It’s generally thought that there are several cycles that reflect where a business is in preparedness for a sale. These capture the economy, the market, and the mindset and planning of the business owners.

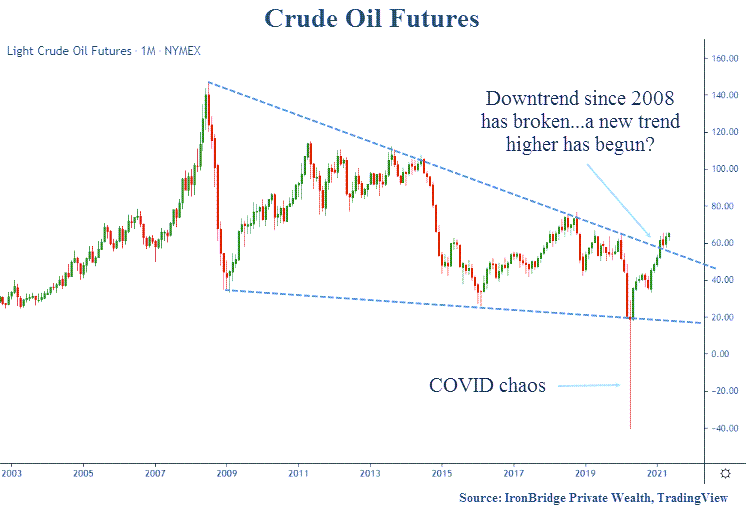

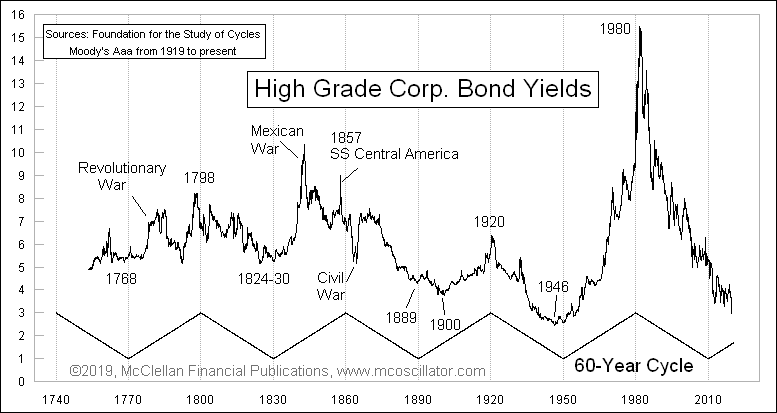

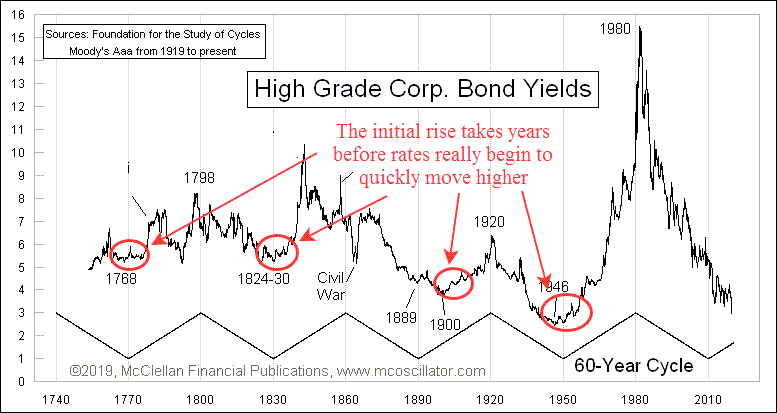

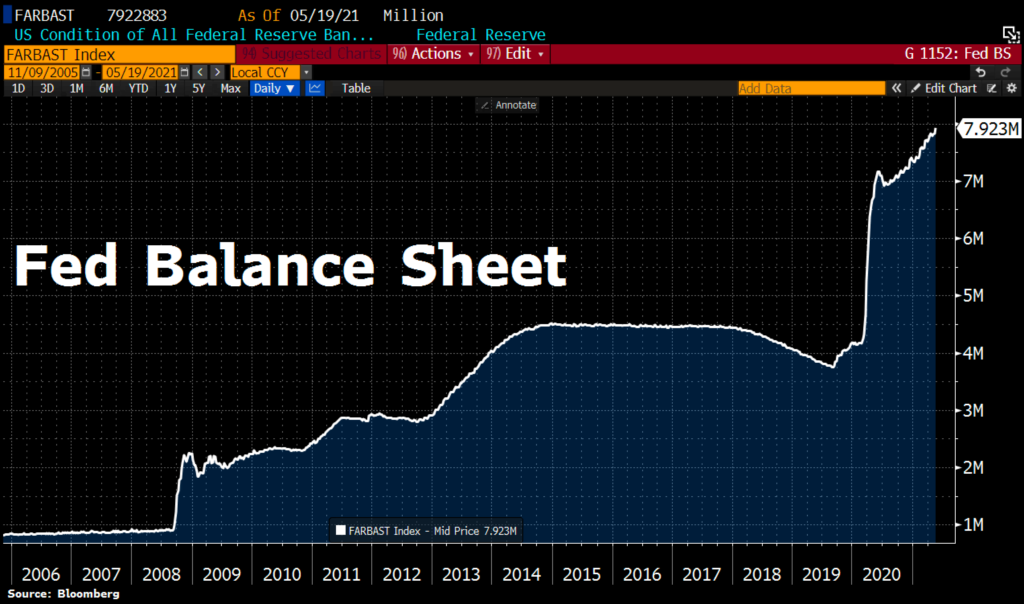

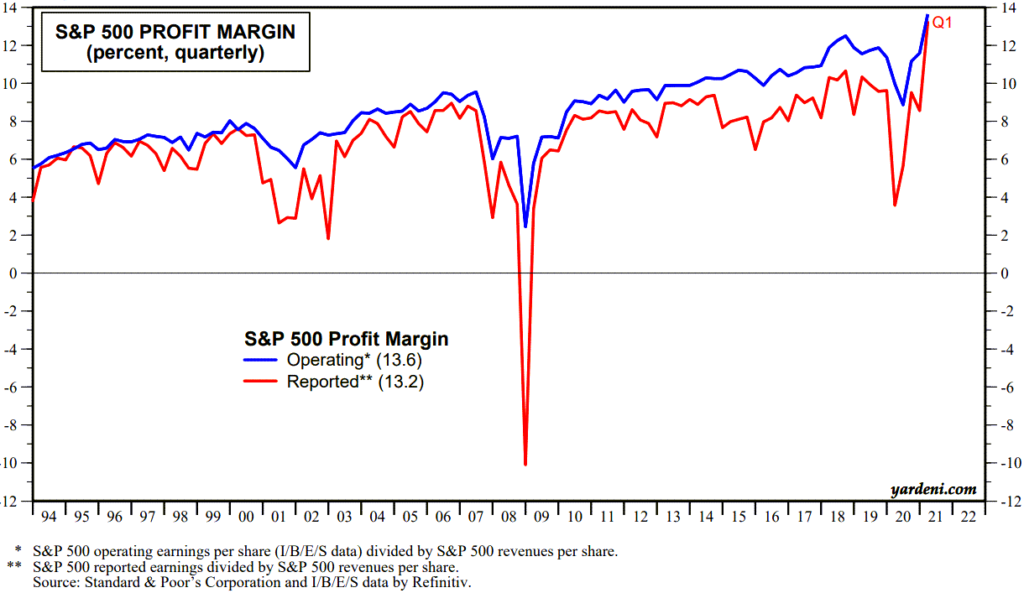

From an economic standpoint, the liquidity cycle is the one that matters. This cycle gauges the amount of available liquidity and the current appetite of investors to invest in companies.1 With record amounts of cash sloshing around looking for investments and interest rates continuing to be low, the liquidity cycle is currently at an advantageous point, and looks poised to remain so.2 While getting the right price is clearly a big consideration, there are a lot of other things to think through that are just as important.

From setting a realistic timeline to thinking about the implications of the sale on other family members, to planning for a life after the sale, each stage brings its own challenges. Assembling a team of advisors with specialized knowledge in every area will be critical, and since this will have a major impact on your wealth and your legacy, you’ll need a quarterback that can keep your big picture in focus all the way through.

The Timeline

Starting well before you want to complete a sale can allow for a productive series of negotiations. It gives you time to surface – and mitigate – any issues that come up, which can leave you in a stronger position. It also provides time to ensure that all shareholders and stakeholders such as creditors, vendors, and employees have time to adjust to the changes the sale may bring, which can facilitate a successful transition. Finally, a longer timeline means you can keep growing the business while you give thought to where you want to be after the sale.

Selecting Your Team

Selling a privately held business is a very specialized transaction. Depending on the size and complexity of your business and the market you compete in, you may need to hire an investment banker, business broker, or third-party business appraiser. Besides advising on the value and the sale, they should be able to help you structure the transaction. You likely already have trusted legal counsel, but unless they also have experience in purchase and sale agreements, you may want to engage an additional resource. The same is true for your tax accountant. You’ll need specific expertise on minimizing the tax consequences of monetizing a business.

Gauging the Cycles

We’ve already discussed the liquidity cycle. The other externally focused cycle to think about is the business cycle for your company’s sector. You’ll need to determine the potential for growth and whether the business is well-positioned to take advantage of opportunities as they arise, or if there are headwinds that can be mitigated.

The last cycle to think about is whether you are ready to sell. What will your life look like after the transition? If you’ve been very involved in the business, how will your new life be structured? Will you continue to play a role, or will you cut all ties? How do family stakeholders feel about the change? Even if the other cycles are at strong points – if you’re not ready to sell, it’s better to wait. It can make sense to assemble your team and proceed with information gathering even if you aren’t sure about an eventual sale. Once you have a clear idea of what the company is worth, you may be able to make a more informed decision.

Breathe

You’ve decided to sell, the cycles are lined up and the structure is right. Now what? This is where having a solid plan comes into play. Acquiring potentially life-changing wealth can be disorienting, to say the least. Imposing a period of time to create and assess various plans, get used to your new life, and have time to decompress can help you to avoid mistakes and when you are ready, you’ll have a better idea of what is really important to you. Eventually, you’ll need a good investment plan that protects your capital, provides you with what you want, and allows you to create the legacy you’d like. But initially, it’s important to maintain a flexible investment plan that can change as you explore your new life.

The Bottom Line

Selling a family business can be stressful and complicated. Assembling a strong team that works hand-in-hand with your financial advisor can smooth the road and ensure your new life plans get a good start.

- What to Consider When Selling the Family Business. Grimes, McGovern & Associates.

- 2021 Global Private Equity Outlook. S&P Global. March 2, 2021.

The information contained herein is intended to be used for educational purposes only and is not exhaustive. Diversification and/or any strategy that may be discussed does not guarantee against investment losses but are intended to help manage risk and return. If applicable, historical discussions and/or opinions are not predictive of future events. The content is presented in good faith and has been drawn from sources believed to be reliable. The content is not intended to be legal, tax or financial advice. Please consult a legal, tax or financial professional for information specific to your individual situation. This work is powered by Seven Group under the Terms of Service and may be a derivative of the original. More information can be found here.