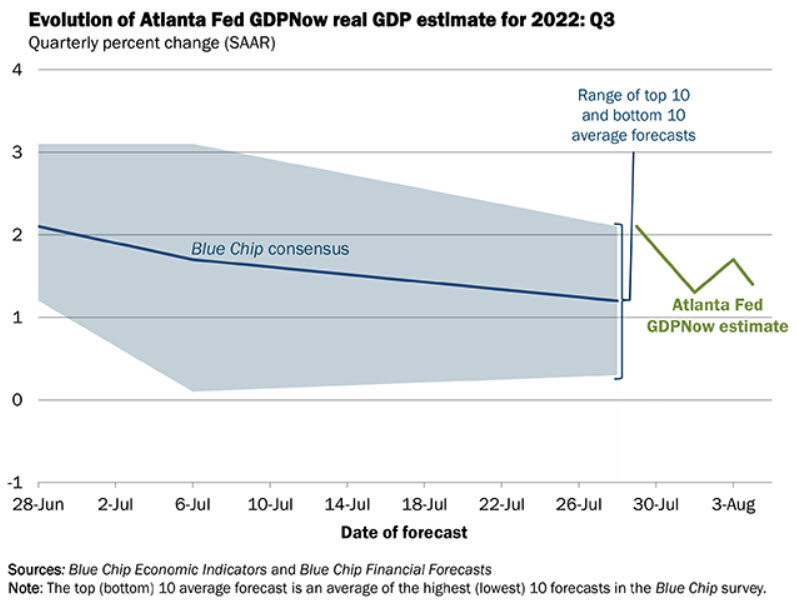

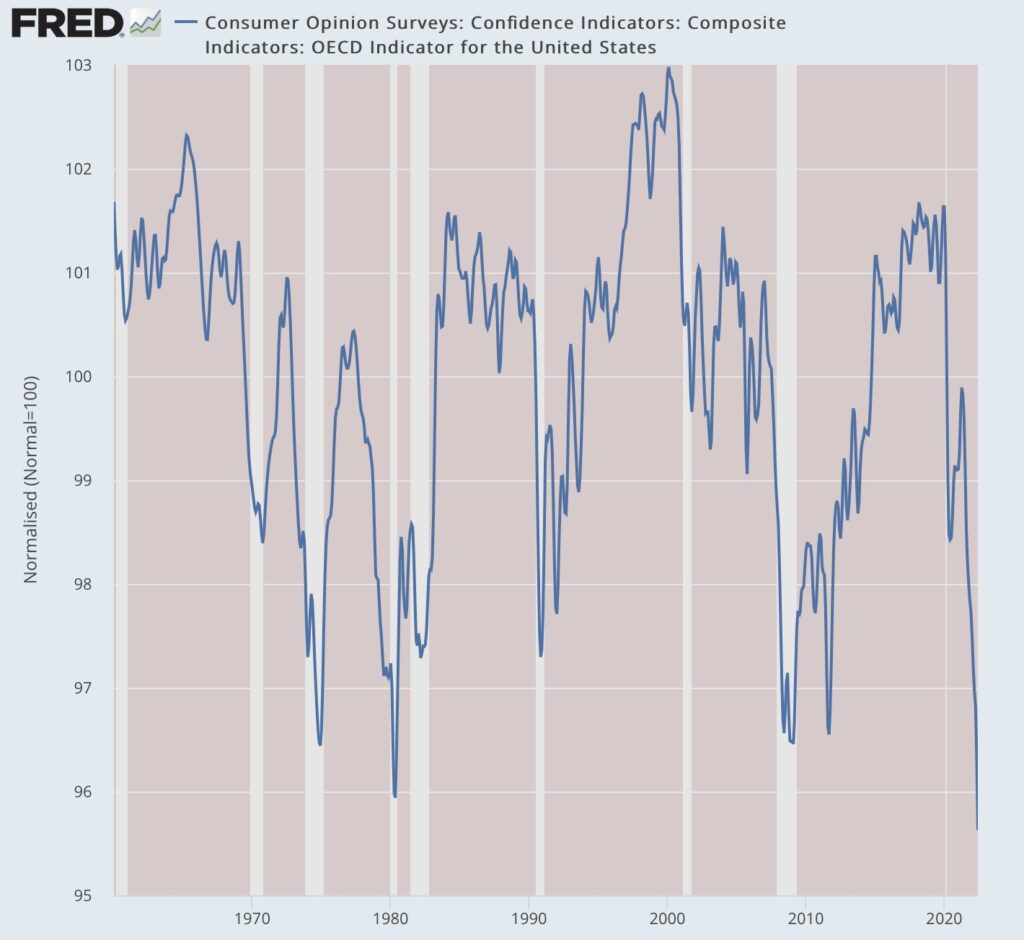

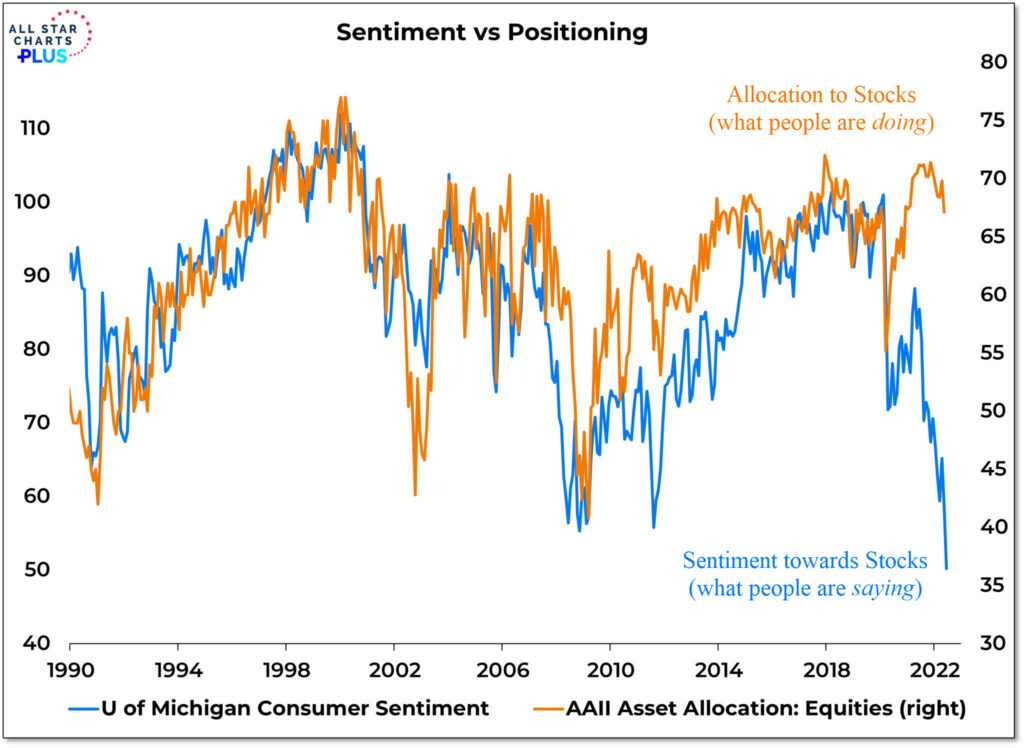

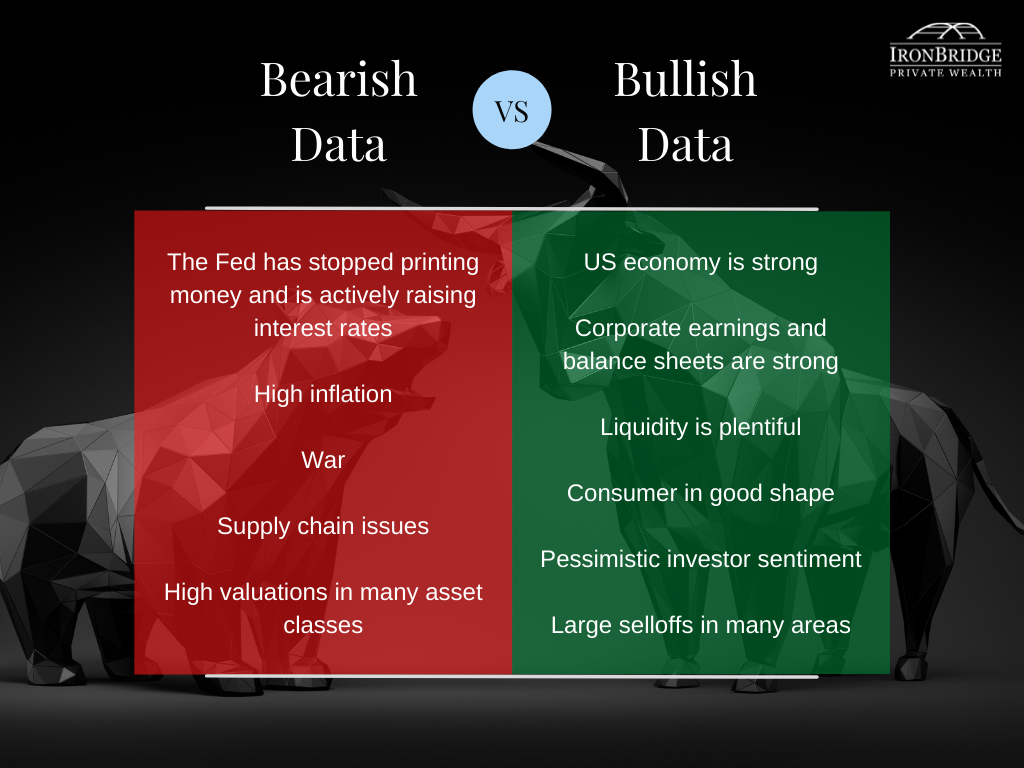

Instead, we suggest that there is one main thing happening now: LIQUIDITY is being removed from the financial system by the Federal Reserve.

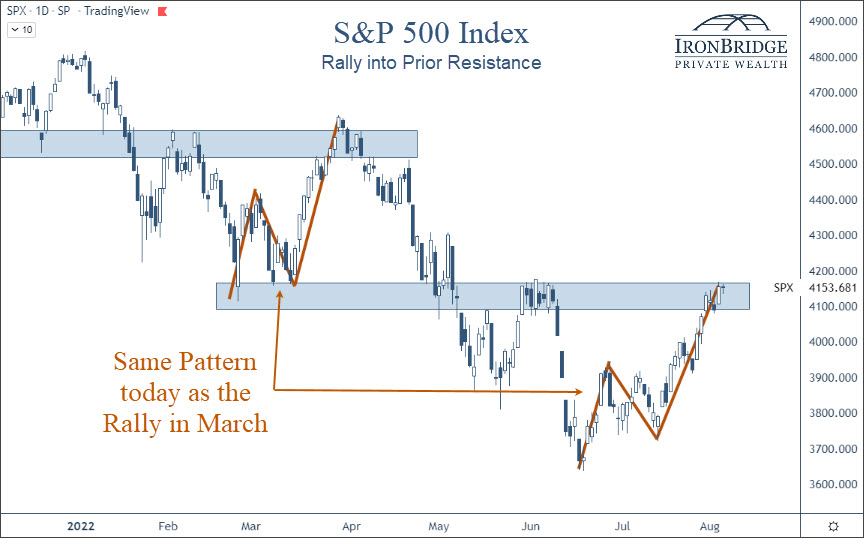

The strong rally in equity markets over the summer was based on the thought that the Fed would slow down the pace of interest rate increases.

This was wrong and illogical thinking.

The Fed has been very clear about this over the past three months.

They are actively trying to remove speculation from markets, in the attempt to reduce demand and drive down prices.

They WANT prices in the economy to fall. They WANT markets to fall. And they won’t stop until inflation is back down to 2%.

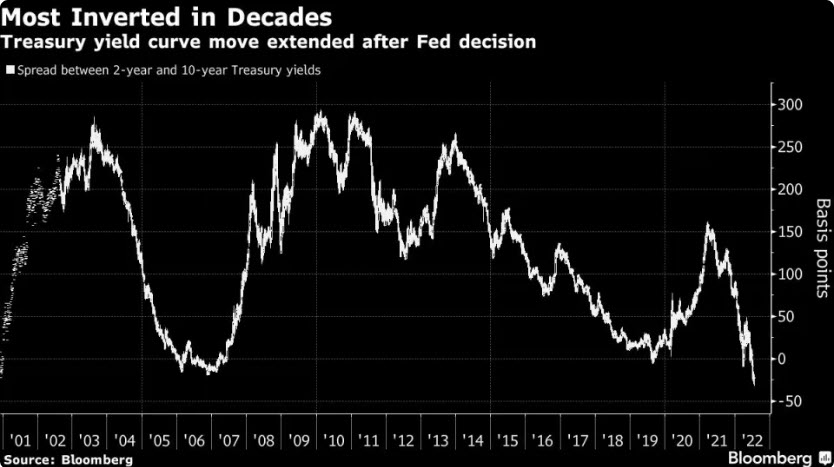

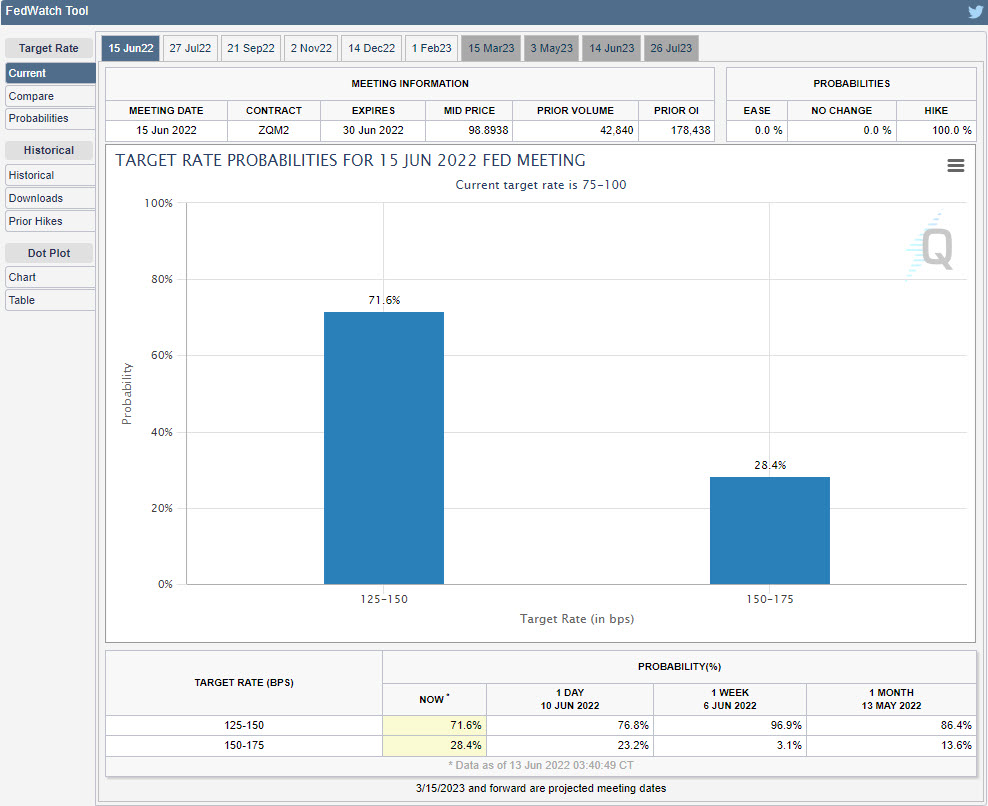

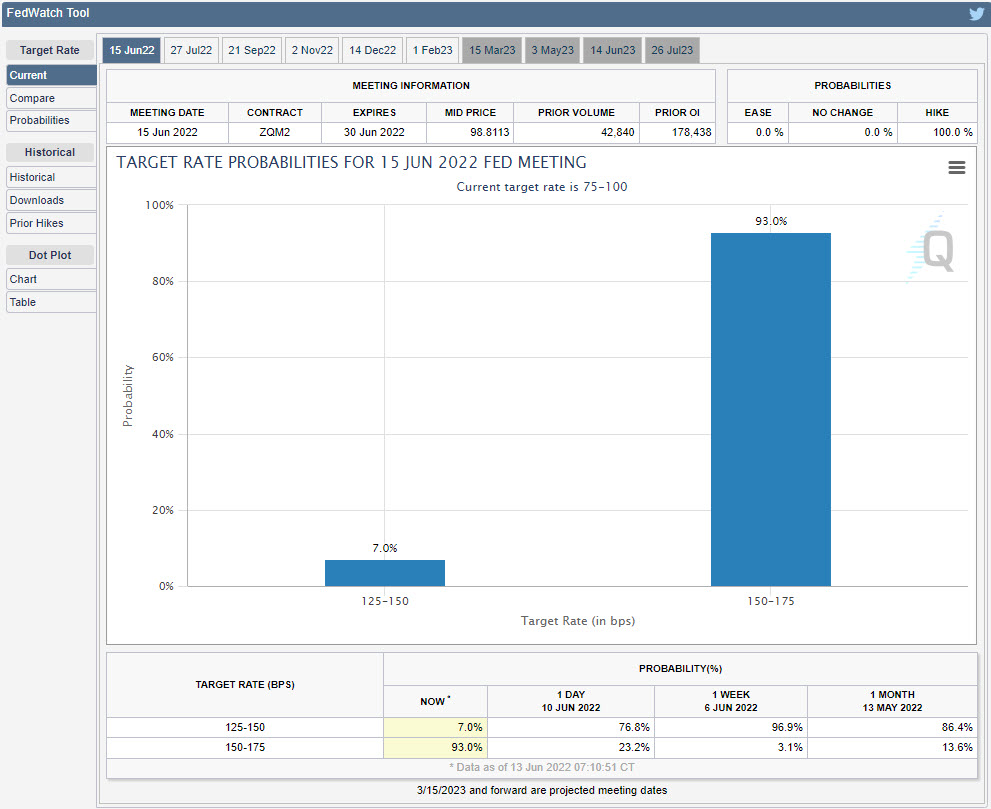

After today, there is a 100% chance that the Fed increases rates by 0.75% next week, with a 34% chance they raise a full one percent. They are not slowing down the pace of rate increases, they are increasing it.

The Fed also increased “Quantitative Tightening” this month. They are scheduled to remove almost $100 billion in liquidity from the financial markets in September alone.

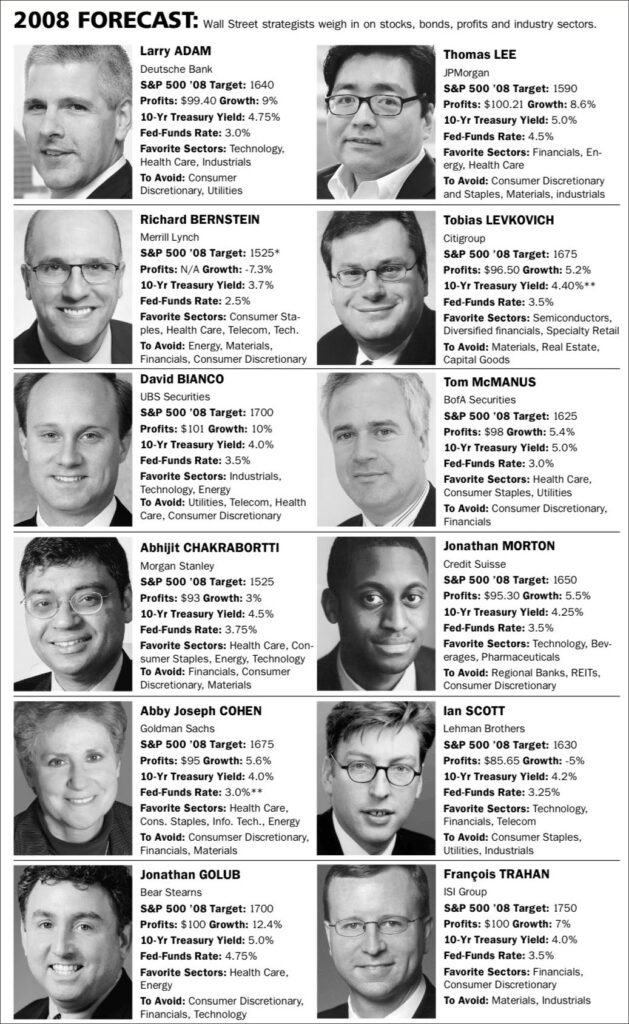

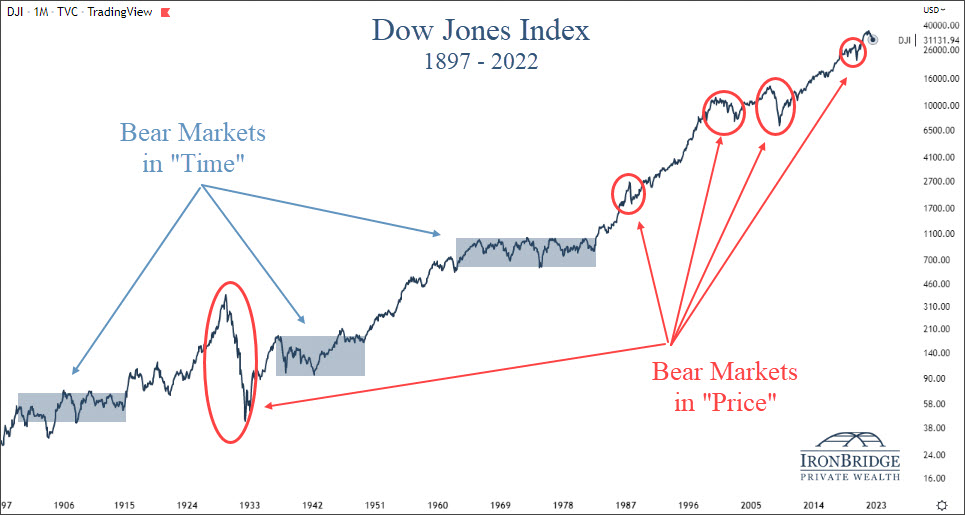

The message in the 10 years after the 2008 financial crisis was “Don’t fight the Fed.” They were printing money like it was a monopoly game, with the goal of increasing asset prices to increase demand.

Now, we have the opposite environment, and the Fed is REMOVING assets from the financial system.

The natural result is decreased demand for risk assets.

But the message is still the same…don’t fight the Fed.

Portfolio Update

This year continues to be volatile, and we expect that to continue.

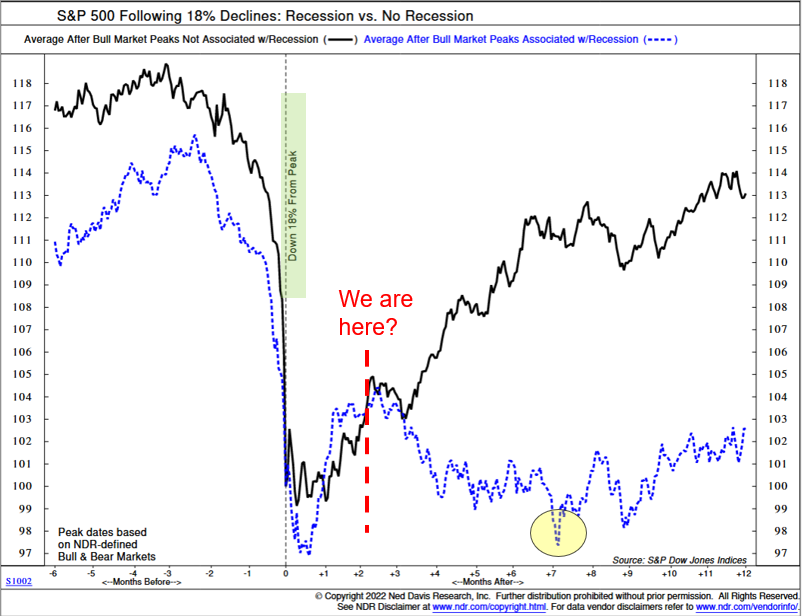

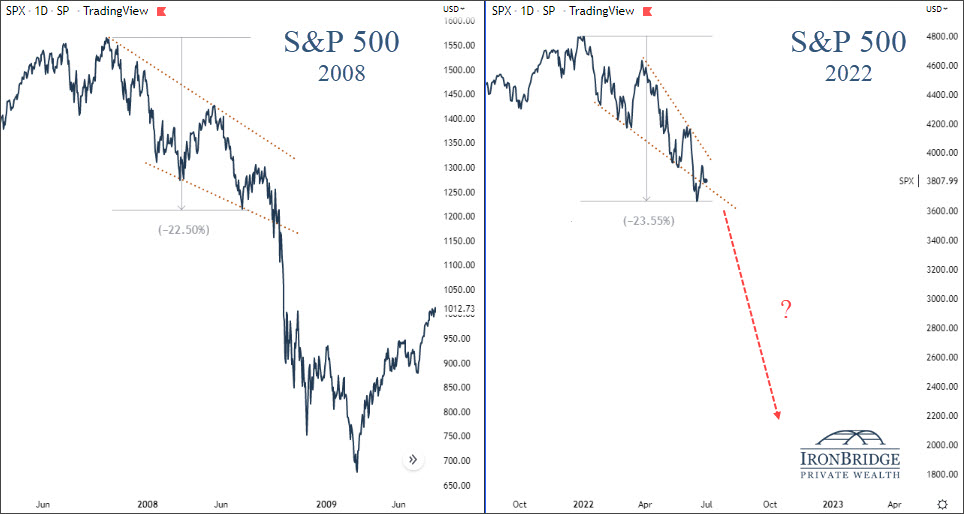

- As we shared in our video last Friday, the market is very volatile (obviously), and the outlook is uncertain. Two of our three highest probability scenarios include major declines in financial markets from here. The link to our video is below.

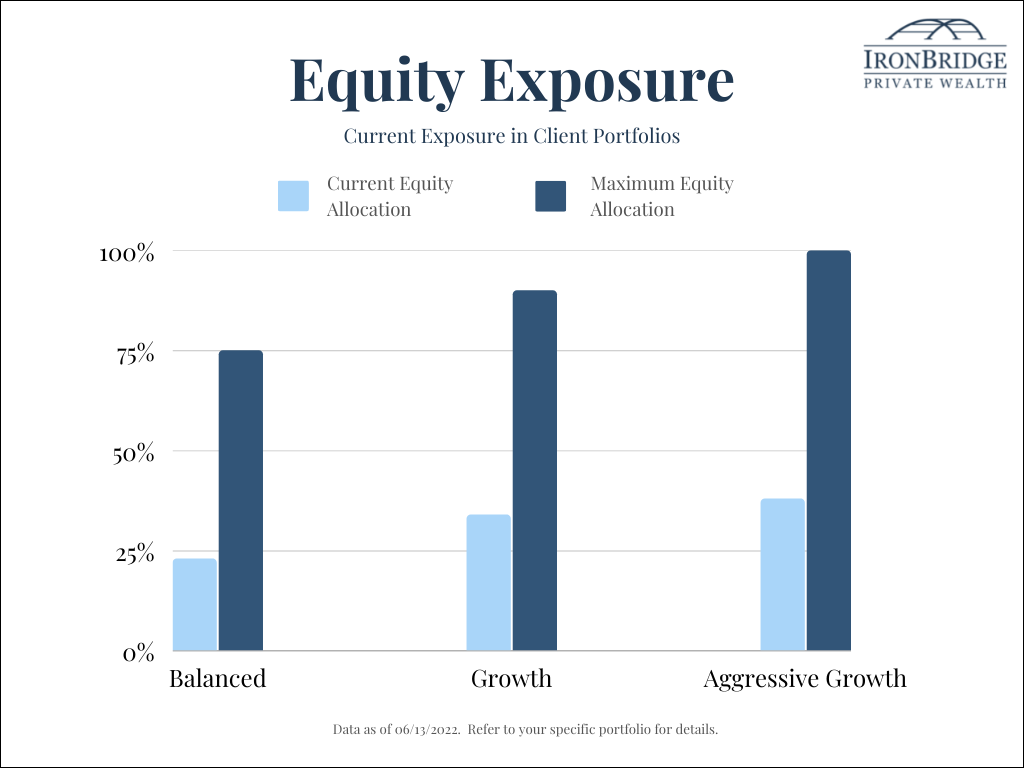

- We were already very defensively positioned in client portfolios with greatly reduced equity exposure and high cash and cash equivalent exposure. We increased cash exposure today as well.

- We see multiple scenarios where hedging positions will be included in client portfolios in the very near future. We also expect equity exposure to continue to be reduced from already low levels.

We discuss the following topics (followed by when they appear in the video):

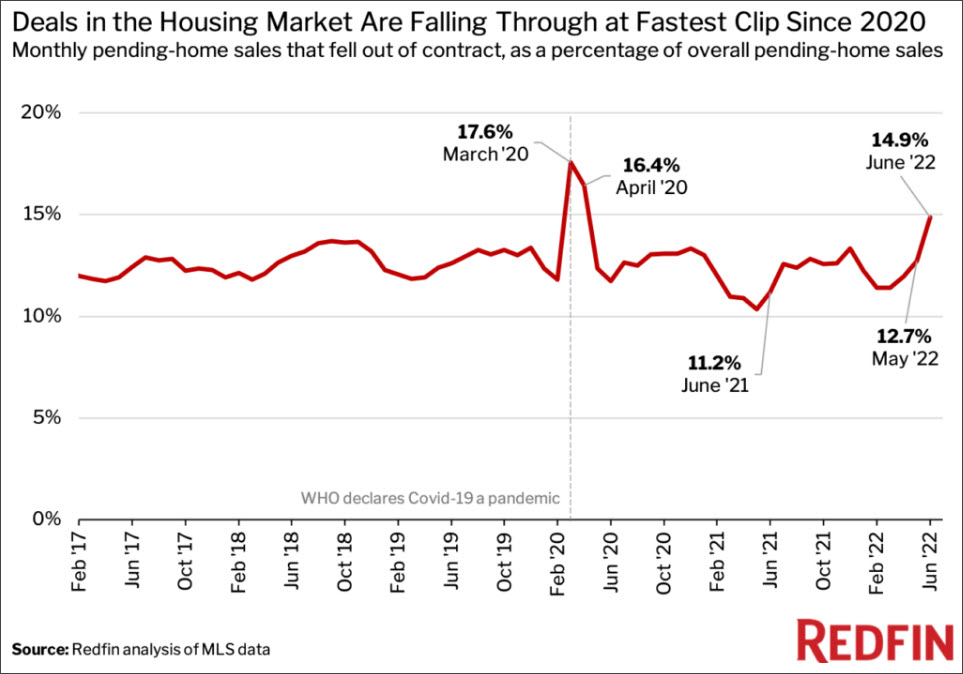

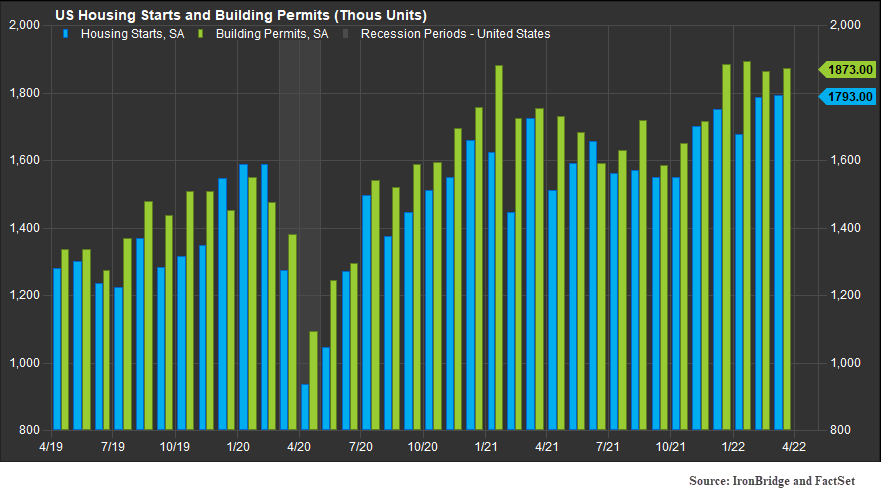

- Why the real estate market may be the best indicator to watch

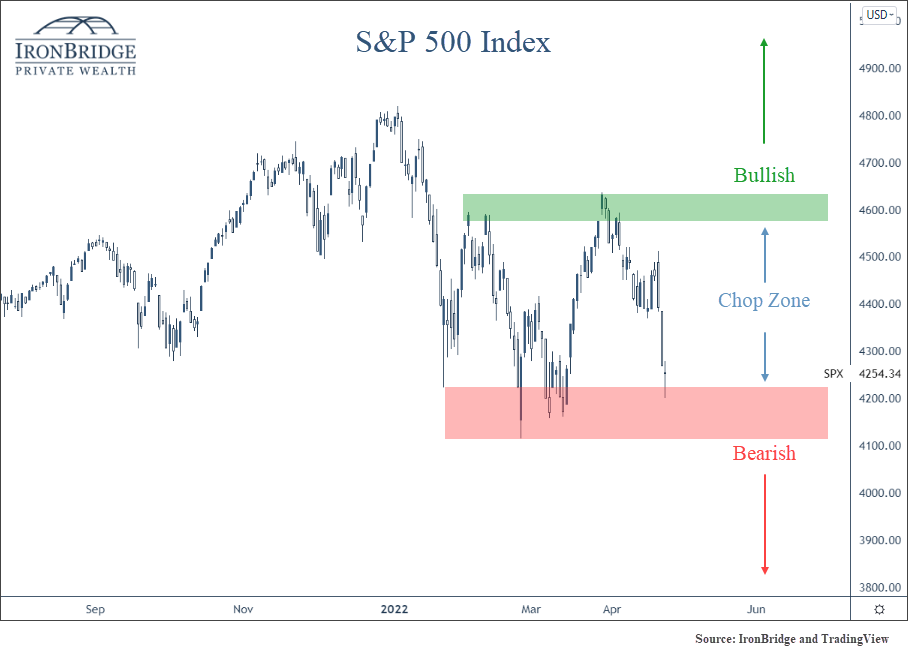

- S&P 500 Overview (4:46)

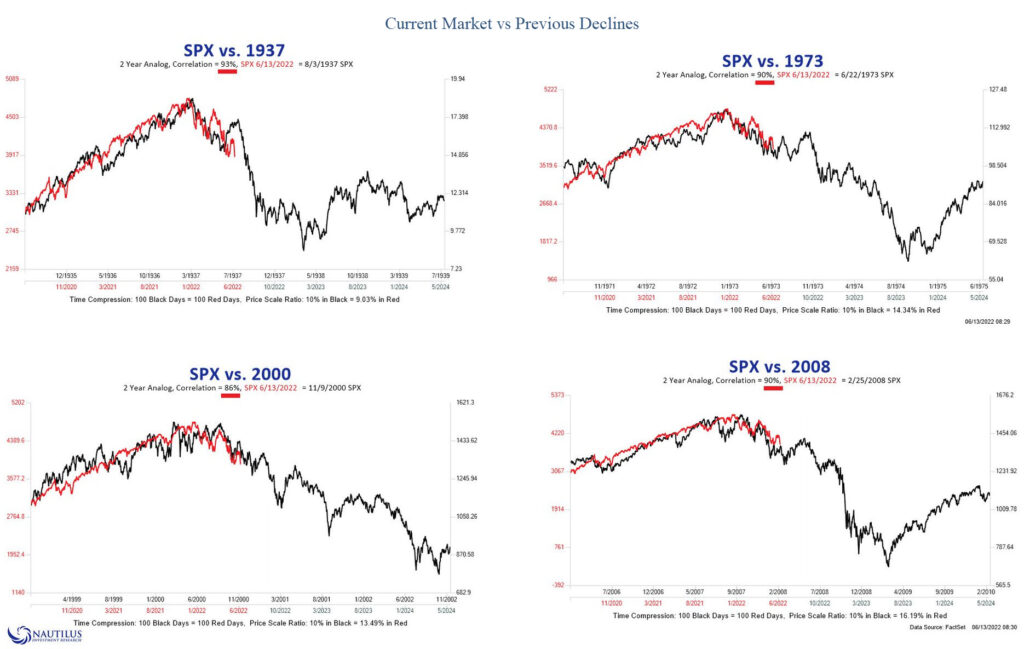

- Similarities between now and 2008 (6:30)

- Our top three potential market scenarios (8:15)

- Yield Curve (12:06)

- Commodities (13:05)

Bottom Line

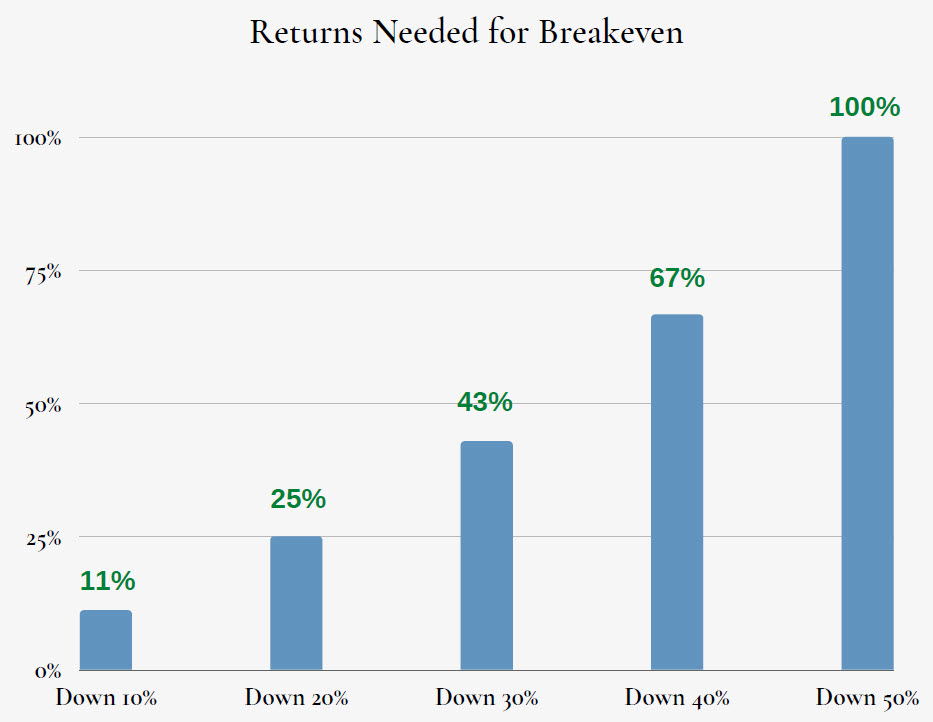

This is not a time to be thinking about increasing allocations to stock. This is a time to be defensive.

This market environments could easily reverse higher, but the likelihood is that there is far more downside ahead.

We hope we are wrong. If we are, we will adjust accordingly.

In the meantime, the worst possible action is to do nothing, keeping large exposure to stocks and HOPE things get better.

Relying on hope in bear markets is the best way to make an investment mistake that could jeopardize your financial plan and your financial future.

As always, please do not hesitate to reach out with any questions.

Invest wisely.