A stick save occurs in ice hockey when a player uses his stick at the last second before the puck enters the goal.

We realize that an ice hockey reference may be considered blasphemous. We’re in Texas, after all.

But a stick save is an excellent reference for what happened this week.

Just when it looked like the bottom was about to fall out of the market, prices reversed higher.

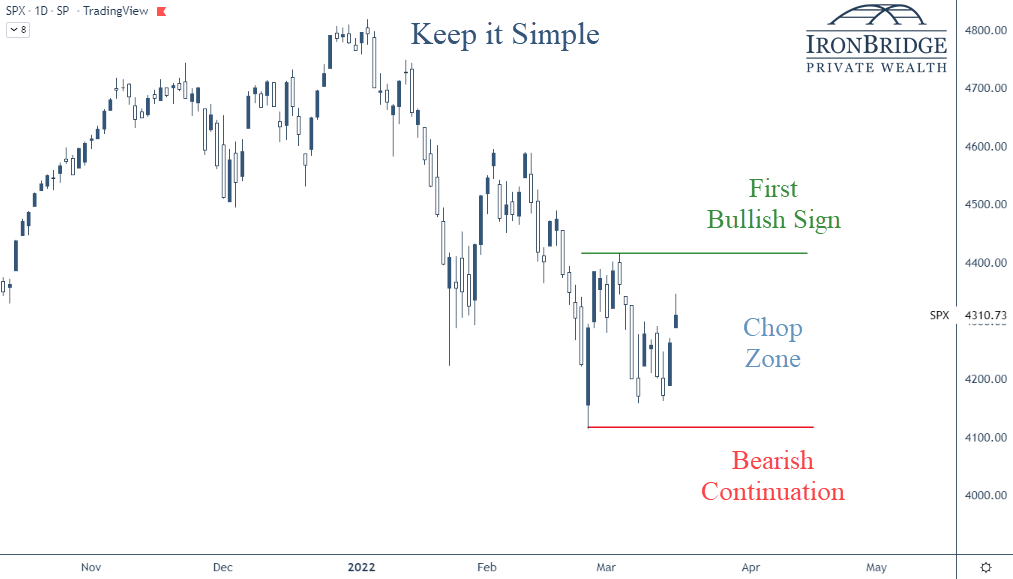

In our recent webinar, we discussed scenarios where the market moved higher to test 4100, and the real information would be gathered if/when that happened.

(Here’s our webinar in case you missed it…our scenario discussions begin at minute 13:31)

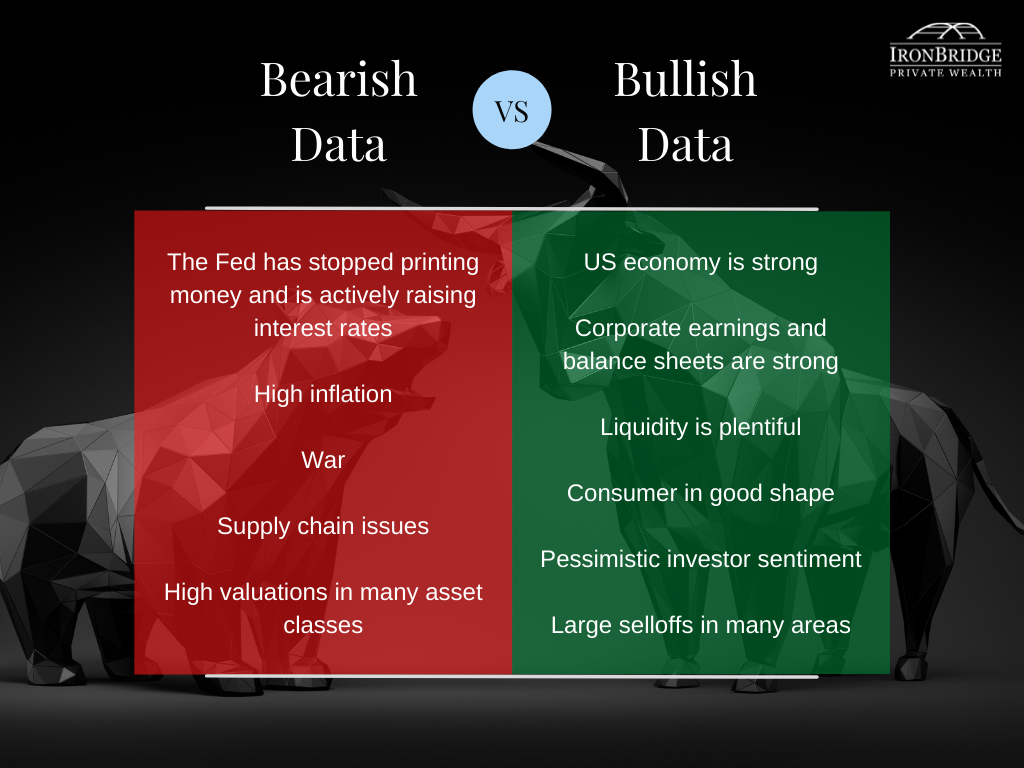

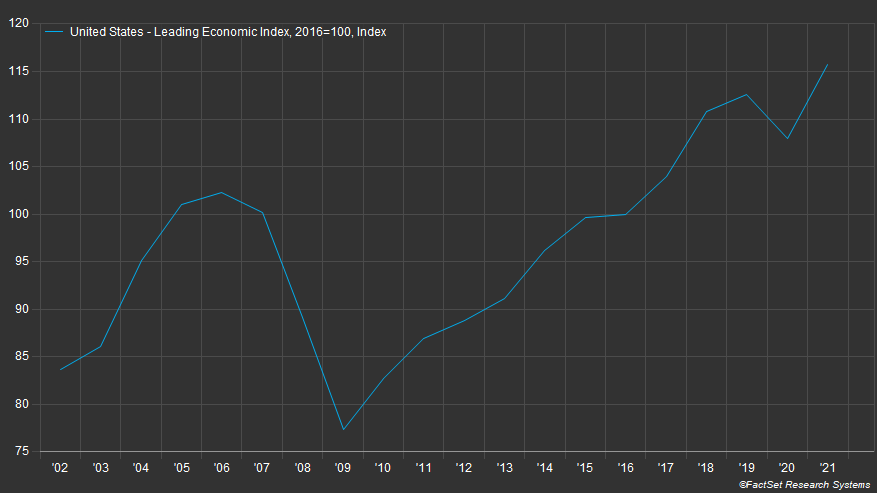

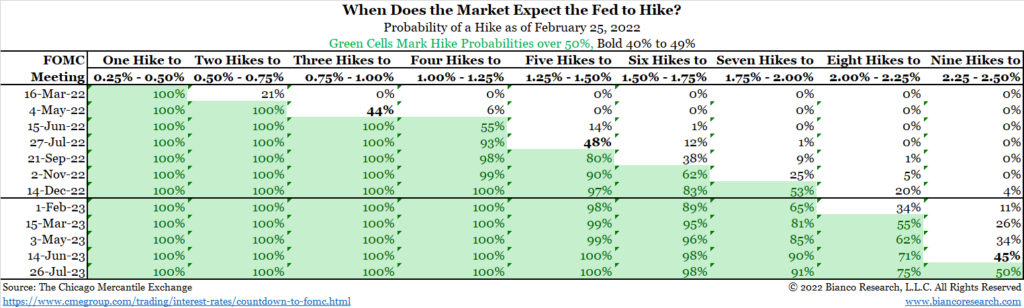

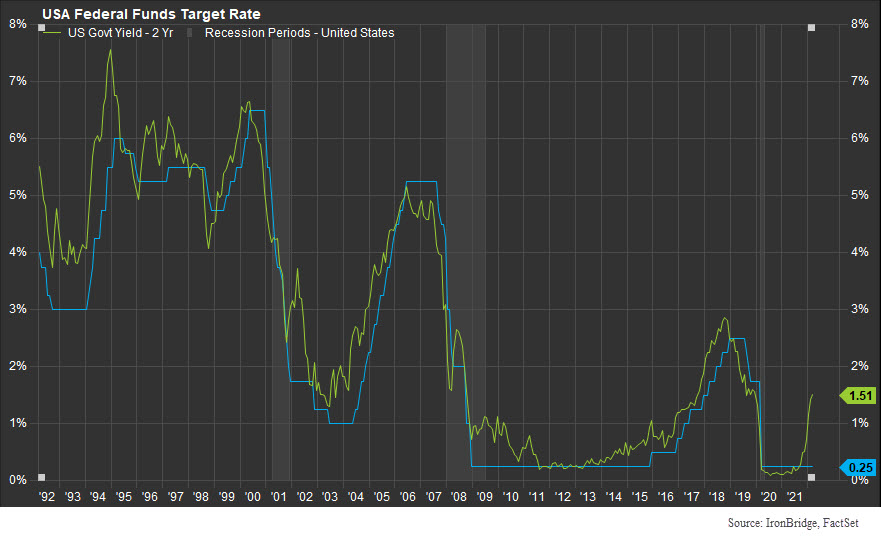

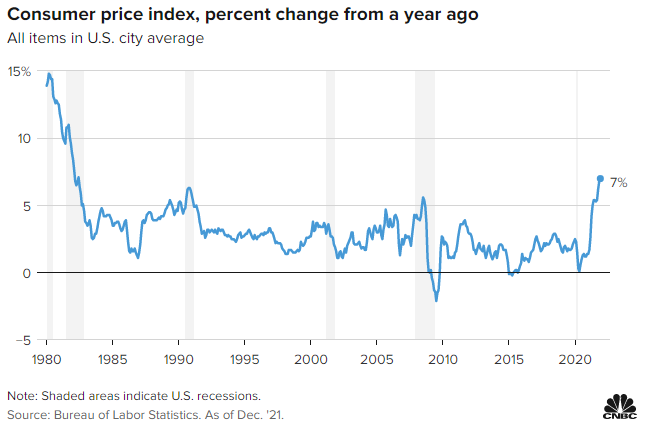

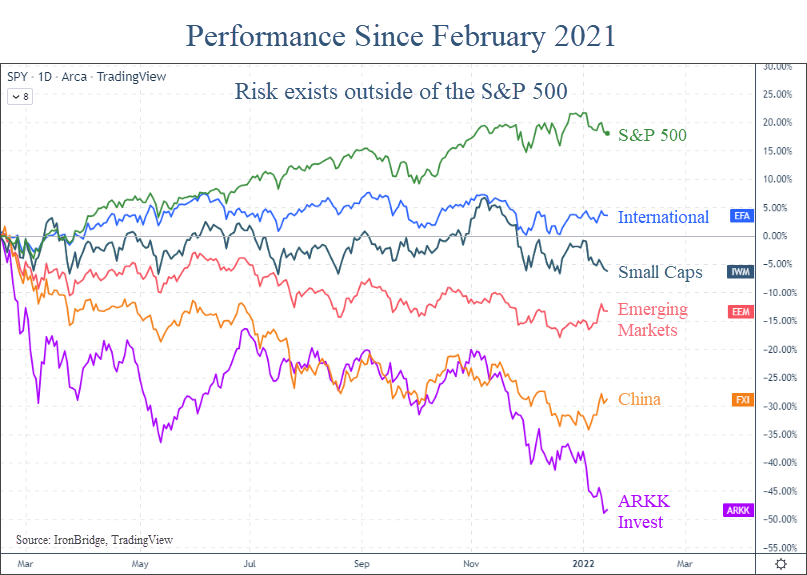

Right now, most of the economic data is heavily skewed to suggesting more downside in prices, mainly due to persistently high inflation and a slowing economy.

As we mentioned in our webinar, the one thing that could support the market here is sentiment.

And it looks like sentiment is coming to the rescue.

When we say “sentiment”, we are referring to two things:

- Investor optimism and pessimism

- The positioning within the market

The first item above is simply a gauge of investor attitudes. It can give good information about the overall environment, but it doesn’t have any direct impact on stock prices.

The second item does.

“Positioning” within the market refers to the actions being taken by market participants.

This is essentially the “plumbing” of the market.

When more money flows in one direction, prices follow. Just like water in a pipe.

If more money is buying, prices go up. And vice-versa.

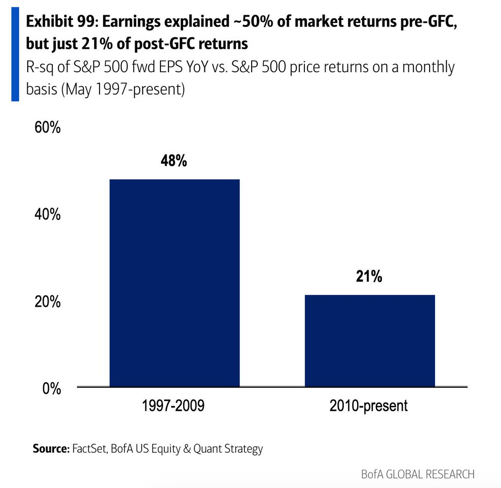

This may sound simple, but this plumbing refers to how markets actually work. It doesn’t matter what the P/E ratio is, or what GDP is doing, or what interest rates are.

GDP may cause more investors to buy or sell, but GDP is not a direct input to stock prices. It is an indirect input.

What matters is flow.

The volume of money moving throughout the market is the only direct input that matters.

Despite the legitimate worries about inflation, the economy, geopolitics, etc. (indirect inputs), enough people acted on it before last week (by selling stocks) that prices moved lower (direct inputs).

It looks like sellers were finally exhausted last week, so buyers were able to push prices higher in the face of deteriorating economic data.

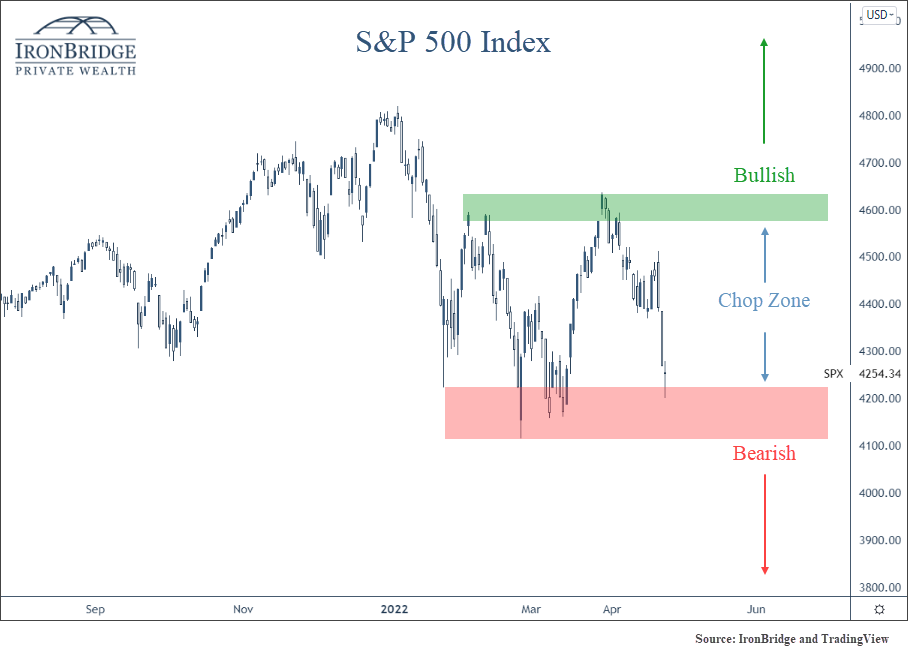

Which puts the market right into the middle of an important resistance zone, as we also identified as a possibility in our webinar.

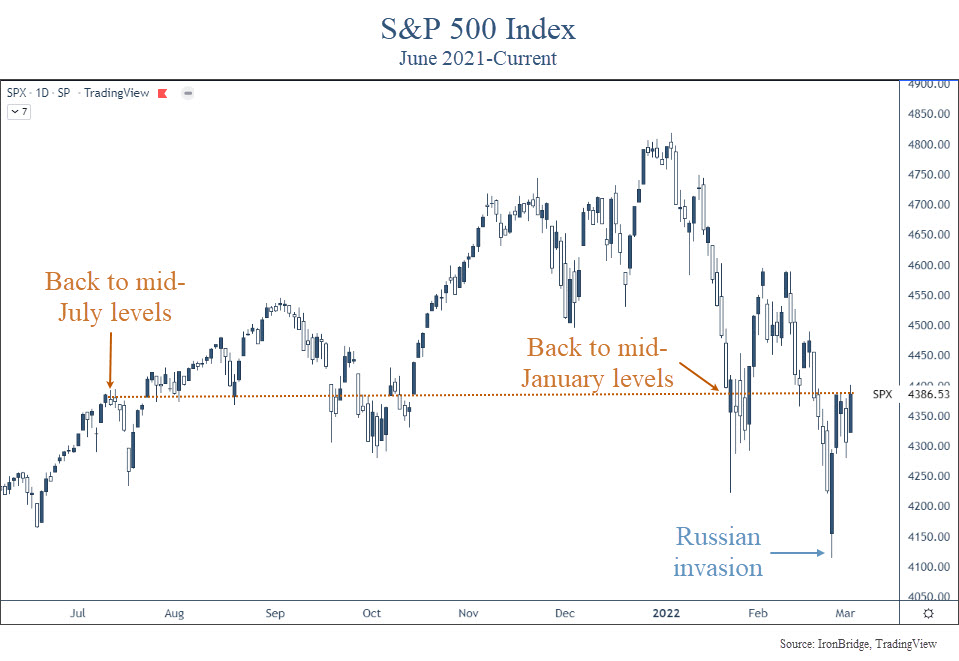

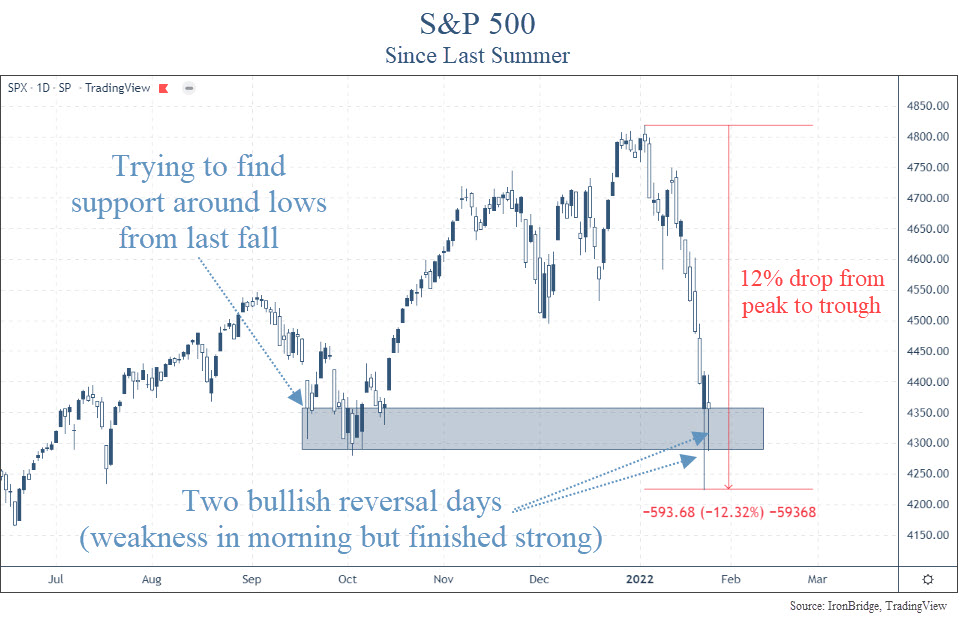

The next chart shows the S&P 500 this year.

A couple weeks ago, the critical 4100 level broke to the downside. However, markets staged a rally and are now testing the resistance area.

It’s akin to a hockey player swiping away a puck right as it is entering the goal.

Stick save.

This rally makes the next two weeks critically important.

Markets were closed on Monday is observance of Memorial Day, but the shortened week should be one of the most important weeks of the year. It may end up carrying into next week, but the market should tip its hand soon.

If it can break higher from here, chances increase that we may have seen the low point for this bear market.

We are definitely not out of the woods if the market breaks higher, but it does start to suggest that the majority of the bad news has indeed been priced in.

However, if we see a selloff this week, then we need to be prepared for another major leg down.

The initial target for the S&P 500 Index on a move lower would be 3400, with another support level at 3100. (The S&P 500 is just over 4100 currently.)

So we can’t be blindly bullish here, but we can’t assume that things are all negative either.

If the market does keep rising, we will begin adding stock exposure back in client portfolios, and take on more of a cautiously optimistic tone.

We’ll provide another report late this week or sometime next week to provide an update.

Invest wisely!