In Shakespeare’s famous play “Julius Caesar”, a group of conspirators gather in the Roman Senate to assassinate the emperor.

Brutus was one of Caesar’s most trusted confidants.

He and the other murderers pull their swords and stabbed him to death on the Senate floor.

With his dying breath, Caesar looks on in shock and betrayal and utters the words “Et tu Brute”.

Across the country today, regional bank CEOs must feel the same betrayal.

Yesterday, the Federal Reserve raised rates an additional 0.25%.

The Federal Reserve is supposed to be the banking system’s most adamant supporter.

After all, their primary job is “financial stability”, and they are considered the “lender of last resort”.

Yet, they inexplicably betrayed the entire banking system with another unnecessary rate hike.

In the midst of an obvious banking crisis, Chairman Powell referred to the banking system as “secure and resilient”. In the past month, we’ve had 3 of the 4 largest bank failures in history. Ah yes, the epitome of strength and resilience for sure.

The primary problem in the banking system right now are deposit rates versus safe alternatives.

This banking crisis is NOT over by any means.

In fact, risks right now are higher than we’ve ever seen them.

Let’s look at the Fed, Regional Banks and the Commercial Real Estate market to assess risks.

The Fed’s Last Hike

In their meeting yesterday, the Fed left the door open to additional interest rate hikes.

Let’s be clear. We believe there is NO REASON for the Fed to hike again. Whether they will or not is anyone’s guess.

They have yet to explicitly acknowledge it, but inflation is no longer the problem.

They are fighting a banking crisis that it nowhere close to being over.

Instead of pausing, Chairman Powell felt he had to project confidence in the financial system.

He was faced with a difficult choice:

- Don’t raise rates, and risk markets interpreting that as fear over the health of the banking sector;

- Raise rates, but risk making the banking crisis worse.

Powell woke up and chose violence.

In the world of instant public relations campaigns, not raising rates would have been an admission that the financial system has major problems.

Even if the system is weak, they can’t let the market perceive that they think the system is weak.

But if they raise rates (like they did), they all but guarantee more stress on the banking system by boosting rates on money markets, increasing the risk of deposit flight.

And if banks try to raise rates to slow the deposit outflow, they destroy any profitability they had.

In the end, the Fed decided to roll the dice and increase rates again.

Unfortunately, this will likely prove to be an incredibly poor decision.

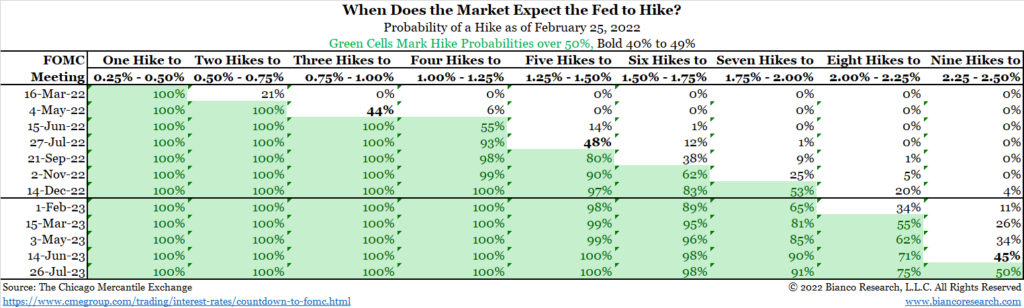

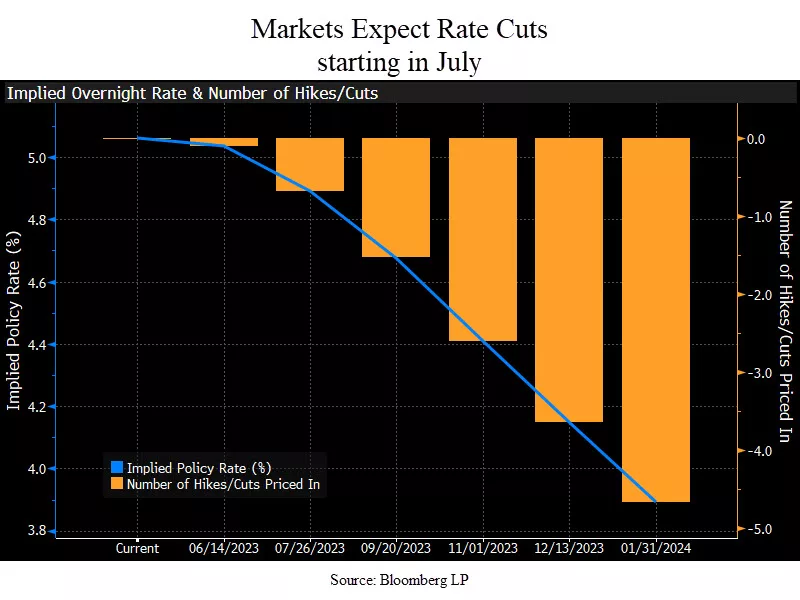

In fact, markets are now pricing in a 15% likelihood that the Fed will CUT rates at their meeting in June. Not next year, but next month.

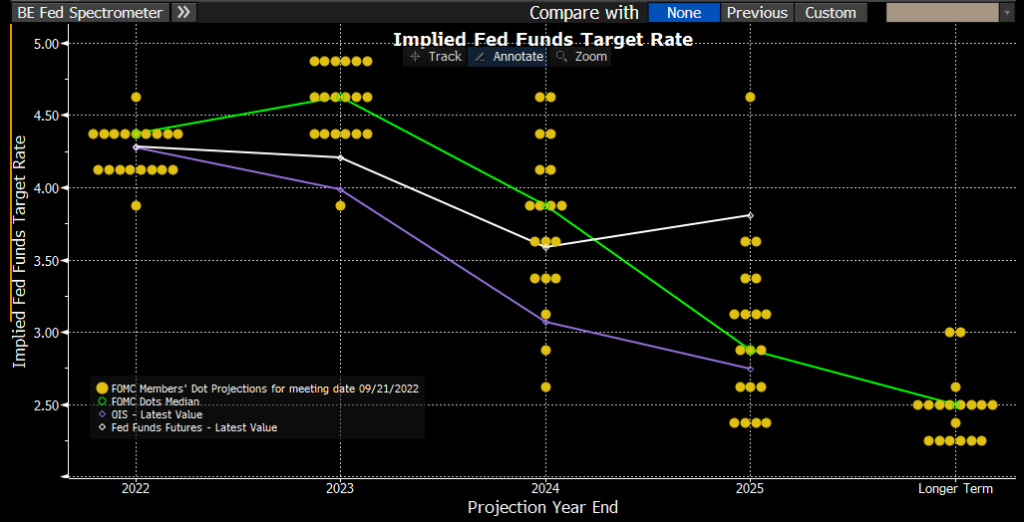

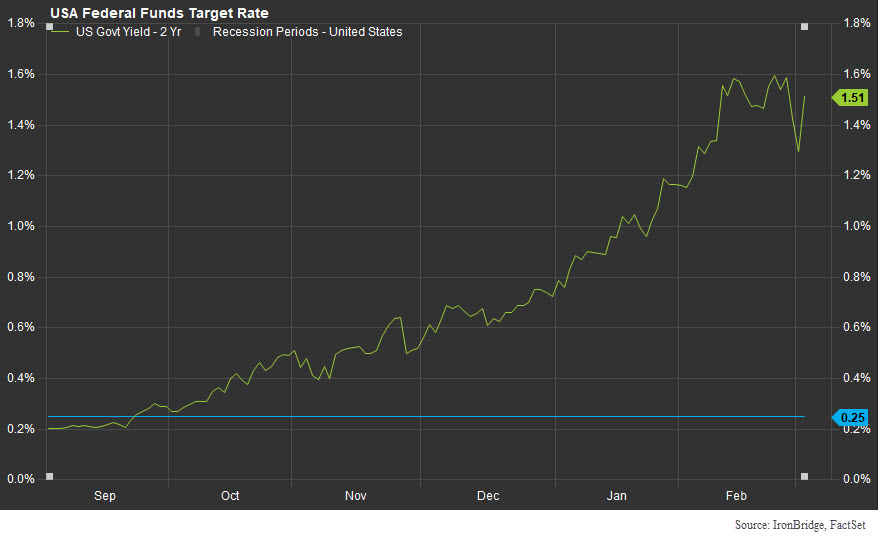

The chart below shows the implied Fed Funds rate through January of 2024.

The blue line (and left side of the chart) is the expected interest rate on the date along the x-axis. The orange bars (along the right side of the chart) is the number of expected cuts by next January.

Markets expect 4.5 interest rate cuts this year, and the rate to go from 5.25% down to 3.9%.

This is quite extraordinary given that the Fed raised rates YESTERDAY.

It firmly implies that markets think the Fed made a huge mistake with this recent hike and that the economy is about to be very bad.

Let’s turn our attention to the regional banks next.

Regional Banks

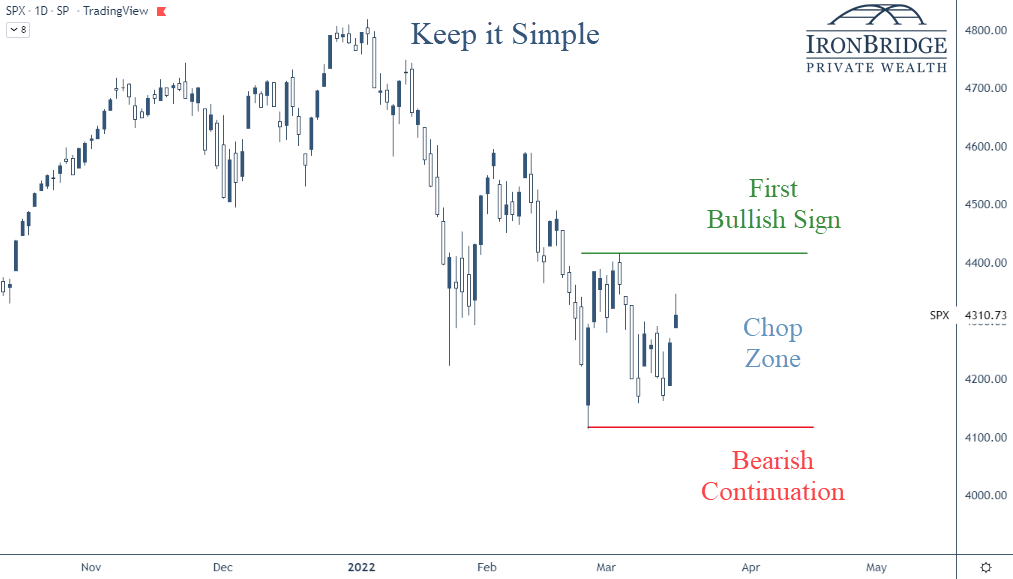

Regional bank stocks are suffering massively.

3 of the 4 largest bank failures in history have occurred in the past month, and there are more to come, likely this weekend with Pac-West Bank. It won’t be the last.

The next chart shows the ticker KRE, which is an ETF comprised of regional banks.

Regional bank stocks are down almost 60% since their highs last year.

They have also have given up ten years of gains. This is simply astonishing.

What this tells us is that the market thinks the banking crisis is much more urgent and important than inflation.

We agree.

Commercial Real Estate

Economic data is weakening. Fast.

Bank lending is one of the biggest contributions to economic growth. We live in a time where loans are the backbone of the US economic engine.

There has been more than $2 trillion of outflows from smaller banks over the past month.

If you are a bank CEO, do you think you would be aggressively handing out loans right now?

No.

You’re keeping all the reserves you can, hoping your customer base is loyal.

Lending standards were tightening before the banking crisis began. Now that it is accelerating, the problems will begin to spread.

The biggest area of concern for us is in commercial real estate.

Let’s look at some stats:

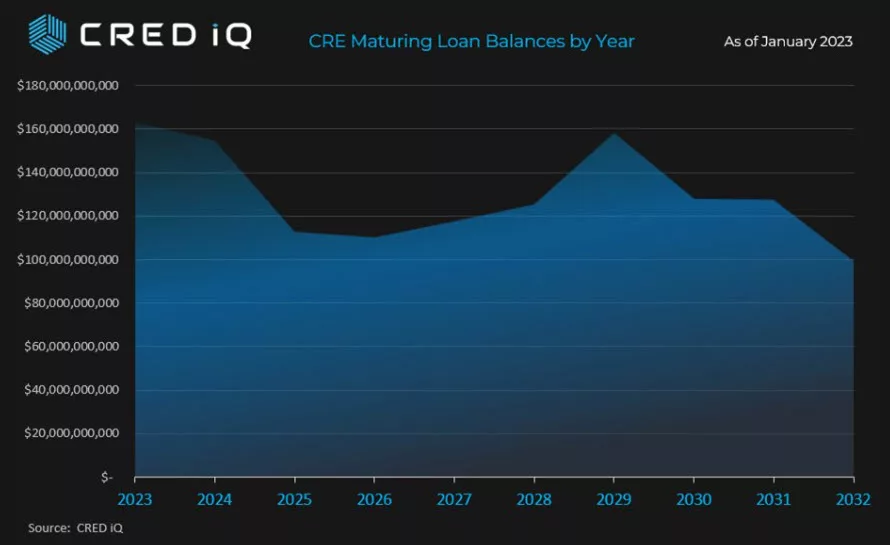

- 67% of all commercial real estate loans were made by smaller banks.

- 83% of all CRE loans are balloon notes. This means they mature and the owner is forced to do something (refinance or sell the property).

In the next two years, over $300 billion of CRE loans mature, as shown in the chart below from CRED IQ.

We must keep in mind that commercial real estate is a diverse market, and not all properties are created equal.

There are some areas of strength:

- Manufacturing facilities are moving back to the U.S. from overseas, creating support for industrial space.

- Grocery-anchored shopping centers (with an HEB for example) are doing quite well.

- Senior-housing facilities are poised to benefit from aging demographics.

But these are relatively small areas in the CRE market.

Currently, these smaller and mid-size banks are dealing with a liquidity crisis.

They may start to face problems with their balance sheet. This would be an entirely different ballgame.

Bottom Line

Risks are incredibly high right now.

Despite that, markets have been relatively calm.

The next few months are perhaps the most important months of the past decade.

If we can get through them with relatively little damage from an economic and earnings standpoint, there is a chance that we avoid some very bad scenarios.

Until then, it is appropriate to err on the side of caution.

IronBridge clients continue to be extremely below their target risk, with elevated holdings in cash equivalents and various short-term high-quality fixed income holdings.

We anticipate that will continue, but as always we will continue to monitor markets for signals to add risk where appropriate.

Please do not hesitate to reach out with any questions.

Invest wisely!